Report Menu

Report Menu

MANAGEMENT DISCUSSION AND ANALYSIS

A. Overview

The following operating and financial review is intended to convey the Management’s perspective on the financial and operating performance of the Company at the end of the Financial Year 2018-19. This Report should be read in conjunction with the Company’s financial statements, the schedules and notes thereto and other information included elsewhere in the Integrated Report. The Company’s financial statements have been prepared in accordance with the Indian Accounting Standards (‘Ind AS’) complying with the requirements of the Companies Act, 2013, as amended and regulations issued by the Securities and Exchange Board of India (‘SEBI’) from time to time.

This report is an integral part of the Board’s Report. Aspects on industry structure and developments, outlook, risks, internal control systems and their adequacy, material developments in human resources and industrial relations have been covered in the Board’s Report and is incorporated herein by reference and forms an integral part of this report. Your attention is also drawn to sections on Strategy, Risk and Opportunities forming part of the Integrated Report. This section gives significant details on the performance of the Company.

B. Tata Steel Group Operations

1. Tata Steel India (TSI)

a) Operations

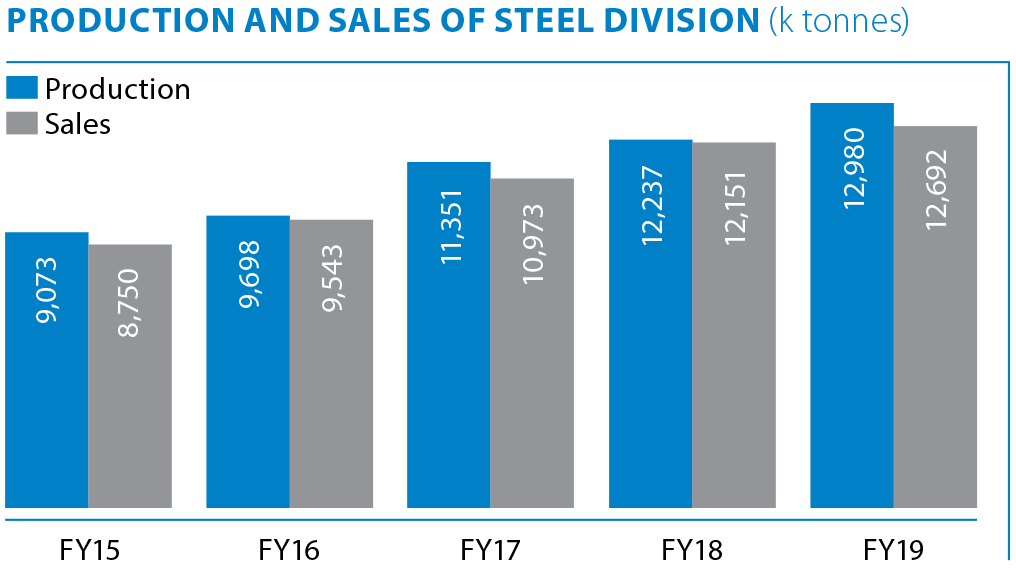

The saleable steel production and sales trend over the years is as follows:

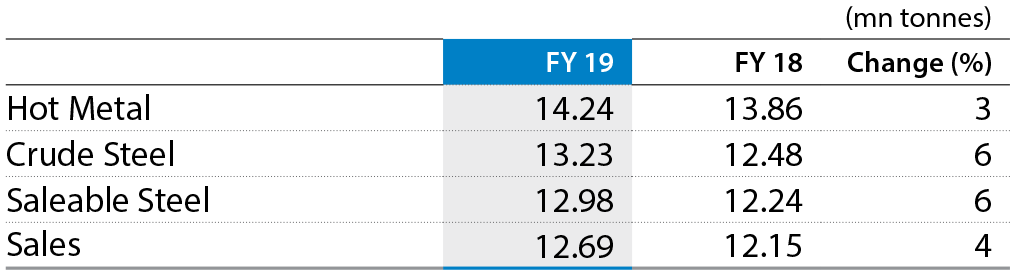

During the Financial Year 2018-19, the saleable steel production stood at 12.98 MnT which is ~6.07% increase over the previous year. The hot metal production for the Financial Year 2018-19 was at 14.24 MnT which is 2.8% increase over previous year. The improvement in performance is due to stabilisation of operations and the ongoing improvement initiatives undertaken by the Company through the Shikhar25 program. Accordingly, Tata Steel Jamshedpur (‘TSJ’) has achieved the Indian benchmark in specific consumption of energy, refractory, pulverised coal injection and coke rate.

At Tata Steel Kalinganagar (‘TSK’), the commercial production at Phase-I of 3 MnTPA plant commenced since June 2016 and has achieved the rated capacity during the Financial Year 2018-19. TSK strives to maintain a world-class environment in the premises by following environmental management systems in accordance with rules and regulations framed by the Government and have comprehensive processes in place for ensuring health and safety of people, plant and equipment. The plant is designed to have minimal water foot print, by-product gas based power generation leading to reduction in carbon footprints, Coke Dry Quenching technology, zero-effluent discharge and significant reduction of noise and dust pollution.

Financial Year 2018-19 saw a significant quality ramp-up in steel making and rolling ahead of plan with successful development of new products that was well accepted by customers.

After successful ramp up, TSK has embarked upon second phase of expansion which will take its production capacity to 8 MnTPA.

b) Marketing and Sales Initiatives

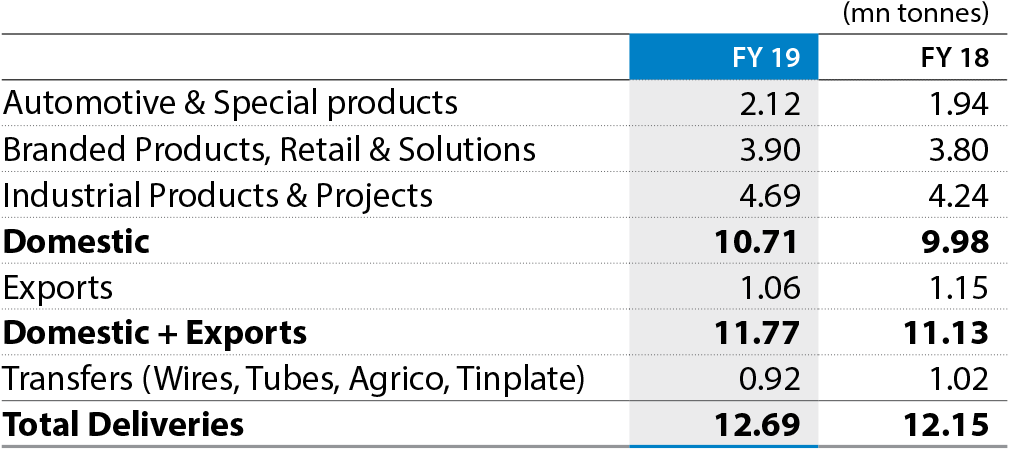

During Financial Year 2018-19, our Steel Business Unit (‘SBU’) has achieved a growth in sales of ~4% over previous year contributed primarily from sales in domestic market.

The break-up of sales in our various segments and the break-up of domestic sales to exports are as follows:

Following are the Key Business Initiatives and achievements of Financial Year 2018-19:

Automotive and Special Products: The Company achieved annual sales in Automotive sector of 2.12 MnT in Financial Year 2018-19 as against 1.94 MnT in the previous Financial Year. Further, the Company registered a growth of 8.2% as against industry growth of 6.3% and has retained its leadership in automotive flat products with a market share of 42% in the Financial Year 2018-19. Sales from Jamshedpur Continuous Annealing & Processing Company Private Limited (‘JCAPCPL’) grew by 40% year-on-year to 289 kilo tonnes in Financial Year 2018-19 as against 206 kilo tonnes in previous year.

During Financial Year 2018-19, as a recognition of various initiatives and contributions, the Company received various accolades and awards from its key customers and automotive leaders, including the ‘Overall Performance Award’ for exhibiting exemplary performance in Quality, Cost, Delivery and Development for the 4th consecutive year and ‘Gold Business Alignment Award’ in recognition of its efforts to cater to increased volumes.

