Tata Steel's Q2 FY21 Financial Results

Tata Steel reports one of the best quarterly financial results in recent times; De-leveraging on track with US$1billion of net debt reduction in the first half of the year; Initiation of talks with SSAB Sweden on potential sale of Tata Steel Netherland business

Highlights:

- All major sites in India1 operating close to full capacity utilization.

- Quarterly deliveries at India1 operations grew 72% Quarter on Quarter and 22% Year on Year.

- EBITDA from India1 operations surged 4.1x QoQ and 49% YoY to Rs.6,025 crores, driven by higher volumes, improved realizations and cost efficiencies.

- Tata Steel Standalone EBITDA surged 3.7x QoQ and 33%YoY to Rs.4,718 crores, which translates into an EBITDA per ton of Rs.13,127 and an EBITDA margin of 29%. Key subsidiaries, Tata Steel BSL and Tata Steel Long Products also delivered strong operating performance. Tata Steel BSL generated an EBITDA of Rs.1,113 crores which translates into a EBITDA/t of Rs.8,735 while Tata Steel Long Products generated an EBITDA of Rs.194 crores which translates into a EBITDA/t of Rs.10,512.

- Consolidated EBITDA surged 10.4x QoQ and 60% YoY to Rs.6,217 crores while consolidated PAT from continuing operations increased by 136% QoQ to Rs.1,635 crores.

- The Free Cash Flow generated during the quarter was Rs.7,832 crores. The company is committed to deleveraging of US$1billion annually and has reduced net debt by Rs.8,197 crores during the quarter.

- The company has initiated discussions with SSAB Sweden based on interest received for the potential acquisition of Tata Steel’s Netherland business including Ijmuiden steelworks. The company has also commenced discussions with the Supervisory Board and Board of Management of Tata Steel Netherlands and the process will move to the next stage including due diligence and stakeholders’ consultations. The company is committed to deploy proceeds of any strategic restructuring towards additional deleveraging of the balance sheet.

- The company has also initiated the process to separate Tata Steel Netherlands and Tata Steel UK and will pursue separate strategic paths for the Netherlands and UK business in the future. Tata Steel continues its dialogue with the UK Government on potential measures to safeguard the long-term future of Tata Steel UK and is also reviewing all options to make the business self-sustaining without the need for any funding support from Tata Steel India in the future.

- Tata Steel is reorganizing its India footprint and folding listed and unlisted subsidiaries into 4 clusters to drive scale, synergies and simplification and to create value for all stakeholders. The business clusters are Long products, Downstream, Mining and Utilities & Infrastructure. Today, the Boards of Tata Steel Long Products, Tata Metaliks and Indian Steel and Wire Products approved the merger of Tata Metaliks and Indian Steel and Wire Products into Tata Steel Long products. The proposed consolidation will create significant synergies and position the company towards future growth in the long products segment. We expect to complete the process in next 6-9 months, subject to necessary regulatory approvals.

1 India includes Tata Steel Standalone, Tata Steel BSL Limited and Tata Steel Long Products Limited on proforma basis without inter-company eliminations.

Financial Highlights:

