Report Menu

Report Menu

Corporate Governance Report

Company’s Corporate Governance Philosophy

Corporate governance is the creation and enhancement of long-term sustainable value for our stakeholders through ethically driven business process. At Tata Steel, it is imperative that our Company’s affairs are managed in a fair and transparent manner.

We ensure that we evolve and follow not just the stated corporate governance guidelines, but also global best practices. We consider it our inherent responsibility to protect the rights of our shareholders and disclose timely, adequate and accurate information regarding our financials and performance, as well as the leadership and governance of the Company.

In accordance with our Vision, Tata Steel Group (‘the Group’) aspires to be the global steel industry benchmark for ‘value creation’ and ‘corporate citizenship’. The Group expects to realise its Vision by taking such actions as may be necessary to achieve its goals of value creation, safety, environment and people.

Corporate Governance Guidelines

The Board of Directors (‘the Board’) has adopted the Tata Group Guidelines on Board Effectiveness to help fulfil its corporate governance responsibility towards its stakeholders. These guidelines provide for the composition and role of the Board and ensure that the Board will have the necessary authority and processes in place to review and evaluate the Company’s operations. Further, these guidelines allow the Board to make decisions that are independent of the Management of the Company.

Board of Directors

The Board is at the core of our corporate governance practice and oversees and ensures that the Management serves and protects the long-term interest of all our stakeholders. We believe that an active, well-informed and independent Board is necessary to ensure the highest standards of corporate governance.

Size and Composition of the Board

Our policy is to have an appropriate mix of Executive Directors (‘EDs’), Non-Executive Directors (‘NEDs’) and Independent Directors (‘IDs’) to maintain the Board’s independence as well as separate its functions of governance and management. As on March 31, 2018, the Board comprised of ten members, two of whom are EDs, three NEDs and five IDs including a Woman Director. The Board periodically evaluates the need for change in its composition and size. Detailed profile of our Directors is available on our website www.tatasteel.com None of our NEDs serve as IDs in more than seven listed companies and none of the EDs serve as IDs on any listed company.

The Company has issued formal letters of appointment to the IDs. As required under Regulation 46 of the SEBI (Listing Obligation and Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’), the terms and conditions of appointment of IDs including their role, responsibility and duties are available on our website www.tatasteel.com

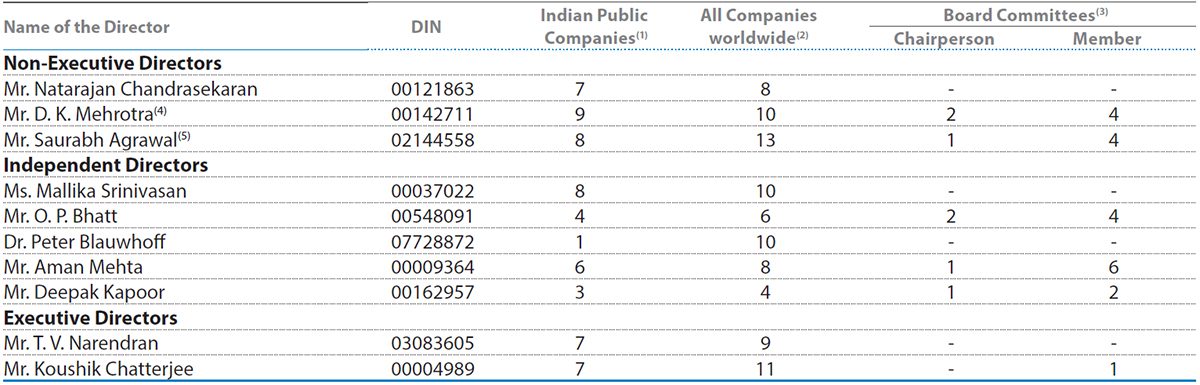

Table A: Composition of the Board and Directorships held as on March 31, 2018:

(1) Directorships in Indian Public Companies including Tata Steel Limited and excluding Section 8 Companies.

(2) Includes Directorship in Indian and foreign companies including Tata Steel Limited and excluding Section 8 Companies.