Branded Products, Retail and Solutions: During the Financial Year 2018-19, the Company achieved an annual sales of branded products at 3.9 MnT thereby registering growth of ~3% over previous year. Brands like Tata Tiscon and Tata Astrum achieved higher sales of 1.43 MnT and 1.52 MnT respectively during the Financial Year 2018-19, thereby registering a year-on-year growth of 3.5% and 9% respectively. The Company’s first portal for the individual home builder, ‘Aashiyana’, crossed the milestone of `100 crore turnover in Financial Year 2018-19, since its launch in May 2018. The portal now hosts six retail brands – Tata Tiscon, Tata Pravesh, Tata Wiron, Tata Structura, Tata Agrico and Tata Shaktee and hosts over 5,000 service partners.

Industrial Products, Projects and Exports: The Company continues to enrich its product portfolio with its focus towards value added and engineering segments. The annual sales of value added flat products in industrial segment grew by 27% year-on-year with a total sales volume of 0.585 MnT. The Company continues to be the industry leader in Liquid Petroleum Gas and Medium & High Carbon segments. During the year under review, the Engineering Segment (Pre-Engineered Building, Lifting & Excavation, Construction & Projects and Oil & Gas) achieved annual sales of 0.450 MnT thereby registering a growth of 49% year-on-year. Despite rising protectionism, the Company maintained its presence in international markets and crossed 1 MnT in exports for second consecutive year. The Company has increased its downstream businesses such as Cut & Bend with Tiscon Readybuild, recording annual sales of 0.144 MnT in the Financial Year 2018-19 as against 0.138 MnT in previous financial year. Further, ‘Sm@rtFAB’ - India’s first branded welded wire fabric achieved an annual sales of ~1,000 tonnes.

Services & Solutions: The Company has further strengthened its position in Service & Solutions space by providing better consumer connect and experience. Since inception, 1 lakh units of Tata Pravesh have been installed and over 10,000 consumers have been served until this financial year. During the year under review, the turnover from Tata Pravesh Doors and Windows have increased by ~80% as compared to previous year. Further, another premium Services & Solutions brand – ‘Nest-In’ has doubled its business during Financial Year 2018-19 compared to previous year.

Digital Initiatives: During the Financial Year 2018-19, the Company has rolled out various digital initiatives across various customer groups. E-selling platform ‘Aashiyana’ was launched for multiple B2C brands, ‘COMPASS’ - a digital supply chain visibility solution was rolled out to select B2B customers and an initiative called ‘DigEca’ was undertaken to capture lead management for Emerging Corporate Accounts (‘ECAs’) for making the process convenient for the customers. These initiatives have contributed to the growth of Company’s turnover for the Financial Year 2018-19.

c) Sustainable Steel Business Initiatives

i) New Materials Business (‘NMB’)

The NMB was set up during the Financial Year 2018-19 with a vision to partially insulate revenues from cyclicity of the steel business and respond to growing demands of alternative materials from a range of industries.

NMB currently focusses on Fibre Reinforced Polymer (‘FRP’) composites with products mainly made of Glass Reinforced Polymer (‘GRP’). FRP is a composite material comprising glass/carbon/any other fibre, embedded in a resin matrix. Its key benefits include lightweight, corrosion resistance, high strength to weight ratio and design freedom. NMB successfully completed India’s first ever FRP based foot over bridge project in March 2019 and sees a huge potential for such bridges in the country.

Further, the Company has set up a Graphene Centre to explore the potential usage of Graphene in a variety of applications. The main application was the development of anti-corrosion coatings on cut and bend rebars. Brand GFX Ultima Superlinks launched in 2018 has performed well and is proposed to be upscaled in the Financial Year 2019-20. The Company is pursuing to develop markets in industrial, retail, mobility, energy, wellness and medical verticals.

The Company is one of the first entrants from the organised sector in India and large corporate groups in the composites industry working on a growth strategy through current manufacturing partners and other inorganic means.

ii) Steel Recycling business

Steel is 100% recyclable and can be recycled to create new steel products in a closed-material loop, making it a perfect candidate for a circular economy. Recycled steel maintains the inherent properties of the original steel.

Steel demand in India, is poised to grow with the scrap demand at present being ~30 MnTPA, with ~5 MnTPA imported from outside India. The supply is likely to increase due to some impending Government policies, rapid urbanisation and economic activity.

Steel production through the Electric Arc Furnace (‘EAF’) route, has potential to reduce carbon emissions, resources and consumption by 60-70%, compared to traditional steel production routes.

Sensing these opportunities, the Company started the Steel Recycling business to meet the long-term growing demands in a more sustainable manner.

Our steel recycling business seeks to collaborate with the Government on multiple frontiers to formalise the scrap industry.

India’s first State of Art Scrap Processing Centre is being set-up through an outsourced model, on BOO (Built, Own, Operate) basis, with a capacity to process 0.5 MnT of scrap annually. The commercial production is expected to begin in the latter half of the Financial year 2019-20.

d) Ferro Alloys and Minerals Division

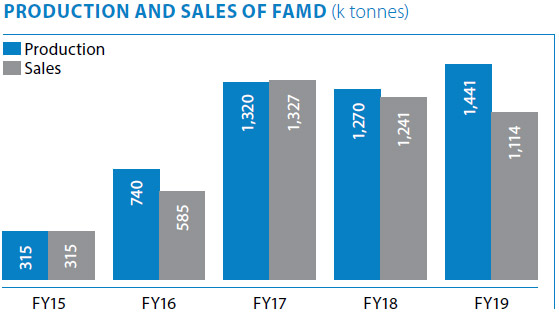

Our Ferro Alloys and Minerals Division (‘FAMD’) is one of the leading chrome alloy producers in the world with operations spanning across continents. In India, it is the largest producer of ferro chrome and leading producer of manganese alloy. It’s production facilities (from Mines to Market) are integrated with production bases spanning across four Indian States and having customers across the world. FAMD has captive plants at Joda, Bamnipal and Gopalpur (since June 2018) and have Ferro Processing Centres (‘FPCs’) under a business partnering agreement for production of Chrome and Manganese alloys.

During the Financial Year 2018-19, FAMD achieved 19% growth in its production primarily in dolomite for meeting the requirements of TSJ and TSK. However, sales were lower than previous year due to lower availability of rakes for despatches.

The division has launched a digital initiative ’Drishti’ to enable end to end tracking of shipments and increase of visibility in the outbound supply chain to eliminate weight loss between plant and end customer.

The division won the ‘National Safety Award 2016’ from his excellency Hon’ble President of India and ‘Kalinga Safety Award 2017’ from his excellency Governor of Odisha.

e) Tubes Division

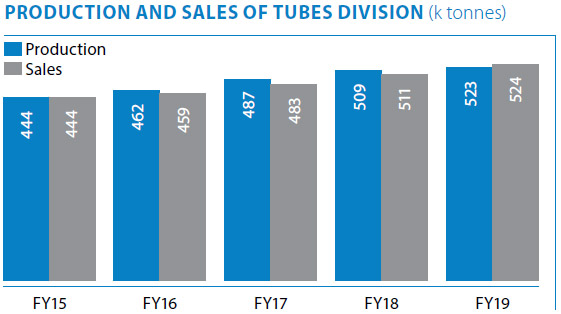

Our Tubes Strategic Business Unit is a leading manufacturer of pipes and tubes in India having its manufacturing facility situated at Jamshedpur with an annual production capacity of ~500 kilo tonnes. The three main lines of businesses are conveyance tubes (Tata Pipes), structural tubes (Tata Structura), precision tubes for auto and boiler segments.

During the Financial Year 2018-19, the division achieved 3% growth in sales over previous year mainly contributed by higher sales of ‘Structura’ due to growth in demand in the construction sector.

The division is focusing on increase in revenues from branded products and has launched two new brands in the retail segment - Tata Structura Z+ and Tata Pipes Jeevan along with thin organic coating spray. The division has leveraged advance technology across functions to bring in more operational efficiencies and accordingly introduced e-initiatives in supply chain ‘COMPASS’, ‘TEJ app’ for channel partners and ‘Aashiyana’ - an e-commerce portal for online sale of tubes. Post-acquisition of Bhushan Steel Limited on May 18, 2018 (renamed Tata Steel BSL Limited), Tubes SBU has launched Tata Structura and Tata Pipes for its B2B and B2SME customers in infrastructural and industrial segments.

