Management Discussion and Analysis 2013-14

Overview

The following operating and financial review is intended to convey the management's perspective on the financial condition and operating performance of the Company at the end of Financial Year 2013-14. The following discussion of the Company's financial condition and results of operations should be read in conjunction with the Company's financial statements, the schedules and notes thereto and the other information included elsewhere in the Annual Report. The Company's financial statements have been prepared in compliance with the requirements of the Companies Act, 1956, guidelines issued by the Securities and Exchange Board of India (SEBI) and the Generally Accepted Accounting Principles (GAAP) in India. The statistical data provided in the analysis represents changes during the calendar year.

I. Industry structure

1. Global steel industry and the outlook

Steel Demand

After a period of 5 years, since the break out of the global financial crisis and with significant liquidity injection by several large economies, the macro data from the developed economies started showing trends of slow improvement during 2013 even though several structural weaknesses still needs to be addressed before these trends can be considered sustainable. Global growth remains below pre-crisis levels and much weaker than during the rebound that took place in 2010 and 2011.

In 2013, global steel demand grew by 3.6% to 1.48 billion tonnes due to improved performance in the developed economies especially in North America and Euro Zone in the second half of the year. However, growth in emerging markets slowed down in 2013 due to weak demand especially in developed countries and tighter financial conditions. The World crude steel production rose by 3.5% to 1.607 billion tonnes in the year 2013.

The following table shows the crude steel production volume of the top 10 steel producing nations:

| in million tonnes | ||||

| Rank | Country | 2013 | 2012 | Change % |

| 1 | China | 779.0 | 716.5 | 8.7 |

| 2 | Japan | 110.6 | 107.2 | 3.2 |

| 3 | United States | 87.0 | 88.7 | (1.9) |

| 4 | India | 81.2 | 77.6 | 4.6 |

| 5 | Russia | 69.4 | 70.4 | (1.4) |

| 6 | South Korea | 66.0 | 69.1 | (4.5) |

| 7 | Germany | 42.6 | 42.7 | (0.1) |

| 8 | Turkey | 34.7 | 35.9 | (3.4) |

| 9 | Brazil | 34.2 | 34.5 | (0.9) |

| 10 | Ukraine | 32.8 | 33.0 | (0.5) |

| Source: World Steel Association | ||||

It would be important to note that while China has been one of the key engines of global growth in the last decade, it is now looking at a more sustainable model of growth in the next decade rather than pursuing absolute growth. The impact of the above shift will be felt across regions especially those economies that are dependent on commodities and exports to China for sustenance. The economic recovery therefore remains fragile due to divergent underlying supply demand conditions across different regions. Despite some signs of recovery in global steel demand, continued volatility and uncertainty make it a challenging environment for steel companies.

2. Steel industry in India

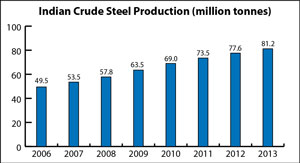

In 2013, India remained the 4th largest steel producing country in the world, behind China, Japan and the US. Crude steel production grew by 4.6% to 81.2 million tonnes and steel demand grew by 1.8%.

India's GDP growth has slowed down to 5% in 2013 on account of rising inflation and tight monetary controls. This has led to weak domestic steel demand, which grew by 3.3% in 2013 inspite of rise in demand in the last quarter. This has resulted in India becoming the net exporter of steel in Financial Year 2013-14 after a gap of six years. Total steel exports by India during the Financial Year stood at 5.59 million tonnes, as against imports of 5.44 million tonnes as per the report issued by Joint Plant Committee (JPC), a unit of the steel ministry.

India's GDP growth has slowed down to 5% in 2013 on account of rising inflation and tight monetary controls. This has led to weak domestic steel demand, which grew by 3.3% in 2013 inspite of rise in demand in the last quarter. This has resulted in India becoming the net exporter of steel in Financial Year 2013-14 after a gap of six years. Total steel exports by India during the Financial Year stood at 5.59 million tonnes, as against imports of 5.44 million tonnes as per the report issued by Joint Plant Committee (JPC), a unit of the steel ministry.

India's GDP is expected to grow by 5% and steel demand is expected to growth by 3.3% in 2014. The automotive sector (passenger vehicles and commercial vehicles), which grew by -6% in the Financial Year 2013-14, is expected to grow by about 3%-4% in Financial Year 2014-15. Similarly, the construction sector growth is expected to grow by 5% in the next year compared to growth of 1.9% in the Financial Year 2013-14.

3. European Union (EU) Steel industry:

The adverse impact of harsh weather conditions and overall weak demand fundamentals in the EU during the first half were swept aside by the gradual recovery in activity of the EU's steel using sectors especially in automotive during 2013. Further, the export demand from emerging economies boosted activity for the premium segment manufacturers.

Apparent steel use in the EU (28) is expected to grow by 3.1% in 2014 to 143.3 million tonnes and 3% in 2015 to reach 147.55 million tonnes led by the growth of construction sector, which has almost bottomed out.

II. TATA STEEL GROUP OPERATIONS

Notwithstanding, the global weak underlying economic conditions and the structural challenges faced by steel sector, the Tata Steel Group deliveries increased by 10% to 26.6 million tonnes in 2013 from 24.1 million tonnes in the previous year. The increase in deliveries came across all geographies with Tata Steel India, Tata Steel Europe, NatSteel Holding and Tata Steel Thailand increasing their deliveries by 14%, 6%, 39% and 10%, respectively. Higher deliveries at Tata Steel India during Financial Year 2013-14 were the outcome of full ramp up of the production facilities under the 3 mtpa expansion programme during in 2013. Higher deliveries at Tata Steel Europe were contributed by the stablisation of the Blast Furnace# 4 at Port Talbot, which was re-started in February 2013. The operating entities of NatSteel Holdings in Vietnam and China also showed significant growth in sales volume. Growth in deliveries in Tata Steel Thailand was achieved through higher rebar sales to the construction sector and exports to neighbouring countries. Consequently, the Group's operations across geographies registered an increase in turnover which was Rs.1,48,614 crores in Financial Year 2013-14, 10% higher than the turnover in Financial Year 2012-13 (Rs.1,34,712 crores). The EBITDA for the Group in the Financial Year 2013-14 was Rs.16,377 crores as compared to Rs.12,654 crores in the Financial Year 2012-13.

