Tata Steel's Q4 FY21 Financial Results

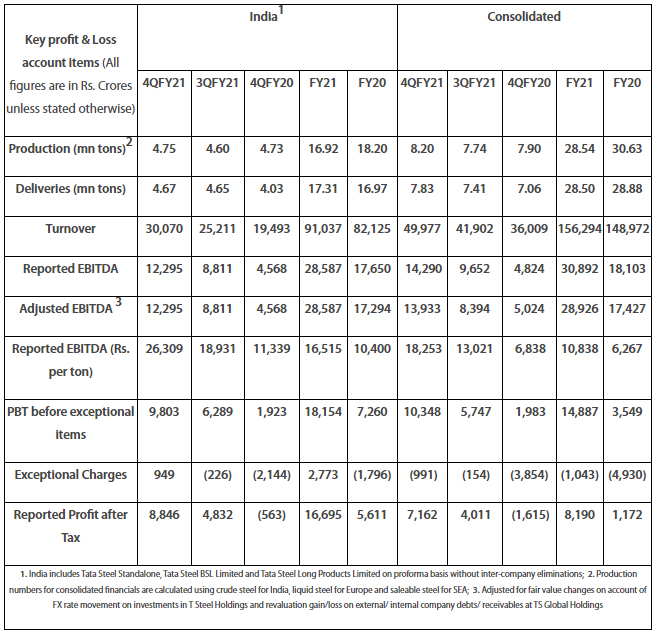

Tata Steel reports highest ever quarterly consolidated EBITDA;

Net debt to EBITDA improves to 1.59x1

|

Key Highlights:

|

Financial Highlights:

|

|

India2 |

Consolidated |

||||||||

|

1QFY22 |

4QFY21 |

1QFY21 |

1QFY22 |

4QFY21 |

1QFY213 |

|||||

|

Production (mn tons)4 |

4.63 |

4.75 |

2.99 |

7.88 |

8.02 |

5.54 |

||||

|

Deliveries (mn tons) |

4.15 |

4.67 |

2.93 |

7.11 |

7.83 |

5.34 |

||||

|

Turnover |

30,344 |

30,070 |

12,689 |

53,372 |

49,977 |

25,475 |

||||

|

Reported EBITDA |

13,946 |

12,295 |

1,455 |

16,185 |

14,290 |

630 |

||||

|

Adjusted EBITDA 5 |

13,617 |

12,295 |

1,455 |

15,892 |

13,933 |

1,071 |

||||

|

Reported EBITDA (Rs. per ton) |

33,604 |

26,309 |

4,969 |

22,779 |

18,253 |

1,181 |

||||

|

PBT before exceptional items |

11,753 |

9,803 |

(1,286) |

12,259 |

10,348 |

(3,439) |

||||

|

Exceptional Items (gain)/loss |

(153) |

(949) |

(2,059) |

182 |

991 |

(58) |

||||

|

Reported Profit after Tax |

9,593 |

8,846 |

411 |

9,768 |

7,162 |

(4,648) |

||||

|

1. On trailing 12 month basis; 2. India includes Tata Steel Standalone, Tata Steel BSL Ltd. and Tata Steel Long Products Ltd. on proforma basis without inter-company eliminations; 3. 1QFY21 figures have been restated consequent to the re-classification of South East Asia operations from "Held for Sale" to "Continuing Operations" during 4QFY21; 4. Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for Europe and saleable steel for SEA; 5. Adjusted for fair value changes on account of FX rate movement on loan given to T Steel Holdings and revaluation gain/loss on external/ internal company debts/ receivables at TS Global Holdings |

||||||||||

Management Comments:

Mr. T V Narendran, Chief Executive Officer & Managing Director:

“Over the last 15 months, the global economy has been recovering driven by policy support and progressive vaccination which has led to improvement in business and customer confidence. However, Indian markets were adversely impacted again during the last quarter due to the 2nd wave of COVID-19 which impacted our steel production as well as deliveries. Demand has begun recovering in India, though domestic steel prices continue to be at a steep discount to China import parity prices. We continue to focus on our objective to attain and retain market leadership in chosen segments by building strong customer relationships, superior distribution network, rolling out brands and developing new products & solutions in steel and new materials.

We are also focused on value accretive growth. Our 5 MTPA TSK phase II expansion is progressing well. It will drive product mix enrichment and cost reduction, further strengthening our competitive position. We have accelerated capex allocation for the 6 MTPA Pellet plant and the CRM complex, both are expected to be commissioned by 1st half of 2022.”

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer:

“Our consolidated financial performance for the quarter was exceptionally strong on the back of strong underlying business performance and buoyant market conditions. The company has achieved highest ever quarterly consolidated EBITDA of Rs.16,185 crores, and a Profit after tax of Rs 9,768 crores which is higher than the full year PAT of Financial Year 2021. While the India business has recorded an EBITDA of Rs.13,946 crores, our European business also had an improved quarter, and the impact of rising spreads are expected to positively benefit in the coming quarters.

Despite the increase in working capital due to higher prices of both steel and raw material, the company generated consolidated free cash flow of over Rs.3,500 crores during this quarter and made debt repayments of Rs.5,894 crores. We are committed to deleverage further and expect to bring down the debt significantly by the end of the current financial year. We continue to prioritize capex spend on ongoing projects and strategically essential investments.

The financial metrics of the company have strengthened further; Net Debt to Equity is less than 1x while Net Debt to EBITDA is now down to 1.59x. We are happy to note that Standard & Poor’s has recently upgraded the credit rating by one notch to BB Stable. The group liquidity position remains strong at Rs.20,695 crores, including Rs.10,264 crores of cash and cash equivalents.”

Disclaimer:

Statements in this press release describing the Company’s performance may be “forward looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors.

About Tata Steel

Tata Steel group is among the top global steel companies with an annual crude steel capacity of 34 million tonnes per annum. It is one of the world's most geographically-diversified steel producers, with operations and commercial presence across the world. The group (excluding SEA operations) recorded a consolidated turnover of US $19.7 billion in the financial year ending March 31, 2020.

A Great Place to Work-Certified organisation, Tata Steel Ltd., together with its subsidiaries, associates and joint ventures, is spread across five continents with an employee base of over 65,000.

Tata Steel was recognised as DJSI steel sector leader in 2018 and has ranked fourth in the steel sector in 2019. Besides being a member of the worldsteel’s Climate Action Programme, Tata Steel has won several awards and recognitions including the World Economic Forum’s Global Lighthouse recognition for its Kalinganagar Plant - a first in India, and Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17. The Company, ranked as India’s most valuable Metals & Mining brand by Brand Finance, received the ‘Honourable Mention’ at the National CSR Awards 2019, Steel Sustainability Champion 2019 by worldsteel, CII Greenco Star Performer Award 2019, ‘Most Ethical Company’ award 2020 from Ethisphere Institute, and Best Risk Management Framework & Systems Award (2020) by CNBC TV-18, among several others.

To know more, visit www.tatasteel.com and www.wealsomaketomorrow.com

Follow us on ![]()

![]()

![]()

![]()

![]()

For media enquiries contact:

Sarvesh Kumar

E-mail: : sarvesh.kumar@tatasteel.com

Rob Simpson

E-mail: rob.simpson@tatasteeleurope.com