Report Menu

Report Menu

Management Discussion and Analysis

A. Overview

The following operating and financial review is intended to convey the Management’s perspective on the financial and operating performance of the Company at the end of Financial Year 2017-18. This Report should be read in conjunction with the Company’s financial statements, the schedules and notes thereto and other information included elsewhere in the Integrated Report. The Company’s financial statements have been prepared in accordance with Indian Accounting Standards (‘Ind AS’) complying with the requirements of the Companies Act, 2013 and guidelines issued by the Securities and Exchange Board of India (‘SEBI’).

This report is an integral part of the Directors’ Report. Aspects on industry structure and developments, outlook, risks, internal control systems and their adequacy, material developments in human resources and industrial relations have been covered in the Directors’ Report. Your attention is also drawn to sections on Strategy forming part of the Integrated Report. This section gives significant details on the performance and the risks faced by the Company.

B. Tata Steel Group Operations

1. Tata Steel India

a) Operations

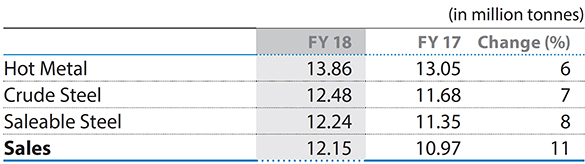

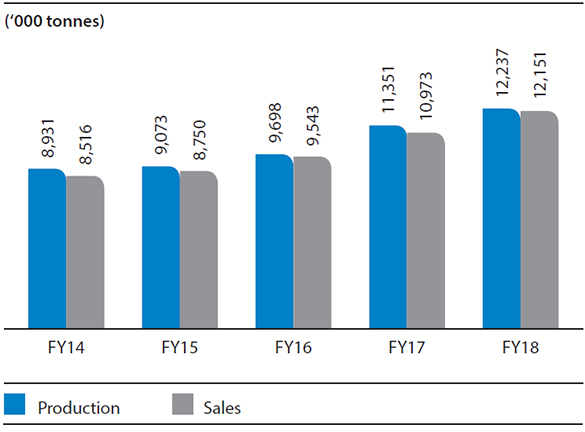

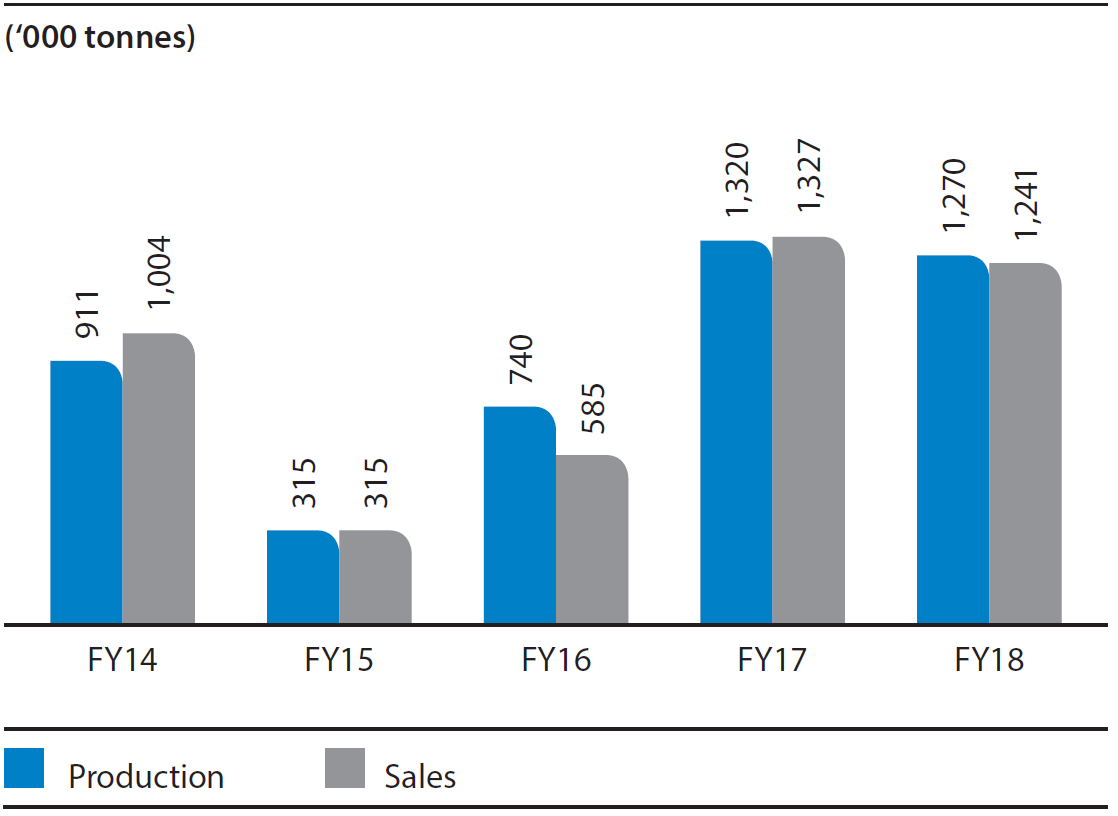

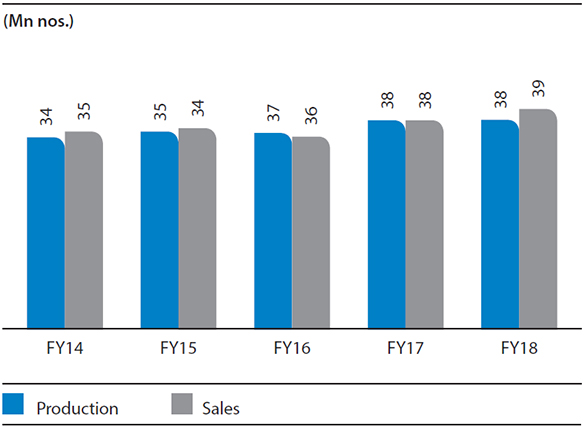

The saleable steel production and sales trend over the years is as follows:

Production and sales of Steel Division

During Financial Year 2017-18, the saleable steel production stood at 12.24 MnT which is ~8% increase over previous year. The hot metal production for the Financial Year was at 13.86 MnT which is 6% higher over previous year. The improvement in performance is due to stabilisation of operations at Kalinganagar which commissioned in June 2016 and various on-going initiatives undertaken for stable performance. Accordingly, Tata Steel Jamshedpur (‘TSJ’) has achieved the Indian bench mark in specific consumption of energy, refractory, pulverised coal injection and coke rate.

Tata Steel Kalinganagar (‘TSK’) strives to maintain a world-class environment in the premises by following environmental management systems in accordance with rules and regulations framed by the government and have comprehensive processes in place for ensuring health and safety of people, plant and equipment. The plant is designed to have minimal water footprint, by-product gas based power generation leading to reduction in carbon footprints, Coke Dry Quenching technology, zero-effluent discharge and significant reduction of noise and dust pollution.

During Financial Year 2017-18, capacity utilisation at TSK reached higher levels over the previous year in all the major facilities marking extremely improved performance. There was a significant quality ramp-up in steel making and successful development of 108 new products as against the plan of 101 new products. The acceptance of the products was good by customers. The product mix comprised of low carbon, medium & high carbon and peritectic grades, which served different market segments such as LPG, tube making, tin plating, construction & projects, lifting & excavation, automotive, heavy engineering, amongst others. The plant has also produced higher automotive grades and is poised to produce Advanced High Strength Steel grades.

After successful ramp-up, TSK has embarked upon second phase of expansion which will take its production capacity to 8 MnTPA.

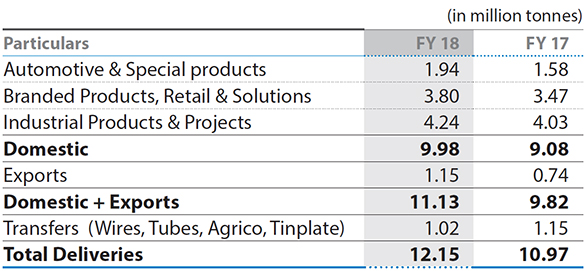

b) Marketing and Sales Initiatives

During Financial Year 2017-18, our Steel Business Unit (‘SBU’) has achieved a growth in sales of ~11% over previous year, outperforming the market growth.

