Tata Steel reports Consolidated EBITDA of Rs 16,771 crores for the first nine months of the financial year

Tata Steel reports Consolidated EBITDA of Rs 16,771 crores for the first nine months of the financial year

|

Highlights:

|

Financial Highlights:

|

|

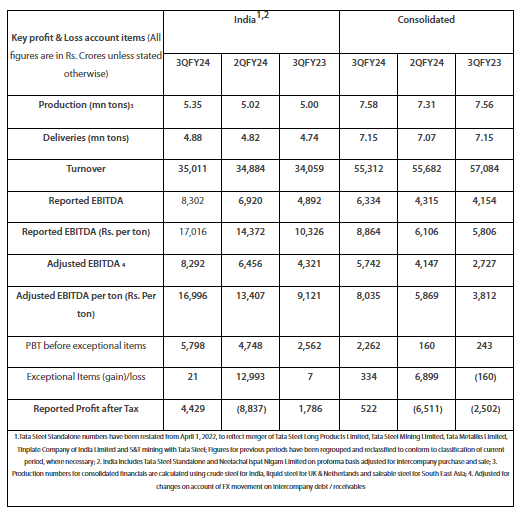

India1,2 |

Consolidated |

||||||||

|

3QFY24 |

2QFY24 |

3QFY23 |

3QFY24 |

2QFY24 |

3QFY23 |

|||||

|

Production (mn tons)3 |

5.35 |

5.02 |

5.00 |

7.58 |

7.31 |

7.56 |

||||

|

Deliveries (mn tons) |

4.88 |

4.82 |

4.74 |

7.15 |

7.07 |

7.15 |

||||

|

Turnover |

35,011 |

34,884 |

34,059 |

55,312 | 55,682 | 57,084 | ||||

|

Reported EBITDA |

8,302 |

6,920 |

4,892 |

6,334 |

4,315 |

4,154 |

||||

|

Reported EBITDA (Rs. per ton) |

17,016 |

14,372 |

10,326 |

8,864 |

6,106 |

5,806 |

||||

|

Adjusted EBITDA 4 |

8,292 |

6,456 |

4,321 |

5,742 |

4,147 |

2,727 |

||||

|

Adjusted EBITDA per ton (Rs. Per ton) |

16,996 |

13,407 |

9,121 |

8,035 |

5,869 |

3,812 |

||||

|

PBT before exceptional items |

5,798 |

4,748 |

2,562 |

2,262 |

160 |

243 |

||||

|

Exceptional Items (gain)/loss |

21 |

12,993 |

7 |

334 |

6,899 |

(160) |

||||

|

Reported Profit after Tax |

4,429 |

(8,837) |

1,786 |

522 |

(6,511) |

(2,502) |

||||

|

1.Tata Steel Standalone numbers have been restated from April 1, 2022, to reflect merger of Tata Steel Long Products Limited, Tata Steel Mining Limited, Tata Metaliks Limited, Tinplate Company of India Limited and S&T mining with Tata Steel; Figures for previous periods have been regrouped and reclassified to conform to classification of current period, where necessary; 2. India includes Tata Steel Standalone and Neelachal Ispat Nigam Limited on proforma basis adjusted for intercompany purchase and sale; 3. Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for UK & Netherlands and saleable steel for South East Asia; 4. Adjusted for changes on account of FX movement on intercompany debt / receivables |

||||||||||

Management Comments:

Mr. T V Narendran, Chief Executive Officer & Managing Director:

“Global operating environment has been complex, with economic slowdown in China and geopolitics weighing on commodity prices in general. During this quarter, China has exported between 7 to 8 million tons of steel every month, which is the highest since 2015 and this has adversely impacted global steel prices as well as profitability. Despite this context, Tata Steel India has delivered better margins aided by higher deliveries as well as realisations on a QoQ basis. Our domestic deliveries for the quarter stood at 4.78 million tons and were up 3% QoQ and 10% YoY. Among the key segments, Automotive and well-established brands such as Tata Tiscon, Tata Steelium and Tata Astrum had best ever 3Q sales. The consistent growth in India deliveries has been aided by crude steel production being close to 5 million tons across the quarters in this financial year. The phased commissioning of our 5 MTPA capacity expansion at Kalinganagar is underway. Moving to Europe, our deliveries in Netherlands were up while UK moved lower QoQ due to subdued demand as well as operational issues given the ageing assets. We will commence statutory consultations with the unions in the UK as a step towards our transition to an EAF based sustainable business. We continue to undertake multiple initiatives across geographies to progress on our sustainability journey. I am happy to share that Tata Steel Meramandali and Tata Steel Kalinganagar sites have now received ResponsibleSteelTM certification and we now have three certified sites in India including Jamshedpur.”

