Tata Steel reports Consolidated EBITDA of Rs 6,822 crores for the quarter ended June 30, 2024

Tata Steel reports Consolidated EBITDA of Rs 6,822 crores for the quarter ended June 30, 2024

|

Highlights:

|

Financial Highlights:

|

|

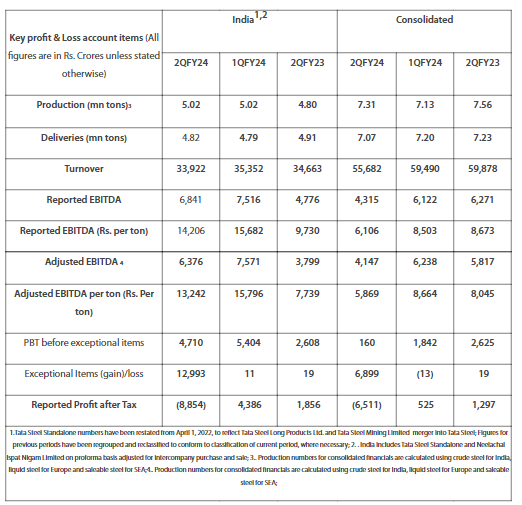

India1,2 |

Consolidated |

||||||

|

1QFY25 |

4QFY24 |

1QFY24 |

1QFY25 |

4QFY24 |

1QFY24 |

|||

|

Production (mn ton)3 |

5.27 |

5.40 |

5.02 |

8.00 |

7.92 |

7.13 |

||

|

Deliveries (mn ton) |

4.94 |

5.42 |

4.79 |

7.39 |

7.98 |

7.20 |

||

|

Turnover |

33,194 |

36,769 |

36,146 |

54,771 |

58,687 |

59,490 | ||

|

Reported EBITDA |

7,029 |

8,285 |

7,613 |

6,822 |

6,631 |

6,122 |

||

|

Reported EBITDA per ton (Rs. Per ton) |

14,227 |

15,282 |

15,884 |

9,234 |

8,311 |

8,503 |

||

|

Adjusted EBITDA 4 |

7,032 |

8,270 |

7,668 |

6,950 |

6,969 |

6,238 |

||

|

Adjusted EBITDA per ton (Rs. Per ton) |

14,233 |

15,255 |

15,998 |

9,407 |

8,735 |

8,664 |

||

|

PBT before exceptional items |

4,704 |

5,905 |

5,460 |

2,735 |

2,403 |

1,842 |

||

|

Exceptional Items (gain)/loss |

237 |

642 |

11 |

358 |

594 |

(13) |

||

|

Reported Profit after Tax |

3,335 |

3,889 |

4,995 |

919 |

555 |

525 |

||

|

1.Tata Steel Standalone numbers have been restated from April 1, 2023, to reflect merger of Angul Energy Limited and Bhubaneshwar Power Private Limited with Tata Steel; Figures for previous periods have been regrouped and reclassified to conform to classification of current period, where necessary; 2. India includes Tata Steel Standalone and Neelachal Ispat Nigam Limited on proforma basis adjusted for intercompany purchase and sale; 3. Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for UK & Netherlands and saleable steel for South East Asia; 4. Adjusted for changes on account of FX movement on intercompany debt / receivables |

||||||||

Management Comments:

Mr. T V Narendran, Chief Executive Officer & Managing Director:

“During the quarter, subdued steel demand across most regions weighed on global steel prices. In India, steel demand was broadly stable despite some impact due to elections and heat waves. In India, our crude steel production was up 5% YoY to around 5.3 million tons. Deliveries at around 4.9 million tons were the ‘best ever 1Q’ sales aided by 4% YoY growth in domestic deliveries. Among business verticals, automotive witnessed 9% YoY growth aided by higher than market growth in select sub segments. Tata Tiscon continued to grow aided by enhanced reach and scale-up of consumer connect programs. We are focusing on innovative solutions to shape market practices and enhance customer experience to retain leadership in chosen segments. We continue to expand our footprint via new dealer appointments, e-commerce portals and influencers. The 5 MTPA expansion project at Kalinganagar is on track for the blast furnace to start in September 2024. The heating process for blast furnace stoves and coke oven batteries has commenced as planned. Additionally, the commissioning activities for Continuous Annealing Line of the 2.2 MTPA CRM complex at Kalinganagar are progressing well for start up in August 2024. In UK, we have safely ceased operations at one of the blast furnaces (BF #5) at Port Talbot and are on track to close the remaining blast furnace by September 2024. We are committed to supporting affected employees alongside providing multiple training and community support schemes. In Netherlands, our production has risen on QoQ as well as YoY basis, upon return to normal operating levels. Sustainable operations are integral to our strategic goals and Tata Steel has launched the first carbon bank in India. Further, Tata Steel remains dedicated to enhancing diversity and am happy to share that we recently deployed the first-ever crew of female firefighters in the Indian steel industry.”

