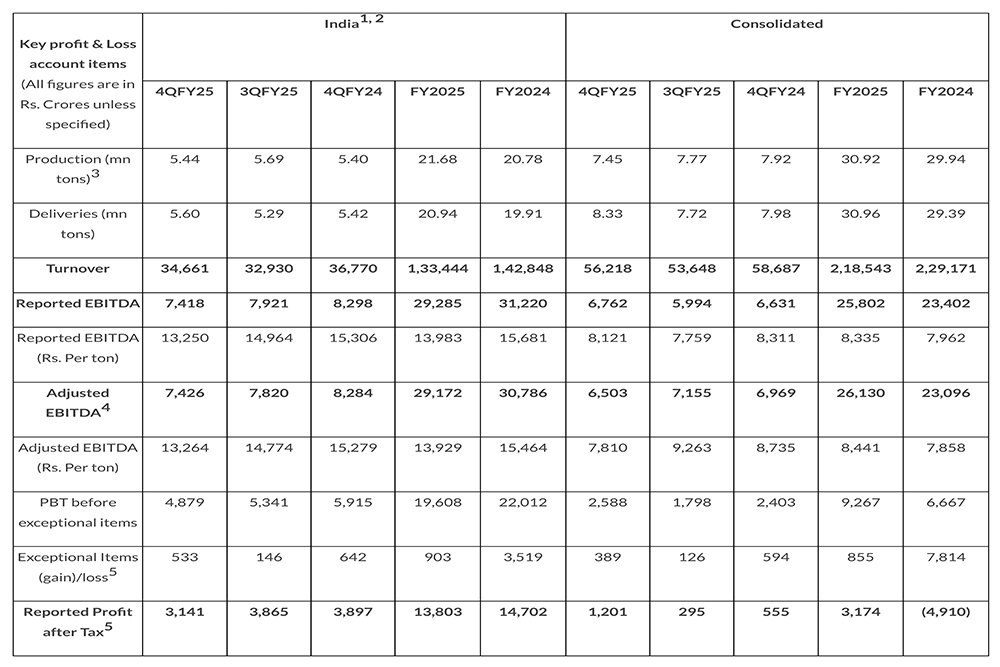

Tata Steel reports Consolidated EBITDA of Rs 25,802 crores for FY2025

Tata Steel reports Consolidated EBITDA of Rs 25,802 crores for FY2025

|

Highlights:

|

Financial Highlights:

|

|

India1, 2 |

Consolidated |

||||||||

|

4QFY25 |

3QFY25 |

4QFY24 |

FY2025 |

FY2024 |

4QFY25 |

3QFY25 |

4QFY24 |

FY2025 |

FY2024 |

|

|

Production (mn tons)3 |

5.44 |

5.69 |

5.40 |

21.68 |

20.78 |

7.45 |

7.77 |

7.92 |

30.92 |

29.94 |

|

Deliveries (mn tons) |

5.60 |

5.29 |

5.42 |

20.94 |

19.91 |

8.33 |

7.72 |

7.98 |

30.96 |

29.39 |

|

Turnover |

34,661 |

32,930 |

36,770 |

1,33,444 |

1,42,848 |

56,218 |

53,648 |

58,687 |

2,18,543 |

2,29,171 |

|

Reported EBITDA |

7,418 |

7,921 |

8,298 |

29,285 |

31,220 |

6,762 |

5,994 |

6,631 |

25,802 |

23,402 |

|

Reported EBITDA (Rs. Per ton) |

13,250 |

14,964 |

15,306 |

13,983 |

15,681 |

8,121 |

7,759 |

8,311 |

8,335 |

7,962 |

|

Adjusted EBITDA4 |

7,426 |

7,820 |

8,284 |

29,172 |

30,786 |

6,503 |

7,155 |

6,969 |

26,130 |

23,096 |

|

Adjusted EBITDA (Rs. Per ton) |

13,264 |

14,774 |

15,279 |

13,929 |

15,464 |

7,810 |

9,263 |

8,735 |

8,441 |

7,858 |

|

PBT before exceptional items |

4,879 |

5,341 |

5,915 |

19,608 |

22,012 |

2,588 |

1,798 |

2,403 |

9,267 |

6,667 |

|

Exceptional Items (gain)/loss5 |

533 |

146 |

642 |

903 |

3,519 |

389 |

126 |

594 |

855 |

7,814 |

|

Reported Profit after Tax5 |

3,141 |

3,865 |

3,897 |

13,803 |

14,702 |

1,201 |

295 |

555 |

3,174 |

(4,910) |

1.Tata Steel Standalone numbers have been restated from April 1, 2023, to reflect merger of Angul Energy Limited, Bhubaneshwar Power Private Limited and Indian Steel & Wire Products Limited with Tata Steel; Figures for previous periods have been regrouped and reclassified to conform to classification of current period, where necessary;

2. India includes Tata Steel Standalone and Neelachal Ispat Nigam Limited on proforma basis adjusted for intercompany purchase and sale;

3. Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for UK & Netherlands and saleable steel for South East Asia;

4. Adjusted for changes on account of FX movement on intercompany debt / receivables’

5. Consequent to the change in accounting policy for investments in subsidiaries in standalone financial statements, exceptional items and Profit after Tax have been restated.