The break-up of sales in our various segments and the break-up of domestic sales to exports are as follows:

Following are the Key Business Initiatives and achievements of Financial Year 2017-18:

Automotive and Special Products: Achieved best ever annual sales in Automotive sector thereby registering a growth of 23% year-on-year as against industry growth of 14% (mainly driven by 2 & 3 wheelers) leading to an increase in market share to 45%. This was achieved due to initiation of commercial supplies of hot rolled products from TSK, ramp-up of cold rolled volumes from Jamshedpur Continuous Annealing & Processing Company Private Limited. (‘JCAPCPL’), high share received in new models through development of advanced hi-end products and various non-product services such as Value Analysis & Value Engineering (‘VAVE’) work shops, collaborative improvement as part of Customer Service Team’s initiatives. As a recognition of the various initiatives, the Company received accolades from its key customers and automotive leaders, the ‘Best Supplier Award’, ‘Business Alignment Gold’ award and ‘Technology/ Innovation’ award.

Branded Products, Retail and Solutions: Sales of branded products grew by ~10% in Financial Year 2017-18 over the previous year. The Company maintained market leadership in B2C sales of Tata Tiscon and Tata Shaktee. Further, there was an increase in B2C sales of new products and brands like Tata Kosh, Tata Shaktee Long Lengths. In Financial Year 2017-18, the Company achieved best ever Emerging Corporate Account (‘ECA’) sales of 2,145 kilo tonnes. Channel capability enhancement and Augmentation of service centres resulted in enhancing our presence in key micro segments (e.g. Solar, Transmission & Distribution, etc) of ECA business. The Company also augmented digital tools for covering entire Tata Tiscon eco-system in order to enhance consumer engagement. Tata Tiscon won ‘Asia’s most admired Brand’ award in construction category, Tata Shaktee received the ‘Flame leadership award’ from the Rural Marketing Association of India (‘RMAI’) for innovative marketing campaign and recognition from one of its Key customers as part of customer centricity for localisation & stabilisation of Enameling process.

Industrial Products, Projects and Exports: The Company continued its focus towards value added products and achieved highest ever annual sales in value added segments of hot rolled coupled with two times growth in Engineering Segment Sales (Pre-Engineered Building, Lifting & Excavation, Construction & Projects and Oil & Gas) over last year through the various product development initiatives. Industrial Products business enhanced its presence in international geographies and crossed the landmark of 1 MnT of exports for the first time in Financial Year 2017-18. The Company has increased its downstream businesses like Cut & Bend (Readybuild) & Couplers and also launched India’s first Branded Welded Wire Fabric ‘Smart Fab’ to capture its market.

Services & Solutions: The Company is increasing its presence in Services & Solutions space for better consumer connect and experience. ‘Pravesh’ (steel doors & windows) has won ‘Best Online Marketing Campaign of the year’ award by ET Now and crossed bookings of 1.2 lakh for the year. The Company enhanced its product portfolio in services & solution through the launch of ‘Nestudio’ under ‘Nest-in’ family of products (a construction solution) for premium housing category for both B2B and B2C consumers and ‘Tata Tiscon Ultima’ coated products of Tata Tiscon such as Plasma coated Rebars and GFX coated Superlinks (Stirrups).

c) Ferro Alloys and Minerals Division

Our Ferro Alloy and Minerals Division (‘FAMD’) is amongst the top six chrome alloy producers in the world with operations spanning across two continents. In India, it is the largest producer of ferro chrome and one of the leading manganese alloy producer.

During the year, there was softening of Ferro Chrome prices in the international market. As market inclination is towards alloys business, the Company has shifted its business model from sale of minerals to Value Addition (to alloys) through Ferro Processing Centres.

FAMD achieved a production of 1,270 kilo tonnes as against 1,320 kilo tonnes in the previous year.

The Company started the first ever Gas Cleaning Plant (Slurry Processing) in the industry to recover Manganese rich sludge and water re-circulation at Ferro Alloys Plant, Joda. Further, the Company launched first of its kind Global Positioning System (‘GPS’) based Ferro Alloy consignment tracking along with mobile app: FASTRACK.

d) Tubes Division:

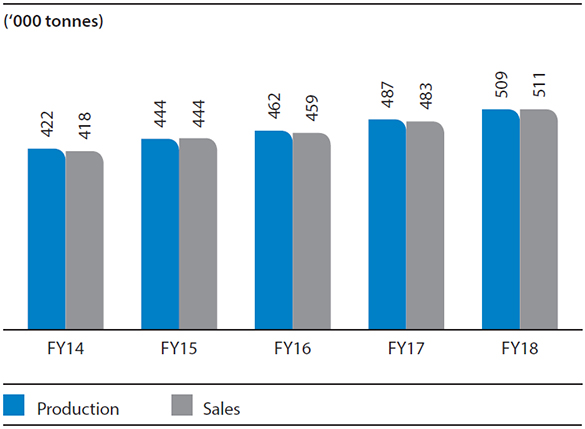

Our Tubes Strategic Business Unit is a leading manufacturer of pipes and tubes in India having its manufacturing facility situated at Jamshedpur with an annual production capacity of ~500 kilo tonnes. The three main lines of businesses are conveyance tubes (Tata Pipes), structural tubes (Tata Structura), precision tubes for auto and boiler segments.

During Financial Year 2017-18, the Tubes Strategic Business Unit achieved 6% growth in sales over previous year mainly contributed by 17% growth in precision tubes in line with the growth of automotive industry and 9% growth in Tata Structura due to improved demand in the construction segment (Telecom, Metro railway projects). The division has developed new products like Colour coated tubes - Primer, Graphene, multilayer coated & Thin Organic Coating (‘TOC’). The division has also started new facilities of Hollow section Universal Mill and Precision Tube Mill at Jamshedpur along with large diameter Tube Mill at TSK.

The division won ‘The Best Company of the Year’ for its contribution to the Construction Industry at the Construction Times Awards 2017.

Production and Sales of (FAMD)

Production and Sales of Tubes Division

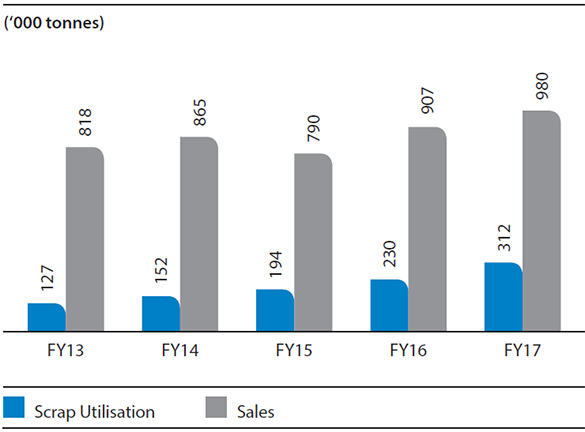

e) Industrial By-products and Management Division

Our Industrial By-products and Management Division (‘IBMD’) handles variety of by-products in the entire value chain. The business operates on the principle of 3Rs (Reduce, Reuse, Recycle), thereby ensuring contribution towards the green journey of the Company. The product portfolio comprises of steel by-products such as metallic scrap, slag, coal tar, flat product scrap and coal by-products like middlings tailings and rejects. Product branding has been done to create recognition among peers and customers’ brands.

During year, the division launched India’s first ever branded LD Slag products Tata Aggreto and Tata Nirman. Further, first ever Blast Furnace Slag was exported to Bangladesh and Tata Ferroshots to Indonesia.

During the Financial Year 2017-18, by-product utilisation at the Plant increased substantially and sales increased by 8% over the previous year.

Harnessing ‘Value from waste and by-products’ has been the objective of the division. It is committed to becoming a knowledge driven business unit leveraging digital and innovation days as key pillars. The division has also delved into downstream value enhancement of by-products which serve as quality benchmarks in the industry. The division is in the process of developing steel recycling business comprising pan-India steel collection and processing centres. These centres would feed the processed scrap to captive electric arc furnace for steel making and downstream rolling which would further contribute towards developing a sustainable ecosystem in the long run.

The division has been awarded with Green-Pro Certification for Ground Granulated Blast Furnace Slag (‘GGBS’) by CII-GBC council. Tata Steel is one of the first companies, in India, to get the green product certification for GGBS.

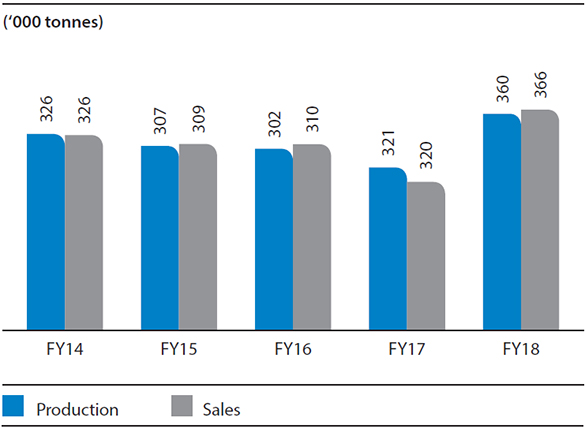

f) Wires Division

Our Global Wires India Business Unit is the largest manufacturer of steel wires in India. The plants are located at Tarapur, Mumbai, Pithampur, Indore and at Jamshedpur, having an annual capacity of 375 kilo tonnes. The products offered are Tyre Bead wire for the tyre industry, spring and spoke wires for the auto industry, Prestressed Concrete (‘PC’) Strands and PC wires for the construction industry, Galvanised wires for fencing and Binding wires for the rural markets.

