Management Discussion and Analysis 2013-14

a) Retail Offerings:

Galvanised Corrugated Sheet was launched as the 'Tata Shaktee' brand in the year 2000. Currently, the distributor network for Tata Shaktee extends across the country, with 2,800 dealers capable of building ~1,80,000 roofs per month across 6,000 talukas throughout India. It has also been acknowledged as a 'Superbrand' in the last edition of the consumer validated Superbrands survey. Among Tata Shaktee's recent initiatives is 'Roofjunction' – a roofing solution service. This includes service and roof installation by expert fabrications, who use modern techniques. Tata Shaktee is also a component in 'Nest-In', the affordable housing initiative promoted by Tata Steel. As a complete building solution, it provides a simple and quick alternative to the traditional process of building houses. Being extremely versatile, it is ideal for many applications.

Tata Tiscon, the premium quality rebar brand in Indian market, was also launched in the year 2000. Acknowledged as a 'Consumer Superbrand' for the 'Construction Rebar' category in two consecutive surveys, it is also the only brand from the Indian Steel Industry to be rated as Asia's most promising Brand 2012-13. A customer-focussed initiative under the Tata Tiscon stable is the readymade stirrup solution branded 'Tiscon Superlinks'.

b) SME Offerings:

Since its launch in 2003, Tata Steelium (CR sheet), the world's first branded Cold Rolled steel has found a wide range of applications in the SME segment as a result of the support of distributors and service centres across the country, who are certified by Tata Steel.

The zero spangle Galvanised Plain Steel brand 'Galvano', launched in May 2009 is produced through 'Lead-Free' costing chemistry making it an eco-friendly steel product. This product also serves many SME customers.

The 'Tata Astrum', launched in November 2012, provides HR Sheet and Coils to the SME customers in the processed form, eliminating the need for on-site processing by end users.

The Company's extensive network of committed channel partners enables it to deliver assured value to priority segments in B2C and B2SME. Apart from providing reach across fragmented consumer bases, this network of partners helps the Company create differentiated value propositions.

Awards and Recognition:

- "Special Support Award" received from Maruti Suzuki India Limited

- "Material Localisation Award" from Nissan India Limited

- "Award for Performance" from Brakes India Limited

- "Best Supplier Award 2013" from Tata Motors Limited

- "Best Business Partner" (Category of product – TMT Bars) from Tata Housing

- TATA Shaktee won the Organisational Award in the category of "Long Term Campaign of the Year" in Rural Marketing Forum & Awards function

- TATA Tiscon received the award "Brand Excellence" in Construction & Real Estate Sector, Best In-House Magazine, Building Bonds, and Effective use of Marketing Communications in 4th CMO Asia Awards for Excellence in Singapore

c) Ferro Alloys and Minerals Division (FAMD):

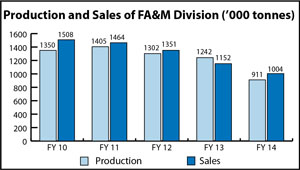

The trend of production and sales volumes of the Ferro Alloys and Minerals Division is shown below:

The Division achieved a total sales volume of 1,004k tonnes in Financial Year 2013-14 against 1,152k tonnes in the previous year.

The success of 'TATA SILCOMAG', the world's first ever branded Ferro Alloy launched in the Financial Year 2012-13, prompted FAMD to launch two more branded Ferro alloys – TATA TISCROME (branded Ferro Chrome) and TATA FERROMAG (branded Ferro Manganese) in the Financial Year 2013-14. FAMD won various awards in the year including the "Gold" and "Silver" category being conferred on Sukinda Chromite Mines & Manganese Mines, respectively, in the Mines and Metals sector at the 14th Annual Greentech Award, 2013.

d) Tubes Division

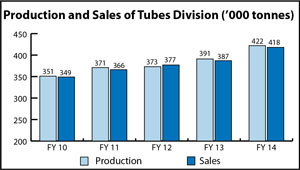

The trend of production and sales volume of the Tubes Division over the last five years is shown below:

Despite a slowdown in the market, the Company's focus on new growth areas resulted in steady growth of 8% in production and sales volumes during Financial Year 2013-14.

The key performance highlights of the Division are as under:

|

|

The Tubes Division received the best supplier award for "Innovation & Technology" from M/s. Tata Motors Ltd.

e) Bearings Division:

The performance of the Bearings Division in terms of production and sales volume is shown below:

Through focus on after-sales market, the Division registered its best ever sales volumes and retail sales increased by 28% during the Financial Year 2013-14. Bearings Division has also re-designed production processes to achieve the best ever process yield of 99.6% (Previous Best 98.7%).

It continued to maintain the trust of its customers, earning a number of awards and accolades including the Platinum Award from Bajaj Auto for quality, cost and delivery besides consistent 'Zero PPM' awards from Bosch, Toyota and Rane NSK.