The division has been awarded the GreenPro certification for Tata Structura & Tata Pipes by CII Green Building Council and ‘Making of Developed India’ award for Brand & Marketing excellence by World Federation of Marketing.

f) Industrial By-Products and Management Division

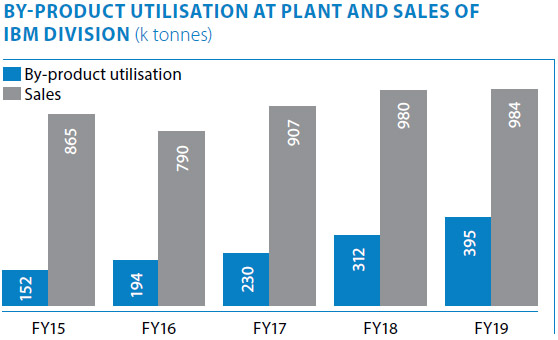

Our Industrial By-products and Management Division (‘IBMD’) handles variety of by-products in the entire value chain. The business operates on the principle of 3Rs (Reduce, Reuse, Recycle), thereby ensuring contribution towards the green journey of Tata Steel.

With the objective of harnessing ‘Value from waste and by-products’, IBMD is committed to becoming a knowledge driven business unit leveraging digital and innovation as key pillars. The division has also delved into downstream value enhancement of by-products which serve as quality benchmarks in the industry.

During the year under review, the division saw substantial growth in its brands Tata Nirman and Tata Aggreto mainly contributed by fly ash bricks and road making applications.

By-product utilisation at the Plant increased substantially by ~26% over the previous year.

During the year under review, the division has achieved best-ever 100% LD Slag Utilisation at TSJ and TSK, successfully implemented E-inspection (digital material inspection) to achieve benefits on safety, reduced cycle time and increase in customer base. Tata Aggreto was approved for usage in rural roads by Indian Road Congress for the first time in India.

The division has been awarded ‘Company of the year’ at the 14th Global Slag Conference and Exhibition 2019 in Aachen, Germany for its work in innovative applications of Slag.

g) Wires Division

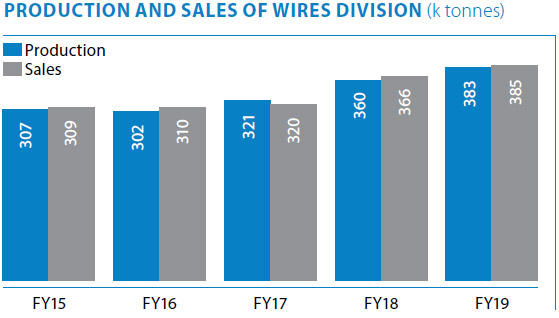

Our Global Wires India (‘GWI’) Business Unit is the largest manufacturer of steel wires in India. The plants are located at Tarapur, Pithampur and Jamshedpur, contributing to nearly 70% of its sales volume, with remaining 30% being catered by Wires Processing Centres. GWI caters to the requirements of the Indian Automobile Industry, Construction Industry and the rural markets with various products.

During the Financial Year 2018-19, the division achieved 6% growth in production and 5% growth in sales due to a consistent year-on-year growth in infrastructure at 11% and in retail at 7%. The division introduced two new products – Wiron Aayush Farming and GI Knotted Fence.

The division’s Wire Plant in Tarapur has been awarded the national award for achieving ‘manufacturing competitiveness’ by Indian Research Institute of Manufacturing.

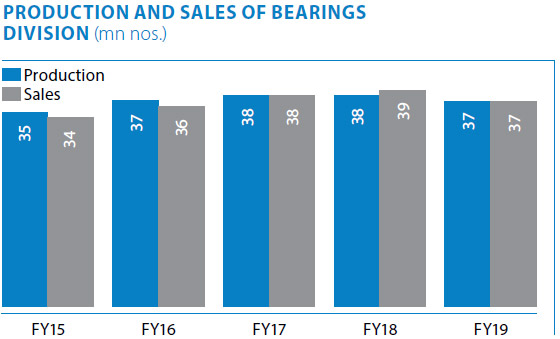

h) Bearings Division

The Bearings Division is one of India’s largest quality bearing manufacturers, having its manufacturing facility situated at Kharagpur, West Bengal with an annual production capacity of 40 million bearing numbers. The Company is foremost in the manufacturing of a wide variety of bearings and auto assemblies and product range includes Ball Bearings, Taper Roller Bearings, Hub Unit Bearings, Clutch Release Bearings, Double Row Angular Contact Bearings, Centre Bearings and Magneto Bearings. It is the only bearings manufacturer in India to win the TPM Award (2004) from Japan Institute of Plant Maintenance, Tokyo.

The sales have reduced by 5% over previous year due to drop in production in the automobile segment, low priced imports from China and increase in cost of basic raw materials - steel and alloy steel. The Division has improved plant availability by debottlenecking and leveraging its existing resources for sustainable operations.

i) Shikhar25 (Operational Improvement Programmes)

The Shikhar25 program, a multi-divisional, multi-location, cross functional program, completed four years in Financial Year 2018-19. The Company has been pursuing the ‘journey for improvement’ since its inception. The continuous learning and improvement journey has been one of the foundation pillars for driving benchmark performance across the value chain.

The programme covers entire steel value chain with structured collaboration from Raw Materials division to Marketing & Sales division as an umbrella initiative. It intends to drive break through improvement projects with best of rigor and simplified governance, without compromising on safety, environment and people standards and in collaboration with internal/external stakeholders to achieve best in class operational performance.

During the year under review, basis previous years’ learnings, the Shikhar25 programme was extended to tap potentials for Cross cutting themes across divisions and its facility at TSK. Three new IMPACT Centers were established namely Tubes, JUSCO and Finance & Accounts. All the Impact Centres focussed on new technology adaptation in collaboration with suppliers and integrating digital initiatives to explore new horizons of improvements. Key levers for improvement were improvement in sale of enriched products, increase in throughput at West Bokaro collieries, maximising captive iron ore supply to Tata Steel BSL Limited (formerly Bhushan Steel Limited), cost reduction of clean coal from Jharia and iron ore, reduction of solid fuel in pellet plant, reduction in graphite electrode consumption in LDs, HM +Scrap yield at LDs, cost reduction of Lime Consumption & Ferro Alloys at LDs, reduction in inbound/outbound logistics spend base, packaging cost, energy efficiency, cost optimisation for other procured goods and services amongst others.

Total improvement savings achieved in the Financial Year 2018-19 is `2,801 crore.

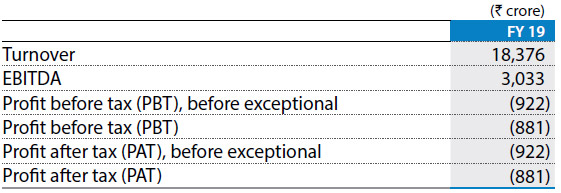

2. Tata Steel BSL Limited (formerly Bhushan Steel Limited)

The Company acquired controlling stake in Bhushan Steel Limited [renamed Tata Steel BSL Limited (‘TSBSL’)] vide National Company Law Tribunal (‘NCLT’) Order dated May 15, 2018 under the Insolvency and Bankruptcy Code (‘IBC’). The Financial Statements of TSBSL have been consolidated effective May 18, 2018 and hence previous year’s figures are not comparable.

The turnover and profit/loss figures of TSBSL for the Financial Year 2018-19 are given below:

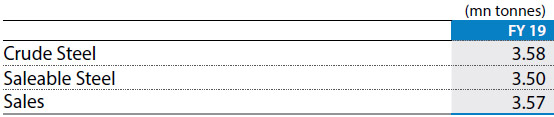

The production and sales performance of TSBSL is given below:

During the Financial Year 2018-19, the saleable steel production stood at 3.5 MnT and the crude steel production stood at 3.58 MnT.

The long-term sustainability of TSBSL requires structured and accelerated operational excellence and integration with Tata Steel. Post the acquisition, many improvement projects have been undertaken at TSBSL. We have put in place strategies to optimise the use of the existing assets and reach higher level of capacity utilisation to produce value added grades, increase the customer base and bring about development in domestic market and value creation through synergy initiatives.

TSBSL is working towards stabilising the operations at the plant, debottlenecking existing facilities, raising its standards to the benchmark demonstrated performance and realising synergies. Further, TSBSL plans to achieve benchmark performance across all areas to achieve rated capacity and generate strong cash flows.

In July 2018, TSBSL launched an accelerated performance improvement plan to achieve industry benchmark in operational excellence and customer focus with the agenda of deep change management encompassing employee engagement and capability building. Accordingly, the IMPACT Centre (‘IC’) methodology along with the D0-D4 stage gate approach (based on degree of hardness) was leveraged to drive this program.