During Financial Year 2017-18, the division achieved 14% growth in sales over previous year mainly contributed by 20% growth in infrastructure segment, 13% growth in automotive segment (in line with the growth of automotive industry) and 11% growth in the retail segment. The Pithampur plant has undertaken major expansion. The annual capacity increased to ~88 kilo tonnes from ~53 kilo tonnes.

The division has won the following accolades:

- The Brand Excellence Award in Iron & Steel Industry’ and Tata Wiron was awarded ‘Emerging Brand Award’ at the brand excellence award hosted by the World Marketing Congress.

- SPANDAN – a farmer connect initiative has been awarded ‘Best Integrated Rural Marketing Campaign’ by National awards for Excellence in Rural Marketing.

Scrap Utilisation at Plant and Sales of IBM Division

Production and Sales of Wires Division

g) Bearings Division

Our Bearings Division is one of the India’s largest quality bearing manufacturers, having its manufacturing facility situated at Kharagpur, West Bengal with an annual production capacity of 40 million bearing numbers. The Company is foremost in the manufacturing of a wide variety of bearings and auto assemblies and product range includes Ball Bearings, Taper Roller Bearings, Hub Unit Bearings, Clutch Release Bearings, Double Row Angular Contact Bearings, Centre Bearings and Magneto Bearings. It is the only bearings manufacturer in India to win the TPM Award (2004) from Japan Institute of Plant Maintenance, Tokyo.

Production and Sales of Bearings Division

The division achieved 3% growth in sales over previous year mainly due to increased off-take by auto two-wheeler and engineering segments. The division has also improved plant availability by de-bottlenecking and leveraging its existing resources for sustainable operations.

The division has been conferred with DOL (Direct on Line) certification from Rockman Industries (Auto components Manufacturer in India).

h) Shikhar 25 (Operational Improvement programmes)

Shikhar 25 programme is a multi-divisional, multi-location, cross functional programme that intends to drive breakthrough improvement projects with best of rigor and simplified governance, without compromising on safety, environment and people standards and works in collaboration with internal/external stakeholders to achieve best in class in operational performance.

The continuous learning and improvement journey has been one of the foundation pillars for driving a benchmark performance across the value chain. The programme was rolled out in steel value chain with structured collaboration from Raw Material division to Marketing & Sales division as an umbrella initiative.

During the year, the Shikhar 25 programme was extended to tap potentials for Cross cutting themes across divisions and the new facility at TSK. Further, 5 new Impact Centres were established namely Value in Use, Jharia, Shared Services, GST and export logistics and TSK. All the Impact Centres focused on new technology adaptation in collaboration with suppliers and integrating digital initiatives to explore new horizons of improvements. Key levers for improvement were improvement in fuel rate in Blast Furnaces and throughput, sale of enriched products, increase in throughput at West Bokaro collieries, cost reduction at Mines and Collieries, solid waste utilisation at Sinter Plants, Hot Metal and Scrap yield, Lime consumption, Ferro Alloys cost reduction at LDs, reduction in the spend base of Inbound/Outbound Logistics, packaging cost, energy efficiency, cost optimisation for other procured goods and services amongst others.

Total improvement savings achieved in Financial Year 2017-18 is ₹2,594 crore.

2. Tata Steel Europe

Global GDP growth in 2017 was 3.8%. The eurozone economy grew by 2.3% in 2017 which was higher than 1.8% in 2016. In order to avoid a deflationary environment, the European Central Bank extended the quantitative easing programme. The UK economy grew by 1.8% in 2017 (1.9% in 2016). The immediate impact of the referendum to leave the EU has been modest. In 2017 the pound depreciated slightly against the euro from 1.16 in January 2017 to 1.13 in December 2017.

Even though steel margins have improved in Europe, there are ongoing challenges due to the overcapacity in Europe and the slowdown in China. The persistent overcapacity in Europe is expected to continue with demand forecast to increase by around 1% per annum over the next 10 years. Current industry forecasts predict EU steel spreads in Financial Year 2018-19 to reduce from current levels by >€20/tonne.

Whilst the Company seeks to increase differentiated/premium business that is less dependent on market price movements, it still retains focus in both the UK and IJmuiden on improving its operations, consistency and taking measures to protect against unplanned interruptions and property damage. Best practices are in asset management, enhancing technical knowledge and skills, improving process safety, targeted capital expenditure and focused risk management.

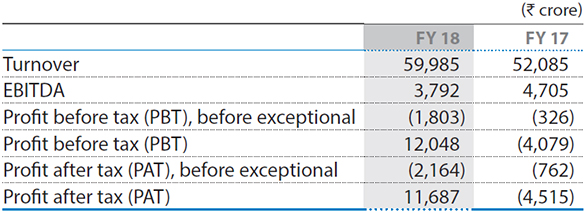

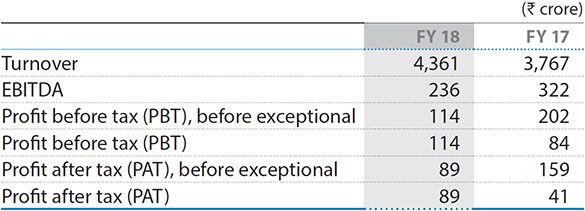

The turnover and profit/loss figures of TSE (continuing operations) are given below:

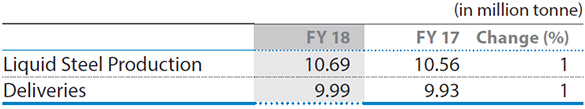

The production and sales performance of TSE (continuing operations) is given below:

TSE’s revenue of ₹59,985 crore for Financial Year 2017-18 increased by ₹7,900 crore (15%) owing to increase in average revenue per tonne due to improved market conditions and marginal increase in deliveries.

The principal activities in Financial Year 2017-18 comprised manufacture and sale of steel products throughout the world. TSE’s continuing operations produced carbon steel by the basic oxygen steelmaking method at its integrated steelworks in the Netherlands at IJmuiden and in the UK at Port Talbot. During Financial Year 2017-18 these plants produced 10.7 MnT of liquid steel.

Strip Products Mainland Europe – During Financial Year 2017-18, the liquid steel production at IJmuiden Steel Works, Netherlands was at 7.1 MnT which was 0.1 MnT higher than the previous year. Record annual outputs of 1.4 MnT were achieved at the Direct Sheet Plant and 0.6 MnT at third galvanising line. The plant has undertaken improvement initiatives on cost reduction, business specific improvement plans and securing access to cost effective raw materials. It is undergoing a ‘Sustainable Profit’ programme which is targeting improvements to delivery and yield performance and reduce operating costs and unplanned downtime and a ‘Strategic Asset Roadmap’ (‘STAR’) capital investment programme to support the strategic growth of differentiated, high value products in the automotive, lifting & excavating, energy and power market sectors. During Financial Year 2017-18, further progress was achieved towards the installation of a new caster to allow enhanced casting capabilities for advanced products and the commissioning of a heavy-duty coiler at the hot strip mill.

Strip Products UK – During the year, the liquid steel production at Port Talbot Steel Works, Wales was at 3.6 MnT which is same as the previous year. Strip Products UK increased the capacity of the ZODIAC automotive hot dipped galvanising line by 100 kilo tonnes to 600 kilo tonnes/annum through enhancements to the furnace and pre and post pot cooling sections, and commissioned a new Automotive Finishing Line (‘AFL’) to provide all material processing requirements for the Strip Automotive market. The hub is pursuing with its ‘Delivering Our Future’ improvement initiative programme. TSE had supplied steel structure to create steel and concrete composite flooring at overseas infrastructure projects, light weight composite steel to automotive makers and transport sectors.

Awards and Accolades:

- TSE won a ‘Steelie’, steel industry’s highest awards, presented by the World Steel Association for taking a new approach to demonstrating that steel is a highly sustainable construction product.

- BMW announced that TSE had been awarded the best performing supplier with a maximum rating of 100 for quality in their scoring system.