2. Tata Steel Europe

| in Rs.crores | ||

| FY 14 | FY 13 | |

| Turnover | 84,666 | 78,012 |

| Profit/(loss) before tax (PBT) | (3,684) | (12,789) |

| Profit/(loss) after tax (PAT)* | (3,011) | (12,649) |

| * PAT represents PAT after minority interest and share of profit of associates. | ||

Tata Steel Europe's (TSE) revenue of Rs.84,666 crores for the Financial Year 2013-14 was 8.5% higher than the previous year in rupee terms (3% lower in GBP terms, being entity's reporting currency). The average revenue per tonne declined by 7% due to weaker market conditions caused by continued lower steel capacity utilisation rates in Europe. The TSE's profit before tax for the Financial Year 2013-14 registered an improvement over last year. There was no impairment charge considered in the Financial Year 2013-14 as compared to the impairment charge of Rs.7,534 crores considered in Financial Year 2012-13.

Operational and Sales Performance:

Stabilisation of Blast Furnace# 4 at Port Talbot, UK, rebuilt during the year and lighted in February 2013, along with an increase in deliveries by the Long Products Division in Europe were reflected in the 16.5% increase in crude steel production to 15.5 million tonnes in Financial Year 2013-14 from 13.3 million tonnes in the Financial Year 2012-13. Deliveries also grew by 6.1% to 13.9 million tonnes from 13.1 million tonnes.

The production and sales performance of TSE are shown below:

| in million tonnes | |||

| FY 14 | FY 13 | Change % | |

| Liquid steel production | 15.5 | 13.4 | 16.3 |

| Deliveries | 13.9 | 13.1 | 6.1 |

Reliability was a key theme for operational excellence during Financial Year 2013-14 with a number of performance records being broken:

- At Port Talbot – (a) the best ever total hot metal make was achieved at Blast Furnace# 4 (2.05 million tonnes - previous best of 1.91 million tonnes in Financial Year 2002); (b) the best ever total hot metal make for the site was achieved (4.16 million tonnes - previous best of 3.86 million tonnes in Financial Year 2007); (c) the best ever total liquid steel make (4.55 million tonnes - previous best of 4.41 million tonnes in Financial Year 2007); and (d) the best ever total slab make (4.45 million tonnes - previous best of 4.29 million tonnes in Financial Year 2007).

- At Llanwern – the best ever total hot dipped galvanising line output on the Zodiac line was registered with 479 thousand tonnes (previous best of 417 thousand tonnes in Financial Year 2006).

- At IJmuiden – (a) the best ever total Hot Strip Mill output was achieved at 5.21 million tonnes (previous best of 5.05 million tonnes in the Financial Year 2011-12); (b) the best ever total Direct Sheet Plant output of 1.26 million tonnes (previous best was 1.19 million tonnes in Financial Year 2007); and (c) the best ever total hot dipped galvanising line output at DVL3 of 552 thousand tonnes (previous best was 465 thousand tonnes in the Financial Year 2012-13).

Production at different facilities in TSE along with their capacities is shown below:

| in million tonnes | ||

| Production capacity |

Actual production |

|

| Port Talbot steelworks, West Glamorgan, Wales | 4.9 | 4.5 |

| Scunthorpe steelworks, South Humberside, England | 4.5 | 3.2 |

| Rotherham steelworks, South Yorkshire, England | 0.8 | 0.7 |

| IJmuiden steelworks, the Netherlands | 7.2 | 7.1 |

| Total | 17.4 | 15.5 |

Tata Steel Europe continued to implement its strategy of market differentiation to achieve its mission of being its customers' preferred supplier in its chosen markets, unlocking the potential of steel. The principal end-user markets for the Company's steel products are the automotive, construction, packaging, rail, lifting & excavating and energy & power sectors. A key metric for the development of the market differentiation strategy is the progress of the New Product Development pipeline. This programme met its intended objectives for the year by launching 30 new products, marking Financial Year 2013-14 as its most successful year. In addition, the volume of new products sold increased by about 75%. Sales of differentiated products – products made by few or no other producers that therefore attract price premiums – also rose by about 15% compared to the previous year, having already exceeded 25% as a proportion of overall sales.

Tata Steel's strategy in Europe is built upon several building blocks: Customer Focus, Operational Excellence, Innovative Products & Services and Responsibility. To increase customer focus, the Company has reorganised its sales and marketing activities in recent years and created a new organisational structure that is unique in the steel industry and differentiates Tata Steel's European operations from the competition. Under this structure, sales and marketing activities are organised by market sectors, ensuring expert face to market and improved level of service.

By strengthening customer focus in this manner, improvements were secured in the product and service portfolio whose results have already been outlined above. These improvements included success in Early Vendor Involvement initiatives, leading to awards and other successes with customers, including the Company's close partnership with JCB, which led to the development of its most productive tractor, the Fastrac 4000. Other such successes are listed below:

Awards and Recognition:

Tata Steel Europe registered a number of customer success during the year:

- Network Rail, the owner and operator of rail infrastructure in the UK, has chosen to source more than 95% of its rail from Tata Steel Europe until 2019.

