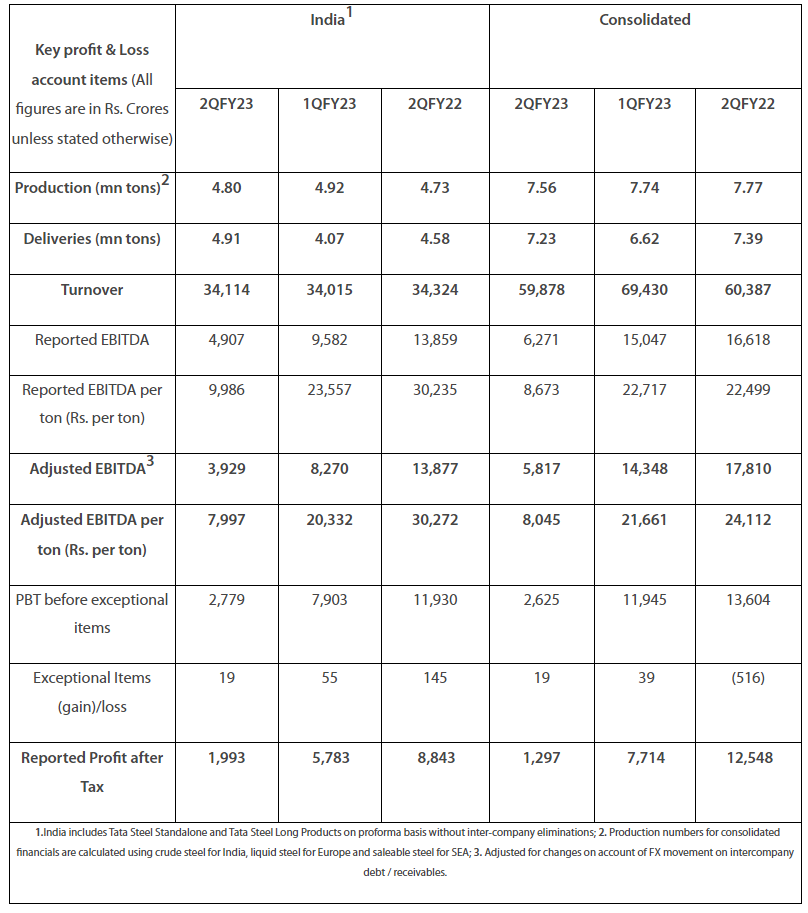

Tata Steel’s 2QFY23 Financial Results

Tata Steel reports consolidated EBITDA at Rs 6,271 crores; Maintains Investment grade credit metrics

|

Highlights:

|

Financial Highlights:

|

|

India1 |

Consolidated |

||||||

|

2QFY23 |

1QFY23 |

2QFY22 |

2QFY23 |

1QFY23 |

2QFY22 |

|||

|

Production (mn tons)2 |

4.80 |

4.92 |

4.73 |

7.56 |

7.74 |

7.77 |

||

|

Deliveries (mn tons) |

4.91 |

4.07 |

4.58 |

7.23 |

6.62 |

7.39 |

||

|

Turnover |

34,114 |

34,015 |

34,324 |

59,878 |

69,430 |

60,387 | ||

|

Reported EBITDA |

4,907 |

9,582 |

13,859 |

6,271 |

15,047 |

16,618 |

||

|

Reported EBITDA per ton (Rs. per ton) |

9,986 |

23,557 |

30,235 |

8,673 |

22,717 |

22,499 |

||

|

Adjusted EBITDA3 |

3,929 |

8,270 |

13,877 |

5,817 |

14,348 |

17,810 |

||

|

Adjusted EBITDA per ton (Rs. per ton) |

7,997 |

20,332 |

30,272 |

8,045 |

21,661 |

24,112 |

||

|

PBT before exceptional items |

2,779 |

7,903 |

11,930 |

2,625 |

11,945 |

13,604 |

||

|

Exceptional Items (gain)/loss |

19 |

55 |

145 |

19 |

39 |

(516) |

||

|

Reported Profit after Tax |

1,993 |

5,783 |

8,843 |

1,297 |

7,714 |

12,548 |

||

|

1.India includes Tata Steel Standalone and Tata Steel Long Products on proforma basis without inter-company eliminations; 2. Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for Europe and saleable steel for SEA; 3. Adjusted for changes on account of FX movement on intercompany debt / receivables. |

||||||||

Management Comments:

Mr. T V Narendran, Chief Executive Officer & Managing Director:

“Concerns about slowdown in key economies, persisting geopolitical issues coupled with seasonal factors led to a volatile operating environment. Despite these headwinds, Tata Steel registered best ever domestic sales in India enabled by a strong product portfolio and an extensive distribution network which services end to end requirements in chosen segments. Our 6 MTPA pellet plant at Kalinganagar is coming on stream shortly and will deliver significant benefits by reducing costs. We will begin the phased commissioning of the 2.2 MTPA state of the art Cold Rolling Mill complex and the 5 MTPA capacity expansion at Kalinganagar thereafter. Despite multiple challenges, we were successful in commissioning Neelachal Ispat Nigam Limited (NINL) within 3 months of acquisition and the ramp-up is progressing well. I am happy to announce that we have commenced work at our new 0.75 MTPA Electric Arc Furnace (EAF) at Punjab, strategically located in proximity to the market and the scrap generating auto hub in North India. We will set up more EAFs in the country, which will enable capacity augmentation and along with NINL expansion, will drive growth in our high margin retail business. Our EAF expansion is an important milestone in our sustainability journey and part of the multiple initiatives we are pursuing to achieve net zero by 2045. Further, in Netherlands, Tata Steel along with its customers has embarked on the journey to be carbon neutral through Zeremis® – a flexible solution that lets you choose the carbon emission intensity reduction”

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer:

“Globally, gross steel spreads declined amidst concerns about global recovery and elevated input costs including energy. Our Consolidated revenues for the quarter stood at Rs 59,878 crores and our consolidated EBITDA stood at Rs 6,271 crores, with Consolidated EBITDA margin of 10% and Standalone EBITDA margin of 16%. Utilisation of high-cost inventory of raw material and steel coincided with drop in realisations to result in margin decline across geographies. Consolidated PAT for the quarter stood at Rs 1,297 crores. In India, Standalone revenue stood at Rs 32,245 crores and was broadly similar on QoQ basis due to higher volumes. Standalone EBITDA was Rs 5,135 crores. In Europe, our EBITDA stood at £199 million, which translates to an EBITDA per ton of £106. The operating environment though should gradually improve in 2HFY23 on government measures and restocking. The margins should benefit across geographies from gradual recovery in Indian markets and favourable movement in raw material prices, especially Coking coal. Energy costs in Europe continue to remain a key watchpoint. We continue to remain focused on cost optimisation, operational improvements and working capital management to maximise cashflows. Our liquidity position continues to be strong and credit metrices remain at Investment grade levels. The proposed merger of seven listed and unlisted entities to be value accretive by enabling faster growth, optimal resource use and will provide greater liquidity to shareholders”

About Tata Steel

Tata Steel group is among the top global steel companies with an annual crude steel capacity of 34 million tonnes per annum. It is one of the world's most geographically diversified steel producers, with operations and commercial presence across the world. The group recorded a consolidated turnover of US $ 32.83 billion in the financial year ending March 31, 2022.

A Great Place to Work-CertifiedTM organisation, Tata Steel Limited, together with its subsidiaries, associates, and joint ventures, is spread across five continents with an employee base of over 65,000. Tata Steel has been a part of the DJSI Emerging Markets Index since 2012 and has been consistently ranked amongst top 10 steel companies in the DJSI Corporate Sustainability Assessment since 2016. Besides being a member of ResponsibleSteelTM, worldsteel’s Climate Action Programme and World Economic Forum’s Global Parity Alliance, Tata Steel has won several awards and recognitions including the World Economic Forum’s Global Lighthouse recognition for its Jamshedpur, Kalinganagar and IJmuiden Plants, and Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17. The Company, ranked as India’s most valuable Metals & Mining brand by Brand Finance, featured amongst CII Top 25 innovative Indian Companies in 2021 and top 10 sustainable organisations of India Hurun Research Institute in the 2021 Capri Global Capital Hurun India Impact 50, received Steel Sustainability Champion recognition from worldsteel for five years in a row, ‘Most Ethical Company’ award 2021 from Ethisphere Institute, RIMS India ERM Award of Distinction 2021, Masters of Risk - Metals & Mining Sector recognition at The India Risk Management Awards for the sixth consecutive year, and Award for Excellence in Financial Reporting FY20 from ICAI, among several others.

To know more, visit www.tatasteel.com and WeAlsoMakeTomorrow

Disclaimer:

Statements in this press release describing the Company’s performance may be “forward looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/ supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/ or other incidental factors.

For media enquiries contact:

Sarvesh Kumar

Chief, Corporate Communications - Tata Steel

E-mail: sarvesh.kumar@tatasteel.com