Management Comments:

Mr. T V Narendran, Chief Executive Officer & Managing Director:

“FY2025 has been an important transition year for Tata Steel with significant developments across operating geographies. We commissioned India’s largest blast furnace at Kalinganagar, safely decommissioned two blast furnaces in UK and achieved production levels near rated capacity in Netherlands. India deliveries were best ever at around 21 million tons and were up 5% YoY aided by a smooth ramp up of the new blast furnace at Kalinganagar and capacity utilisation close to 100% at the remaining operations. At the segment level, Tata Steel continues to be the preferred supplier for automotive steel, with high share of business in new model launches. Tata Tiscon achieved ‘best ever’ volumes and grew by 19% YoY to around 2.4 million tons. We have invested more than Rs 1,600 crores on R&D in the last 5 years, enabling us to become the first Indian steel supplier to have end-to-end capabilities in hydrogen transportation and to localise CP780 automotive grade demonstrating our customer centricity. In yet another step towards growing in chosen segments in India, we have begun catering to commercial shipbuilding. Deliveries in the UK were ~2.5 million tons as we smoothly transitioned to supplying our customers on the basis of imported substrate processed at our downstream mills while fixed costs have reduced by around £230 million, the benefit was not visible due to surging imports. In Netherlands, our deliveries were ~6.25 million tons and for the quarter were 1.75 million tons, highest in the last six years. The QoQ improvement in profitability at Netherlands includes efforts to reduce controllable costs while a transformation program to restore long term competitiveness has been launched in April 2025. This year also marked landmark achievement in the form of a century of mining at Noamundi and in FY2025, we mined around 40 million tons of iron ore across our mines in India. I am also happy to share that we have been recognised by worldsteel as Sustainability champion for the eighth time in a row.”

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer:

“Tata Steel Consolidated revenues for FY2025 were around $26 billion and EBITDA was $3.1 billion. Consolidated EBITDA improved by 10% YoY aided by higher volumes and reduction in controllable costs despite the drop in realisations. Neelachal Ispat Nigam Limited achieved annual EBITDA of around Rs 1,000 crores with a margin of 19% and free cash flow in excess of Rs 1,000 crores. This demonstrates the turnaround of the company which was closed at the time of acquisition almost three years ago. Operating cash flows after interest and adjustments improved by 37% or ~Rs 4,800 crores YoY to Rs 17,700 crores aided by working capital release of ~Rs 3,600 crores. We spent Rs 15,671 crores on capital expenditure during the year. For the quarter, Consolidated revenues stood at Rs 56,218 crores and EBITDA was Rs 6,762 crores, which translates to a margin of around 12%, with India EBITDA margin being higher at 21%. Consolidated EBITDA margin was 100 bps higher on QoQ basis. We are focused on cost takeouts to enhance competitiveness and have already achieved ~Rs 6,600 crores during the year vs. FY2024 levels, of which £230 million or Rs 2,600 crores was in UK, Rs 2,800 crores was in India and Rs 1,150 crores was in Netherlands and the cost transformation program will continue in the future. Our Electric Arc Furnace project in UK is also progressing as per plan with award of key OEM contracts, receipt of planning permissions with construction likely to begin by July 2025. Tata Steel Netherlands annual EBITDA has improved to €90 million as production returned to near rated capacity and operating cash flows after interest were around €450 million through significant cash and cost focused actions. The discussion with the Government of Netherlands on the integrated decarbonisation and environmental measures project continues to be intense and we are also engaged with the provincial and environmental authorities on the above.”

Disclaimer:

Statements in this press release describing the Company’s performance may be “forward-looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors.

For media enquiries contact:

Sarvesh Kumar

E-mail: sarvesh.kumar@tatasteel.com

About Tata Steel

- Tata Steel group is among the top global steel companies with an annual crude steel capacity of 35 million tonnes per annum.

- It is one of the world's most geographically diversified steel producers, with operations and commercial presence across the world.

- The group recorded a consolidated turnover of around US$26 billion in the financial year ending March 31, 2025.

- A Great Place to Work-CertifiedTM organisation, Tata Steel Limited, together with its subsidiaries, associates, and joint ventures, is spread across five continents with an employee base of over 78,000.

- Tata Steel has announced its major sustainability objectives including Net Zero by 2045.

- The Company has been on a multi-year digital-enabled business transformation journey intending to be the leader in ‘Digital Steel making’. The Company has received the World Economic Forum’s Global Lighthouse recognition for its Jamshedpur, Kalinganagar, and IJmuiden Plants. Tata Steel has also been recognised with the ‘Digital Enterprise of India – Steel’ Award 2024 by Economic Times CIO.

- The Company has been recognised with the World Economic Forum’s Global Diversity Equity & Inclusion Lighthouse 2023

- The Company has been a part of the DJSI Emerging Markets Index since 2012 and has been consistently ranked among the top 10 steel companies in the DJSI Corporate Sustainability Assessment since 2016.

- Tata Steel’s Jamshedpur Plant is India’s first site to receive ResponsibleSteelTM Certification. Subsequently, its Kalinganagar and Meramandali plants have also received the certification. In India, Tata Steel now has more than 90% of its steel production from ResponsibleSteelTM certified sites.

- Received Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17, 2025 Steel Sustainability Champion recognition from worldsteel for seven years in a row, 2023 Climate Change Leadership Award by CDP, Top performer in Iron and Steel sector in Dun & Bradstreet's India's top 500 companies 2022, Ranked as the 2024 most valuable Mining and Metals brand in India by Brand Finance, ‘Most Ethical Company’ award 2021 from Ethisphere Institute, and ‘Best Corporate for Promotion of Sports’ recognition at the Sportstar Aces Awards 2024.

- Received the 2023 Global ERM (Enterprise Risk Management) Award of Distinction at the RIMS ERM Conference 2023, ‘Masters of Risk’ - Metals & Mining Sector recognition at The India Risk Management Awards for the eighth consecutive year, and ICSI Business Responsibility and Sustainability Award 2023 for its first Business Responsibility and Sustainability Report (BRSR), Excellence in Financial Reporting FY20 from ICAI, among several others.

Photographs: Management and Plant facilities

Logos: Files and usage guidelines

Website: www.tatasteel.com and www.wealsomaketomorrow.com