(3) As required under Regulation 26(1)(b) of the Listing Regulations, the disclosure includes chairmanship/membership of the Audit Committee and Stakeholders’ Relationship Committee in Indian public companies including Tata Steel Limited.

(4) Mr. D. K. Mehrotra ceased to be Member of the Board effective May 16, 2018.

(5) Mr. Saurabh Agrawal was appointed as an Additional (Non-Executive) Director effective August 10, 2017.

Note:

There are no inter-se relationships between our Board Members.

Selection of New Directors and Board Membership Criteria

The Nomination and Remuneration Committee (‘NRC’) works with the Board to determine the appropriate qualifications, positive attributes, characteristics, skills and experience required for the Board as a whole and its individual members with the objective of having a Board with diverse backgrounds and experience in business, government, education and public service. The Policy for appointment and removal of Directors and determining Directors’ independence is annexed to the Directors’ Report and is available on our website www.tatasteel.com

Familiarisation Programme for Independent Directors

All new Independent Directors inducted on the Board are given a formal orientation. The familiarisation programme for our Directors is customised to suit each one’s interests and area of expertise. The Directors are encouraged to visit the plant and raw material locations of the Company and interact with the members of Senior Management as part of the induction programme. The Senior Management make presentations giving an overview of the Company’s strategy, operations, products, markets, group structure and subsidiaries, Board constitution and guidelines, matters reserved for the Board and the major risks and risk management strategy. This enables the Directors to get a deep understanding of the Company, its people, values and culture and facilitates their active participation in overseeing the performance of the Management.

Further, during the year, the Board held one meeting at our Jamshedpur Plant location to discuss strategy. The Board Members also interacted with the Senior Management Personnel and visited the facilities in proximity to Jamshedpur.

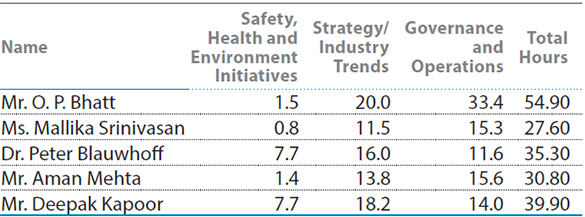

As stated in the Director’s Report, the details of orientation given to our existing Independent Directors are provided in Table B below.

Table B: Details of orientation given to the existing Independent Directors during the year are as follows:

Dr. Peter Blauwhoff, Mr. Aman Mehta and Mr. Deepak Kapoor, Independent Directors of the Company, were taken through a comprehensive induction programme, spanning over 7-10 days, covering the economic, environmental and social aspects of the organisation. As part of their induction, they met Senior Management Personnel at various plant and raw material locations.

These details are also available on our website www.tatasteel.com

Board Evaluation

The Nomination and Remuneration Committee has formulated a Policy for evaluation of the Board, its Committees and Directors and the same has been approved by the Board. The details of Board Evaluation forms part of the Directors’ Report.