3. NatSteel Holdings

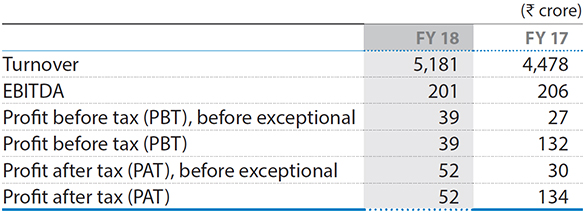

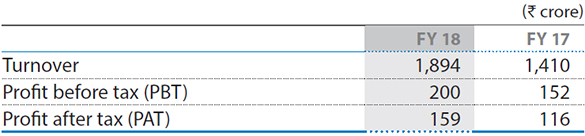

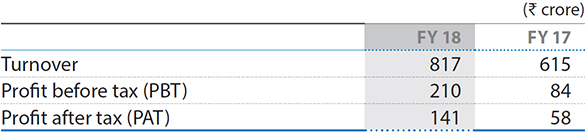

The turnover and profit/loss figures of NatSteel Holdings (‘NSH’) for Financial Year 2017-18 are as follows:

During the year, the Singapore economy grew by 3.5%, highest in 3 years, supported by strong manufacturing and service sectors. Construction continues to be lagging behind. The demand for steel to remain stagnated due to contraction in construction spend. Steel demand in Malaysia grew by 5%, driven by infrastructure and construction demand and the steel demand in Vietnam is expected to grow at a slower rate than previous years.

During Financial Year 2017-18, the deliveries were 1,293 kilo tonnes as against 1,349 kilo tonnes of previous year. The decline in volumes were due to lower demand because of slowdown of the construction activities and lower exports. An increase in turnover was reported due to increased realisation offset by lower volumes.

During the year, NSH received the national bizSAFE partner award and Singapore Health Award.

4. Tata Steel Thailand

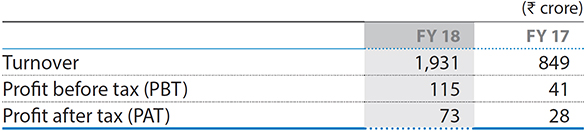

The turnover and profit/loss figures of Tata Steel Thailand (‘TSTH’) for Financial Year 2017-18 are as follows:

During 2017, the Thailand economy grew by 3.9%, above its 10-year average, improving from 3.2% in 2016. Private consumption continually expanded by 3.2%, which was supported by government stimulus measures. Private consumption growth was encouraged by an increase in minimum wage and more deductions for personal income tax. Public spending growth slowed down due to delay in investments in mega projects and disbursement of the government’s annual budget.

The steel consumption declined by 14% Y-o-Y, the worse impact being on long products which declined 26% Y-o-Y. Construction sector declined by 5.5% Y-o-Y mainly due to slowdown in public investments because of slow budget disbursements. The price of finished products increased in line with strong global metallic price trend, high prices of ferro alloys and electrodes.

During Financial Year 2017-18, the deliveries were at 1,217 kilo tonnes as against 1,262 kilo tonnes of previous year primarily due to slowdown in the construction sector. The turnover increased over previous year, due to increased realisation partly offset by lower sales volumes. The increase in profits is attributable to one-off item in Financial Year 2016-17 relating to provision of impairment loss of Mini Blast Furnace which is not present in the current year.

During the year, TSTH received the following awards:

- N.T.S. Steel Group Public Company Ltd. won the prestigious Prime Minister’s Awards 2017 on Safety Management.

- The Siam Construction Steel Company Ltd. (‘SCSC’) and The Siam Iron and Steel Company Ltd. (‘SISCO’) plants received ‘CSR – DIW Awards’ from the Department of Industrial Works.

- TSTH won the Kaizen Gold award in the category of Innovation during Thailand Kaizen Award 2017.

5. Tata Metaliks Limited

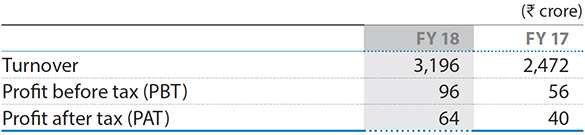

The turnover and profit/loss figures of Tata Metaliks Limited (‘TML’) for Financial Year 2017-18 are as follows:

TML has its manufacturing plant at Kharagpur, West Bengal, India which produces annually 300 kilo tonnes of pig iron and 200 kilo tonnes of ductile iron pipes. Pig iron is marketed under the brand name ‘Tata eFee’ (world’s first brand) and ductile iron pipe is marketed in the brand name ‘Tata Ductura’.

During Financial Year 2017-18, the sale of pig iron was at 291 kilo tonnes as against 195 kilo tonnes of previous year and sale of Ductile Iron pipes was at 209 kilo tonnes as against 182 kilo tonnes of previous year due to increased demands. The annual profits of current year are higher as compared to previous year primarily due to higher volumes of pig iron and ductile iron pipes.

TML took following strategic measures during the year:

- Air pre-heater in Mini Blast Furnace (‘MBF’) - 1 higher hot blast temperature leading to lower coke rate.

- 40 tonnes Hot Metal carrier for transfer of hot metal from MBF to Ductile Iron for lower temperature loss and higher yield.

ICRA increased the credit rating of TML from A+ to AA group due to better performance.

6. The Tinplate Company of India Limited

The turnover and profit/loss figures of The Tinplate Company of India Limited (‘TCIL’) for Financial Year 2017-18 are as follows:

TCIL is the largest indigenous producer of tin coated and tin free steel used for metal packaging. It has also been ‘value-adding’ its products by way of providing printing and lacquering facility to reach closer to food processors/fillers. TCIL has two Cold Rolling Mills and two electrolytic tinning lines with an installed annual production capacity of around 379 kilo tonnes of tinplate and tin-free steel.

During the year, TCIL achieved sales of 361 kilo tonnes as against 317 kilo tonnes of previous year. The annual production of tinning is at 356 kilo tonnes which is 11% higher than previous year at 321 kilo tonnes. Turnover is higher over the previous year due to shift in business model from conversion to buy and sale model along with higher deliveries and improvement in realisations. The annual profits improved over previous year in line with higher turnover, partly offset by increase in input steel cost.

7. Tata Steel Processing and Distribution Limited

The turnover and profit/loss figures of Tata Steel Processing and Distribution Limited (‘TSPDL’) for Financial Year 2017-18 are as follows:

TSPDL has extended its footprint with a new distribution centre at Sanand, Gujarat in the year 2017. It has commissioned a Wide Cut To Length (‘WCTL’) line having an annual capacity of 410 kilo tonnes to process thick Hot Rolled materials (8-25mm) at the Company’s Kalinganagar facility in June 2017. An inspection and parting line with annual capacity of 120 kilo tonnes was commissioned at CRM Bara Complex of the Company in August 2017. These have enabled to increase the total capacity to 3.3 MnT as compared to the installed capacity of 2.8 MnT in the previous year. However, during the year, the capacity utilisation has been 2.13 MnT compared to 1.9 MnT achieved in the previous year. As a constant endeavour to improve the quality of products to customers, TSPDL developed a scale brushing system which has been commissioned at Narrow Cut To Length (‘NCTL’) in Chennai and WCTL line at Kalinganagar. TSPDL undertook an EBITDA improvement initiative ‘Lakshya 25’.

During the year, the profits increased due to higher contribution from tolling business along with increase in tolling compensation received from the Company and others. Distribution volumes increased by 32% due to increase in production.

During the year TSPDL received the following accolades:

- Pune unit was awarded the ‘Energy Efficient Unit’ at CII National Energy Management Award 2017,

- NSCI safety award - 2017 Prashansa Patra (certificate) in Group D under the manufacturing sector category.

8. Tata Sponge Iron Limited

The turnover and profit/loss figures of Tata Sponge Iron Limited (‘TSIL’) for Financial Year 2017-18 are as follows:

TSIL is a manufacturer of sponge iron with an annual production capacity of 390 kilo tonnes and generates 26 MW of power through the waste heat recovery route.

During the year, sale of sponge iron was 414 kilo tonnes as against 393 kilo tonnes of previous year. Further, the sale of power during the Financial Year 2017-18 was at 143 MKWH as against 132 MKWH of previous year. These increases are primarily due to increased realisation from sponge iron.

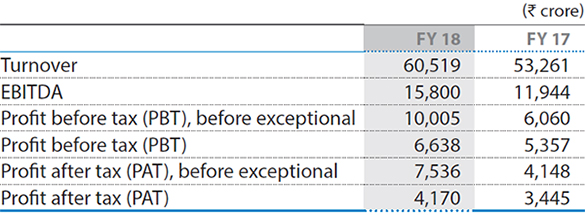

C. Financial Performance

1. TATA STEEL INDIA

During the year, the Company recorded a profit after tax of ₹4,170 crore (previous year: ₹3,445 crore). The increase is primarily on account of improved realisations and higher deliveries, partly offset by higher exceptional charges over previous year. The basic and diluted earnings per share for Financial Year 2017-18 were at ₹38.57 and ₹38.56 respectively (previous year: ₹31.74).

