|

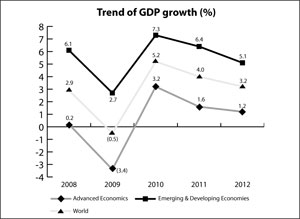

DIVIDEND: The Board recommended dividend of Rs.8 per Ordinary Share on 97,12,15,229 Ordinary Shares (Financial Year 2011-12: Rs.12 per Ordinary Share on 97,12,14,450 Ordinary Shares of Rs.10 each) for the year ended 31st March, 2013. The dividend on Ordinary Share is subject to the approval of the shareholders at the Annual General Meeting. The total dividend payout works out to 18% (Financial Year 2011-12: 20%) of the net profit for the standalone results. GLOBAL ECONOMIC CONDITIONS The world Gross Domestic Product (GDP), as reported by the International Monetary Fund, witnessed a moderate growth of 3.2% in 2012 as compared to a growth of 4.0% in 2011. While the growth in the advanced economies was 1.2% in 2012 in contrast to 1.6% in 2011, growth in the emerging and developing economies fell to 5.1% in 2012 compared to 6.4% in 2011. There was a noticeable slowdown in the emerging market and developing economies during 2012, a reflection of the sharp deceleration in demand from key advanced economies. Global prospects have improved but the road to recovery in the advanced economies is still uncertain and volatile. The US GDP increased by 2.2% in 2012 reflecting significant legacy effects from the financial crisis, continued fiscal consolidation, a weak external environment and disruptions in the northeast following Superstorm Sandy. The recovery is beginning to show some bright spots as credit growth has picked up and bank lending conditions have been easing slowly from tight levels. However, the impact of recent recovery is yet to show material impact on the economy. In comparison to the US, the euro zone economy contracted by 0.6% in 2012 over 2011. Amongst the euro zone countries, Germany posted a marginal growth of 0.9% while Italy and Spain posted a decrease of 2.4% and 1.4% respectively. Decisive policy actions at the European level–including Outright Monetary Transactions, the completion of the European Stability Mechanism, the Greek debt relief programme and the agreement on the Single Supervisory Mechanism–have increased confidence in the viability of the Economic and Monetary Union. However, lower sovereign spreads and improved bank liquidity are yet to translate into either improved private sector borrowing conditions or stronger economic activity. Emerging economies of eastern Europe experienced a sharp growth slowdown in 2012 reflecting spillover effect from the euro area crisis and domestic policy tightening in the larger economies. For 2012 as a whole, EU apparent steel consumption is estimated to have decreased by -9.7% to 140 million tonnes, with lower demand due to poor economic situation in the euro zone and reduced global trade. Output in the main EU27 steel using sectors declined in 2012 (Construction -5%, Automotive -4%, Mechanical Engineering -1%). The GDP of Association of South East Asian Nation (ASEAN) (Indonesia, Malaysia, the Philippines, Thailand and Vietnam) grew at 6.1% reflecting resilient domestic demand. Thailand economy grew at 6.4% while that of Indonesia grew by 6.2% in 2012. It is estimated that the public spending by the Government especially in infrastructure and public reconstruction will sustain the growth in Thailand in the future. It is expected that continued remittance flows and low interest rates should continue to support the private consumption and investments in the region. Steel consumption in the ASEAN region (Indonesia, Malaysia, the Philippines, Singapore, Thailand, Brunei, Burma, Cambodia, Laos and Vietnam) have surged by 7.6% year on year to 56.4 million tonnes in 2012. Thailand registered the highest growth rate of 13.9% year on year followed by Vietnam at 9.9%, and Indonesia at 8.8%. Malaysia and Philippines both registered marginal increases in steel demand of 1.7% and 2.2%, respectively, while steel demand in Singapore declined marginally during the year. The domestic economy in India witnessed a significant slowdown during the year with certain sectors like automotive, capital goods showing a marked slowdown in demand. The moderation in the industrial growth particularly in the manufacturing sector is largely attributed to sluggish growth in investments and tighter monetary policy. Growth in services was 6.6% as compared to a growth of 8.2% in 2011-12. Amongst the key macro-economic indicators, the current account deficit is currently at a very high level which would put significant pressure on the economy especially on the currency. In India the flat steel consumption grew by 4.3% in the fiscal, while long steel consumption grew by 4.7%. Amongst the main steel consuming sectors, the construction sector grew at around 5.9% and the consumer durables sector grew by 4.5% while the capital goods is expected to have declined significantly by around 10.1% and the automotive sector grew by 1.2%. TATA STEEL GROUP PERFORMANCE: In the backdrop of a weak global economy and a challenging market situation, the gross deliveries of the Tata Steel Group at 24.1 million tonnes in 2012-13 were almost at the similar levels as the previous year of 24.2 million tonnes. The turnover of the Tata Steel India operations increased by 13% primarily due to enhanced volume from the newly commissioned facilities of the 2.9 million tonnes per annum capacity expansion in Jamshedpur and enhanced product mix in the Long Products segment. However, there was a decrease in the turnover in Tata Steel Europe by 15% (in its reporting currency) primarily due to weaker market conditions and lower operating volume in Europe. The consolidated profit before finance costs, depreciation, exceptional items and taxes of the Group was Rs.12,800 crores in the Financial Year 2012-13 lower by 9% over the previous year primarily due to lower operating performance in Europe, relatively weaker steel prices across all geographies. Consequently, the consolidated Profit before exceptional items and taxes were Rs.3,257 crores in the Financial Year 2012-13 compared to Rs.5,223 crores in the previous year. Indian operations: The Financial Year 2012-13 marked a major milestone in operating history of Tata Steel as the capacity expansion at Jamshedpur was completed with most of the facilities of 2.9 mtpa brownfield expansion being commissioned for production. The expansion project includes the commissioning of the 6 mtpa Pellet Plant, a 3.05 mtpa Blast Furnace (I Furnace), a new LD Shop (LD#3) and the 2.54 mtpa Thin Slab Caster and Rolling (TSCR), and two new Lime Kilns (Nos. 8 & 9) (600 tpd each). The other capital projects commissioned during the Financial Year 2012-13 were the augmentation of Noamundi and Joda Iron Ore Mines and setting up of one 0.7 mtpa Coke Ovens Battery (No.10) along with the By-Product Plant. In order to prepare for marketing the additional volume of production from the new expansion, the Company has been working on significant initiatives on the marketing front which included (a) the launch of the Astrum brand (HR coils) to serve the large SME market, (b) acquisition and expansion of large commercial accounts in tubing, cold rolling, packaging and LPG segments, (c) developing international markets for the products and (d) initiating new product development process for securing customer approvals in the automotive segment. The Company completed the Financial Year 2012-13 with an overall increase of approximately 14% in production and sales volumes. The production of Hot Metal (8.86 million tonnes), Crude Steel (8.13 million tonnes) and Saleable Steel (7.94 million tonnes) reached their respective highest levels till date. Correspondingly, the deliveries recorded new highs at 7.48 million tonnes for the year. There were also several best performances recorded by many of the other operating units of the Company during the Financial Year 2012-13 some of which are as follows:

The Company achieved a savings of approximately Rs.1,625 crores by improving operational excellence through focused initiatives in the Financial Year 2012-13. The special improvement initiative 'KVHS' (Kar Vijay Har Shikhar – Conquer Every Peak) launched during the Financial Year 2011-12, contributed approximately Rs.1,057 crores in the Financial Year 2012-13. This initiative is focused on Tata Steel's aspiration to improve its earnings through generation of new ideas and deploying the same through a structured framework. It is a multi-unit, multi-location and a cross functional improvement programme that aims to excel across the entire value chain – from the raw materials mining to the operating units across all divisions. Inspite of very challenging market conditions and weak steel prices in India, the Company sold an additional 850,000 tonnes during the Financial Year 2012-13. During the fourth quarter of the financial year, the Company sold around 2.2 million tonnes of steel that is the highest quarterly volume in the history of the Company. This was possible due to the successful ramp up of the new facilities in Jamshedpur and the marketing initiatives taken by the Company to gear up to sell the additional volume of the expanded capacity. The profit before finance costs, depreciation, exceptional items and taxes for the stand alone Tata Steel was Rs.12,028 crores for the Financial Year 2012-13 which was marginally lower by about 3% compared to the previous financial year. |

|

|

- Management

- |

- Financial Highlights

- |

- Integrated Reporting

- |

- NVG Principles

- |

- Directors' Report

- |

- MDA

- |

- Financials

- Balance Sheet

- Profit & Loss Account

- Cash Flow Statement

- Notes

- Auditors' Report on Consolidated Financial Statements

- Consolidated Balance Sheet

- Consolidated Statement of

Profit and Loss - Consolidated Cash Flow Statement

- Notes to Consolidated Balance Sheet and Statement of Profit and Loss

- Attendance Slip and Proxy Form

- The Deming Grand Prize

- |

- Notice

- |

- Downloads

Home  Directors' Report Directors' Report

|

| Directors' Report |