Tata Steel reports Consolidated EBITDA of Rs 23,402 crores for FY2024

Tata Steel reports Consolidated EBITDA of Rs 23,402 crores for FY2024

|

Highlights:

|

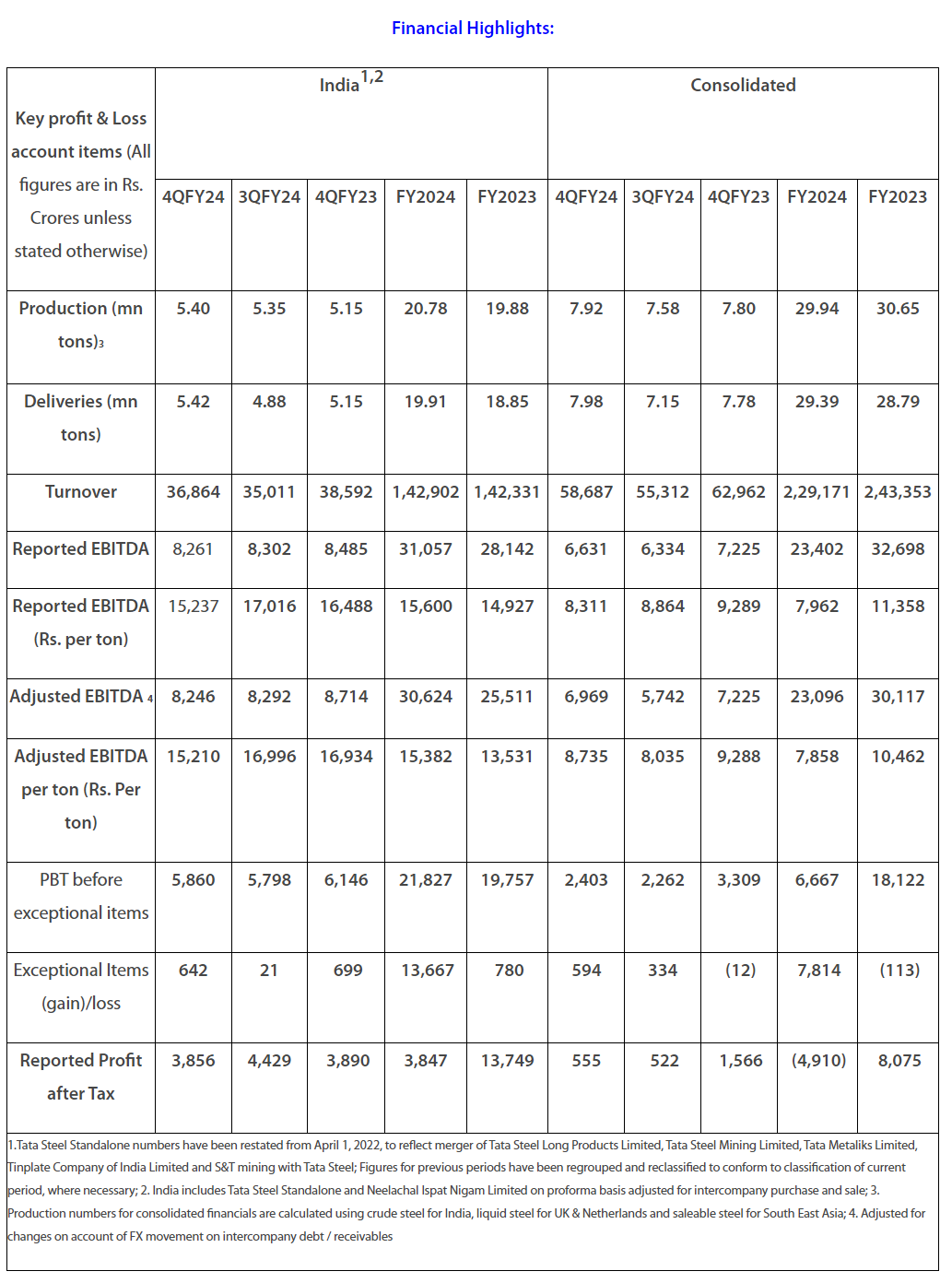

Financial Highlights:

|

|

India1,2 |

Consolidated |

||||||||

|

4QFY24 |

3QFY24 |

4QFY23 |

FY2024 |

FY2023 |

4QFY24 |

3QFY24 |

4QFY23 |

FY2024 |

FY2023 |

|

|

Production (mn tons)3 |

5.40 |

5.35 |

5.15 |

20.78 |

19.88 |

7.92 |

7.58 |

7.80 |

29.94 |

30.65 |

|

Deliveries (mn tons) |

5.42 |

4.88 |

5.15 |

19.91 |

18.85 |

7.98 |

7.15 |

7.78 |

29.39 |

28.79 |

|

Turnover |

36,864 |

35,011 |

38,592 |

1,42,902 |

1,42,331 |

58,687 | 55,312 | 62,962 | 2,29,171 | 2,43,353 |

|

Reported EBITDA |

8,261 |

8,302 |

8,485 |

31,057 |

28,142 |

6,631 |

6,334 |

7,225 |

23,402 |

32,698 |

|

Reported EBITDA (Rs. per ton) |

15,237 |

17,016 |

16,488 |

15,600 |

14,927 |

8,311 |

8,864 |

9,289 |

7,962 |

11,358 |

|

Adjusted EBITDA 4 |

8,246 |

8,292 |

8,714 |

30,624 |

25,511 |

6,969 |

5,742 |

7,225 |

23,096 |

30,117 |

|

Adjusted EBITDA (Rs. Per ton) |

15,210 |

16,996 |

16,934 |

15,382 |

13,531 |

8,735 |

8,035 |

9,288 |

7,858 |

10,462 |

|

PBT before exceptional items |

5,860 |

5,798 |

6,146 |

21,827 |

19,757 |

2,403 |

2,262 |

3,309 |

6,667 |

18,122 |

|

Exceptional Items (gain)/loss |

642 |

21 |

699 |

13,667 |

780 |

594 |

334 |

(12) |

7,814 |

(113) |

|

Reported Profit after Tax |

3,856 |

4,429 |

3,890 |

3,847 |

13,749 |

555 |

522 |

1,566 |

(4,910) |

8,075 |

|

1.Tata Steel Standalone numbers have been restated from April 1, 2022, to reflect merger of Tata Steel Long Products Limited, Tata Steel Mining Limited, Tata Metaliks Limited, Tinplate Company of India Limited and S&T mining with Tata Steel; Figures for previous periods have been regrouped and reclassified to conform to classification of current period, where necessary; 2. India includes Tata Steel Standalone and Neelachal Ispat Nigam Limited on proforma basis adjusted for intercompany purchase and sale; 3. Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for UK & Netherlands and saleable steel for South East Asia; 4. Adjusted for changes on account of FX movement on intercompany debt / receivables |

||||||||||

Management Comments:

Mr. T V Narendran, Chief Executive Officer & Managing Director:

“FY2024 has been a year of progress for Tata Steel with transition towards stated goals in India and abroad despite the challenging operating environment. In India, which is a structurally attractive market, we have delivered improved margins and continued to expand our footprint in terms of volumes as well as product portfolio. Our domestic deliveries were best ever at around 19 million tons and were up 9% YoY with broad based improvement across chosen market segments. Automotive volumes were aided by higher deliveries of hot-rolled and cold-rolled steel to auto OEMs while our well-established retail brand Tata Tiscon crossed 2 million tons on an annual basis. We have consistently filed 100+ patents per annum, on average, in the last 5 years. Overall, India deliveries now make up 68% of total deliveries and will continue to grow with incremental volumes from 5 MTPA capacity expansion at Kalinganagar. With respect to the UK operations, we have decided to proceed with the proposed restructuring of heavy end UK assets and transition to greener steelmaking after due consideration of all the options over the last 7 months in consultation with union representatives. We are committed to creating a low-CO2 steel business that preserves the majority of the jobs in UK while also creating economic opportunities. In Netherlands, our production was lower due to the relining of BF6. The relining was completed in early February and we have stabilised the operations. We continue to undertake multiple initiatives across geographies to progress on our sustainability journey. I am happy to share that we have achieved zero effluent discharge at our Kalinganagar site in India and have been recognised by worldsteel as Sustainability champion for the seventh time in a row.”

