Tata Steel’s Koushik Chatterjee joins the Taskforce on Nature-related Financial Disclosures (TNFD) to tackle nature-related risks

~ TNFD announces Taskforce Members and Launch of Consultative Forum, Leveraging Global Nature and Finance Expertise ~

~ Taskforce Members will work with TNFD Co-Chairs to deliver the Framework in the next two years ~

Koushik Chatterjee, ED & CFO of Tata Steel, along with other senior executives from across financial institutions, other corporates and market service providers representing major global markets have joined the Taskforce on Nature-related Financial Disclosures (TNFD) as its Members.

The 30 Taskforce Members of TNFD have been selected for their sector and geographical coverage and their individual subject-matter expertise across nature and finance that can support TNFD’s mission. The Members represent sectors with the largest impact and dependencies on nature, such as agribusiness, the blue economy, food & beverage, mining, construction, infrastructure and others, and are globally representative coming from 14 countries across 5 continents.

Officially launched in June 2021, TNFD aims to provide a framework for organisations to report and act on evolving nature-related risks, in order to support a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes.

T V Narendran, CEO & MD, Tata Steel, said: “Tata Steel has a long history of leadership in sustainability practices, including measurement and awareness of our consumption of natural capital. Given our large operations, we understand the need to preserve bio-diversity around our several manufacturing and mining sites. I fully support Tata Steel and Koushik's association with TNFD, which will drive more effective and practical measurement, mitigation and solutions for nature-related risks - something that is essential for the sustainability of our planet, our economies and our businesses.”

Led by TNFD Co-Chairs Elizabeth Mrema, United Nations Assistant Secretary General and Executive Secretary of the UN Convention on Biological Diversity (CBD) and David Craig, Former CEO of Refinitiv and Strategic Advisor to London Stock Exchange Group (LSEG), the Taskforce Members are convening for the first time on the 6th of October to kick off their work developing and delivering a risk management and financial disclosure framework to support a shift in global financial flows away from nature-negative outcomes and towards nature-positive outcomes.

The finalised framework is earmarked for release in late 2023. However, a draft beta version will be circulated in early 2022 to be tested and refined via an open-innovation approach with market participants throughout next year.

The Taskforce membership will ultimately consist of up to 35 individuals. Selection of the remaining senior executives is currently underway, bringing in further specialists from sectors and geographies to broaden the Taskforce’s geographic and sector coverage and its diversity of expertise.

“The business and financial world’s race towards net zero emissions will only succeed if they race equally fast towards nature-positivity. While the importance and urgency of our work is clear, so is the complexity of the challenge ahead for the TNFD. The TNFD initiative is by the market for the market. Therefore, development of a practical framework for nature-related risks will only be achievable by bringing together market practitioners and experts in biodiversity, data, metrics and standards, risk management and disclosure frameworks into a unique collaborative endeavour. We are looking forward to immediately starting the work with our Taskforce Members,” said TNFD Co-Chairs, Elizabeth Mrema and David Craig.

Each Taskforce Member will be part of at least one of five initial Working Groups through which the specific, technical work will begin to develop the TNFD framework.

The five Working Groups comprise, and their work will focus on:

- Defining nature-related risks

- Data availability

- Landscape of standards and metrics

- Development of a Beta framework

- Pilot testing and integration

Supporting the work of the Taskforce itself is a broader consultative body of institutional supporters and partners known as the TNFD Forum.

The TNFD Forum is a global multi-disciplinary consultative group of institutions launching with over 100 Forum members. These institutions share the vision and mission of the TNFD and have expressed the willingness to make themselves available to contribute to the work of the Taskforce. The TNFD Forum is open for membership and expected to grow over time as more organisations become aware of the importance of their engagement and come on board to support a shift in financial flows towards nature-positive outcomes. In addition to the already confirmed Forum members, a further 100 institutions have also expressed interest in joining the Forum in the short term.

A TNFD Secretariat is in place to support the work of the Co-Chairs, the Taskforce Members and their Working Groups Leads.