Under the program, 13 ICs were rapidly setup and stabilised across the entire value chain laying down the culture for continuous improvement, ownership and drive. These ICs are working on over 500 ideas including synergy initiatives across the value chain. The benefits achieved from these initiatives in the Financial Year 2018-19 is ~`630 crore.

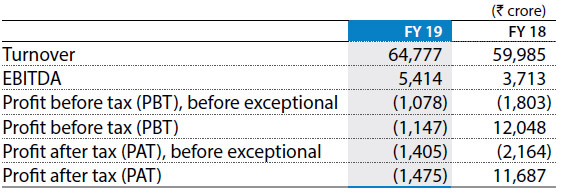

3. Tata Steel Europe (‘TSE’)

Global GDP growth in 2018 was 3.2%. The eurozone economy grew by 1.8% in 2018 compared to 2.5% in 2017. Growth was negatively impacted by a slowing Chinese economy and US protectionism. The UK economic growth eased to 1.4% in 2018 compared to 1.7% in 2017 mainly due to ongoing uncertainty towards Brexit which caused businesses to postpone decisions regarding future investments.

As economic growth weakened, capacity utilisation in the global steel industry reduced causing steel prices and margins to fall. The World Steel Association predicts that EU steel demand is expected to grow by only 0.5% in 2019. Margins are expected to remain under pressure in 2019 as further reductions to global overcapacity is unlikely.

Negotiations between the EU and the UK in relation to Brexit and the evolving political situations are being monitored by the TSE Brexit Working Group, which includes an assessment of the threats and opportunities that Brexit may impose on the EU steel market and the TSE customers. TSE is committed to maintaining close dialogue with its customers and partners to ensure that all potential Brexit scenarios are planned for, short-term disruption is minimised and opportunities for the re-alignment of supply chains are identified.

The European Commission granted the UK a 6-month extension to Brexit till October 31, 2019 averting the UK to leave the EU without a deal. As part of its risk management, TSE has identified a number of mitigating actions it would implement for a ‘no-deal’ scenario. Due to the ongoing Brexit uncertainty, the pound has continued to remain weak against major currencies in the Financial Year 2018-19 averaging 1.13 against the euro (2017-18: 1.14) and 1.32 versus the US dollar (2017-18: 1.33).

The turnover and profit/loss figures of TSE (continuing operations) are given below:

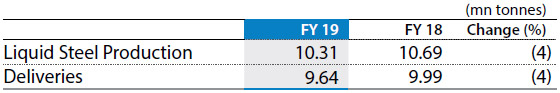

The production and sales performance of TSE (continuing operations) is given below:

TSE’s revenue of `64,777 crore for the Financial Year 2018-19 increased by 8% over previous year primarily owing to an increase in average revenue per tonne due to improved market conditions partly offset by reduction in deliveries.

The principal activities in Financial Year 2018-19 comprised manufacture and sale of steel products throughout the world. TSE’s continuing operations produced carbon steel by the basic oxygen steelmaking method at its integrated steelworks in the Netherlands at IJmuiden and in the UK at Port Talbot. During Financial Year 2018-19 these plants produced 10.3 MnT of liquid steel.

Whilst the Group seeks to increase its differentiated/premium business which is less dependent on market price movements, it still retains focus in both the UK and IJmuiden on improving its operations, consistency, and taking measures to protect against unplanned interruptions and property damage.

Strip Products Mainland Europe – During the Financial Year 2018-19, the liquid steel production at IJmuiden Steel Works, Netherlands was at 7.1 MnT which remained unchanged compared to previous year. Record annual outputs of 1.4 MnT were achieved at the Direct Sheet Plant. Further, during the year under review, Strip Products Mainland Europe continued with its ‘Sustainable Profit’ programme which targets improvements to delivery and yield performance, commercial mix and reduce operating costs and unplanned downtime. Further progress was also achieved in its ‘Strategic Asset Roadmap’ (‘STAR’) capital investment programme to support the strategic growth of differentiated, high value products in the automotive, lifting & excavating, energy and power market sectors.

The World Economic Forum announced that Tata Steel IJmuiden had been inducted into its prestigious community of ‘Lighthouses’ for its Advanced Analytics-programme, a distinction awarded to manufacturing facilities which are leaders in the technologies of the Fourth Industrial Revolution. In 2018, Tata Steel IJmuiden celebrated its centennial anniversary. The festivities were highly valued by the employees and visitors to the site.

Strip Products UK – During the year under review, the liquid steel production at Port Talbot Steel Works, Wales was at 3.2 MnT which was lower by 0.4 MnT from the previous year due to an outage to extend the life of Blast Furnace 5. During Financial Year 2018-19 Strip Products UK further optimised its new automotive finishing line (‘AFL’) and extensive work was undertaken on the power plant to extend its generation capability. Further progress was achieved in its ‘Delivering Our Future’ improvement initiative programme that is now incorporated more deeply across the full UK supply chain. In addition, the ‘Sustainable Operational Excellence’ programme was rolled out across the hub with a significant impact on daily management activities through the mass engagement and coaching of points of leadership and their teams.

Strategic Activities

During the year under review,

- TSE signed definitive agreements with thyssenkrupp AG to combine the European Steel Business into a 50:50 joint venture, named thyssenkrupp Tata Steel BV on June 30, 2018. The transaction is subject to merger control clearance in several jurisdictions, including the European Union.

- TSE successfully completed a major project to extend the life of Blast Furnace 5 at Port Talbot. The project comprised a capital investment of £56m and is expected to extend the life of the furnace by 5 to 7 years and improve its operational stability.

- TSE announced its intention to divest its Cogent, Kalzip, Firsteel, Engineering Steels Service Centre (Wolverhampton) and Tata Steel Istanbul Metals (Colours) businesses. The disposal of the Kalzip business to Donges SteelTec GmbH was completed on October 1, 2018. Discussions to divest the other businesses remain ongoing.

Awards and Accolades:

- TSE won an award for its innovative construction software ‘BIM DNA Profiler’ which was named the best new product at the BIM show.

- TSE won an award for ‘Excellence in Education and Training’ at the Steelie Awards 2018.

- TSE has been named a sustainability champion by the World Steel Association.

4. South East Asia Operations

On January 28, 2019, T S Global Holdings Pte. Ltd. (‘ TSGH’) (an indirect wholly-owned subsidiary of the Company) executed definitive agreements to divest its entire equity stake in NatSteel Holdings Pte. Ltd. (‘ NSH’) and Tata Steel (Thailand) Public Company Ltd. (‘ TSTH’) As per the agreement, the divestment will be made to a company, to be formed, in which 70% equity shares will be held by an entity controlled by HBIS Group Co., Ltd. and 30% will be held by TSGH.

The assets and liabilities of these companies have been classified as held for sale as on March 31, 2019 and have been presented separately in the Consolidated Balance Sheet of Tata Steel. The results for the current period of these companies have been disclosed within discontinued operations and results for the previous periods have been restated accordingly.

Loss of `89 crore for the Financial Year 2018-19 (Previous Year Profit of `141 crore) have been reported under ‘discontinued operations’ in the Statement of Profit and Loss of Tata Steel for the period ended March 31, 2019.

5. Tata Metaliks Limited

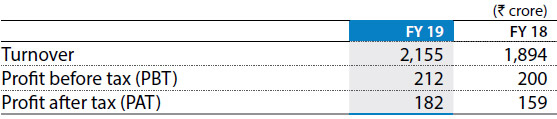

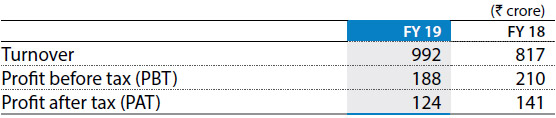

The turnover and profit/loss figures of Tata Metaliks Limited (‘TML’) for Financial Year 2018-19 are as follows:

TML has its manufacturing plant at Kharagpur, West Bengal, India which produces annually 300 kilo tonnes of pig iron and 200 kilo tonnes of ductile iron pipes. Pig iron is marketed under the brand name ‘Tata eFee’ (world’s first brand) and ductile iron pipe is marketed under the brand name ‘Tata Ductura’.

During the Financial Year 2018-19, the sale of pig iron was at 280 kilo tonnes as against 291 kilo tonnes of previous year owing to a sluggish demand. However, the sale of ductile iron pipes increased to 240 kilo tonnes as against 209 kilo tonnes of previous year due to higher demand in the project segment.

TML has started Pulverised Coal Injection (‘PCI’) and usage of pellets in both the Mini Blast Furnaces (‘MBFs’).

