Tata Steel reports Consolidated EBITDA of Rs 6,122 crores for the quarter ended June 30, 2023

Highlights:

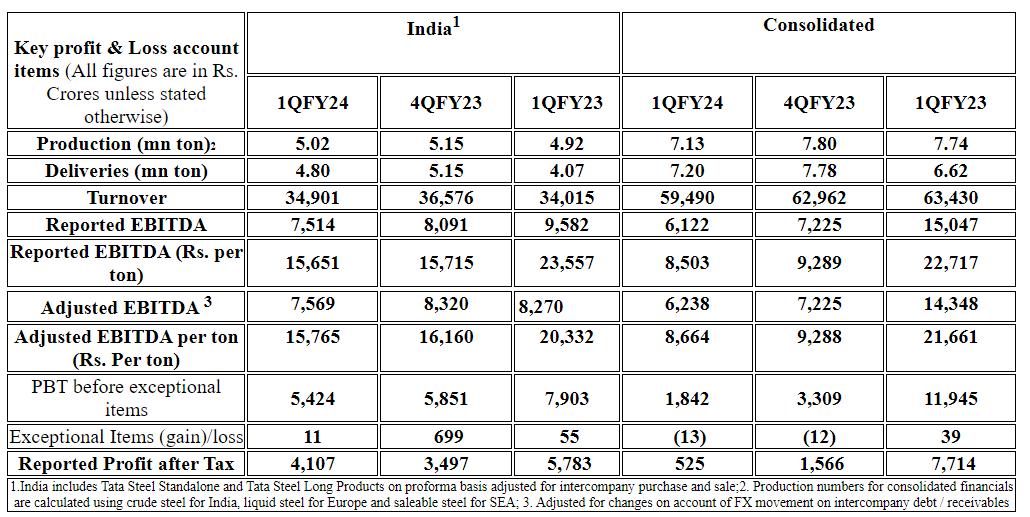

- Consolidated Revenues for the quarter stood at Rs 59,490 crores. EBITDA was Rs 6,122 crores and EBITDA margin was 10%.

- Consolidated Profit after Tax stood at Rs 525 crores. Profitability was affected by non-cash deferred tax charge on account of buy-in transaction at British Steel Pension Scheme. With this, the insurance buy-in of BSPS has been completed, successfully derisking Tata Steel UK.

- The company has spent Rs 4,089 crores on capital expenditure during the quarter. Work on 5 MTPA expansion at Kalinganagar and EAF mill of 0.75 MTPA in Punjab is progressing.

- Net debt stands at Rs. 71,397 crores. Our group liquidity remains strong at Rs 30,569 crores.

- India1 revenues were Rs 34,901 crores and EBITDA was Rs 7,514 crores

- Crude steel production was around 5 million tons and was up 2% YoY primarily driven by ramp up at Neelachal Ispat Nigam Limited.

- Deliveries at 4.8 million tons were higher by 18% on YoY basis, driven by rise in domestic deliveries. Broad based improvement was witnessed across key end use segments.

- EBITDA was Rs.7,514 crores which translates into EBITDA per ton of Rs 15,651 and EBITDA margin of 22%

- Europe revenues were £2,083 million and EBITDA loss stood at £153 million.

- The planned relining of BF6 at Tata Steel Netherlands commenced in April and this has led to drop in crude steel production.

- Liquid steel production was 1.79 million tons while deliveries stood at 1.99 million tons.

Financial Highlights:

|

|

India1 |

Consolidated |

||||||||

|

1QFY24 |

4QFY23 |

1QFY23 |

1QFY24 |

4QFY23 |

1QFY23 |

|||||

|

Production (mn ton)2 |

5.02 |

5.15 |

4.92 |

7.13 |

7.80 |

7.74 |

||||

|

Deliveries (mn ton) |

4.80 |

5.15 |

4.07 |

7.20 |

7.78 |

6.62 |

||||

|

Turnover |

34,901 |

36,576 |

34,015 |

59,490 | 62,962 | 63,430 | ||||

|

Reported EBITDA |

7,514 |

8,091 |

9,582 |

6,122 |

7,225 |

15,047 |

||||

|

Reported EBITDA (Rs. per ton) |

15,651 |

15,715 |

23,557 |

8,503 |

9,289 |

22,717 |

||||

|

Adjusted EBITDA 3 |

7,569 |

8,320 |

|

6,238 |

7,225 |

14,348 |

||||

|

Adjusted EBITDA per ton (Rs. Per ton) |

15,765 |

16,160 |

20,332 |

8,664 |

9,288 |

21,661 |

||||

|

PBT before exceptional items |

5,424 |

5,851 |

7,903 |

1,842 |

3,309 |

11,945 |

||||

|

Exceptional Items (gain)/loss |

11 |

699 |

55 |

(13) |

(12) |

39 |

||||

|

Reported Profit after Tax |

4,107 |

3,497 |

5,783 |

525 |

1,566 |

7,714 |

||||

|

1.India includes Tata Steel Standalone and Tata Steel Long Products on proforma basis adjusted for intercompany purchase and sale;2. Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for Europe and saleable steel for SEA; 3. Adjusted for changes on account of FX movement on intercompany debt / receivables |

||||||||||

Management Comments:

Mr. T V Narendran, Chief Executive Officer & Managing Director:

“During the quarter, global economic recovery continued to face headwinds affecting commodity prices including steel. In India, domestic steel demand continued to grow and was up around 10% on YoY basis but steel spot prices moderated in line with global cues. Tata Steel delivered steady performance, with India crude steel production of around 5 million tons. Domestic deliveries were up >20% and grew at a faster pace than India’s apparent steel consumption. We saw strong growth in key segments such as Branded Products & Retail and Industrial Products & Projects. which grew by 37% and 24% respectively, on YoY basis. Our retail sales majorly to individual home builders crossed 3 million tons in the last 12 months and we now service 8,000+ out of ~19,100 pin codes in India. I am happy to share that Neelachal Ispat Nigam Limited has begun to stabilise and is operating close to rated capacity within just 9 months of acquisition. The 5 MTPA expansion at Kalinganagar is underway with facilities getting commissioned in a phased manner. This is an important milestone in our journey to grow to 40 million tons and will aid in further consolidating our market position in India. We continue to progress on our sustainability journey and multiple initiatives are underway, calibrated to each operating location. In Netherlands, we are pursuing Roadmap+ program to bring about a significant reduction in emissions, dust, odour and noise. We are also engaged in discussions with technology providers and the government for transitioning to greener steel.”

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer:

“Tata Steel Consolidated revenues for the quarter stood at Rs 59,490 crores and consolidated EBITDA stood at Rs 6,122 crores, which translates to an EBITDA per ton of Rs 8,503. Despite a moderation in global steel spreads, our margin was broadly stable at around 10%. India business generated higher margin of around 22% and EBITDA stood at Rs 7,514 crores. Standalone revenues stood at Rs 32,342 crores and EBITDA was Rs 7,348 crores, which translates to an EBITDA per ton of ~Rs 15,895. In Europe, margins were broadly similar on QoQ basis as rise in revenue per ton was offset by lower volumes and elevated input costs. In UK, the buy-in transaction for the residual liabilities of British Steel Pension Scheme has been completed, successfully derisking Tata Steel UK. Volatility in steel markets have impacted working capital and cash flows but we continue to commit to growth in India and spent Rs 4,089 crores on capital expenditure during the quarter. This has led to a Net debt of Rs 71,397 crores. Group liquidity position remains strong at Rs 30,569 crores, which includes Rs 19,043 crores of cash and cash equivalents. We remain focused on cost optimisation, operational improvements and working capital management to maximise cashflows. Sustainability is at the core of our strategy which includes providing comprehensive disclosures. We recently published our first Business Responsibility and Sustainability Report and are actively involved in the development of global and national standards with respect to sustainability disclosures.”

Disclaimer:

Statements in this press release describing the Company’s performance may be “forward looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors.

For queries and information

Sarvesh Kumar,

Chief Corporate Communications - Tata Steel,

E-mail : sarvesh.kumar@tatasteel.com

About Tata Steel

- Tata Steel group is among the top global steel companies with an annual crude steel capacity of 35 million tonnes per annum.

- It is one of the world's most geographically diversified steel producers, with operations and commercial presence across the world.

- The group recorded a consolidated turnover of ~US$30.3 billion in the financial year ending March 31, 2023.

- A Great Place to Work-CertifiedTM organisation, Tata Steel Limited, together with its subsidiaries, associates, and joint ventures, is spread across five continents with an employee base of over 77,000.

- Tata Steel has announced its major sustainability objectives including Net Zero Carbon by 2045, Net Zero Water consumption by 2030, improving Ambient Air Quality and No Net loss in Biodiversity by 2030.

- The Company has been on a multi-year digital-enabled business transformation journey intending to be the leader in ‘Digital Steel making by 2025’. The Company has received the World Economic Forum’s Global Lighthouse recognition for its Jamshedpur, Kalinganagar and IJmuiden Plants.

- Tata Steel aspires to have 25% diverse workforce by 2025. The Company has been recognised with the World Economic Forum’s Global Diversity Equity & Inclusion Lighthouse 2023.

- The Company has been a part of the DJSI Emerging Markets Index since 2012 and has been consistently ranked amongst top 10 steel companies in the DJSI Corporate Sustainability Assessment since 2016.

- Tata Steel’s Jamshedpur Plant is India’s first site to receive ResponsibleSteelTM Certification.

- Received Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17, 2023 Steel Sustainability Champion recognition from worldsteel for six years in a row, 2022 ‘Supplier Engagement Leader’ recognition by CDP, Top performer in Iron and Steel sector in Dun & Bradstreet's India's top 500 companies 2022, No. 1 brand in India in the Mining and Metals industry in Top 100 brand rankings for 2023 by Brand Finance, and ‘Most Ethical Company’ award 2021 from Ethisphere Institute.

- Received 2022 ERM Global Award of Distinction, ‘Masters of Risk’ - Metals & Mining Sector recognition at The India Risk Management Awards for the seventh consecutive year, and Award for Excellence in Financial Reporting FY20 from ICAI, among several others.

Photographs: Management and Plant facilities

Logos: Files and usage guidelines

Website: www.tatasteel.com and www.wealsomaketomorrow.com