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer:

“Tata Steel Consolidated revenues for the quarter were Rs 54,771 crores and EBITDA was Rs 6,822 crores. Consolidated EBITDA margin was around 12.5%, with an improvement of more than 100 bps on QoQ basis. India revenues were around Rs 33,194 crores and EBITDA was Rs 7,029 crores, which translates to an EBITDA per ton of Rs 14,227 and an EBITDA margin of 21%. Netherlands revenues were broadly stable despite subdued demand dynamics but cost profile continued to improve with stabilisation of operations leading to EBITDA improving from -ve £27 million in 4Q to +ve £43 million in 1Q. This was partly offset by EBITDA loss at UK operations which is in the midst of restructuring and transition. Given the planned closure of blast furnaces in UK, there has been steel stock build-up for the downstream operations which impacted working capital. We continue to focus on growth in India and have spent Rs 3,777 crores on capital expenditure during the quarter. Net debt stands at Rs 82,162 crores. Group liquidity position remains strong at Rs 36,460 crores, which includes Rs 10,799 crores of cash and cash equivalents. We also remain focused on cost optimisation, operational improvements and working capital management to maximise cashflows. With respect to the UK transition, we are proceeding as per previously announced timelines for the closure of the heavy end, a step which is critical to address the deep cash burn associated with the upstream end of life assets. We are also on track with regard to supply chain preparedness for imports of semi-finished steel which will be utilized by the downstream assets to continue to service customers, after the closure of the blast furnaces. We are fully committed to supporting affected employees, have offered the best ever package of support in Tata Steel UK, and continue to engage deeply with the Unions in this respect. The Voluntary Redundancy Aspiration process was launched on 10th July and will close on 07th August. We are working closely with the recently elected UK government on finalisation of grant funding process for the new Electric Arc Furnace project. We have also started active engagement with the government in Netherlands on support for the decarbonisation project.”

Disclaimer:

Statements in this press release describing the Company’s performance may be “forward-looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred, or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors

For queries and information

Sarvesh Kumar, Chief Corporate Communications - Tata Steel,

E-mail : sarvesh.kumar@tatasteel.com

About Tata Steel

- Tata Steel group is among the top global steel companies with an annual crude steel capacity of 35 million tonnes per annum.

- It is one of the world's most geographically diversified steel producers, with operations and commercial presence across the world.

- The group recorded a consolidated turnover of around US$27.7 billion in the financial year ending March 31, 2024.

- A Great Place to Work-CertifiedTM organisation, Tata Steel Limited, together with its subsidiaries, associates, and joint ventures, is spread across five continents with an employee base of over 78,000.

- Tata Steel has announced its major sustainability objectives including Net Zero by 2045.

- The Company has been on a multi-year digital-enabled business transformation journey intending to be the leader in ‘Digital Steel making’. The Company has received the World Economic Forum’s Global Lighthouse recognition for its Jamshedpur, Kalinganagar, and IJmuiden Plants. Tata Steel has also been recognised with the ‘Digital Enterprise of India – Steel’ Award 2024 by Economic Times CIO.

- Tata Steel aspires to have a 20% diverse workforce by 2025. The Company has been recognised with the World Economic Forum’s Global Diversity Equity & Inclusion Lighthouse 2023.

- The Company has been a part of the DJSI Emerging Markets Index since 2012 and has been consistently ranked among the top 10 steel companies in the DJSI Corporate Sustainability Assessment since 2016.

- Tata Steel’s Jamshedpur Plant is India’s first site to receive ResponsibleSteelTM Certification. Subsequently, its Kalinganagar and Meramandali plants have also received the certification. In India, Tata Steel now has more than 90% of its steel production from ResponsibleSteelTM certified sites.

- Received Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17, 2024 Steel Sustainability Champion recognition from worldsteel for seven years in a row, 2023 Climate Change Leadership Award by CDP, Top performer in Iron and Steel sector in Dun & Bradstreet's India's top 500 companies 2022, Ranked as the 2024 most valuable Mining and Metals brand in India by Brand Finance, ‘Most Ethical Company’ award 2021 from Ethisphere Institute, and ‘Best Corporate for Promotion of Sports’ recognition at the Sportstar Aces Awards 2024.

- Received the 2023 Global ERM (Enterprise Risk Management) Award of Distinction at the RIMS ERM Conference 2023, ‘Masters of Risk’ - Metals & Mining Sector recognition at The India Risk Management Awards for the eighth consecutive year, and ICSI Business Responsibility and Sustainability Award 2023 for its first Business Responsibility and Sustainability Report (BRSR), Excellence in Financial Reporting FY20 from ICAI, among several others.

Photographs: Management and Plant facilities

Logos: Files and usage guidelines

Website: www.tatasteel.com and www.wealsomaketomorrow.com