|

Overview The following operating and financial review is intended to convey the management's perspective on the financial condition and on the operating performance of the Company as at the end of the Financial Year 2012-13. The following discussion of the Company's financial condition and result of operations should be read in conjunction with the Company's financial statements, schedules and notes thereto and the other information included elsewhere in the Annual Report.The Company's financial statements have been prepared in compliance with the requirements of the Companies Act, 1956, guidelines issued by the Securities and Exchange Board of India (SEBI) and the Generally Accepted Accounting Principles (GAAP) in India. I. Industry Structure 1. Global Steel Industry: While global industrial production in 2012 dropped to its lowest level since 2009, global steel production reached a record high of 1.55 billion tonnes, up by 1.2% as compared to 2011. The growth came mainly from Asia and North America while production in the European Union and South America decreased in 2012 compared to 2011. Global steelmakers continued to witness supply growth outpacing demand, with capacity utilisation rates remaining consistently below 80%. Subdued steel prices and a slowdown in demand growth from China continued to weigh on the global steel sector in the past year. Annual production for Asia was 1.01 billion tonnes of crude steel in 2012, an increase of 2.6% as compared to 2011. China's crude steel production in 2012 reached 716.5 million tonnes, an increase of 3.1% on 2011, resulting in a hike in the country's share of world crude steel production from 45.4% in 2011 to 46.3% in 2012. The EU meanwhile recorded a decrease of 4.7% compared to 2011, producing 169.4 million tonnes of crude steel in 2012. Among specific countries, Germany produced 42.7 million tonnes of crude steel, a decrease of 3.7% on 2011. Italy produced 27.2 million tonnes, a 5.2% decrease over 2011. France's crude steel production in 2012 was 15.6 million tonnes, a decrease of 1.1%. Spain produced 13.6 million tonnes of crude steel in 2012, a 12.1% decrease on 2011. In 2012, crude steel production in North America was 121.9 million tonnes, an increase of 2.5% on 2011 while that for South America was 46.9 million tonnes, a decrease of 3.0% on 2011. The US produced 88.6 million tonnes of crude steel, 2.5% higher than 2011. The past year proved to be a challenge for the steel industry with apparent steel usage increasing at the slowest rate since 2009. The euro zone crisis persisted throughout 2012 and macro-economic pressures in major economies contributed significantly to the global slowdown. Lower industrial production and reduced investment in large scale infrastructure projects resulted in a marked decrease in the growth of steel demand from both the developed and emerging markets. Apparent global steel usage in 2012 had grown by only 1.2%. A modest pick-up in global steel demand is expected in 2013. Global apparent steel usage is forecasted to increase by 2.9% to 1.45 billion tonnes in 2013, following the slower-than-expected growth in 2012. Demand is likely to improve faster in emerging markets. Apparent steel use in China, the largest steel producer and consumer, is expected to grow by 3.5% in 2013 to 668.8 million tonnes following a 1.9% increase in 2012. There are trends of demand recovery in the property sector and the demand for infrastructure has also been strong since June, 2012. However, underlying demand in the EU is not expected to improve much in 2013 despite moderate restocking seen in the beginning of the year. Overall, steel demand is expected to remain weak due to the continuing economic crisis in the developed countries and the structural shift in the Chinese economy. The following table shows the crude steel production volume of the top 10 steel producing nations: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