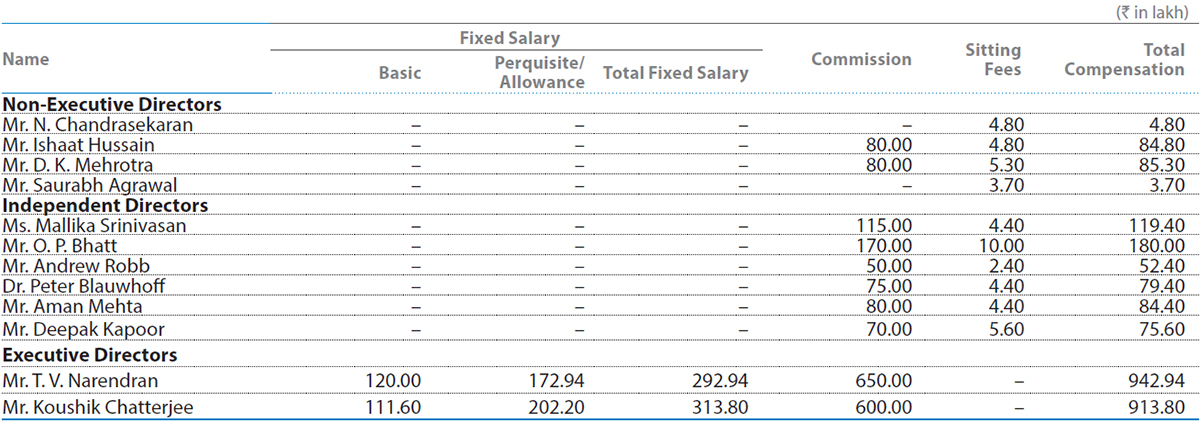

Compensation Policy for Board and Senior Management

The Board has approved the Remuneration Policy for Directors, Key Managerial Personnel (‘KMPs’) and all other employees of the Company. The same is annexed to the Directors’ Report and is available on our website www.tatasteel.com Details of remuneration for Directors in Financial Year 2017-18 are provided in Table C below.

Table C: Shares held and cash compensation paid to Directors for the year ended March 31, 2018:

Notes:

As a policy, Mr. N. Chandrasekaran, Chairman, has abstained from receiving

commission from the Company. Further, in line with the internal guidelines of

the Company, no payment is made towards commission to the Non-Executive

Directors of the Company, who are in full time employment with any other

Tata Company. The commission of Mr. D. K. Mehrotra is paid to Life Insurance

Corporation of India.

Mr. Ishaat Hussain and Mr. Andrew Robb retired as Members of the Board effective September 1, 2017.

Dr. Peter Blauwhoff is a Director of Tata Steel Europe (‘TSE’) and Chairman and Member of Supervisory Board of Tata Steel Nederland BV (‘TSN BV’). Towards this, he receives an annual fee of £70,000 from TSE and €80,000 from TSN BV. The fee paid is consistent with the market practices and are aligned to the benchmark figures published by global consulting firms.

In addition to the compensation shown above, Mr. T. V. Narendran was paid `42.30 lakh under the Company’s Long Term Incentive Plan. This amount relates to the period April 1, 2013 through September 17, 2013 prior to him becoming Member of the Board.

Mr. T. V. Narendran holds 2,032 Fully Paid Ordinary Shares and 139 Partly Paid Ordinary Shares of the Company and Mr. Koushik Chatterjee holds 1,531 Fully Paid Ordinary Shares and 105 Partly Paid Ordinary Shares of the Company as on March 31, 2018.

None of the Directors hold stock options as on March 31, 2018. None of the Executive Directors are eligible for payment of any severance fees and the contracts with Executive Directors may be terminated by either party giving the other party six months’ notice or the Company paying six months’ salary in lieu thereof.

Board Meetings

Scheduling and selection of agenda items for Board Meetings

Dates for Board Meetings in the ensuing financial year are decided in advance and communicated to the Board. The information as required under Regulation 17(7) read with Schedule II Part A of the Listing Regulations is made available to the Board. The Board reviews minutes of the meetings of board of directors of the unlisted subsidiaries of the Company. The agenda and explanatory notes are sent to the Board in advance. The Board periodically reviews compliance reports of all laws applicable to the Company. The Board meets at least once a quarter to review the quarterly financial results and other items on the agenda and also on the occasion of the Annual General Meeting (‘AGM’) of the Shareholders. Additional meetings are held, when necessary. Committees of the Board usually meet the day before the formal Board Meeting, or whenever the need arises for transacting business. The recommendations of the Committees are placed before the Board for necessary approval and noting.

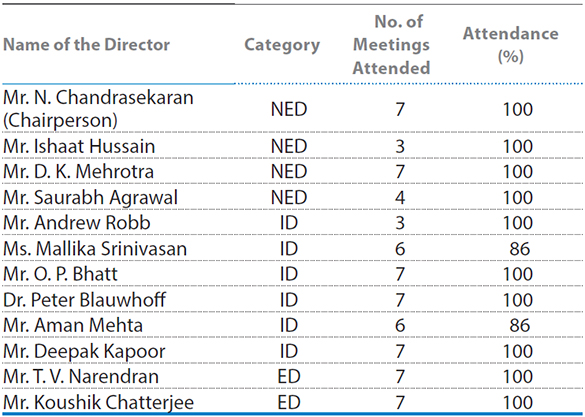

Table D: Attendance details of Directors for the year ended March 31, 2018 are given below:

NED – Non-Executive Director; ID – Independent Director;

ED – Executive Director

Mr. Saurabh Agrawal was appointed as an Additional (Non-Executive) Director effective August 10, 2017.