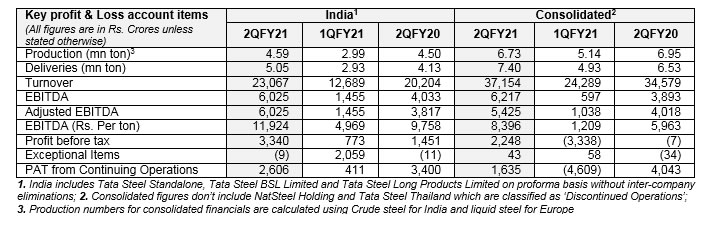

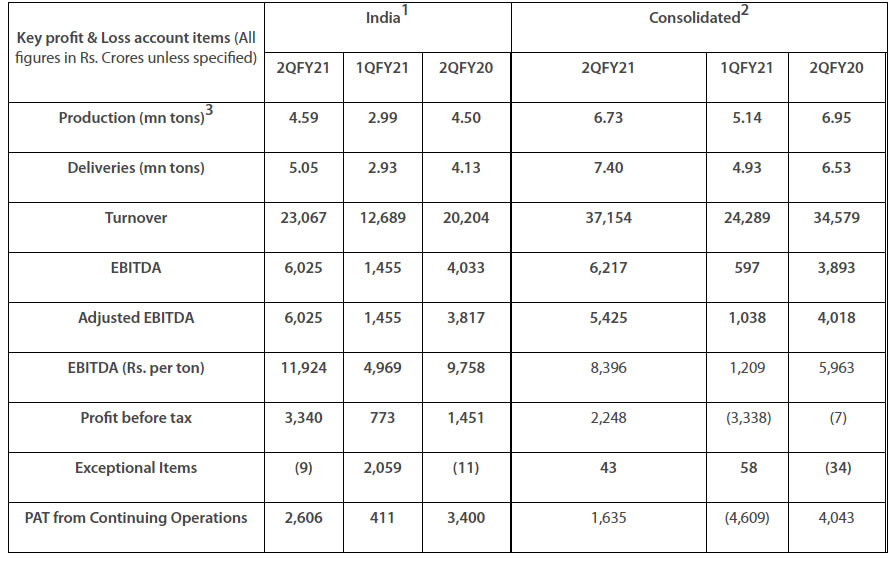

Key profit & Loss account items (All figures in Rs. Crores unless specified) |

India1 |

Consolidated2 |

||||||||||

|

2QFY21 |

1QFY21 |

2QFY20 |

2QFY21 |

1QFY21 |

2QFY20 |

|||||||

|

Production (mn tons)3 |

4.59 |

2.99 |

4.50 |

6.73 |

5.14 |

6.95 |

||||||

|

Deliveries (mn tons) |

5.05 |

2.93 |

4.13 |

7.40 |

4.93 |

6.53 |

||||||

|

Turnover |

23,067 |

12,689 |

20,204 |

37,154 |

24,289 |

34,579 |

||||||

|

EBITDA |

6,025 |

1,455 |

4,033 |

6,217 |

597 |

3,893 |

||||||

|

Adjusted EBITDA |

6,025 |

1,455 |

3,817 |

5,425 |

1,038 |

4,018 |

||||||

|

EBITDA (Rs. per ton) |

11,924 |

4,969 |

9,758 |

8,396 |

1,209 |

5,963 |

||||||

|

Profit before tax |

3,340 |

773 |

1,451 |

2,248 |

(3,338) |

(7) |

||||||

|

Exceptional Items |

(9) |

2,059 |

(11) |

43 |

58 |

(34) |

||||||

|

PAT from Continuing Operations |

2,606 |

411 |

3,400 |

1,635 |

(4,609) |

4,043 |

||||||

1. India includes Tata Steel Standalone, Tata Steel BSL Limited and Tata Steel Long Products Limited on proforma basis without inter-company eliminations; 2. Consolidated figures don’t include NatSteel Holding and Tata Steel Thailand which are classified as ‘Discontinued Operations’; 3. Production numbers for consolidated financials are calculated using Crude steel for India and liquid steel for Europe

Management Comments:

Mr. T V Narendran, CEO & Managing Director:

“Tata Steel has delivered strong results in India with broad based, market leading volume growth and strong cashflow generation. The resilience of our business model and the commitment of our teams has enabled us to ramp-up capacity utilization to normal levels and achieve highest ever sales despite the ongoing challenges due to the COVID pandemic. There has also been a significant improvement in product mix towards domestic sales and higher value-added products and a sharp reduction in costs. We are now embarking on re-organizing our Indian subsidiaries into four verticals to drive scale, synergies and simplification which we are confident will create value for our stakeholders.

In Europe, though the overall environment remains challenging and recovery is more gradual, there has been an improvement in volumes and sales mix. We will continue to drive performance and work on a strategic resolution to ensure the focus remains on cash flows and self-sufficiency. We are continuing our discussions with the UK Government regarding the future strategy of our UK business”

Mr. Koushik Chatterjee, Executive Director and CFO:

“It is very heartening to report that despite the pandemic, Tata Steel has delivered one of the best quarterly results in India in the recent times. This was driven by relentless focus on operating performance and a reduction in our cash costs by almost 14% on a quarter on quarter basis. India operations generated an EBITDA of Rs.6,025 crores and Tata Steel Standalone EBITDA margin crossed 29% with an EBITDA/t of Rs.13,127.

We continue to pivot the business decisions on cash while aggressively managing costs and being highly disciplined on capex to ensure we progress on our deleveraging journey. This quarter we reduced our consolidated net debt by Rs.8,197 crores which is now below March 2019 levels. We ended 2Q with a liquidity buffer of Rs.24,323 crores with about Rs.17,824 crores in cash & cash equivalents which along with robust internal generation gives us enough headroom to further deleverage going forward.

Based on the discussions, initiated by SSAB Sweden, regarding a potential acquisition of Tata Steel’s Netherlands business, we will undertake a due process and move to the next stages including consultation and due diligence. In India too, we are moving on the consolidation and the corporate simplification process with the announcement today of the merger of Tata Metaliks and Indian Steel and Wire products into Tata Steel Long Products.”

About Tata Steel

Tata Steel group is among the top global steel companies with an annual crude steel capacity of 34 million tonnes per annum. It is one of the world's most geographically-diversified steel producers, with operations and commercial presence across the world. The group (excluding SEA operations) recorded a consolidated turnover of US $19.7 billion in the financial year ending March 31, 2020.

A Great Place to Work-CertifiedTM organisation, Tata Steel Ltd., together with its subsidiaries, associates and joint ventures, is spread across five continents with an employee base of over 65,000.

Tata Steel was recognized as DJSI steel sector leader in 2018 and has ranked fourth in the steel sector in 2019. Besides being a member of the worldsteel’s Climate Action Programme, Tata Steel has won several awards and recognitions including the World Economic Forum’s Global Lighthouse recognition for its Kalinganagar Plant - a first in India, and Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17. The Company, ranked as India’s most valuable Metals & Mining brand by Brand Finance, received the ‘Honourable Mention’ at the National CSR Awards 2019, Steel Sustainability Champion 2019 by worldsteel, CII Greenco Star Performer Award 2019, ‘Most Ethical Company’ award 2020 from Ethisphere Institute, and Best Risk Management Framework & Systems Award (2020) by CNBC TV-18, among several others.

To know more, visit www.tatasteel.com and www.wealsomaketomorrow.com

Follow us on ![]()

![]()

![]()

![]()

![]()

Kulvin Suri

Tel: +91 22 6665 0581/ +91 92310 52397

E-mail: kulvinsuri@tatasteel.com

Rob Simpson

Tel: +44 207 717 4404/ +44 7990 786 531

E-mail: rob.simpson@tatasteeleurope.com