|

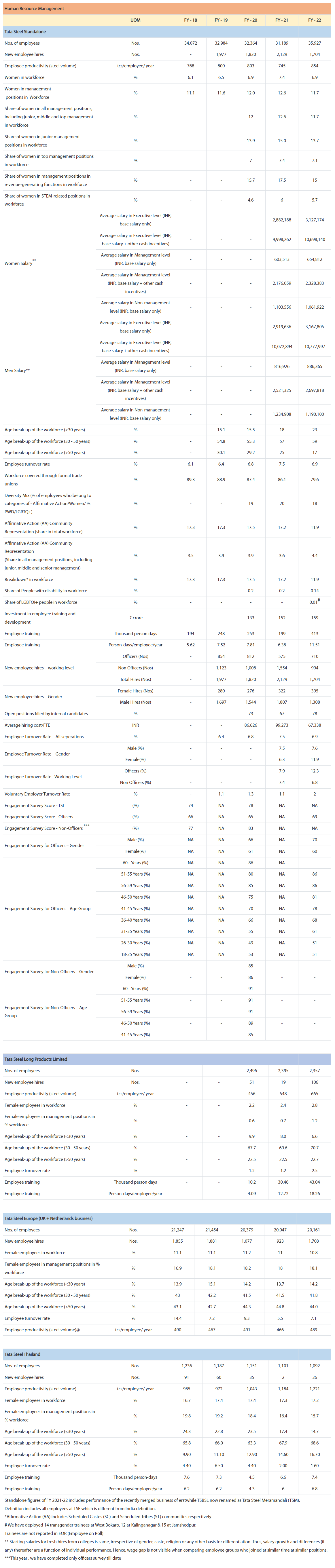

Human Resource Management

|

|

|

|

|

UOM

|

FY18

|

FY19

|

FY20

|

FY21

|

FY22

|

FY23

|

|

Tata Steel Standalone

|

|

Employees on roll

|

Nos.

|

34,072

|

32,984

|

32,364

|

31,189

|

35,927

|

36,151

|

|

New employee hires

|

Nos.

|

-

|

1,977

|

1,820

|

2,129

|

1,704

|

4,855

|

|

Employee productivity (steel volume)

|

tcs/employee/ year

|

768

|

800

|

803

|

745

|

854

|

885

|

|

Share of Women in workforce

|

%

|

6.1

|

6.5

|

6.9

|

7.4

|

6.9

|

7.6

|

|

Share of Women in management

positions in Workforce

|

%

|

11.1

|

11.6

|

12.0

|

12.6

|

11.7

|

11.5

|

|

Share of women in junior management positions, i.e. first level of management (as % of total junior management positions)

|

%

|

-

|

-

|

13.9

|

15.0

|

13.7

|

13.15

|

|

|

Share of women in top management positions in workforce

|

%

|

-

|

-

|

7

|

7.4

|

7.1

|

7.30

|

|

Share of women in management positions in revenue-generating functions in workforce

|

%

|

-

|

-

|

15.7

|

17.5

|

15

|

14.20

|

|

Share of women in STEM-related positions in workforce

|

%

|

-

|

-

|

4.6

|

6

|

5.7

|

6.10

|

|

Women Salary**

|

Average salary in Executive level (INR, base salary only)

|

-

|

-

|

-

|

28.82

|

31.27

|

36.75 lakh

|

|

Average salary in Executive level (INR, base salary + other cash incentives)

|

-

|

-

|

-

|

99.98

|

106.98

|

138.18 lakh

|

|

Average salary in Management level (INR, base salary only)

|

-

|

-

|

-

|

6.04

|

6.55

|

6.56 lakh

|

|

Average salary in Management level (INR, base salary + other cash incentives)

|

-

|

-

|

-

|

21.76

|

23.28

|

20.83 lakh

|

|

Average salary in Non-management level (INR, base salary only)

|

-

|

-

|

-

|

11.04

|

10.62

|

10.2 lakh

|

|

Men Salary**

|

Average salary in Executive level (INR, base salary only)

|

-

|

-

|

-

|

29.20

|

31.68

|

38.06 lakh

|

|

Average salary in Executive level (INR, base salary + other cash incentives)

|

-

|

-

|

-

|

100.73

|

107.78

|

131.36 lakh

|

|

Average salary in Management level (INR, base salary only)

|

-

|

-

|

-

|

8.17

|

8.86

|

8.51 lakh

|

|

Average salary in Management level (INR, base salary + other cash incentives)

|

-

|

-

|

-

|

25.21

|

26.98

|

23.4 lakh

|

|

Average salary in Non-management level (INR, base salary only)

|

-

|

-

|

-

|

12.35

|

11.90

|

12.1 lakh

|

|

Age break-up of the workforce (<30 years)

|

%

|

-

|

15.1

|

15.5

|

18

|

23

|

19.40

|

|

Age break-up of the workforce (30 - 50 years)

|

%

|

-

|

54.8

|

55.3

|

57

|

59

|

56.10

|

|

Age break-up of the workforce (>50 years)

|

%

|

-

|

30.1

|

29.2

|

25

|

17

|

24.50

|

|

Workforce covered through formal trade unions

|

%

|

89.3

|

88.9

|

87.4

|

86.1

|

79.6

|

91.00

|

|

Diversity Mix (% of employees who belong to categories of - Affirmative Action/Women/ % PWD/LGBTQ+)

|

%

|

-

|

-

|

19

|

20

|

18

|

18.95

|

|

Affirmative Action (AA) Community

Representation (share in total workforce)

|

%

|

-

|

-

|

-

|

-

|

11.9

|

11.80

|

|

Affirmative Action (AA) Community Representation

(Share in all management positions, including junior, middle and senior management)