The analysis of major items of the financial statements is given below:

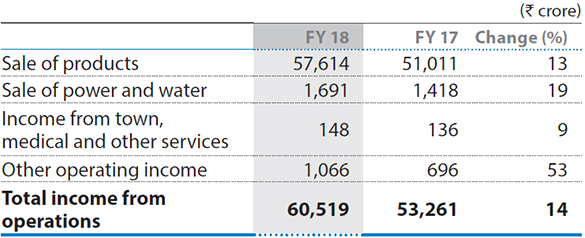

a) Net sales and other operating income

During the year, overall turnover was higher as compared to the previous year, primarily due to increased operations at Tata Steel Kalinganagar (‘TSK’) along with increase in realisations. Ferro Alloys and Mineral Division (‘FAMD’) registered higher revenue owing to higher production of Ferro Chrome along with improved demand in the international market.

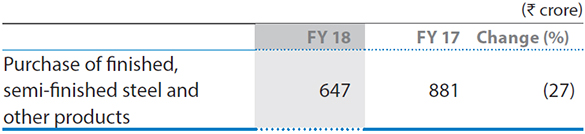

b) Purchase of finished, semi-finished steel and other products

During the year, purchase of finished and semi-finished materials decreased as compared to the previous year due to lower purchases of steel wire rods and imported rebars for resale.

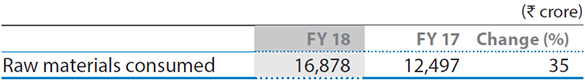

c) Raw materials consumed

During the year, the consumption of Raw Material increased primarily due to increased operations at TSK as well as higher cost of imported coal.

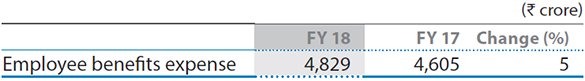

d) Employee benefits expense

During the year, the expense increased, primarily on account of salary revisions and its consequential impact on the retirement provisions.

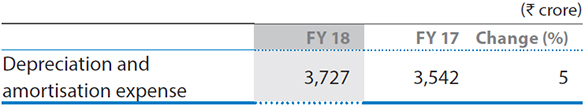

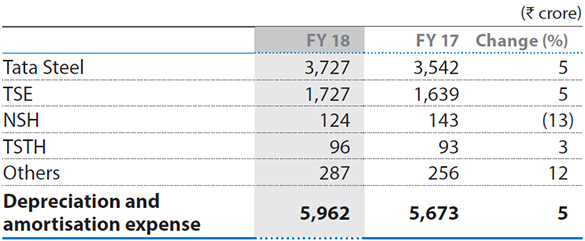

e) Depreciation and amortisation expense

The increase in depreciation is primarily due to full year charge (TSK commenced operations with effect from June 1, 2016), partly offset by lower amortisation charges.

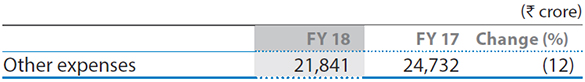

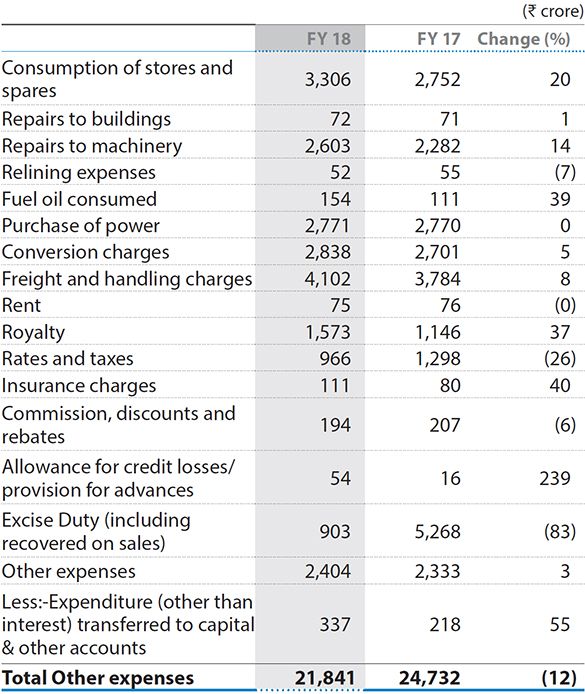

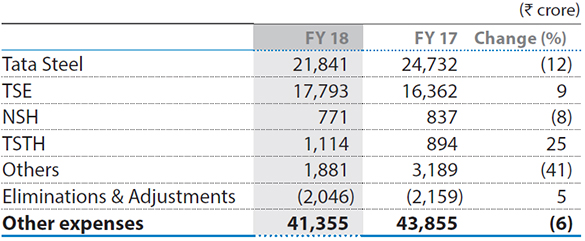

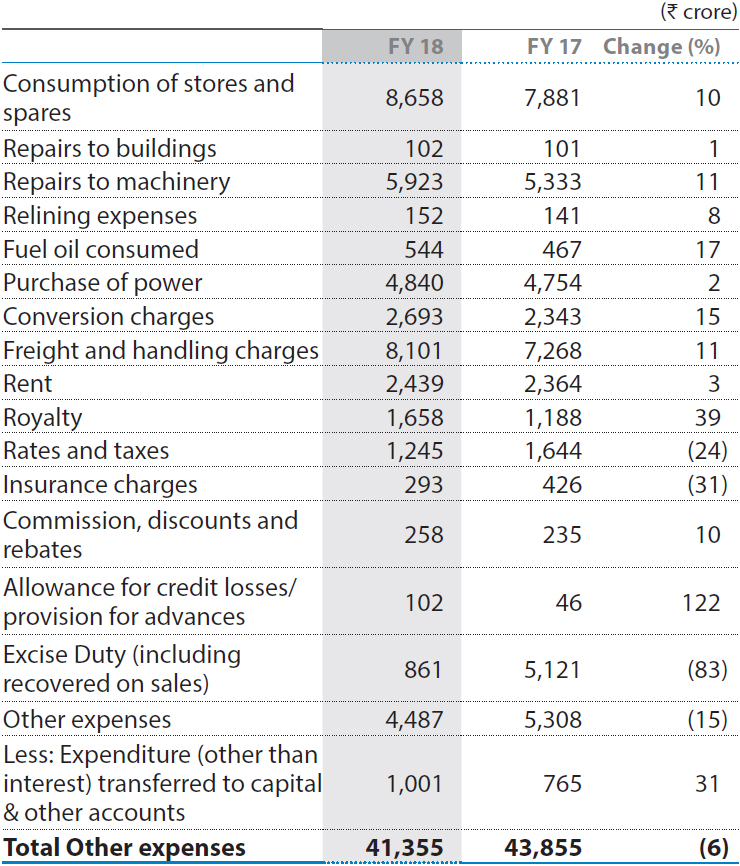

f) Other expenses

Other expenditure represents the following expenditure:

Other expenses were higher as compared to the previous year, primarily on account of higher consumption of stores and spares on account of increased operations at TSK. Further, increase in repairs and maintenance expenses was due to higher contract jobs at mines and collieries and at TSK. There was increase in royalty charges, freight and handling, fuel oil consumed and insurance charges at TSK due to full scale operations of the facilities. This was partly offset by lower expenses under rates and taxes due to implementation of GST.

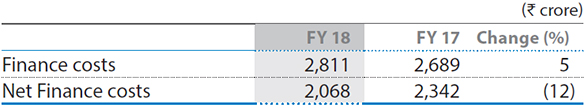

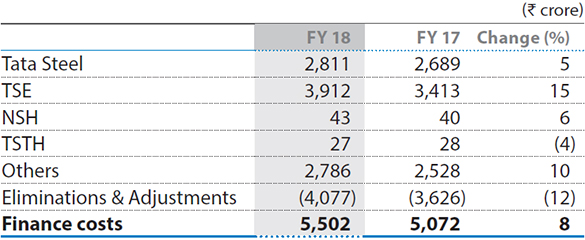

g) Finance costs and Net Finance costs

During the year, finance costs were higher as previous year included higher interest capitalised in relation to TSK. Net finance charges were lower on account of higher income from mutual funds, partly offset by increase in finance costs.

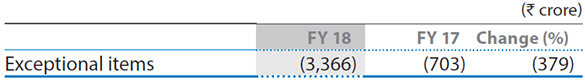

h) Exceptional items

The exceptional items during the year primarily represents statutory demands and claims, net of liability towards district mineral foundation no longer required, written back, charge on account of Employee Separation Scheme (‘ESS’) under ‘Sunhere Bhavishya ki Yojana’ (‘SBKY’) scheme, provision for advances given for repurchase of equity shares in Tata Teleservices Limited from NTT DoCoMo Inc. and provision for diminution in value of investment held in subsidiaries and joint ventures.

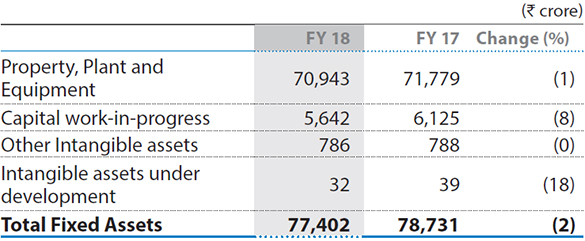

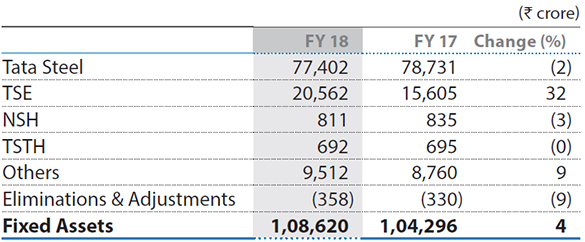

i) Fixed Assets

Capitalisation of Kalinganagar facilities from June 1, 2016.

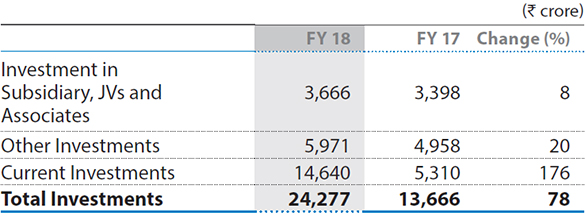

j) Investments

During the year, the increase in total investments was predominantly on account of higher investments in Mutual Funds as compared to the previous year and fair value adjustments of non-current investments.

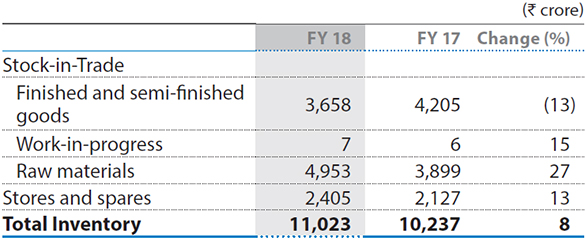

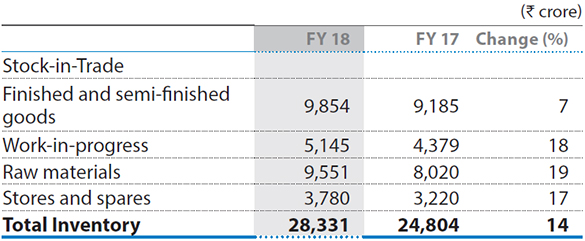

k) Inventories

Finished and semi-finished inventory decreased as compared to the previous year mainly due to decrease in flat products inventory at Jamshedpur. The increase in raw material inventories as compared to the previous year is mainly due to increase in inventory of coal at Jamshedpur and Kalinganagar. The increase in stores and spares inventory is due to increase in prices.

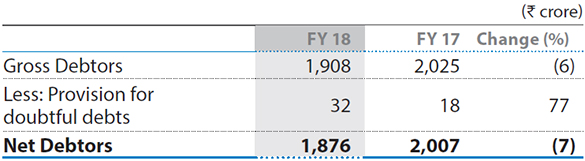

l) Sundry Debtors

The decrease in sundry debtors as compared to the previous year is primarily due to better realisation.

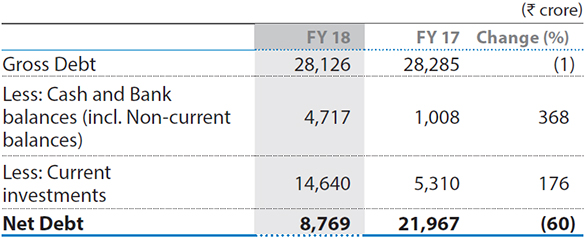

m) Gross Debt and Net Debt

The Net debt was lower as compared to the previous year. This is attributable to increase in current investments along with cash and bank balances.

Gross debt was almost at par as there was less drawal of commercial paper (net of payment) which was offset by increase in term loans (net of repayment).

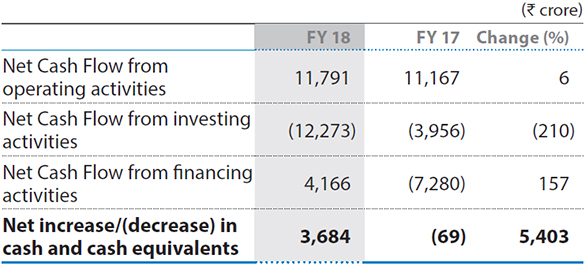

n) Cash Flow

Net cash flow from operating activities

During the year, the net cash flow from operating activities was ₹11,791 crore as compared to ₹11,167 crore during the previous year. The cash operating profit before working capital changes and direct taxes was ₹15,109 crore as compared to ₹11,561 crore during the previous year due to higher operational profit. Working Capital increased during the year by ₹815 crore mainly due to increase in inventories by ₹785 crore and decrease in trade payables and other liabilities by ₹487 crore, which is partly offset by decrease in Non-current/Current financial and other assets by ₹457 crore. The income taxes paid during the year was ₹2,503 crore as compared to ₹1,541 crore during the previous year.

Net cash flow from investing activities

During the year, the net cash outflow from investing activities amounted to ₹12,273 crore as compared to ₹3,956 crore during the previous year. The outflow during the year broadly represents purchase (net of sale) of current investments of ₹8,651 crore, purchase of investments in subsidiaries of ₹5,019 crore, capex of ₹2,527 crore, partly offset by sale of investments in Tata Motors Limited of ₹3,778 crore.

Net cash flow from financing activities

During the year, the net cash inflow from financing activities was ₹4,166 crore as compared to an outflow of ₹7,280 crore as compared to previous year. The inflow during the year represents proceeds from rights issue of equity capital ₹9,087 crore partly offset by payment of interest of ₹2,770 crore, payment of dividend including taxes of ₹1,160 crore and repayment of borrowings (net of proceeds) of term loans of ₹506 crore.

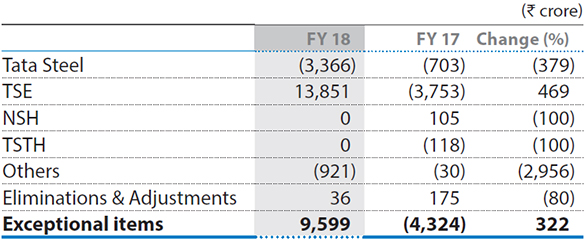

2. TATA STEEL GROUP

Tata Steel Group profit after tax from continuing operations before exceptional items for the current year was ₹8,105 crore as against ₹4,020 crore during previous year. Exceptional items, including non-cash gains arising out of modification in benefit structure of Pension Scheme, aggregating to ₹9,599 crore resulted in a profit of ₹17,704 crore from continuing operations during the current year.

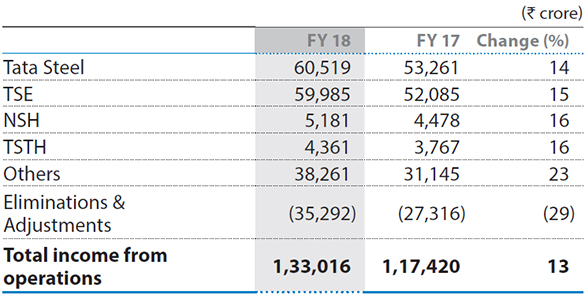

a) Net sales and other operating income

The turnover of the Group was higher as compared to previous year. The increase at Tata Steel India was primarily on account of higher volumes from TSK and higher revenue at FAMD owing to higher production of Ferro Chrome along with increase in realisation of Ferro Manganese. Moreover, revenues from Wires and Tubes division also increased due to higher volumes and increase in realisations.

The increase in turnover at Tata Steel Europe (‘TSE’) was mainly on account of an increase in average revenue per tonne, partly offset by adverse exchange impact on translation.

The increase in turnover of NSH and TSTH was mainly on account of higher realisations.

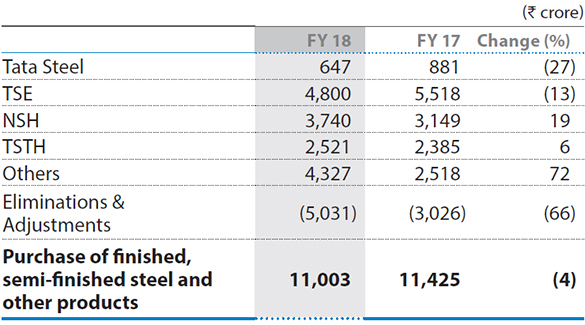

b) Purchases of finished, semi-finished steel & other products

Purchases at TSTH and NSH increased owing to increase in production and input metallic price. Indian operations decreased primarily on account of lower purchases of imported rebars due to lower requirement. The decline at TSE was due to change in sales mix after the sale of long products along with favourable exchange impact on translation.

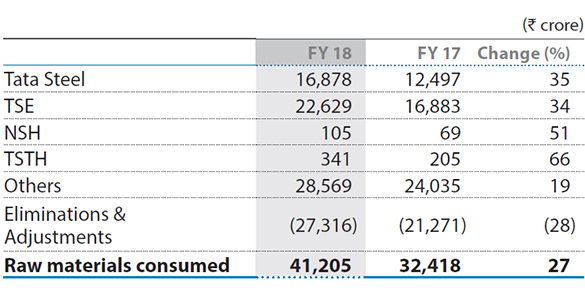

c) Raw materials consumed

The increase at Tata Steel India is due to higher consumption at TSK and cost of imported coal, higher production at FAMD and increase in cost of ore. The increase at TSE is primarily due to increase in price of coke which has doubled from previous year, along with increase in iron ore and coking coal prices, partly offset by favourable exchange impact on translation.

Others primarily reflect activities at Tata Steel Group Procurement in relation to raw material procurement, eliminated on consolidation.

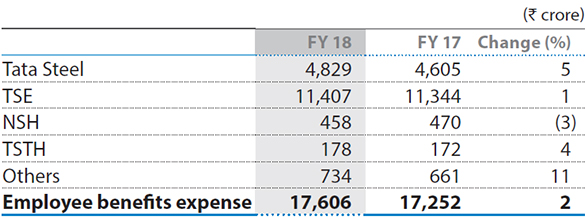

d) Employee benefits expense

Employee Benefit expenses increased in Tata Steel India mainly on account of salary revisions and its consequential impact on the retirement provisions. The wage cost at TSE increased on account of normal increase in wages and contribution to provident and other funds, partly offset by favourable exchange impact on translation.

e) Depreciation and amortisation expense

The increase in depreciation is primarily at Tata Steel India due to due to full year charge (TSK commenced operations with effect from June 1, 2016), partly offset by lower amortisation charges. Expense increased at TSE which was partly offset by favourable exchange impact on translation.

f) Other expenses

Other expenditure represents the following expenditure:

Other expenditures in Tata Steel India were higher mainly on account of increased operations at TSK. Increase at TSE is primarily on account of increase in levels of maintenance activity in Strip Products MLE, higher stores and spares consumed, freight and handling expenses due to increase in transport costs, partly offset by exchange impact on translation. The decrease in others is primarily due to favourable exchange rate movement at Tata Steel Global Holdings, Singapore.

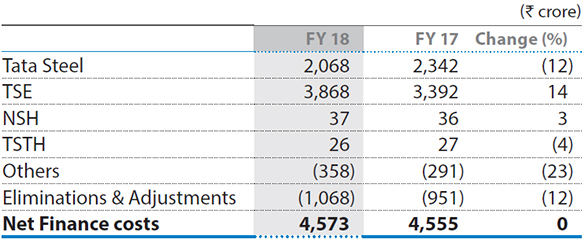

g) Finance costs and Net Finance costs

Higher finance cost at Tata Steel India as compared to previous year included interest capitalised mainly on account of TSK. Increase at TSE is primarily due to addition of subordinate loan over last year along with higher utilisation of working capital facility following an increase in raw material prices, partly offset by exchange impact on translation.

Net finance charges were almost at par as the increase in finance cost was almost offset by increase in finance income at Tata Steel India mainly due to higher income from mutual funds.

h) Exceptional items

Exceptional items during the year primarily represents:

- Statutory demands and claims, net of liability towards district mineral foundation no longer required written back and provision for advances paid for repurchase of equity shares in Tata Teleservices Ltd. from NTT DoCoMo Inc. at Tata Steel India.

- Charge on account of Employee Separation Scheme (‘ESS’) under Sunhere Bhavishya Ki Yojana (‘SBKY’) scheme at Tata Steel India and at Jamshedpur Utilities & Services Company Limited.

- Gains arising out of modification in benefit structure for members of the new pension scheme (‘NBSPS’) vis-à-vis their benefits under Tata Steel Europe’s British Steel Pension Scheme (‘BSPS’), offset by settlement charges for those members who did not join the NBSPS and one-off costs at TSE.

- Impairment charges in respect of property, plant and equipment (including Capital Work-in-progress) relating to Global mineral entities.

Exceptional items during the previous year primarily represents:

- Statutory demands and claims, provision for advances given for repurchase of equity shares in Tata Teleservices Limited from NTT DoCoMo Inc. and charge on account of Employee Separation Scheme (‘ESS’) under ‘Sunhere Bhavishya Ki Yojana’ (‘SBKY’) at Tata Steel India.

- Impairment of property plant and equipment mainly relating to the European and South East Asian operations.

- Curtailment charge relating to closure of Tata Steel Europe’s British Steel Pension Scheme (‘BSPS’) to future accrual.

i) Fixed Assets

TSE was impacted on account of increase in closing exchange rate of GBP during the year as compared to previous year.

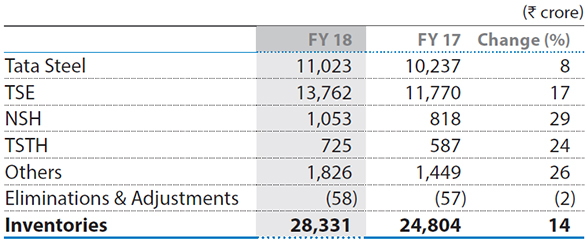

j) Inventories

Increase was primarily at Tata Steel India on account of increase in raw material inventory mainly increase in quantity of coal, partly offset by decline in inventory of finished and semi-finished goods mainly in flat products at Indian operations. At TSE, the increase was primarily in finished and semi-finished inventory on account of exchange impact on translation and lower deliveries.

Stores and spares stock increased in Tata Steel India mainly due to increase in prices. The increase at TSE was on account of exchange impact on translation.

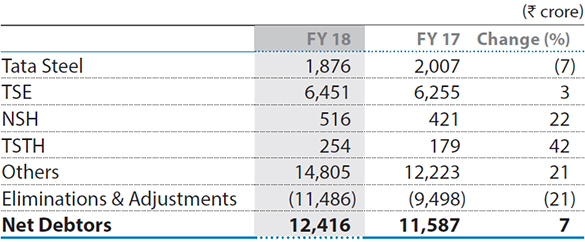

k) Sundry Debtors

Increase at TSE was mainly on account of exchange impact on translation, partly offset by decrease at Tata Steel India. Increase in NSH and TSTH was in line with increase in turnover due to higher realisations.

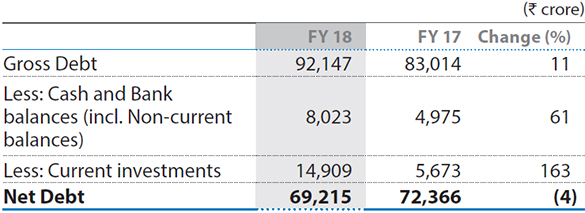

l) Gross Debt and Net Debt

Increase in Gross Debt was mainly on account of proceeds from borrowings (net of repayment) by ₹4,225 crore along with exchange impact on translation being ₹3,567 crore (mainly at TSE). The increase in borrowings was mainly at Singapore entities, partly offset by net repayments at NSH and Tata Steel India.

The decrease in Net Debt was mainly on account of increase in current investments and cash and bank balances at Tata Steel India, partly offset by net increase in gross debt.

m) Cash Flow

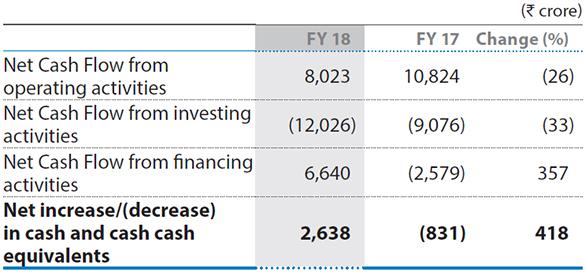

Net cash flow from operating activities

During the year, the Group generated ₹8,023 crore from operations as compared to ₹10,824 crore in the previous year. The cash generated from operations before changes in working capital and tax payments during the year was ₹20,187 crore as against ₹17,581 crore in previous year reflecting higher operating profits. Working capital increased during the year by ₹9,276 crore primarily due to decrease in trade payable and other liabilities along with increase in inventories. The payments of income taxes during the year were ₹2,888 crore as compared to ₹1,843 crore in the previous year.

Net cash flow from investing activities

During the year, the cash outflow was ₹12,026 crore as compared to ₹9,076 crore in the previous year. The outflow represents capex by ₹7,479 crore and purchase (net of sale) of current investments by ₹8,555 crore partly offset by proceeds from sale of investments in Tata Motors ₹3,778 crore.

Net cash flow from financing activities

During the year, net cash inflow from financing activities amounted to ₹6,640 crore as compared to an outflow of ₹2,579 crore in the previous year. The net inflow broadly represents proceeds from rights issue of equity shares by ₹9,087 crore and proceeds from borrowings (net of repayment) was ₹4,225 crore, partly offset by interest paid by ₹5,146 crore and dividend payment by ₹1,180 crore.

D. Risks and Mitigation Strategies

Tata Steel operates in an interconnected world with stringent regulatory and environmental requirements, increased geopolitical risks and fast-paced technological disruptions that could have a material impact across the value chain of the organisation. Tata Steel has implemented an Enterprise Risk Management (‘ERM’) process to provide a holistic view of aggregated risk exposures as well as to facilitate more informed decision-making.

In its journey towards risk intelligence, a robust governance structure has been developed across the organisation. The Board of Directors has constituted a Committee of the Board called Risk Management Committee. At the Senior Management level, a Group Risk Review Committee has been constituted to drive the ERM process across the Tata Steel Group.

Information regarding key risks facing Tata Steel and their mitigation strategies is given here:

1. Macroeconomic Risks

- Overcapacity and oversupply in the global steel industry as well as increased levels of imports may adversely affect steel prices, impacting profitability.

- Newer developments in the competitive global business environment and potential consolidation among competitors may adversely impact the Company’s financial condition and prospects.

- Slower than expected pace of growth in India, coupled with expansion in domestic steel capacity, may result in lower than expected realisations.

Key Mitigation Strategies

- Diversification of product portfolio

- Development of alternate markets

- Participation in industry consolidation

2. Financial Risks

- Fluctuation in foreign exchange rates due to volatility in financial markets may impact the Company’s debt servicing and create uncertainties in accessing financial markets.

- Substantial amount of debt on the balance sheet may have an adverse impact on the Company’s ability to raise finance at competitive rates.

- Changes in assumptions underlying the carrying value of certain assets may result in the impairment of such assets.

Key Mitigation Strategies

- Maximising operational cashflow

- Terming out debt and refinancing debt with favourable covenants

- Appropriate foreign exchange hedging policies

- Integration of business planning and cashflow projections with liquidity management

3. Regulatory Risks

- Non-compliance to increasing stringent regulatory environmental norms may result in liabilities and damage to reputation.

- The Company operates leased mines. Non-renewal of mining leases may result in the Company having to purchase minerals at higher prices from the open market, impacting its profitability.

- Removal of favorable trade measures such as anti-dumping laws, countervailing duties, etc. may impact the Company’s business and prospects.

Key Mitigation Strategies

- Focus on compliance

- Dialogue with regulatory authorities for greater clarity and availing legal consultations for timely clearances

- Working with industry associations towards simplification of rules, a predictive policy regime and transition time for regulatory changes

4. Operational Risks

- The steel industry is prone to high proportion of fixed costs and volatility in prices of raw materials and energy. Limitations or disruptions in the supply of raw materials could adversely affect Company’s profitability.

- Failure of critical information systems/ servers that control the Company’s manufacturing plants may adversely impact business operations.

- Violation of safety standards, unsafe acts and conditions may lead to Lost Time Injuries or fatalities, resulting in stoppage of operations, loss of personnel, damage to assets and reputation.

Key Mitigation Strategies

- Enhancing in-house capability and leveraging from past learnings and expertise

- Establishing sources of supplies from alternate geographies

- Enhancing in-house capability in rail logistics and developing Deep Sea Port capacity

- “Committed to Zero” - Safety drives across the Company

5. Market Related Risks

- Steel is a cyclical industry and excess volatility in the steel and raw material markets may adversely impact the Company’s financial condition.

- Competition from substitute materials, or changes in manufacturing processes, may lead to a decline in product demand, resulting in loss of market share.

- Product liability claims could have an adverse impact on the Company’s finances.

Key Mitigation Strategies

- Development of value-added products and enhanced services and solutions

- Strengthening contractual agreements

6. Climate Change Risks

- As of May 2018, 195 United Nations Framework Convention on Climate Change (UNFCCC) members have signed the Paris agreement, and 176 countries, including India, have become party to it. The Agreement aims to keep a check on rising global temperatures and intensify actions required for a sustainable low-carbon future. Going forward, the steel industry will face stringent international and domestic regulations relating to Greenhouse Gas emissions. Increasingly stringent climate control regulations may impact the Company’s operations and prospects.

Key Mitigation Strategies

- Continued investment in environment related projects

- Collaboration with academic/research institutes for projects on climate change issues

7. People Risks

- Any labour dispute or social unrest in regions where the Company operates may adversely affect its operations and financial condition.

- Loss of one or more members of the Senior Management, or inability to attract and retain employees, may affect the Company’s business and prospects.

Key Mitigation Strategies

- Build relations with key stakeholders including local/ regional influential people, interest groups and bureaucracy across levels of administrative machinery (taluka to state level) to address labour or social unrest

- Succession planning for Senior Management to ensure continuity in business

- People related policies for attracting and retaining talent

8. Strategic Risks

- The Company is growing its Indian operations through organic and inorganic routes. The Company may be unable to realise the anticipated benefits of these growth plans which could have a material adverse impact on its financial condition and reputation.

- The Company may be subject to business risk relating to proposed joint venture with thyssenkrupp AG, including potential delays in completing the proposed transaction and/or the proposed transaction not consummating successfully

Key Mitigation Strategies

- Strong engineering and project team to commission the expansion project within budgeted time and cost

- Ensuring that learnings from previous projects are applied for improved execution and faster ramp-up of production

- Deputation of experienced team from Tata Steel along with strong review and governance to accelerate the performance of the acquired assets

- Integrate the management of acquired company to drive synergies. Bring Tata Steel expertise to the acquired assets in operations, maintenance and marketing to ensure high capacity utilisation, cost competitiveness and better product mix

- Experienced team driving focused consultations with the relevant Stakeholders in Europe

E. Opportunities

India is expected to experience sustained growth in short to medium term driven by growth in steel consuming sectors, revival of rural demand, increased spending on infrastructure amongst others. Further, the conducive government stance towards the steel industry through policies focusing on ‘Make in India’ and Smart City Mission reinforces India’s stance as an attractive place for the steel industry. India continues to be an attractive region for steel given its low per capita consumption of approximately 65 kg (world average of 208 kg, China 493 kg). This shows that there is significant headroom for consumption growth. The Company expects to take advantage of the growth opportunity provided by the Indian economy.

The Company aims to be at the forefront in attaining the leadership position in the steel industry. Towards this objective it has plans to grow organically as well as inorganically. The Company has seized the opportunity to acquire distressed assets in the steel industry under the Insolvency and Bankruptcy Code, 2016 and expects to leverage its acquisition opportunities on possibilities for synergies, broadening customer base, access to raw materials, manufacturing facilities, infrastructure, new geographic locations, advanced technology and growth.

Further, India’s iron ore reserves and competitive labour costs give steel manufacturers based in the country a distinctive cost advantage. The Company seeks to leverage this advantageous position and strengthen its status as a low-cost and high-quality producer of steel.

The competitive business environment, the Company operates in, makes innovation imperative for success of the business. Recognising the need to improve, expand and innovate, the Company is concentrating efforts on research and development of alternate materials and new products.

Steel is a completely recyclable material making it ideal for achieving a circular economy in India. The Company will seize the opportunity to create an organised circular economy system for steel recycling.

The Company expects the demand for steel products to be strong in the developing economies and the Company proposes to utilise it as well as its Group’s existing network to meet this increased demand.

The Company is actively seeking opportunities to redefine existing processes and systems by leveraging digital technologies which has the potential to transform all aspects of the steel value chain. Keeping pace with the global trends of digitalisation, the digital team of the Company has been working in tandem with the business to identify business opportunities and drive digitalisation initiatives across the value chain to add value to the business by being a key enabler for the Company’s strategies.

To enable the Company’s customers to realise value from its by-products, the Company assists them in exploring new application areas.

F. Statutory Compliance

The Chief Executive Officer and Managing Director makes a declaration at each Board Meeting regarding compliance with provisions of various statutes after obtaining confirmation from respective units of the Company. The Company Secretary ensures compliance with Company Law, SEBI and other corporate laws applicable to the Company.