- Schneider Electric conferred the Preferred Supplier 2013 award on TSE.

- Royal Mint conferred its Most Innovative Supplier award on TSE for the third year running.

- Awarded 'GOLD' in the Caterpillar Supplier Quality Excellence Process for its global supply of track shoe profiles.

- Toyota Certificate of Recognition for important contribution in the area of quality.

3. NatSteel Holdings

| in Rs.crores | ||

| FY 14 | FY 13 | |

| Turnover | 12,128 | 9,393 |

| Profit/(loss) before tax (PBT) | 42 | 155 |

| Profit/(loss) after tax (PAT)* | 43 | 113 |

| * PAT represents PAT after minority interest and share of profit of associates. | ||

During Financial Year 2013-14, NatSteel Holdings (NSH) enhanced its capabilities across all geographies as the Company invested for the future in IT, Technology and Internal Capability Building. This was done in the backdrop of a volatile, uncertain and highly competitive business environment.

The Company's Singapore operations completed its major plant modernisation projects, including the New Scrap Shear, New Shaft Furnace and various downstream automation projects. NSH once again achieved its highest-ever downstream deliveries of 512k tonnes and maintained its leadership position in downstream volumes, emerging as the largest supplier of mesh in Singapore. Overall Sales grew by 29% across the Group. A partnership with two private steel companies for the supply of billets along with a conversion and marketing agreement in the Fujian province, doubled sales to 1.4 million tonnes during the Financial Year 2013-14 from 653k tonnes in the Financial Year 2012-13. Consequently NSH's market share in the Fujian province rose to 15%. Vietnam achieved record sales volume of 134k tonnes, 19% higher than last year. However, profitability was adversely affected due to a downward pressure on price caused by the influx of low-priced materials from China. Rationalisation and productivity efforts in Australia have resulted in a turnaround in the business to a positive EBITDA in the Financial Year 2013-14.

4. Tata Steel Thailand

| in Rs.crores | ||

| FY 14 | FY 13 | |

| Turnover | 4,860 | 4,436 |

| Profit/(loss) before tax (PBT) | 18 | (626) |

| Profit/(loss) after tax (PAT)* | 8 | (635) |

| * PAT represents PAT after minority interest and share of profit of associates. | ||

Sales of Tata Steel Thailand increased by 10% during the Financial Year 2013-14 despite the adverse effects of political turmoil on the Thai GDP which has grown below 3% in 2013 and the estimate for 2014 is pegged in the range of 2-2.4%.

The challenge of GDP contraction notwithstanding Tata Steel Thailand (TSTH) further strengthened its leadership position in Rebars, increasing its market share from 32% to 35% in Financial Year 2013-14 by leveraging the strong presence of its brand TATA TISCON in the regional markets of Thailand. Finished goods production for the year stood at 1.29 million tonnes, 10.5% higher than in the previous year. TSTH reported a profit after tax of Rs.8 crores during Financial Year 2013-14 compared to a loss in the previous year riding on continuous improvements in the fields of customer intimacy and operational excellence.

5. Tata Metaliks Limited

| in Rs.crores | ||

| FY 14 | FY 13 | |

| Turnover | 1,425 | 995 |

| Profit/(loss) before tax (PBT) | 3 | (114) |

| Profit/(loss) after tax (PAT)* | 9 | (87) |

| * PAT represents PAT after minority interest and share of profit of associates. | ||

There was a significant improvement in the operating margin of Tata Metaliks Limited (TML) during the Financial Year 2013-14 with both production and sales escalating by 38% and 51% respectively, compared to the previous year. Production and sales of ductile iron pipes also increased by 54% and 61% respectively, compared to the previous year. TML recorded significant improvements in its operating margin as a consequence of improvements in operating parameters like yield, rejection rate, plant availability, etc., as well as sales performance in terms of net realisation.

A consolidated profit after tax of Rs.9 crores was reported during the Financial Year 2013-14 after accounting for an exceptional loss of Rs.21 crores on sale of its entire plant and machinery at the Redi unit. TML intends to improve its operating margin further in 2014 by setting up a coke oven plant along with a 10 MW power plant at Kharagpur on a BOOT (Built Operate Own & Transfer) basis.

On 10th April 2013, Tata Steel Limited announced the merger of TML and TMKPL with itself under a Scheme of Amalgamation to be sanctioned through a court approval process. Tata Steel will issue 4 (four) equity shares of Rs.10 each for every 29 (twenty nine) equity shares of Rs.10 each held by the public shareholders of TML upon approval of the scheme by the courts. Tata Steel holds 50.09% of the equity share capital of TML. The shareholders' approval for the Scheme is being sought at the Court Convened Meeting of the shareholders to be held on 16th May, 2014.