Mr. Ishaat Hussain and Mr. Andrew Robb retired from the Board effective September 1, 2017.

All the Directors as on the date of the AGM were present at the AGM of the Company held on August 8, 2017.

7 Board Meetings were held during the year ended March 31, 2018 on April 20, 2017, May 16, 2017, August 7, 2017, September 8, 2017, October 30, 2017, December 18, 2017 continued through December 19, 2017 and February 9, 2018. The gap between any two Board meetings during this period did not exceed one hundred and twenty days

Discussions with Independent Directors

The Board’s policy is to regularly have separate meetings with Independent Directors, to update them on all business related issues, new initiatives and changes in the industry specific market scenario. At such meetings, the Executive Directors and other Members of the Management make presentations on relevant issues.

Meeting of the Independent Directors

Pursuant to Schedule IV of the Companies Act, 2013, the Independent Directors met on April 20, 2017 without the presence of Non-Independent Directors and Members of the Management. The Independent Directors inter alia evaluated the performance of the Non-Independent Directors and the Board of Directors as a whole, evaluated the performance of the Chairman of the Board taking into account the views of Executive and Non-Executive Directors and discussed aspects relating to the quality, quantity and timeliness of the flow of information between the Company, the Management and the Board.

Board Committees

Audit Committee

The primary objective of the Audit Committee is to monitor and provide an effective supervision of the Management’s financial reporting process, to ensure accurate and timely disclosures, with the highest levels of transparency, integrity and quality of financial reporting. The Committee oversees the work carried out in the financial reporting process by the Management, the internal auditor, the statutory auditor and the cost auditor and notes the processes and safeguards employed by each of them. The Committee further reviews the process and controls including compliance with applicable laws, Tata Code of Conduct and Tata Code of Conduct for Prevention of Insider Trading, Whistle Blower Policy and related cases thereto, functioning of the Prevention of Sexual Harassment at Workplace Policy and guidelines and internal controls. The Tata Code of Conduct is available on our website www.tatasteel.com

Discussion with external Auditors:

To ensure independence and objectivity of external auditors, the Committee discusses on significant issues pertaining to Financial Statements, impairment of assets, appropriate estimates and judgements of the Management, conclusions reached by Auditors in respect of key judgement and identifying any other issues in relation to the above.

The Board of Directors of the Company adopted the Charter on March 31, 2015 which was revised on March 2, 2017.

The Company Secretary acts as the Secretary to the Committee. The internal auditor reports functionally to the Audit Committee. The Executive Directors and Senior Management of the Company also attend the meetings as invitees to address concerns raised by the Committee Members.

5 meetings of the Committee were held during the year ended March 31, 2018 on April 20, 2017, May 15, 2017, August 7, 2017, October 29, 2017 and February 8, 2018.

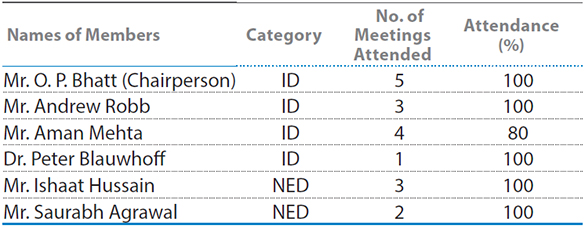

Table E: The composition of the Committee and the attendance details of the Members are given below:

ID – Independent Director; NED – Non-Executive Director

Dr. Peter Blauwhoff was appointed as Member of the Audit Committee effective December 18, 2017 and Mr. Saurabh Agrawal was appointed as an Additional (Non-Executive) Director effective August 10, 2017 and was appointed as a Member of the Audit Committee effective same date.