|

%

|

3.5

|

3.9

|

3.9

|

3.6

|

4.4

|

4.42

|

|

Share of People with disability in workforce

|

%

|

-

|

-

|

-

|

0.3

|

0.3

|

0.30

|

|

Share of LGBTQI+ people in workforce

|

%

|

-

|

-

|

-

|

-

|

0.003

|

0.20

|

|

Investment in employee training and development

|

₹ crore

|

-

|

-

|

133

|

152

|

159

|

193

|

|

|

Average investment in employee training & development

|

INR

|

-

|

-

|

41095

|

48735

|

44256

|

53,387.18

|

|

Employee training

|

Thousand person days

|

194

|

248

|

253

|

199

|

413

|

468

|

|

|

Person-days/employee/year

|

5.62

|

7.52

|

7.81

|

6.38

|

11.51

|

12.93

|

|

|

Average Hours per FTE

|

50.58

|

67.68

|

70.29

|

57.42

|

103.59

|

116.44

|

|

|

Average Hours per FTE - Officers

|

-

|

-

|

-

|

-

|

-

|

94.26

|

|

|

Average Hours per FTE - Non-Officers

|

-

|

-

|

-

|

-

|

-

|

124.11

|

|

Technical/ Functional Training

|

Average Hours per FTE

|

|

|

|

|

|

115.00

|

|

Managerial training

|

Average Hours per FTE

|

|

|

|

|

|

1.44

|

|

New employee hires – working level

|

Officers (Nos)

|

-

|

854

|

812

|

575

|

710

|

964.00

|

|

Non Officers (Nos)

|

-

|

1,123

|

1,008

|

1,554

|

994

|

3,891.00

|

|

Total Hires (Nos)

|

-

|

1,977

|

1,820

|

2,129

|

1,704

|

4,855.00

|

|

New employee hires – Gender

|

Female Hires (Nos)

|

-

|

280

|

276

|

322

|

395

|

885.00

|

|

Transgender Hires (Nos)

|

-

|

-

|

-

|

-

|

-

|

134.00

|

|

Male Hires (Nos)

|

-

|

1,697

|

1,544

|

1,807

|

1,308

|

3,386.00

|

|

Open positions filled by internal candidates

|

%

|

-

|

-

|

73

|

67

|

78

|

66

|

|

Average hiring cost/FTE

|

INR

|

-

|

-

|

86,626

|

99,273

|

67,338

|

90,401.00

|

|

Employee Turnover Rate – All seperations

|

%

|

6.1

|

6.4

|

6.8

|

7.5

|

6.9

|

8.2

|

|

Employee Turnover Rate – (Resignations)

|

%

|

|

|

|

1.2

|

2

|

2.70

|

|

Voluntary Employer Turnover Rate (Resignations)

|

%

|

-

|

|

|

1.1

|

2

|

2.70

|

|

Employee Turnover Rate (Resignations) – Gender

|

Male (%)

|

-

|

-

|

-

|

-

|

1.6

|

2.50

|

|

Female(%)

|

-

|

-

|

-

|

-

|

5.8

|

5.90

|

|

Employee Turnover Rate (Resignations) - Working Level

|

Officers (%)

|

-

|

-

|

-

|

-

|

6.6

|

6.70

|

|

Non Officers (%)

|

-

|

-

|

-

|

-

|

0.3

|

0.80

|

|

Engagement Survey Score - Officers

|

(%)

|

66

|

NA

|

65

|

NA

|

69

|

72.00

|

|

|

Engagement Survey Score - Non-Officers ***

|

(%)

|

77

|

NA

|

83

|

NA

|

NA

|

-

|

|

Engagement Survey for Officers – Gender

|

Male (%)

|

NA

|

NA

|

66

|

NA

|

70

|

73.00

|

|

Female(%)

|

NA

|

NA

|

61

|

NA

|

60

|

63.00

|

|

Engagement Survey for Officers – Age Group

|

60+ Years (%)

|

NA

|

NA

|

86

|

NA

|

-

|

100.00

|

|

51-55 Years (%)

|

NA

|

NA

|

80

|

NA

|

86

|

83

|

|

56-59 Years (%)

|

NA

|

NA

|

85

|

NA

|

86

|

85

|

|

46-50 Years (%)

|

NA

|

NA

|

75

|

NA

|

81

|

83

|

|

41-45 Years (%)

|

NA

|

NA

|

70

|

NA

|

78

|

80

|

|

36-40 Years (%)

|

NA

|

NA

|

66

|

NA

|

68

|

69

|

|

31-35 Years (%)

|

NA

|

NA

|

55

|

NA

|

61

|

67

|

|

26-30 Years (%)

|

NA

|

NA

|

49

|

NA

|

51

|

57

|

|

18-25 Years (%)

|

NA

|

NA

|

53

|

NA

|

51

|

63

|

|

Engagement Survey for Non-Officers – Gender

|

Male (%)

|

-

|

-

|

85

|

-

|

-

|

-

|

|

Female(%)

|

-

|

-

|

86

|

-

|

-

|

-

|

|

Engagement Survey for Non-Officers – Age Group

|

60+ Years (%)

|

-

|

-

|

91

|

-

|

-

|

-

|

|

51-55 Years (%)

|

-

|

-

|

91

|

-

|

-

|

-

|

|

56-59 Years (%)

|

-

|

-

|

91

|

-

|

-

|

-

|

|

46-50 Years (%)

|

-

|

-

|

89

|

-

|

-

|

-

|

|

41-45 Years (%)

|

-

|

-

|

85

|

-

|

-

|

-

|

Corporate

Corporate

Sustainability

Sustainability

Products & Solutions

Products & Solutions

Investors

Investors

Media

Media

Careers

Careers

Contact Us

Contact Us