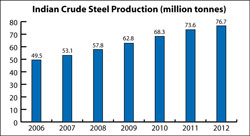

2. Steel Industry in India: During 2012, India maintained its ranking as the 4th largest steel producing country in the world behind China, Japan and the US with a crude steel production of 76.7 million tonnes representing a 4.3% growth over 2011. The Indian steel industry continued to showcase trends of higher consumption of finished steel and continued to be a net importer on account of increased demand for special grades of steel in the country. As GDP growth weakened more than expected in 2012 on account of stalled investment against the backdrop of tightening policies, widening trade and fiscal deficit, high inflation and weak FDI inflows, the Financial Year 2012-13 was a year of subdued activity for steel using sectors in particular the auto segment; it is expected that 2013 will continue to remain a challenging year for the automotive sector as high interest rates and fuel expenses will continue to act as a drag on demand. However, the construction sector remained relatively resilient in 2012 and is expected to remain stable. Steel demand has remained sluggish so far in 2013 amidst weak activity and poor sentiment; however, activity is expected to accelerate modestly in the coming months. Steel demand is expected to grow by 5.9% to 75.8 million tonnes in 2013 following 2.5% growth in 2012 as monetary easing is expected to support investment activities. Strengthening domestic consumption and improving external conditions will also help underpin the growth of steel using sectors. 3. UK and European Steel Industry: With the debt crisis having weighed heavily on economic activity, especially during the last quarter of 2012 due to continued uncertainty, apparent steel use in EU 27 during 2012 fell by 9.3% with a widening gap seen at the country level. Economic growth remained uneven among major European countries, and steel demand continued to be depressed. Most of the countries in the EU witnessed contraction in steel usage during 2012. It was not only the debt-ridden countries such as Spain and Italy that experienced a decline in apparent steel consumption, but also resilient economies such as Germany that also faced demand pressure. In particular, in Italy and Spain, the apparent steel use contracted by over 18% in 2012. Slow domestic demand in the EU was characterised by a further drop in business sentiment and intensifying financing restraints resulting in a further decline in activity in the steel using sectors with automotive and construction showing the worst trend. Export demand had also come under pressure due to the slowdown in global economic growth. The outlook for 2013 remains bleak. Steel demand in EU 27 is expected to contract further by 0.5% in 2013, but is forecasted to return to a growth of 3.3% in 2014 to reach 144.1 million tonnes. Total activity in the steel using sectors is expected to register a decline in 2013 due to the continuation of difficult operating conditions across most sectors. Domestic demand is expected to remain sluggish due to austerity, weak confidence and difficult access to finance. However, stimulus packages in major global economies, measures from the European Central Bank to contain the debt crisis and signs of stabilisation in the overall economic situation are expected to improve steel outlook by late 2013 but the sentiment of uncertainty continues to dominate the market. 4. South East Asian Steel Industry: The South East Asian region continues to show signs of economic resilience, backed by strong domestic demand. All the ASEAN member countries of SEAISI (South East Asian Iron & Steel Institute), with the exception of Singapore, registered growth rates of more than 5% in 2012. Philippines headed the pack with a strong growth rate of 6.6%, followed by Thailand (6.4%), Indonesia (6.2%), Malaysia (5.6%) and Vietnam (5.1%). Singapore, the most advanced country in the region, recorded a slow growth rate of 1.3% in 2012. Thailand's economy had rebounded strongly from 0.1% in 2011 to register a growth rate of 6.4% last year. As a result of the strong economic recovery in the country, Thailand's apparent steel consumption also surged significantly in 2012, rising by 13.9% year on year (y-o-y), the highest in the region followed by Vietnam at 9.9% and Indonesia at 8.8%. Malaysia and Philippines both registered marginal increases in steel demand of 1.7% and 2.2% respectively while steel demand in Singapore declined by 4.9% y-o-y. Thailand's total steel consumption rose from 14.5 million tonnes in 2011 to 16.6 million tonnes in 2012, driven mainly by robust demand in the construction, automotive and appliance sectors. The country continued to remain one of the top 10 steel importing countries in the world having imported a total of 15 million tonnes of steel products in 2012 while exports stagnated at 1.2 million tonnes. Import of flat products was in excess of 8.8 million tonnes. Production in the region is estimated to have declined slightly, by 2% y-o-y to 25.5 million tonnes in 2012 as a result of a decline in steel output in most of the countries in the region, except Philippines. Imports surged significantly, by 8% y-o-y to 36.9 million tonnes in 2012 while exports from the region are estimated to have declined by 22% y-o-y to 6 million tonnes in 2012. All countries in the region except Singapore registered a decline in the volume of exports. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- Management

- |

- Financial Highlights

- |

- Integrated Reporting

- |

- NVG Principles

- |

- Directors' Report

- |

- MDA

- |

- Financials

- Balance Sheet

- Profit & Loss Account

- Cash Flow Statement

- Notes

- Auditors' Report on Consolidated Financial Statements

- Consolidated Balance Sheet

- Consolidated Statement of

Profit and Loss - Consolidated Cash Flow Statement

- Notes to Consolidated Balance Sheet and Statement of Profit and Loss

- Attendance Slip and Proxy Form

- The Deming Grand Prize

- |

- Notice

- |

- Downloads

Home  Management Discussion and Analysis Management Discussion and Analysis

|

| Management Discussion and Analysis |