The increase in turnover is due to an increase in net realisation of pig-iron and ductile iron pipes offset by lower sale of pig iron.

The increase in PAT is due to improvement in cost primarily due to improvement in specific consumption of raw materials – coke, iron ore, operational efficiency and lower overheads.

During the year under review, TML was awarded with ‘Noteworthy Water Efficient Unit’ at the 4th Water Innovation Summit 2018 (Economic Growth & Human Development in Context of Water Security) & National Awards for Excellence in Water Management and ‘Excellence in Corporate Social Responsibility in 2018’ by the CII-ITC Centre for Excellence for Sustainable Development.

6. The Tinplate Company of India Limited

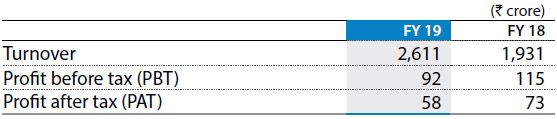

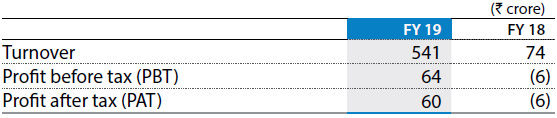

The turnover and profit/loss figures of The Tinplate Company of India Limited (‘TCIL’) for Financial Year 2018-19 are as follows:

TCIL is the largest indigenous producer of tin coated and tin free steel used for metal packaging. It has also been ‘value-adding’ its products by way of providing printing and lacquering facility to reach closer to food processors/fillers. TCIL has two Cold Rolling Mills and two electrolytic tinning lines with an installed annual production capacity of around 379 kilo tonnes of tinplate and tin-free steel.

During the year under review, TCIL’s consumption in India grew by ~6% primarily driven by paints & aerosol end use segments growing at ~8% each. Tin Free Steel (‘TFS’) for crown caps also increased considerably by 18%. However, the demand from oil can, one of the largest end use segments, was much lower than expected due to fillers choosing alternate packaging medium owing to steep increase in the tinplate price.

During the Financial Year 2018-19, TCIL achieved deliveries of 359 kilo tonnes as against 361 kilo tonnes of previous year due to sluggish demand. The turnover is higher over the previous year due to increase in realisations as there has been an increase in steel prices. However, PAT is lower than previous year due to increase in cost of raw materials.

TCIL was awarded ‘Award for Excellence in Consistent TPM Commitment’ for 2018, by Japan Institute of Plant Maintenance.

7. Tata Steel Processing and Distribution Limited

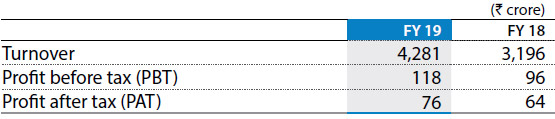

The turnover and profit/loss figures of Tata Steel Processing and Distribution Limited (‘TSPDL’) for the Financial Year 2018-19 are as follows:

TSPDL is India’s largest steel service centre organisation with primary operations being steel coil slitting, cut-to-length, blanking, corrugation, plate burning and fabrication. TSPDL is the pioneer and a leader in the organised steel processing and distribution market.

World-class processing facilities and comprehensive quality assurance systems combine to make TSPDL a benchmark in the steel service industry. TSPDL has developed IT rack solutions (Wall Mounted, Floor Standing and Open) for various applications.

TSPDL currently has a processing capacity of 3.5 MnT with around 75% of utilisation in the Financial Year 2018-19 as compared to the processing capacity of 3.2 MnT in the previous year.

During the Financial Year 2018-19, TSPDL achieved 1,807 kilo tonnes of tolling volumes and 805 kilo tonnes of distribution volumes, an increase of 19% and 18% respectively over previous year which resulted in an increase in turnover. The profits are higher primarily due to higher contribution from tolling.

TSPDL won the Suraksha Puraskar (Bronze Trophy) and was awarded ‘CII National Energy Management award 2018- Energy Efficient Unit’

8. Tata Sponge Iron Limited

The turnover and profit/loss figures of Tata Sponge Iron Limited (‘TSIL’) for the Financial Year 2018-19 are as follows:

TSIL is a manufacturer of sponge iron with an annual production capacity of 390 kilo tonnes and generates 26 MW of power through the waste heat recovery route.

During the Financial Year 2018-19, sale of sponge iron was 437 kilo tonnes as against 414 kilo tonnes of previous year. The turnover has increased by 21% due to increase in net realisation from sponge iron and higher sales volume. However, the profit is lower than previous year due to higher cost of ore and coal.

9. Bhubaneshwar Power Private Limited

The turnover and profit/loss figures of Bhubaneshwar Power Private Limited (‘BPPL’) for the Financial Year 2018-19 are as follows:

Note: The Financial Year 2017-18 is reported from February 1, 2018 to March 31, 2018, as BPPL became a subsidiary of Tata Steel Limited effective February 1, 2018.

BPPL is in the business of generation of power. It owns 135 MW (2x67.5 MW) coal based power plant in Odisha. During the Financial Year 2018-19, the plant operated at a load factor of 78.1%, generated 924 million units of power, an improvement of ~8% over the previous year with a plant availability of 94%. BPPL supplies 120.5 MW power to the Company and T S Alloys Limited. Further, during the Financial Year 2018-19, BPPL reported profit against loss in previous year.

C. Financial Performance

1. Tata Steel Limited (Standalone)

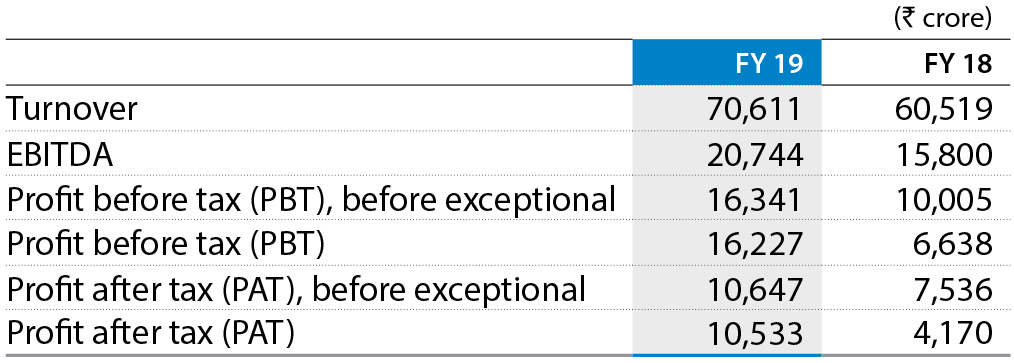

During the year under review, the Company recorded a profit after tax of `10,533 crore (previous year: `4,170 crore). The increase is primarily on account of improved realisations, higher deliveries and lower exceptional charges over previous year. The basic and diluted earnings per share for the Financial Year 2018-19 were at `90.41 per share and `90.40 per share respectively (previous year: basic: `38.57 per share, diluted: `38.56 per share).

The analysis of major items of the financial statements is given below:

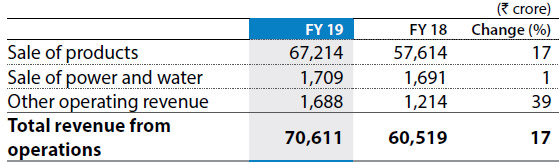

a) Revenue from operations

During the year under review, sale of products was higher as compared to the previous year, primarily due to higher realisations and increased volumes. The Ferro Alloys and Mineral Division registered a higher revenue owing to higher production of Ferro Chrome along with improved demand in the international market. The Wires and Tubes division registered higher revenue due to increase in realisations. Other operating revenue increased mainly due to higher benefits arising out of exports.

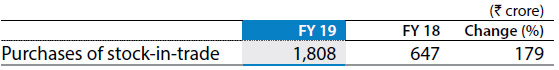

b) Purchases of stock-in-trade

During the year under review, purchases of stock-in-trade was higher as compared to the previous year due to higher purchases of steel wire rods, imported rebars, hot rolled coils, cold rolled coils and slabs, owing to higher requirement.

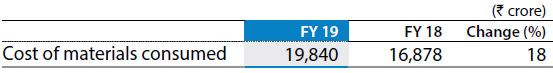

c) Cost of materials consumed

During the year under review, the cost of materials consumed increased primarily due to higher consumption of coal and purchased pellet along with higher cost of imported coal.

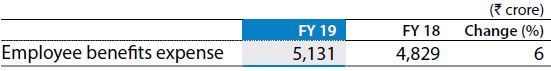

d) Employee benefits expense

During the year under review, the expense increased primarily on account of salary revisions, its consequential impact on the retirement provisions.