The Group reported a consolidated profit after tax (after minority interest and share of profit of associates) of Rs.3,595 crores during Financial Year 2013-14 as against a loss of Rs.7,058 crores (after considering the non-cash impairment charge of Rs.8,356 crores) in Financial Year 2012-13.

1. Tata Steel India

| in Rs.crores | ||

| FY 14 | FY 13 | |

| Turnover | 41,711 | 38,199 |

| Profit before tax (PBT) | 9,714 | 7,837 |

| Profit after tax (PAT) | 6,412 | 5,063 |

a) Steel Division

The impact of volatility in prices, exchange rates, on-going mining challenges, erratic weather occurrences, geo-political situation, a perceived slowdown and uncertainties in the policy landscape contributed to the lack of confidence in the market during the Financial Year 2013-14. Moreover, the increasing coal and fuel shortage is hurting the economic and industrial activity in the country.

Slow growth has been observed in the demand for steel products in India primarily due to near stagnant growth in steel consuming sectors like infrastructure, housing, auto and consumer goods. An upside was provided by the depreciating rupee allowing India, for the first time in recent years, to become a net exporter of steel products in the Financial Year 2013-14.

Tata Steel demonstrated agility in responding to market changes by selling in excess of 8.5 million tonnes of Steel and achieving the highest ever production of 9.9 million tonnes of Hot Metal during the Financial Year 2013-14.

The Jamshedpur Steel Works has a crude steel production capacity of 9.7 mtpa.

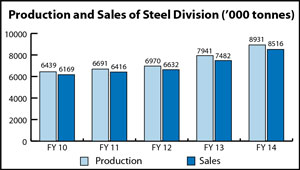

The trend in production and sales figures of the steel division of the Company are shown in the following table:

| in million tonnes | |||

| FY 14 | FY 13 | Change % | |

| Hot Metal | 9.90 | 8.86 | 11.7 |

| Crude Steel | 9.16 | 8.13 | 12.6 |

| Saleable Steel | 8.93 | 7.94 | 12.5 |

| Sales | 8.52 | 7.48 | 13.9 |

The trend of steel production and sales is shown below:

A summary of Steel Business Performance is as follows:

Operational and Sales Performance:

Hot Metal production in Financial Year 2013-14 was higher than Financial Year 2012-13 by 1.04 million tonnes (increase of 12%) primarily due to the addition of its new state-of-the-art "I" Blast Furnace (part of 3 mtpa expansion programme). This was the first full year of operation for the new resource efficient and energy efficient Blast Furnace. LD#3 – the new Steel Melting Shop – and TSCR, both commissioned under the 3 mtpa expansion project completed their first full year of operation.

The successful ramp up of the new facilities under the 3 mtpa expansion programme led to an increase of 1.03 million tonnes (increase of 13%) in crude steel production in the Financial Year 2013-14.

Enhanced availability of saleable material along with marketing initiatives in Emerging Corporate Accounts (emerging customers with sizable volumes and customised service needs) enabled the Company to sell the additional volumes without compromising on the premium in the Financial Year 2013-14.

The average net realisation of the Steel Business remained low due to depressed prices on account of tepid demand throughout the Financial Year 2013-14.

Key Marketing and Sales initiatives:

Given the challenges ahead, pressure on margins, addition of new capacities, juxtaposed with opportunities in both domestic and exports markets with the Indian rupee settling at a lower value during Financial Year 2013-14, the Marketing and Sales function of the Company reoriented its approach to develop strategies that respond to demand and expand market access. The function has been re-aligned from product-based to a customer-based marketing approach for establishing stronger customer relationship. The objective is to extend the function beyond selling products so that the Company product mix is aligned with customer specific needs. The re-alignment, which reflects dominant customer segments, is aimed at bringing in better synergy and providing a one-stop experience for customers. The following new verticals were created:

- Automotive and Special products

- Branded products, Retail and Solutions

- Industrial Products, Projects and Exports

The re-alignment ensured that in one of the worst years for the Auto Industry, Tata Steel recorded a 15% increase in sales to automotive segment over Financial Year 2012-13 by engaging with customers through cross functional teams, focussing on new models, Hi-end sales (e.g. GA, Skin Panel and Hi-tensile) and entering into new segments/customers.

Sales of branded products also grew by 11% during Financial Year 2013-14 over the previous year despite a slowdown in the construction sector and liquidity crunch for the Small Medium Enterprise (SME) industry. Amongst others, this was achieved by significantly increasing the number of dealers for the Tata Tiscon brand and increasing the availability of thin and wider GC sheets.

The Company's focus on Hi-end grade sales (e.g. Exports special, Corton grade for Railways, API grade etc.) and value added products like Tata Tiscon 'ReadyBuild' enabled the sales to grow significantly in Financial Year 2013-14 under all the new verticals.

The Company continues to focus on sales of its branded products and solutions which command a premium over non-branded products. Tata Steel, the first steel company in India to de-commoditise steel and provide value added products, has year-on-year steadily increased its share of branded products in its overall turnover. In the steel business, the brand offerings of the Company in Retail (B2C) space and SME space are as follows: