| |

Continuous Improvement is an integral part of the management culture in Tata Steel, with projects that cover all areas of functionality in the Company. Here are some of the important Continuous Improvement Programmes implemented across the Tata Steel Group.

|

| Kar Vijay Har Shikhar |

The 'Kar Vijay Har Shikhar' (KVHS) initiative was launched in Marketing and Sales at the Indian operations in October 2010, to enable a proactive and differentiated approach towards market creation and thus develop a market to support Tata Steel's volume expansion in India to 16 million mt. This is to be achieved by developing a third pillar for growth, i.e. SMEs, beyond OEMs and Retail.

The initiative has been launched in all four Business Units - Flats, Longs, Tubes and Wires. A specifically designed approach - the 'ECVM Way' (Emerging Corporate Value Management) - is being implemented across verticals tailored to the specific context.

In Flat Products, the context has been to create a market for the forthcoming capacity increase from TSCR, with a premium position. The team adopted a 4-step process:

- Discovering the dominant segments in respective clusters.

- Understanding segment-wise product service needs through customer interactions.

- Mapping the demand along with segment-wise need gap analysis.

- Testing the acceptance of the Company's value proposition, thus validating customer needs through pilots.

Some of the pilots have been completed and market ramp up has started. The results have been very encouraging, and there is a clear line of sight of both market share and share of business gains with customers with a premium position.

In Long Products, in view of an unchanged volume position, the context was to drive margin enhancement. To achieve this, the team has worked on two fronts:

- Market work to implement the specifically designed 'ECVM Way' with SME customers.

- Designing and implementing a downstream business model for Long Products.

Specifically, a lean capex model of Cut and Bend has been designed, along with a value selling model for this market shaping initiative, which is now being rolled out pan-India.

In Tubes, the context has been to profitably increase market share in the Process Tubes vertical, keeping in mind the increasing competitive intensity. Pain points of customers were mapped through the entire value chain of tubes usage and ideas were generated on ways to solve these. These ideas were then moulded into segmental value propositions.

The response has been positive, and the Company should soon be able to launch sub-brands to specifically target these sub-segments in a focused way.

Steel being produced at Jamshedpur, India

In Wires, the team is working on migrating the Wires business up the maturity curve from a Wire and Wire Products manufacturer to a Solutions Provider, across several segments.

In conclusion, KVHS in Marketing and Sales is working to create a significantly differentiated position for Tata Steel's products in the marketplace. In the context of the Company's ambitions in the Indian market, this customercentric approach will provide impetus for sustainable growth in the years to come.

|

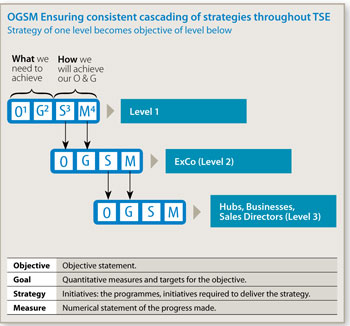

| OGSM at Tata Steel Europe |

As part of developing and deploying an integrated strategy process across the Company, Tata Steel introduced the OGSM (Objective, Goal, Strategy, Measure) process throughout its European operations to ensure that actions undertaken in the coming years meet the long-term goals of the Company.

The OGSM process drives step-change improvement in three key areas: corporate citizenship (health, safety and environment), value creation and enablers (business excellence and people engagement).

OGSM is enabling significant improvement in the competitive gap in the following areas:

- EBITDA and Cash;

- Health and Safety;

- Environmental asset compliance;

- Business Excellence;

- World-class customer service and satisfaction.

The OGSM approach is common across Europe and each area has an OGSM process owner to support development and deployment of strategies as well as enabling the necessary knowledge skills and capabilities. OGSM strategy and process owners are supported in deployment of strategies by the business excellence infrastructure across TSE. Balance Scorecards and strategies are now in place across the organisation

|

| |

| How OGSM works |

Progress of strategies is driven and progress is monitored through degree of hardness (DoH). The levels of DoH range from DoH1 - idea generation, strategy formulation, ownership and initial benefits calculation - through to DoH5, which represents implementation, when all milestones in the action plan have been reached and the benefits are delivered and sustainable.

The process is structured and delivered through strong project management such as A3 thinking and discipline. Key steps moving from DoH2 to DoH5 require financial validation, which requires strategy owners to work in collaboration with finance to prepare the necessary supporting financial case. The maturity of the OGSM process, through engagement, empowerment and ownership of action across the TSE, is enabled by having a 'local' OGSM 'Plan-Do-Check-Act' (PDCA) in place across TSE. This is fostering a 'can do' attitude where employees are now able to demonstrate and see how their actions contribute to the company objectives and ambitions.

TSE-wide OGSM Reviews are held every month in three major centres (two in the UK and one in the Netherlands). The OGSM programme office identifies strategies and ideas that can be explored in detail

through 'deep dives' working in close collaboration with senior leadership and the 'shop floor'. Web

conferencing is used to increase participation at reviews and recorded web casts are also available to drive sharing and learning across TSE.

|

| Improvement initiatives at NatSteel |

The implementation of the Total Operational Performance (TOP) initiatives helped NatSteel's upstream operations in Singapore achieve savings of S$7 million in the Financial Year 2011-12. Investments in technology and efforts to reduce electricity consumption were successful, with the billet centre reaching a world-benchmark in energy efficiency at 365 kWh/MT.

NatSteel also undertook a productivity enhancement drive, Project Phoenix, in its downstream operations, which helped the Company achieve a high of close to 42k tonnes in March 2012.

Similar initiatives in NatSteel's Australian operations also yielded significant results. A potential $4.5 million in savings/revenue gains was achieved through a programme called PUSH. The Australian operations also reduced its overheads by A$1.1 million.

Caging centre NatSteel, Singapore.

In Financial Year 2011-12, NatSteel's operations in Vietnam underwent a complete modernisation, doubling its rated capacity to over 200k tonnes per annum. Subsequently, a Retail Value Management (RVM) initiative has been undertaken to enhance retail presence in the individual home builder segment in North Vietnam.

|

| The Turnaround Plan at Tata Steel Thailand |

During the Financial Year 2011-12, Tata Steel Thailand (TSTH) launched the 'Turnaround plan' in Thailand, which included most of the Company's improvement projects. These improvement projects covered the areas of product portfolio optimisation, new product development, operations cost reduction and procurement cost savings. Here are some of the projects in detail:

- Product portfolio optimisation: A production planning model was implemented to improve the total contribution by adjusting the product mix to suit the productivity and contribution per tonne across the three plant sites.

- New product development: This specifically focused on introducing special bar quality products in the Thailand market and attained consistent sales of 2500 tpm in the very first year. It also covered the development of high-end wire rods hitherto not made at TSTH and imported in Thailand.

- Operations cost: This covered the conversion cost elements directed at addressing the overall KPI of lowest billet cost.

- Procurement area: A project was launched to improve the reliability in domestic scrap collection and optimisation of blending in various grades to help in reducing the total billet cost. In addition, the 'Group buy' concept in high spend product categories like bearings, electrodes has been initiated.

|

|

|