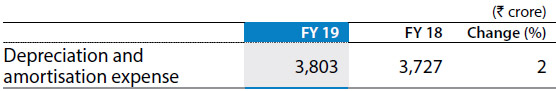

e) Depreciation and amortisation expense

The increase in depreciation is due to regular additions in fixed assets.

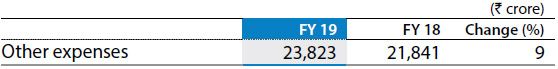

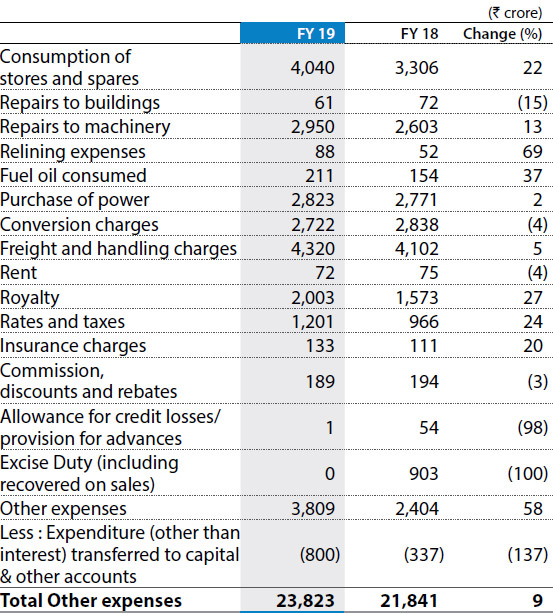

f) Other expenses

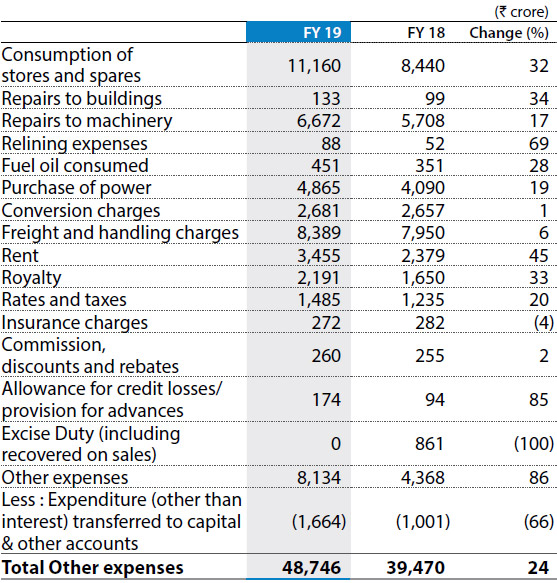

Other expenditure represents the following expenditure:

Other expenses were higher as compared to the previous year primarily on account of higher consumption of stores and spares on account of increased operations and shutdowns at TSJ and TSK, higher repairs and maintenance expenses mainly due to higher contract jobs at mines and collieries, increase in royalty on account of increase in volumes and rates, higher freight and handling in line with higher volumes.

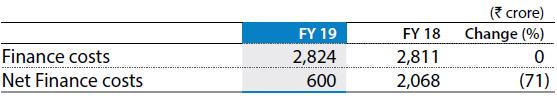

g) Finance costs and net finance costs

During the year under review, finance costs were almost at par with the previous year. Net finance charges were lower on account of higher interest income on inter-company deposits (‘ICDs’) partly offset by lower income from mutual funds.

h) Exceptional items

The details of exceptional items for the current year and previous year are as follows:

- Impairment of investments/doubtful advances amounting to `12 crore (2017-18: `35 crore) relates to provision recognised for impairment of investments in subsidiaries and joint ventures. During financial year 2017-18 the Company had recognised provision in respect of advances paid for repurchase of equity shares in Tata Teleservices Limited from NTT Docomo Inc amounting to `27 crore.

- Provision for demands and claims amounting to `329 crore (2017-18: `3,214 crore) relating to certain statutory demands and claims on environment and mining matters.

- Provision for Employee Separation scheme (ESS) under Sunehere

Bhavishya Ki Yojana (‘SBKY’) scheme amounting to `35 crore

(2017-18: `90 crore).

Partly offset by, - Profit on sale of non-current investments in TRL Krosaki Refractories Limited (an associate of the Company) amounting to `262 crore (2017-18: Nil)

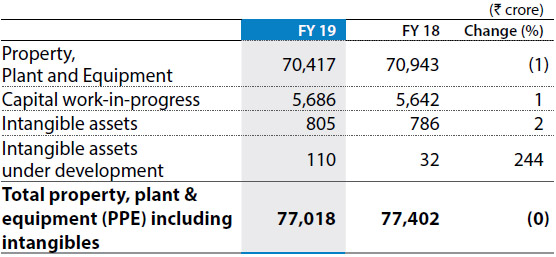

i) Property, plant & equipment (PPE) including intangibles

The movement in total PPE including intangible is almost at par with the previous year.

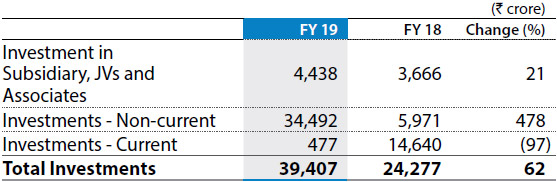

j) Investments

The increase in investments was predominantly on account of higher investments in preference shares of subsidiaries mainly in TSBSL (formerly Bhushan Steel Limited), partly offset by decrease in investments in mutual funds.

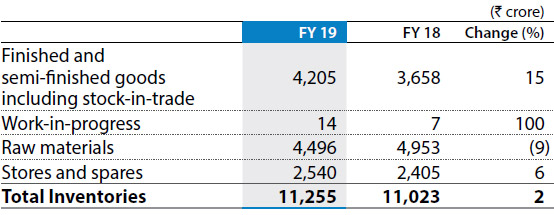

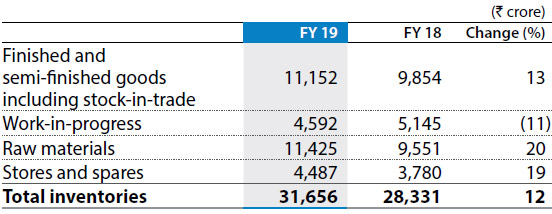

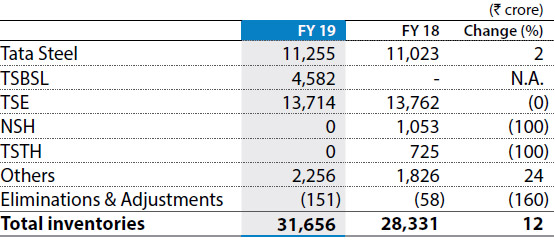

k) Inventories

Finished and semi-finished inventory increased as compared to previous year mainly due to increase in flat products inventory. The decrease in raw material inventories over the previous year was mainly due to decrease in coal inventory. Stores and spares inventory had increased

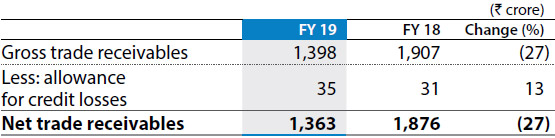

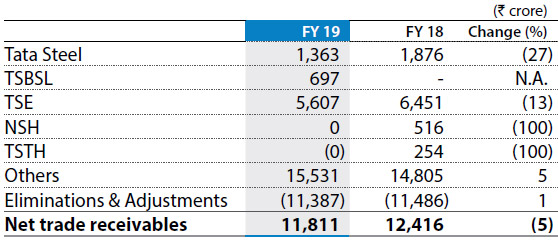

l) Trade receivables

Decrease in trade receivables as compared to previous year is primarily due to higher discounting.

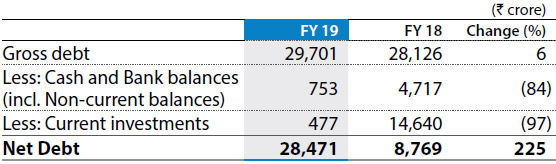

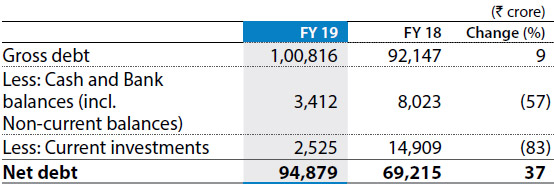

m) Gross debt and net debt

Net debt was higher as compared to previous year. This is attributable to decrease in current investments along with cash and bank balances.