Mr. Ishaat Hussain and Mr. Andrew Robb retired from the Board effective September 1, 2017 and consequently ceased to be Members of the Audit Committee effective same date.

Mr. O. P. Bhatt, Chairman of the Audit Committee as on date of the AGM was present at the AGM of the Company held on August 8, 2017.

Nomination and Remuneration Committee

The purpose of the Nomination and Remuneration Committee (‘NRC’) is to oversee the Company’s nomination process including succession planning for the senior management and the Board and specifically to assist the Board in identifying, screening and reviewing individuals qualified to serve as Executive Directors, Non-Executive Directors and Independent Directors consistent with the criteria as stated by the Board in its Policy on Appointment and Removal of Directors and to recommend, for approval by the Board, nominees for election at the AGM of the Shareholders.

The Board has adopted the NRC Charter for the functioning of the Committee on May 20, 2015.

The NRC also discharges the Board’s responsibilities relating to compensation of the Company’s Executive Directors and Senior Management. The Committee has formulated the Remuneration Policy for Directors, KMPs and all other employees of the Company. The remuneration policy and the criteria for making payments to Non-Executive Directors is available on our website www.tatasteel.com The Committee has the overall responsibility of approving and evaluating the compensation plans, policies and programmes for Executive Directors and the Senior Management. The Committee reviews and recommends to the Board, the base salary, incentives/ commission, other benefits, compensation or arrangements and executive employment agreements for the Executive Directors for its approval. The Committee co-ordinates and oversees the annual self-evaluation of the performance of the Board, Committees and of individual Directors.

5 meetings of the Committee were held during the year ended March 31, 2018 on April 20, 2017, May 16, 2017, August 7, 2017, October 5, 2017 and October 30, 2017.

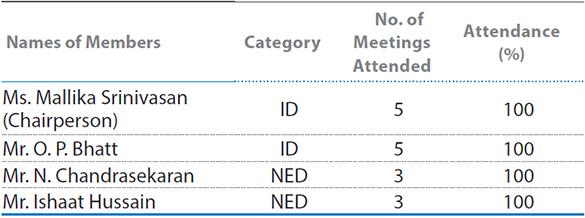

Table F: The composition of the Committee and the attendance details of the Members are given below:

ID – Independent Director; NED – Non-Executive Director

Mr. N. Chandrasekaran was appointed as Member of the Nomination and Remuneration Committee on May 16, 2017. Ms. Mallika Srinivasan, Chairperson of the Nomination and Remuneration Committee was present at the AGM of the Company held on August 8, 2017.

Mr. Ishaat Hussain retired from the Board effective September 1, 2017 and consequently ceased to be Member of the NRC effective same date.

Corporate Social Responsibility and Sustainability Committee

The purpose of our Corporate Social Responsibility and Sustainability (‘CSR&S’) Committee is to formulate and recommend to the Board, a Corporate Social Responsibility Policy. The Policy shall indicate the initiatives to be undertaken by the Company, recommend the amount of expenditure the Company should incur on Corporate Social Responsibility (‘CSR’) activities and to monitor from time to time the CSR activities and Policy of the Company. The Committee provides guidance in formulation of CSR strategy and its implementation and also reviews practices and principles to foster sustainable growth of the Company by creating values consistent with long-term preservation and enhancement of financial, manufactured, natural, social, intellectual and human capital.

The Board has approved a Charter for the functioning of the Committee, on March 31, 2015 which was subsequently revised on March 2, 2017.

The CSR policy is available on our website www.tatasteel.com

4 meetings of the CSR&S Committee were held during the year ended March 31, 2018 on June 6, 2017, July 14, 2017, October 30, 2017 and February 8, 2018

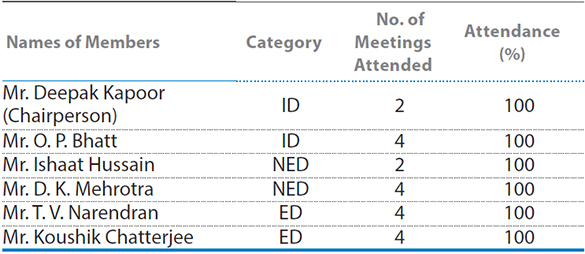

Table G: The composition of the Committee and the attendance details of the Members are given below:

NED – Non-Executive Director; ID – Independent Director;

ED – Executive Director

Mr. Deepak Kapoor was appointed as Chairperson and Member of the CSR&S Committee effective August 7, 2017. He was present at the AGM held on August 8, 2017.

