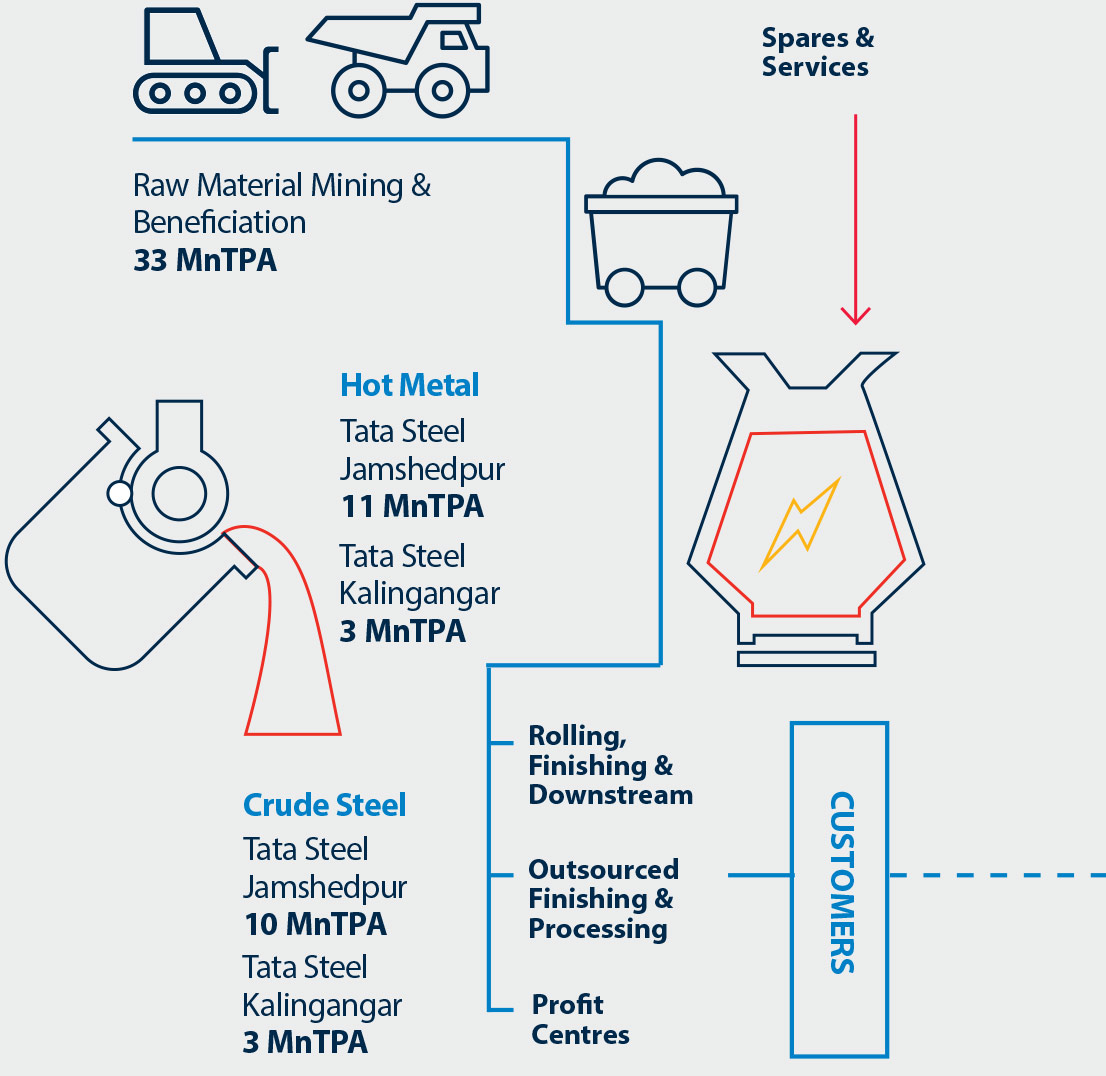

BUSINESS MODEL

ACTIONS TO ENHACE/MITIGATE OUTCOMES

INPUT

| Financial Capital | UOM | FY17 |

|---|---|---|

| Capex | ` Cr. | 3,173 |

| Revenue Spend(Other than ED, Tax and extraordinary items) | ` Cr. | 44,074 |

| Manufactured Capital | UOM | FY17 |

|---|---|---|

| Crude Steel production capacity | MnTPA | 12.7 |

| Inbound raw materials | MnTPA | ~40 |

| Outbound finished goods | MnTPA | >11 |

| Pan India Stockyards | Nos. | 18 |

| Fininshed Goods Inventory | Kt | 226 |

| Intellectual Capital | UOM | FY17 |

|---|---|---|

| Patents filed (Cumulative till FY2017) | Nos. | 870 |

| R&D spend (Cumulative since FY11) | ` Cr. | 681 |

| Human Capital | UOM | FY17 |

|---|---|---|

| Employees on roll | Nos. | 34,989 |

| Skilled Manpower | % | ~100 |

| Spend on training | ` Cr. | >50 |

| Relationship Capital | UOM | FY17 |

|---|---|---|

| Pan India dealers & distributors | Nos. | >12,000 |

| Pan India Sales Offices | Nos. | >25 |

| Application Engineers working jointly with customers | Nos. | ~30 |

| Customer facing processes | Nos. | 8 |

| Members in customer service teams | Nos. | >100 |

| Supplier base | Nos. | >5,000 |

| Suppliers trained through VCAP* | Nos. | 204 |

| Social Capital | UOM | FY17 |

|---|---|---|

| CSR spend | ` Cr. | 194 |

| Natural Capital | UOM | FY17 |

|---|---|---|

| Captive Iron Ore | % | 100 |

| Captive Coal | % | 36 |

| Specific Water Consumption - TSJ | m3/tcs | 3.83 |

| Specific Water Consumption - TSK | m3/tcs | 7.66 |

| Energy Intensity - TSJ, TSK | GCal/tcs | 5.67, 8.49 |

| Tree plantation | Nos. | 4,00,225 |

| Capital Spend on environment | ` Cr. | 605 |

TSJ- Tata Steel Jamshedpur

TSK- Tata Steel Kalinganagar

TSK under ramp-up

BUSINESS ACTIVITIES AND PROCESSES

VISION, MISSION, VALUES, TATA CODE OF CONDUCT, POLICIES

STAKEHOLDER ENGAGEMENT

RISKS AND OPPORTUNITIES

STRATEGY AND RESOURCE ALLOCATION

KEY WORK SYSTEMS

SUPPORT FUNCTIONS

SAFETY & ERGONOMICS |

CORPORATE ETHICS |

HUMAN RESOURCE MANAGEMENT |

CORPORATE STRATEGY & PLANNING |

ENVIRONMENT MANAGEMENT |

INDUSTRIAL

BY-PRODUCTS MANAGEMENT DIVISION |

CORPORATE SOCIAL RESPONSIBILITY |

FINANCE &

ACCOUNTS |

SHARED SERVICES |

INFORMATION TECHNOLOGY SERVICES |

PROCUREMENT |

CUSTOMER SERVICES DEPARTMENT |

RAW MATERIAL MANAGEMENT |

CORPORATE

COMMUNICATION |

CORPORATE SERVICES |

ENGINEERING & PROJECTS |

RESEARCH & DEVELOPMENT |

AUTOMATION |

TECHNOLOGY GROUPS

OUTPUT

HOT METAL PRODUCTION 14 MnTPA

