Tata Steel reports Consolidated EBITDA of Rs 8,309 crores for the quarter and Rs 24,894 crores for the nine months ended December 31, 2025

|

Highlights:

|

Financial Highlights:

|

|

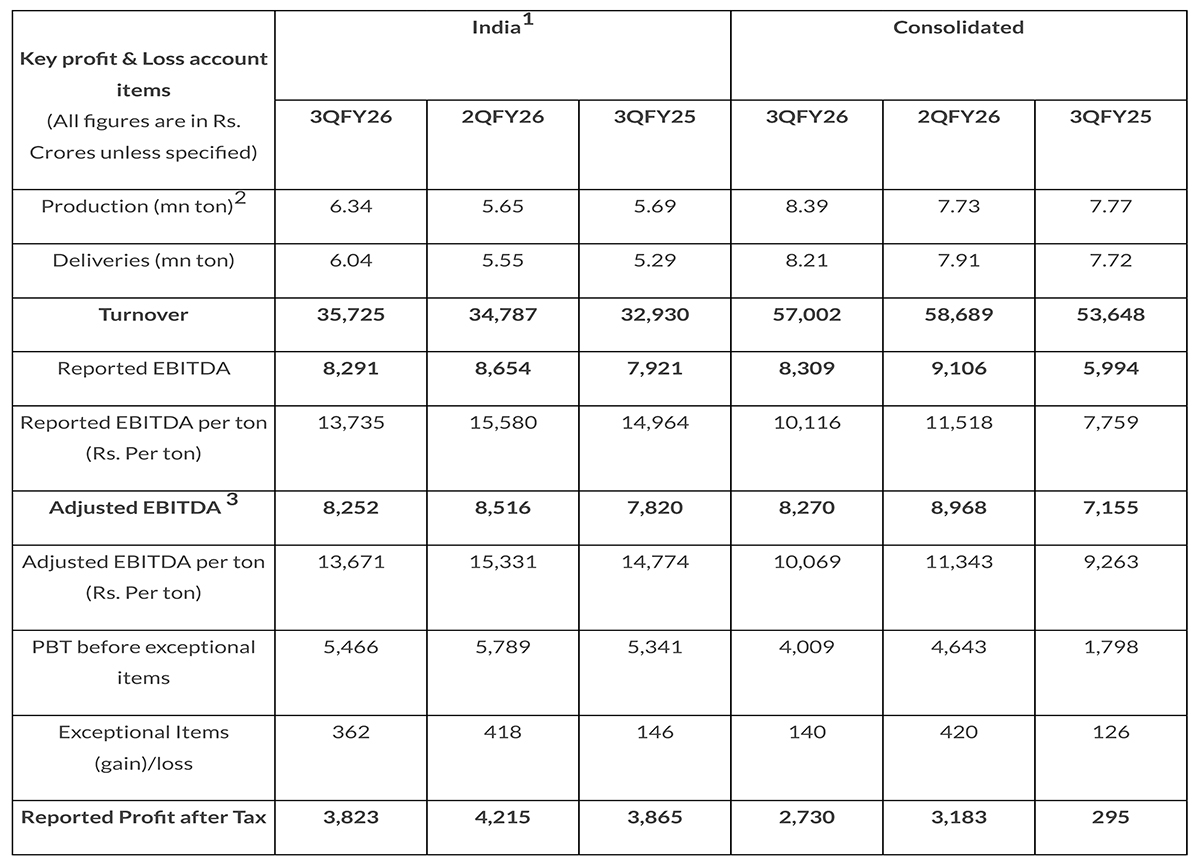

India1 |

Consolidated |

||||

|

3QFY26 |

2QFY26 |

3QFY25 |

3QFY26 |

2QFY26 |

3QFY25 |

|

|

Production (mn ton)2 |

6.34 |

5.65 |

5.69 |

8.39 |

7.73 |

7.77 |

|

Deliveries (mn ton) |

6.04 |

5.55 |

5.29 |

8.21 |

7.91 |

7.72 |

|

Turnover |

35,725 |

34,787 |

32,930 |

57,002 |

58,689 |

53,648 |

|

Reported EBITDA |

8,291 |

8,654 |

7,921 |

8,309 |

9,106 |

5,994 |

|

Reported EBITDA per ton (Rs. Per ton) |

13,735 |

15,580 |

14,964 |

10,116 |

11,518 |

7,759 |

|

Adjusted EBITDA 3 |

8,252 |

8,516 |

7,820 |

8,270 |

8,968 |

7,155 |

|

Adjusted EBITDA per ton (Rs. Per ton) |

13,671 |

15,331 |

14,774 |

10,069 |

11,343 |

9,263 |

|

PBT before exceptional items |

5,466 |

5,789 |

5,341 |

4,009 |

4,643 |

1,798 |

|

Exceptional Items |

362 |

418 |

146 |

140 |

420 |

126 |

|

Reported Profit after Tax |

3,823 |

4,215 |

3,865 |

2,730 |

3,183 |

295 |

1. India includes Tata Steel Standalone and Neelachal Ispat Nigam Limited on proforma basis adjusted for intercompany purchase and sale;

2. Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for UK & Netherlands and saleable steel for South East Asia;

3. Adjusted for changes on account of FX movement on intercompany debt / receivables’.

Management Comments:

Mr. T V Narendran, Chief Executive Officer & Managing Director:

“Our global operating environment continues to be shaped by tariffs, geopolitical shifts and policy divergence. Steel markets were impacted by elevated finished steel exports from China, which at 119 million tons surpassed the 2015 peak. Against this backdrop, Tata Steel delivered a strong performance in this quarter, with India crude steel production rising 12% while deliveries grew faster at 14% YoY, surpassing the 6 million tons mark in a quarter for the first time. We continued to strengthen our market leadership across chosen segments, supported by capacity expansion and a focused downstream strategy. Automotive volumes grew 20% YoY, while our retail vertical gained further momentum. Tata Tiscon continued its growth, and our e-commerce platforms, Aashiyana and DigECA, achieved Gross Merchandise Value of Rs 2,380 crores for the quarter, up 68% YoY. Within the downstream portfolio, our tubes and wires businesses delivered their best-ever quarterly performance, supported by capacity additions, a richer product mix and dominant share in high-value infrastructure projects. We also strengthened our colour-coated portfolio through the majority acquisition in Tata Bluescope Steel Private Limited, which has now transitioned to Tata Steel Colors Private Limited. Looking ahead, the proposed 4.8 MTPA expansion at NINL and the 0.75 MTPA EAF at Ludhiana will significantly enhance our long products portfolio. At the same time, our strategic partnership in Maharashtra will fortify raw material needs beyond 2030 and help cater to the growing demand in western and southern India. In our overseas operations, deliveries stood at 0.52 million tons in the UK and 1.40 million tons in the Netherlands. Supportive policy frameworks are vital to transition to a more sustainable operating model. While the recent progress in Europe has supported sentiment, the UK market continues to be depressed, and the quota framework needs to be revised to reflect underlying market conditions.”

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer:

“Tata Steel delivered consistent performance despite a challenging operating environment. For the nine months ended 31st December 2025, EBITDA margin improved by around 300 bps YoY, reflecting strong operational execution and sustained cost discipline. Our cost transformation program, focused on multiple levers including operating KPIs, supply chain efficiencies and procurement, has delivered savings of around Rs 3,000 crores for the quarter and around Rs 8,600 crores for the first nine months of the financial year. During the quarter, consolidated EBITDA was Rs 8,309 crores, translating to a margin of around 15%. In India, domestic steel prices were at multi-year lows weighing on the steel spot spreads. Despite this, our India operations delivered an EBITDA margin of ~23% aided by value led growth and cost optimisation. Both in UK and Netherlands, volumes moderated on QoQ basis. UK performance was adversely impacted by subdued demand dynamics while the Netherlands delivered an EBITDA of €55 million. Overall, operating cash flows before capex were Rs 10,345 crores for the quarter. Our consolidated Net debt declined to Rs 81,834 crores. Our group liquidity remains strong at Rs 44,062 crores, which includes cash & cash equivalents of Rs 10,765 crores. In India, we remain focused on volume growth, investments in downstream and strengthening our raw material linkages. UK market conditions continue to be pressured by subdued demand, while policy interventions are taking longer than anticipated to materialise. We are closely monitoring the situation and the evolving tariff framework and CBAM in EU, which are pivotal for rebalancing EU market dynamics. We remain focused on prioritising, optimising and sequencing our capital allocation to balance investment needs with returns, while maintaining financial discipline and long‑term value creation for stakeholders.”

Disclaimer:

Statements in this press release describing the Company’s performance may be “forward-looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors.

For queries and information:

Sarvesh Kumar Chief, Corporate Communications, Tata Steel

E-mail: sarvesh.kumar@tatasteel.com

About Tata Steel

- Tata Steel group is among the top global steel companies with an annual crude steel capacity of 35 million tonnes per annum.

- It is one of the world's most geographically diversified steel producers, with operations and commercial presence across the world.

- The group recorded a consolidated turnover of around US$26 billion in the financial year ending March 31, 2025.

- A Great Place to Work®-certified organisation, Tata Steel Limited, together with its subsidiaries, associates, and joint ventures, is spread across five continents with an employee base of over 76,000.

- Tata Steel has announced its major sustainability objectives including Net Zero by 2045.

- The Company has been on a multi-year digital-enabled business transformation journey intending to be the leader in ‘Digital Steel making’. The Company has received the World Economic Forum’s Global Lighthouse recognition for its Jamshedpur, Kalinganagar, and IJmuiden Plants. Tata Steel has also been recognised with the ‘Digital Enterprise of India – Steel’ Award 2024 by Economic Times CIO.

- The Company has been recognised with the World Economic Forum’s Global Diversity Equity & Inclusion Lighthouse 2023.

- The Company has been a part of the DJSI Emerging Markets Index since 2012 and has been consistently ranked among the top 10 steel companies in the DJSI Corporate Sustainability Assessment since 2016.

- Tata Steel’s Jamshedpur Plant is India’s first site to receive ResponsibleSteelTM Certification. Subsequently, its Kalinganagar and Meramandali plants have also received the certification. In India, Tata Steel now has more than 90% of its steel production from ResponsibleSteelTM certified sites.

- Received Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17, 2025 Steel Sustainability Champion recognition from worldsteel for eight years in a row, CDP 2024 ‘Supplier Engagement Assessment’ Leader, Top performer in Iron and Steel sector in Dun & Bradstreet's India's top 500 companies 2022, Ranked as the 2024 most valuable Mining and Metals brand in India by Brand Finance, ‘Most Ethical Company’ award 2021 from Ethisphere Institute, and ‘Best Corporate for Promotion of Sports’ recognition at the Sportstar Aces Awards 2024.

- Received the 2023 Global ERM (Enterprise Risk Management) Award of Distinction at the RIMS ERM Conference 2023, ‘Masters of Risk – Risk Technology’ recognition at The India Risk Management Awards, and ICSI Business Responsibility and Sustainability Award 2023 for its first Business Responsibility and Sustainability Report (BRSR), Excellence in Financial Reporting FY20 from ICAI, among several others.

Photographs: Management and Plant facilities

Logos: Files and usage guidelines

Website: www.tatasteel.com