Tata Steel reports Consolidated EBITDA of Rs 7,480 crores for the quarter ended June 30, 2025

Tata Steel reports Consolidated EBITDA of Rs 7,480 crores for the quarter ended June 30, 2025

|

Highlights:

|

Financial Highlights:

|

|

India1 |

Consolidated |

||||

|

1QFY26 |

4QFY25 |

1QFY25 |

1QFY26 |

4QFY25 |

1QFY25 |

|

|

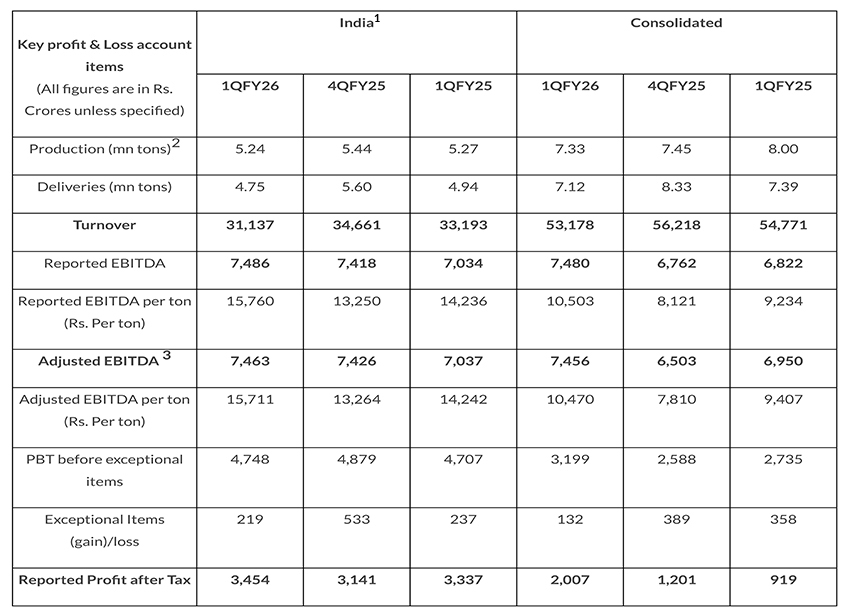

Production (mn tons)2 |

5.24 |

5.44 |

5.27 |

7.33 |

7.45 |

8.00 |

|

Deliveries (mn tons) |

4.75 |

5.60 |

4.94 |

7.12 |

8.33 |

7.39 |

|

Turnover |

31,137 |

34,661 |

33,193 |

53,178 |

56,218 |

54,771 |

|

Reported EBITDA |

7,486 |

7,418 |

7,034 |

7,480 |

6,762 |

6,822 |

|

Reported EBITDA per ton (Rs. Per ton) |

15,760 |

13,250 |

14,236 |

10,503 |

8,121 |

9,234 |

|

Adjusted EBITDA 3 |

7,463 |

7,426 |

7,037 |

7,456 |

6,503 |

6,950 |

|

Adjusted EBITDA per ton (Rs. Per ton) |

15,711 |

13,264 |

14,242 |

10,470 |

7,810 |

9,407 |

|

PBT before exceptional items |

4,748 |

4,879 |

4,707 |

3,199 |

2,588 |

2,735 |

|

Exceptional Items (gain)/loss |

219 |

533 |

237 |

132 |

389 |

358 |

|

Reported Profit after Tax |

3,454 |

3,141 |

3,337 |

2,007 |

1,201 |

919 |

1.India includes Tata Steel Standalone and Neelachal Ispat Nigam Limited on proforma basis adjusted for intercompany purchase and sale;

2. Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for UK & Netherlands and saleable steel for South East Asia;

3. Adjusted for changes on account of FX movement on intercompany debt / receivables’.

Management Comments:

Mr. T V Narendran, Chief Executive Officer & Managing Director:

“Tata Steel has demonstrated robust profitability across geographies despite volatile global macro conditions and heightened uncertainty. The strong improvement in our 1Q performance on QoQ as well as YoY basis was driven by an increase in our net steel realisations and the planned cost-take outs. In India, our large distribution network with 25,000+ dealers & distributors and our focus on delivering customer requirements helped us in selling higher value-added products and in creating value from the new facilities we commissioned. The volume ramp up at Kalinganagar is progressing smoothly and within six months of the start-up of the continuous annealing line facility, we have been successful in receiving grade approvals for high strength and ultra-high strength steel. Tata Steel now stands at par with global leaders in providing next generation lightweighting solutions and catering to advanced mobility applications. We are also leveraging the growing digital marketplace by expanding presence through e-commerce platforms such as Aashiyana and DigECA. The Gross Merchandise Value through these platforms now stands at Rs 5,400 crores on annualised basis, an increase of 52% YoY. Our mining operations complement steelmaking by providing secure and reliable supply of raw materials. I am happy to share that our Noamundi Iron ore mine was adjudged with 7-star rating by the Ministry of Mines for scientific and sustainable mining, one of only three such mines in India. In UK, we recently had the groundbreaking ceremony for the EAF at Port Talbot which marks yet another milestone in our journey to become a sustainable green steel operations. In Netherlands, our liquid steel production was 1.7 million tons and was close to rated capacity and performance was aided by favourable sales mix and higher realisations in the downstream business.”