Mr. Ishaat Hussain retired from the Board effective September 1, 2017 and consequently ceased to be Member of the CSR&S Committee effective same date.

Risk Management Committee

Risk Management is crucial to achieve the Group’s objective in strengthening its financial position, safeguarding interests of stakeholders, enhancing its ability to continue as a going concern and maintain a consistent sustainable growth.

The Company has constituted a Risk Management Committee (‘RMC’) for framing, implementing and monitoring the Risk Management Policy of the Company. The Committee assists the Board in fulfilling its oversight responsibility with respect to Enterprise Risk Management (‘ERM’).

The terms of reference of the RMC are:

- Overseeing key risks, including strategic, financial, operational and compliance risks.

- Assisting the Board in framing, implementing and monitoring the risk management plan for the Company and reviewing and guiding the Risk Policy.

- Developing risk management policy and risk management system/framework for the Company.

The Board has adopted a Charter for the RMC Committee on May 20, 2015 in accordance with Regulation 21 of the Listing Regulations.

2 meetings of the RMC were held during the year ended March 31, 2018 on July 14, 2017 and February 8, 2018.

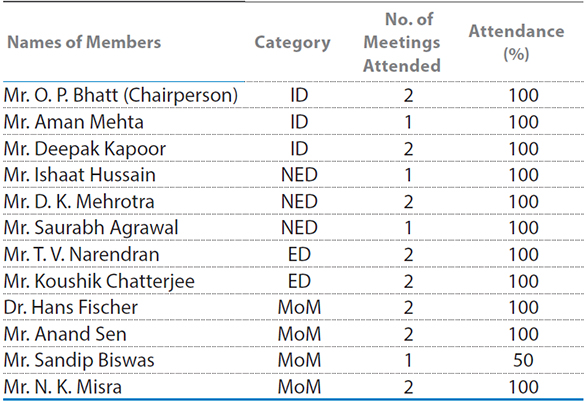

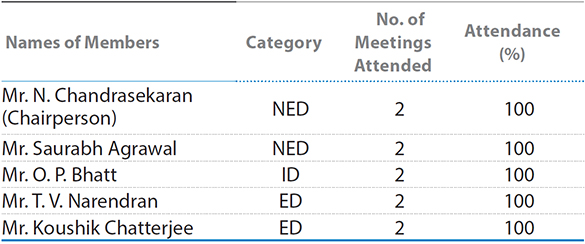

Table H: The composition of the Committee and the attendance details of the Members are given below:

ID – Independent Director; NED – Non-Executive Director;

ED – Executive Director; MoM – Member of Management.

Mr. Aman Mehta and Mr. Saurabh Agrawal were appointed as Members of the RMC effective August 7, 2017.

Mr. Ishaat Hussain retired from the Board effective September 1, 2017 and consequently ceased to be Member of the RMC effective same date.

Note: Details on risks and opportunities including commodity price risks and foreign exchange risks are available in the Risks and Opportunities sections of the Management Discussion and Analysis annexed to the Directors’ Report.

Stakeholders’ Relationship Committee

The Stakeholders’ Relationship Committee (‘SRC’) considers and resolves the grievances of our shareholders, debenture holders and other security holders, including complaints relating to non-receipt of annual report, transfer and transmission of securities, non-receipt of dividends/interests and such other grievances as may be raised by the security holders from time to time.

1 meeting of the SRC was held during the year on February 9, 2018.