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer:

“Tata Steel Consolidated revenues for FY2024 were around $27.7 billion aided by higher volumes in India. Consolidated EBITDA was Rs 23,402 crores, which translates to an EBITDA margin of around 10%. India EBITDA increased by 10% YoY to Rs 31,057 crores, with margin improvement of around 200 bps to 22%, translating to Profit after tax (excluding exceptional items) of Rs 17,514 crores. For the quarter, Consolidated revenues were Rs 58,687 crores and EBITDA was marginally higher at Rs 6,631 crores on QoQ basis. Consolidated cash flow from operations was around Rs 7,400 crores for the quarter and Rs 20,300 crores for the full year. Our capital expenditure was Rs 4,850 crores for the quarter and Rs 18,207 crores for the full year, up 29% YoY. Our Group liquidity remains strong at Rs 31,767 crores. The Board has recommended a dividend of Rs 3.60 per share. Moving to strategic initiatives, we have been carefully considering the alternative proposal from the representative body of the UK trade unions and have concluded that maintaining one blast furnace till the transition would have incurred at least £1.6 billion of additional costs, created significant operational and safety risk, and delayed the EAF by two years. We have therefore discussed with the Unions and concluded national level consultation on the asset plan. We will proceed with our proposal to shut down heavy end assets this year, and setup the EAF by 2027. This is a difficult period of change for our people and we will do our upmost to support the affected employees. With respect to the Electric Arc Furnace, we will place equipment orders by Sep 2024 and have signed the agreement with the UK National Grid securing the high voltage connection, which will be available on schedule. We have as part of discussions with the unions, offered the best ever package of support for affected employees in Tata Steel UK. We have also agreed the final and detailed terms of the proposed grant package with the UK government to support the £1.25 billion investment.”

Disclaimer:

Statements in this press release describing the Company’s performance may be “forward-looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred, or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors.

For media enquiries contact:

Sarvesh Kumar

Chief Corporate Communications

Tel: +91 98301 71705

E-mail: sarvesh.kumar@tatasteel.com

About Tata Steel

- Tata Steel group is among the top global steel companies with an annual crude steel capacity of 35 million tonnes per annum.

- It is one of the world's most geographically diversified steel producers, with operations and commercial presence across the world.

- The group recorded a consolidated turnover of ~US$30.3 billion in the financial year ending March 31, 2023.

- A Great Place to Work-CertifiedTM organisation, Tata Steel Limited, together with its subsidiaries, associates, and joint ventures, is spread across five continents with an employee base of over 77,000.

- Tata Steel has announced its major sustainability objectives including Net Zero Carbon by 2045.

- The Company has been on a multi-year digital-enabled business transformation journey intending to be the leader in ‘Digital Steel making by 2025’. The Company has received the World Economic Forum’s Global Lighthouse recognition for its Jamshedpur, Kalinganagar and IJmuiden Plants.

- Tata Steel aspires to have 20% diverse workforce by 2025. The Company has been recognised with the World Economic Forum’s Global Diversity Equity & Inclusion Lighthouse 2023.

- The Company has been a part of the DJSI Emerging Markets Index since 2012 and has been consistently ranked amongst top 10 steel companies in the DJSI Corporate Sustainability Assessment since 2016.

- Tata Steel’s Jamshedpur Plant is India’s first site to receive ResponsibleSteelTM Certification.

- Received Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17, 2023 Steel Sustainability Champion recognition from worldsteel for six years in a row, 2022 ‘Supplier Engagement Leader’ recognition by CDP, Top performer in Iron and Steel sector in Dun & Bradstreet's India's top 500 companies 2022, Ranked as the 2023 most valuable Mining and Metals brand in India by Brand Finance, and ‘Most Ethical Company’ award 2021 from Ethisphere Institute.

- Received 2023 ERM (Enterprise Risk Management) Award of Distinction at the RIMS ERM Conference 2023, ‘Masters of Risk’ - Metals & Mining Sector recognition at The India Risk Management Awards for the seventh consecutive year, and Award for Excellence in Financial Reporting FY20 from ICAI, among several others.

Photographs: Management and Plant facilities

Logos: Files and usage guidelines

Website: www.tatasteel.com and www.wealsomaketomorrow.com