Gross debt was marginally higher due to issue of non-convertible debentures and fresh loan drawn of term loan, partly offset by scheduled repayment and pre-payments.

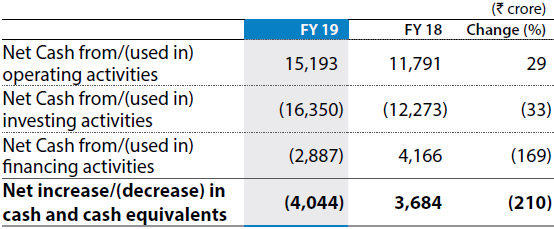

n) Cash Flows

Net cash flow from/(used in) operating activities

During the year under review, the net cash generated from operating activities was `15,193 crore as compared to `11,791 crore during the previous year. The cash inflow from operating profit before working capital changes and direct taxes during the current year was `19,949 crore as compared to inflow of `15,109 crore during the previous year due to higher operating profit. Cash outflow from working capital changes in 2018-19 is `223 crore mainly due to increase in inventories by `215 crore and increase in Non-current/Current financial and other assets by `611 crore partly offset by increase in Non-current/current financial and other liabilities/provisions by `603 crore. The income taxes paid during the current year was `4,533 crore as compared to `2,503 crore during Financial Year 2017-18.

Net cash flow from/(used in) investing activities

During the year under review, the net cash outflow from investing activities amounted to `16,350 crore as compared to `12,273 crore during the previous year. The outflow during the current year broadly represents, purchase of investments in subsidiaries `29,076 crore, capex of `3,677 crore partly offset by proceeds from sale of current investments of `14,760 crore.

Net cash flow from/(used in) financing activities

During the year under review, the net cash outflow from financing activities was `2,887 crore as compared to an inflow of `4,166 crore during the previous year. The outflow during the current year broadly represents payment of interest `2,608 crore, payment of dividend including taxes `1,371 crore and proceeds from borrowings (net of repayments) `1,437 crore.

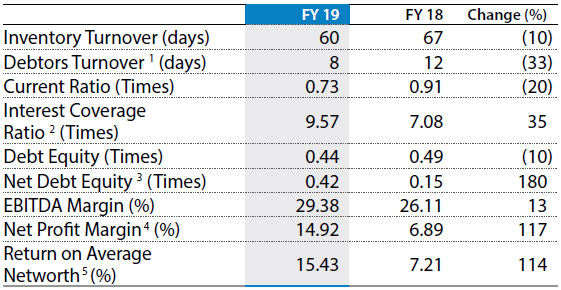

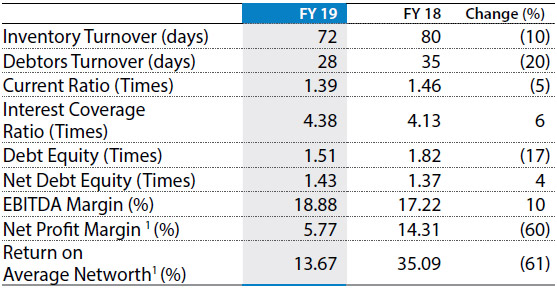

o) Changes in key financial ratios

The details of changes in the key financial ratios as compared to previous year are stated below:

1) Debtors Turnover Ratio:Improved primarily on account of decrease in debtors by 27% owing to higher discounting.

2) Interest Coverage Ratio:Improved primarily on account of higher operating profits.

3) Net Debt Equity Ratio:Increased primarily on account of significant decline in cash and bank balances and other liquid investments over previous year.

4) Net Profit Margin:Increased primarily on account of increase in net profits attributable to higher operating profits, lower exceptional charge and higher finance income during Financial Year 2018-19.

5) Return on net worth:Increased primarily on account of increase in net profits attributable to higher operating profits during Financial Year 2018-19.

2. Tata Steel Limited (Consolidated)

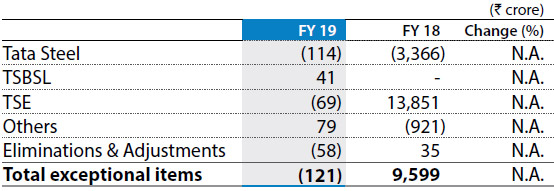

Tata Steel Consolidated profit after tax (including discontinued operations) was `9,098 crore as against `17,763 crore in the previous year. The decrease was mainly due to previous year’s exceptional gain of `9,599 crore as against charge of `121 crore during current year.

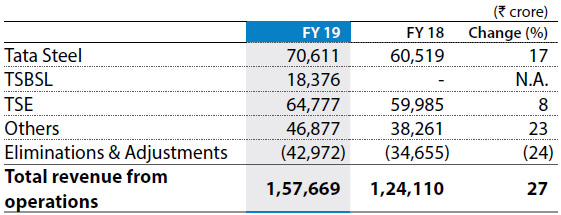

a) Revenue from Operations

The consolidated revenue from operations was higher as compared to the previous year primarily due to acquisition of TSBSL. Increase at Tata Steel Standalone was primarily on account of higher Steel volumes and realisations and higher other operating income.

TSE reported increase mainly on account of an increase in average revenue per tonne, supported by favourable forex impact on translation.

Increase in ‘Others’ primarily reflects transactions through TSPDL, TCIL and Tata Steel Global Procurement (‘TSGP’), which are, eliminated on consolidation.

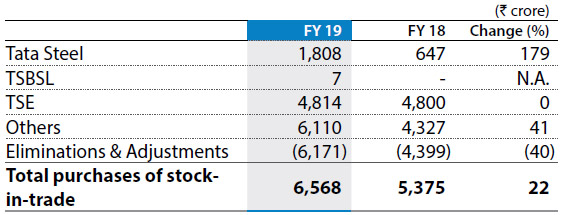

b) Purchases of stock-in-trade

Expense was higher mainly at Tata Steel (Standalone) due to higher purchases of wire rods, imported rebars, hot rolled coils, cold rolled coils and slabs owing to higher requirement.

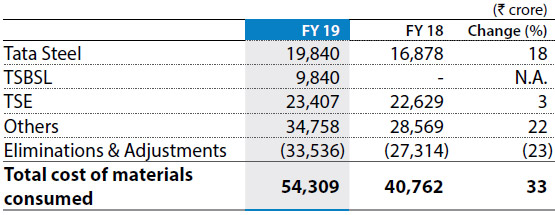

c) Cost of materials consumed

Consumption was higher mainly on account of acquisition of TSBSL. Increase at Tata Steel (Standalone) was higher due to higher consumption of coal and purchased pellet, along with higher cost of imported coal. TSE reported an increase mainly on account of adverse exchange impact on translation.

Others primarily reflects activities at Tata Steel Global Procurement (‘TSGP’) which are majorly eliminated on consolidation.

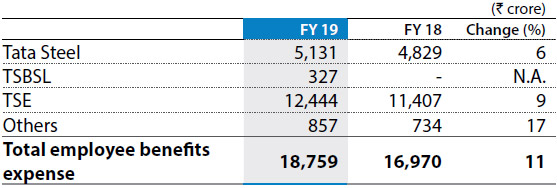

d) Employee benefits expense

Acquisition of TSBSL resulted in increase in employee benefit expense. Expense at Tata Steel (Standalone) increased mainly on account of salary revisions and its consequential impact on the retirement provisions. TSE reported increase due to adverse exchange impact on translation and normal salary increase.

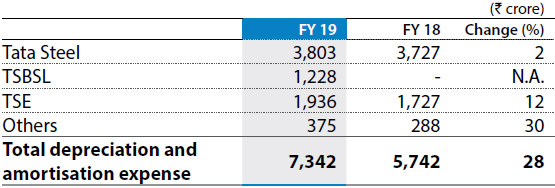

e) Depreciation and amortisation expense

Expense was higher than previous year mainly on account of acquisition of TSBSL. Increase in expense at Tata Steel (Standalone) was in line with normal addition. Expense at TSE was higher in line with normal addition along with adverse exchange impact on translation.