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer:

“Tata Steel has delivered resilient performance and sequentially improved margins by around 200 bps despite challenging demand and uncertainty on trade & tariffs. Consolidated revenues for the quarter were Rs 53,178 crores and EBITDA was Rs 7,480 crores, which translates to a margin of around 14% and Rs 10,503 per ton. Higher steel realisations offset the decline in volumes across geographies. Our cost transformation program, focused on multiple levers including operating KPIs, supply chain and procurement, has delivered around Rs 2,900 crores during the quarter. We remain focused on cost optimisation, operational improvements and working capital management to maximise cashflows. India revenues were Rs 31,137 crores and EBITDA was Rs 7,486 crores for the quarter. India EBITDA improved from Rs 13,250 per ton in 4Q to Rs 15,760 per ton in 1Q. Continuing our efforts to further consolidate the India footprint, we successfully acquired the residual equity stake in Neelachal Ispat Nigam Limited and with this, NINL is now a wholly owned subsidiary. NINL generated an EBITDA of Rs 224 crores in 1Q and is our strategic lever to expand in long products business. Among our overseas operations, Netherlands EBITDA improved by €35 per ton while UK EBITDA improved by £58 per ton on QoQ basis. We are committed to capacity growth in structurally attractive India market and have spent around Rs 3,829 crores towards capital expenditure during the quarter. As of 30th June 2025, Net debt stood at Rs 84,835 crores and our group liquidity position remains strong at Rs 43,578 crores with cash & cash equivalents of Rs 14,118 crores. Site activity has officially commenced at Port Talbot, UK for the Electric Arc Furnace. In India, we are progressing on the construction of the Electric Arc Furnace at Ludhiana with commencement of equipment erection activities. The G blast furnace relining in Jamshedpur is at an advanced stage of completion and with Kalinganagar ramping up, India volumes are expected to be sequentially higher in the next quarter.”

Disclaimer:

Statements in this press release describing the Company’s performance may be “forward-looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors.

For media enquiries contact:

Sarvesh Kumar

E-mail: sarvesh.kumar@tatasteel.com

About Tata Steel

- Tata Steel group is among the top global steel companies with an annual crude steel capacity of 35 million tonnes per annum.

- It is one of the world's most geographically diversified steel producers, with operations and commercial presence across the world.

- The group recorded a consolidated turnover of around US$26 billion in the financial year ending March 31, 2025.

- A Great Place to Work®-certified organisation, Tata Steel Limited, together with its subsidiaries, associates, and joint ventures, is spread across five continents with an employee base of over 76,000.

- Tata Steel has announced its major sustainability objectives including Net Zero by 2045.

- The Company has been on a multi-year digital-enabled business transformation journey intending to be the leader in ‘Digital Steel making’. The Company has received the World Economic Forum’s Global Lighthouse recognition for its Jamshedpur, Kalinganagar, and IJmuiden Plants. Tata Steel has also been recognised with the ‘Digital Enterprise of India – Steel’ Award 2024 by Economic Times CIO.

- The Company has been recognised with the World Economic Forum’s Global Diversity Equity & Inclusion Lighthouse 2023.

- The Company has been a part of the DJSI Emerging Markets Index since 2012 and has been consistently ranked among the top 10 steel companies in the DJSI Corporate Sustainability Assessment since 2016.

- Tata Steel’s Jamshedpur Plant is India’s first site to receive ResponsibleSteelTM Certification. Subsequently, its Kalinganagar and Meramandali plants have also received the certification. In India, Tata Steel now has more than 90% of its steel production from ResponsibleSteelTM certified sites.

- Received Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17, 2025 Steel Sustainability Champion recognition from worldsteel for eight years in a row, CDP 2024 ‘Supplier Engagement Assessment’ Leader, Top performer in Iron and Steel sector in Dun & Bradstreet's India's top 500 companies 2022, Ranked as the 2024 most valuable Mining and Metals brand in India by Brand Finance, ‘Most Ethical Company’ award 2021 from Ethisphere Institute, and ‘Best Corporate for Promotion of Sports’ recognition at the Sportstar Aces Awards 2024.

- Received the 2023 Global ERM (Enterprise Risk Management) Award of Distinction at the RIMS ERM Conference 2023, ‘Masters of Risk – Risk Technology’ recognition at The India Risk Management Awards, and ICSI Business Responsibility and Sustainability Award 2023 for its first Business Responsibility and Sustainability Report (BRSR), Excellence in Financial Reporting FY20 from ICAI, among several others.

Photographs: Management and Plant facilities

Logos: Files and usage guidelines

Website: www.tatasteel.com and www.wealsomaketomorrow.com