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer:

“Tata Steel Consolidated revenues for the quarter stood at Rs 55,312 crores and EBITDA was Rs 6,334 crores, an increase in margins by around 300 bps QoQ. India EBITDA was Rs 8,302 crores, a QoQ margin increase of 400 bps while subdued demand dynamics weighed on margins in UK and Netherlands. The UK business continues to face production shortfalls arising from the end-of-life condition of several of its heavy end assets. In Netherlands, we expect BF#6 to restart by the end of January. Cashflow from operations in India rose sharply to Rs 9,016 crores while consolidated cash flow from operations were lower at Rs 7,879 crores. Our Net debt stands at Rs 77,405 crores and the group liquidity position remains strong at Rs 23,349 crores. Moving to strategic initiatives, we have largely fulfilled our plan to simplify our India footprint, having now completed the merger of Tinplate Company of India and Tata Metaliks into Tata Steel. Our announcement on 19th January in relation to Tata Steel UK follows detailed discussions with and careful consideration of the alternative proposal from the representative body of the UK trade unions and their advisor. The company’s analysis shows that partial continuity of blast furnaces until completion of transition to the EAF is not affordable and engineering studies have found that building the EAF in an already operating steel melt shop is not feasible. Tata Steel is acutely aware of the impact of its proposal to wind down the heavy end in Port Talbot on individuals and the local community associated with our steel works, we will meaningfully consult with our employees and work to provide them with a fair, dignified and considerate outcome. Tata Steel proposes to commit in excess of £130 million to a comprehensive support package for affected employees. This is in addition to the £100 million funding for the Transition Board set up by the company along with the UK and Welsh governments. Tata Steel has begun engineering design work on the EAF and discussions with National Grid for supporting infrastructure with a target to commission the EAF by 2027.”

Disclaimer:

Statements in this press release describing the Company’s performance may be “forward-looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred, or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors.

For media enquiries contact:

Sarvesh Kumar

Chief Corporate Communications

Tel: +91 98301 71705

E-mail: sarvesh.kumar@tatasteel.com

About Tata Steel

- Tata Steel group is among the top global steel companies with an annual crude steel capacity of 35 million tonnes per annum.

- It is one of the world's most geographically diversified steel producers, with operations and commercial presence across the world.

- The group recorded a consolidated turnover of ~US$30.3 billion in the financial year ending March 31, 2023.

- A Great Place to Work-CertifiedTM organisation, Tata Steel Limited, together with its subsidiaries, associates, and joint ventures, is spread across five continents with an employee base of over 77,000.

- Tata Steel has announced its major sustainability objectives including Net Zero Carbon by 2045.

- The Company has been on a multi-year digital-enabled business transformation journey intending to be the leader in ‘Digital Steel making by 2025’. The Company has received the World Economic Forum’s Global Lighthouse recognition for its Jamshedpur, Kalinganagar and IJmuiden Plants.

- Tata Steel aspires to have 25% diverse workforce by 2025. The Company has been recognised with the World Economic Forum’s Global Diversity Equity & Inclusion Lighthouse 2023.

- The Company has been a part of the DJSI Emerging Markets Index since 2012 and has been consistently ranked amongst top 10 steel companies in the DJSI Corporate Sustainability Assessment since 2016.

- Tata Steel’s Jamshedpur Plant is India’s first site to receive ResponsibleSteelTM Certification.

- Received Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17, 2023 Steel Sustainability Champion recognition from worldsteel for six years in a row, 2022 ‘Supplier Engagement Leader’ recognition by CDP, Top performer in Iron and Steel sector in Dun & Bradstreet's India's top 500 companies 2022, Ranked as the 2023 most valuable Mining and Metals brand in India by Brand Finance, and ‘Most Ethical Company’ award 2021 from Ethisphere Institute.

- Received 2023 ERM (Enterprise Risk Management) Award of Distinction at the RIMS ERM Conference 2023, ‘Masters of Risk’ - Metals & Mining Sector recognition at The India Risk Management Awards for the seventh consecutive year, and Award for Excellence in Financial Reporting FY20 from ICAI, among several others.

Photographs: Management and Plant facilities

Logos: Files and usage guidelines

Website: www.tatasteel.com and www.wealsomaketomorrow.com