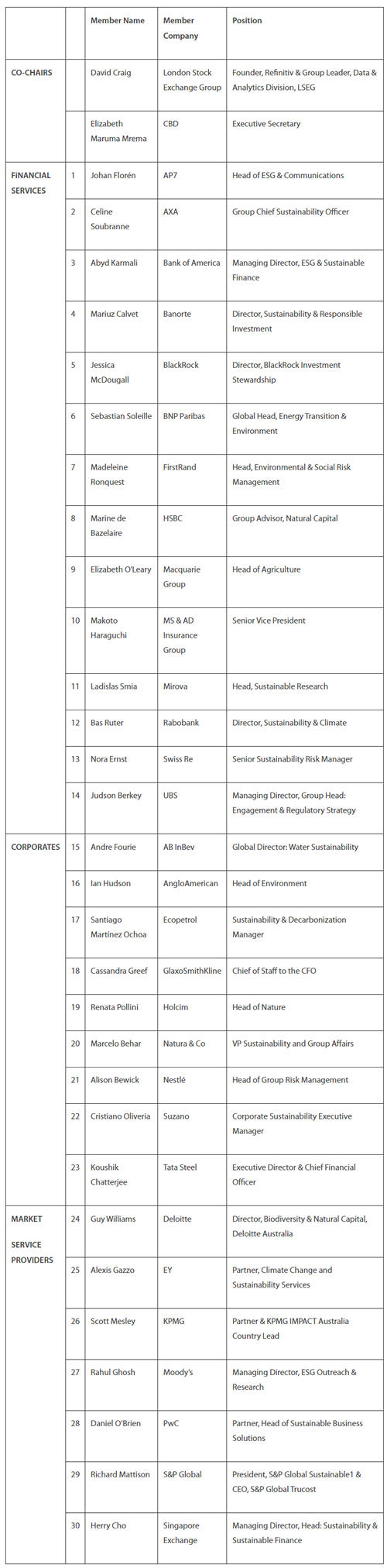

The full list of the Co-Chairs + 30 Taskforce Members:

|

|

|

Member Name |

Member Company |

Position |

|

CO-CHAIRS |

|

David Craig |

London Stock Exchange Group |

Founder, Refinitiv & Group Leader, Data & Analytics Division, LSEG |

|

|

Elizabeth Maruma Mrema |

CBD |

Executive Secretary |

|

|

FiNANCIAL SERVICES |

1 |

Johan Florén |

AP7 |

Head of ESG & Communications |

|

2 |

Celine Soubranne |

AXA |

Group Chief Sustainability Officer |

|

|

3 |

Abyd Karmali |

Bank of America |

Managing Director, ESG & Sustainable Finance |

|

|

4 |

Mariuz Calvet |

Banorte |

Director, Sustainability & Responsible Investment |

|

|

5 |

Jessica McDougall |

BlackRock |

Director, BlackRock Investment Stewardship |

|

|

6 |

Sebastian Soleille |

BNP Paribas |

Global Head, Energy Transition & Environment |

|

|

7 |

Madeleine Ronquest |

FirstRand |

Head, Environmental & Social Risk Management |

|

|

8 |

Marine de Bazelaire |

HSBC |

Group Advisor, Natural Capital |

|

|

9 |

Elizabeth O'Leary |

Macquarie Group |

Head of Agriculture |

|

|

10 |

Makoto Haraguchi |

MS & AD Insurance Group |

Senior Vice President |

|

|

11 |

Ladislas Smia |

Mirova |

Head, Sustainable Research |

|

|

12 |

Bas Ruter |

Rabobank |

Director, Sustainability & Climate |

|

|

13 |

Nora Ernst |

Swiss Re |

Senior Sustainability Risk Manager |

|

|

14 |

Judson Berkey |

UBS |

Managing Director, Group Head: Engagement & Regulatory Strategy |

|

|

CORPORATES |

15 |

Andre Fourie |

AB InBev |

Global Director: Water Sustainability |

|

16 |

Ian Hudson |

AngloAmerican |

Head of Environment |

|

|

17 |

Santiago Martínez Ochoa |

Ecopetrol |

Sustainability & Decarbonization Manager |

|

|

18 |

Cassandra Greef |

GlaxoSmithKline |

Chief of Staff to the CFO |

|

|

19 |

Renata Pollini |

Holcim |

Head of Nature |

|

|

20 |

Marcelo Behar |

Natura & Co |

VP Sustainability and Group Affairs |

|

|

21 |

Alison Bewick |

Nestlé |

Head of Group Risk Management |

|

|

22 |

Cristiano Oliveria |

Suzano |

Corporate Sustainability Executive Manager |

|

|

23 |

Koushik Chatterjee |

Tata Steel |

Executive Director & Chief Financial Officer |

|

|

MARKET SERVICE PROVIDERS |

24 |

Guy Williams |

Deloitte |

Director, Biodiversity & Natural Capital, Deloitte Australia |

|

25 |

Alexis Gazzo |

EY |

Partner, Climate Change and Sustainability Services |

|

|

26 |

Scott Mesley |

KPMG |

Partner & KPMG IMPACT Australia Country Lead |

|

|

27 |

Rahul Ghosh |

Moody’s |

Managing Director, ESG Outreach & Research |

|

|

28 |

Daniel O’Brien |

PwC |

Partner, Head of Sustainable Business Solutions |

|

|

29 |

Richard Mattison |

S&P Global |

President, S&P Global Sustainable1 & CEO, S&P Global Trucost |

|

|

30 |

Herry Cho |

Singapore Exchange |

Managing Director, Head: Sustainability & Sustainable Finance |

You can find the list of the confirmed TNFD Forum Members here.

ABOUT THE TNFD

The Taskforce on Nature-related Financial Disclosures (TNFD) aims to provide a framework for organisations to report and act on evolving nature-related risks, in order to support a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes.

The TNFD officially launched in June 2021 following a 11-month preparatory phase where 75 Members (49 financial institutions and corporates, 8 governments and 18 consortiums and think-tanks) worked on a proposed scope and workplan for the TNFD. This Informal Working Group was supported by an informal Technical Expert Group, and a Partner Group consisting of Global Canopy, UNDP, UNEP FI, and WWF. An Observer Group of governmental, private sector and civil society organisations was involved by following the activities of the Informal Working Group and feeding back on their deliberations.

Up to 35 Taskforce Members are working with the TNFD Co-Chairs to develop the TNFD Framework. A group of over 100 institutions also support the work of the Taskforce as part of the TNFD Forum.

The TNFD will deliver its framework in 2023, enabling organisations to report and act on evolving nature-related risks. Better information will allow financial institutions and companies to incorporate nature-related risks and opportunities into their decision-making processes.

For more information, contact:

Annebeth Wijtenburg

Communications Lead, TNFD

annebeth.wijtenburg@tnfd.global

+31642291086

About Tata Steel

Tata Steel group is among the top global steel companies with an annual crude steel capacity of 34 million tonnes per annum. It is one of the world's most geographically diversified steel producers, with operations and commercial presence across the world. The group recorded a consolidated turnover of US $21.06 billion in the financial year ending March 31, 2021.

A Great Place to Work-CertifiedTM organisation, Tata Steel Ltd., together with its subsidiaries, associates, and joint ventures, is spread across five continents with an employee base of over 65,000.

Tata Steel has been a part of the DJSI Emerging Markets Index since 2012 and has been consistently ranked amongst top 5 steel companies in the DJSI Corporate Sustainability Assessment since 2016. Besides being a member of ResponsibleSteelTM and worldsteel’s Climate Action Programme, Tata Steel has won several awards and recognitions including the World Economic Forum’s Global Lighthouse recognition for its Jamshedpur, Kalinganagar and IJmuiden Plants, and Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17. The Company, ranked as India’s most valuable Metals & Mining brand by Brand Finance, featured amongst CII Top 25 innovative Indian Companies in 2020, received rating of ‘A-‘ (leadership band) from CDP for its Climate Change disclosure and Supply Chain disclosure, Steel Sustainability Champion 2020 recognition from worldsteel, ‘Most Ethical Company’ award 2021 from Ethisphere Institute, Best Risk Management Framework & Systems Award (2020) from CNBC TV-18, and Award for Excellence in Financial Reporting FY20 from ICAI, among several others.

To know more, visit www.tatasteel.com and WeAlsoMakeTomorrow

Disclaimer:

Statements in this press release describing the Company’s performance may be “forward looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors.

For media enquiries contact:

Sarvesh Kumar

Chief, Corporate Communications - Tata Steel

E-mail: sarvesh.kumar@tatasteel.com