CRUDE STEEL PRODUCTION 13 MnTPA

KEY CUSTOMER SEGMENTS & PRODUCTS

AUTOMOTIVE SEGMENT (OEMs & Auto Ancillaries):

CR SHEETS, COILS, TUBES, SPRINGS, BEARINGS

CONSTRUCTION SEGMENT:

TMT REBARS, STEEL HOLLOW SECTIONS, GC ROOFING SHEETS

GENERAL ENGINEERING SEGMENT:

CR SHEETS AND COILS, HR SHEETS AND COILS, COATED PRODUCTS

INDUSTRIAL SEGMENT:

HOT ROLLED COILS, WIRE RODS

BY-PRODUCTS AND THEIR CONSUMERS

POWER PLANTS, COKE PLANTS, BRICK KILNS:

COAL REJECTS, COAL MIDDLINGS

CEMENT INDUSTRY:

BLAST FURNACE SLAG, LD SLAG

CONSTRUCTION SECTOR (ROAD):

LD SLAG

OUTCOME

| Financial Capital | UOM | FY17 |

|---|---|---|

| Turnover | ` Cr. | 53,261 |

| EBITDA | % | 22 |

| PAT | ` Cr. | 3,445 |

| Savings from improvement projects | ` Cr. | 3,400 |

| Value from by-products | ` Cr. | 2,882 |

| Revenue from new products | % | 5 |

| Revenue through services and solutions business | ` Cr. | ~750 |

| Manufactured Capital | UOM | FY17 |

|---|---|---|

| Coke Rate | Kg/tonne of hot metal | 360 |

| Availability of critical manufacturing units | % | >90 |

| Intellectual Capital | UOM | FY16 |

|---|---|---|

| Patents granted (Cumulative till FY2017) | Nos. | 360 |

| New products launched | Nos. | 31 |

| Human Capital | UOM | FY17 |

|---|---|---|

| Safety - LTI | Nos. | 80 |

| Safety - Fatalities | Nos. | 5 |

| Health Index | Score out of 16 | 12.59/16 |

| Employee Productivity (TSJ) | tcs/employee/year | 720 |

| Diversity - Gender and SC/ST | % | 5.8 and 16.9 |

| Attrition Rate | % | 4.83 |

| Employees trained | man-days | 3,34,050 |

| Relationship Capital | UOM | FY17 |

|---|---|---|

| Customer satisfaction | % | 81.3 |

| Customer complaints | ppm | 759 |

| Brand Equity Index - Tata Shaktee | Score out of 10 | 7 |

| Brand Equity Index - Tata Tiscon | Score out of 10 | 6.6 |

| Continuing leadership position in chosen segments (Automotive and Construction) | ||

| Loyal (repeat) customers | % | 70 |

| Timely environmental clearances without any major issues | ||

| Social Capital | UOM | FY17 |

|---|---|---|

| Lives impacted through CSR - Health, Education, Livelihood programmes | Nos. | 1.1 Million |

| Economic Value Distributed | % | 95.34 |

| Social licence to operate without any major issues | ||

| Natural Capital | UOM | FY17 | ||

|---|---|---|---|---|

| CO2 emissions - TSJ, TSK | tCO2e/tcs | 2.29, 3.08 | ||

| Effluent discharge - TSJ | m3/tcs | 1.01 | ||

| Solid Waste Utilisation - TSJ | % | 82.4 | ||

| Dust emissions - TSJ, TSK | kg/tcs | 0.44, 1.3 | ||

|

||||