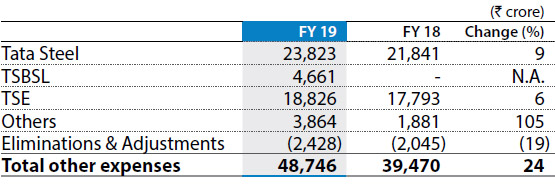

f) Other expenses

Other expenditure represents the following expenditure:

Expense was higher mainly due to acquisition of TSBSL. Tata Steel (Standalone) reported increase mainly on account of higher consumption of stores and spares, higher repairs and maintenance expenses, royalty charges and freight and handling charges.

TSE reported increase mainly on account of higher stores and spares consumed, higher level of repairs and maintenance, power cost along with exchange impact on translation.

Increase in Others was mainly at Tata Steel Global Holdings on account of adverse exchange rate movement.

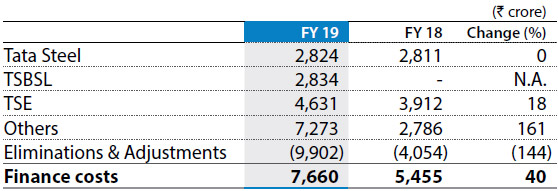

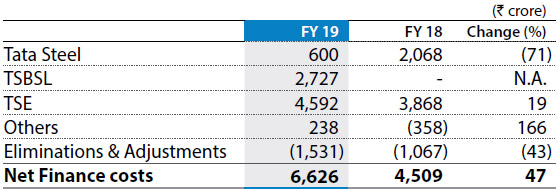

g) Finance costs and net finance costs

Finance cost was higher due to external borrowings taken by Bamnipal Steel Limited for the acquisition of TSBSL.

Expense at TSBSL mainly relates to fund provided by Bamnipal Steel Limited for the acquisition which was eliminated on consolidation.

Net finance charge was higher in line with increase in finance cost. However, expense was lower at Tata Steel (Standalone) mainly on account of interest income from inter-company deposits (‘ICD’) given to Bamnipal Steel Limited for acquisition of TSBSL, which was eliminated on consolidation.

h) Exceptional items

Exceptional items during the current financial year, primarily represents:

- Provision for demands and claims amounting to `329 crore relating to certain statutory demands and claims on environment and mining matters at Tata Steel Limited (Standalone).

- Provision of `172 crore in respect of advances with public bodies paid under protest by TSBSL.

- Provision for Employee Separation Scheme (‘ESS’) under Sunehere Bhavishya Ki Yojana (‘SBKY’) scheme amounting to `35 crore at Tata Steel Limited (Standalone).

- Impairment charges of `10 crore in respect of property, plant and equipment (including capital work-in-progress and capital advances) and intangible asset at TSBSL.

Partly offset by,

- Profit on sale of non-current investments amounting to `180 crore, primarily in TRL Krosaki Refractories Limited (an associate of the Company) and certain other subsidiaries and joint ventures.

- Restructuring and write back of provisions amounting to `245 crore which primarily includes write-back of liabilities no longer required at TSBSL and arbitration settlement at Jamshedpur Utilities & Services Company Ltd., partly offset by charge at Tata Steel Europe.

The exceptional items in Financial Year 2017-18 primarily include:

- Gains arising out of modification in benefit structure for members

of the new pension scheme (‘NBSPS’) versus their benefits under

Tata Steel Europe’s British Steel Pension Scheme (‘BSPS’), offset by

settlement charges for those members who did not join the NBSPS

and one-off costs at Tata Steel Europe amounting to `13,851 crore.

Partly offset by,

- Provision of `3,214 crore in respect of certain statutory demands and claims relating to environment and mining matters, net of liability written back towards District Mineral Fund (DMF) at Tata Steel Limited (Standalone).

- Provision for advances paid for repurchase of equity shares in Tata Teleservices Ltd. from NTT DoCoMo Inc. amounting to `27 crore at Tata Steel Limited (Standalone).

- Provision for Employee Separation Scheme (‘ESS’) under Sunehere Bhavishya Ki Yojana (‘SBKY’) scheme `108 crore mainly at Tata Steel Limited (Standalone) and at Jamshedpur Utilities & Services Company Ltd.

- Impairment charges `903 crore in respect of property, plant and equipment (including Capital Work-in-Progress) and intangible assets relating to Global Mineral entities.

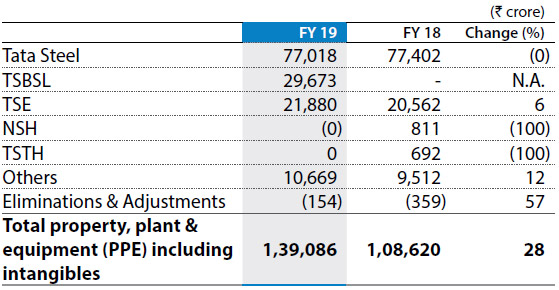

i) Property, plant & equipment (PPE) including intangibles

Increase in PPE and intangibles mainly due to acquisition of TSBSL was partly offset by decrease at NatSteel Holdings and Tata Steel Thailand as these companies have been classified as ‘held for sale’ as on March 31, 2019.

j) Inventories

Increase was primarily on account of acquisition of TSBSL. Tata Steel Standalone reported increase on account of higher finished and semi-finished goods, stores and spares, partly offset by decrease at NatSteel Holdings and Tata Steel Thailand as these companies have been classified as held for sale as on March 31, 2019.

k) Trade receivables

Decrease at NatSteel Holdings and Tata Steel Thailand was primarily on account of their classification as ‘held for sale’ as on March 31, 2019. Decrease at Tata Steel (Standalone) was primarily due to better realisations. These decreases were partly offset by increase on account of acquisition of TSBSL.

l) Gross debt and net debt

Net debt was higher by `25,664 crore over previous year.

Gross Debt at `1,00,816 crore was higher by `8,669 crore as compared to the previous year. Increase in Gross Debt was mainly on account of proceeds from borrowings (net of repayment) by `8,340 crore along with exchange impact on translation being `345 crore.

The increase in borrowings was mainly at TSBSL and Tata Steel Standalone, partly offset by decrease at Tata Steel Europe and Singapore based entities.

The increase in Net Debt was in line with increase in gross debt along with decrease in current investments along with cash and bank balances mainly at Tata Steel Standalone.

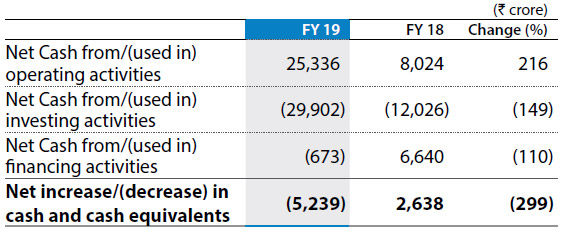

m) Cash flows

Net cash flow from/(used in) operating activities

During the year under review, the net cash from operating activities was `25,336 crore as compared to `8,023 crore during the previous year. The cash inflow from operating profit before working capital changes and direct taxes during the current year was `27,840 crore as against `20,187 crore during the previous year reflecting higher operating profits. Cash inflow from working capital changes during the current period was `2,591 crore primarily due to increase in Non-current/Current financial and other liabilities/provisions by `3,774 crore, partly offset by increase in inventories by `1,069 crore and Non-current/Current financial and other assets `115 crore. The payments of income taxes during the year under review were `5,094 crore as compared to `2,888 crore during the previous year.

Net cash flow from/(used in) investing activities

During the year under review, the net cash outflow from investing activities was `29,902 crore as against an outflow of `12,026 crore during the previous year. The outflow in the Financial Year 2018-19 broadly represents capex `9,091 crore, acquisition of subsidiaries/undertakings `35,282 crore, mainly related to amount paid for acquisition of TSBSL, partly offset by sale (net of purchase) of current investments amounting to `13,093 crore.

Net cash flow from/(used in) financing activities

During the year under review, net cash outflow from financing activities amounted to `673 crore as against inflow of `6,640 crore during the previous year. The net outflow primarily represents interest paid `7,152 crore and payment of dividend including taxes `1,424 crore, partly offset by proceeds from borrowings (net of repayment) `8,518 crore.

n) Changes in key financial ratios

The details of changes in the key financial ratios as compared to previous year are stated below:

1Decreased primarily on account of decrease in net profits attributable to higher exceptional gains arising out of modification in benefit structure of Pension Scheme during the previous year.

D. Statutory Compliance

The Chief Executive Officer and Managing Director makes a declaration at each Board Meeting regarding compliance with provisions of various statutes after obtaining confirmation from respective units of the Company. The Company Secretary & Chief Legal Officer (Corporate & Compliance) ensures compliance with Company Law, SEBI, and other laws applicable to the Company.