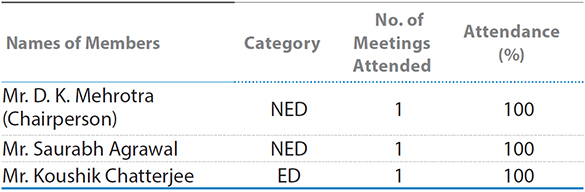

Table I: The composition of the Committee and the attendance details of the Members are given below:

NED – Non-Executive Director; ED – Executive Director

Mr. Saurabh Agrawal was appointed as an Additional (Non-Executive) Director effective August 10, 2017 and was inducted as a Member of the SRC effective same date.

Mr. Ishaat Hussain retired from the Board effective September 1, 2017 and consequently ceased to be a Member of the SRC effective same date.

Further, Mr. D. K. Mehrotra, Chairman of the SRC was present at the AGM of the Company held on August 8, 2017.

In terms of Regulation 6 and Schedule V of the Listing Regulations, the Board has appointed Mr. Parvatheesam K, Company Secretary as the Compliance Officer of the Company.

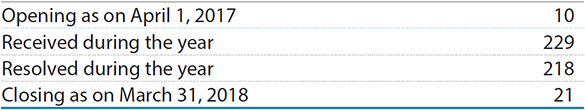

The details of complaints received and resolved during the Financial Year ended March 31, 2018 are given in the Table below. The complaints relate to non-receipt of annual report, dividend, share transfers and other investor grievances.

Table J: Details of complaints received and resolved during the Financial Year 2017-18:

Executive Committee of the Board

The Executive Committee of the Board (‘ECOB’) approves capital expenditure schemes or any change in their scope if any and donations within the stipulated limits and to recommend to the Board, capital budgets and other major capital schemes, to consider new businesses, acquisitions, alliances and Joint Ventures, subsidiaries, divestments, changes in organisational structure, financing requirements of the Company and Company contracts above 5 years. It also periodically reviews the Company’s business plans and future strategies and metrics for long-term value creation. The Committee also reviews climate change matters and regulatory compliance and policy advocacy. The Finance Committee of the Board and the Committee of Directors have been merged and form part of the ECOB effective August 7, 2017.

2 meetings of the ECOB were held during the year ended March 31, 2018 on January 19, 2018 and March 14, 2018.

Table K: The composition of the Committee and the attendance details of the Members are given below:

NED – Non-Executive Director; ID – Independent Director;

ED – Executive Director

Mr. O. P. Bhatt was appointed as Member of the ECOB effective August 7, 2017. Also, Mr. Saurabh Agrawal was appointed as an Additional (Non-Executive) Director effective August 10, 2017 and was inducted as a Member of the ECOB effective same date.

Mr. Ishaat Hussain retired from the Board effective September 1, 2017 and consequently ceased to be a Member of the ECOB effective same date.

Safety, Health and Environment Committee

The Safety, Health and Environment Committee (‘SH&E Committee’) of the Board oversees the policies relating to Safety, Health and Environment and their implementation across Tata Steel Group.

The Board has approved a Charter for the functioning of the Committee on October 27, 2009.

3 meetings of the Committee were held during the year ended March 31, 2018 on July 6, 2017, October 25, 2017 and February 8, 2018.

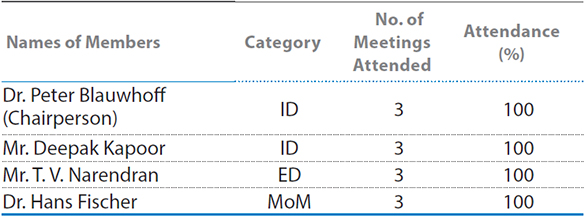

Table M: The composition of the Committee and the attendance details of the Members are given below:

ID – Independent Director; ED – Executive Director,

MoM - Member of Management

General Information for Shareholders

Disclosures regarding the appointment or re-appointment of Directors

In terms of the relevant provisions of the Companies Act, 2013, Mr. N. Chandrasekaran is liable to retire by rotation at the ensuing Annual General Meeting (‘AGM’) and being eligible, seeks re-appointment.

Further, during the year under review, based on the recommendation of the NRC, the Board appointed Mr. Saurabh Agrawal as an Additional (Non-Executive) Director effective August 10, 2017. The Board has recommended that Mr. Agrawal be appointed as a Director, subject to Shareholders’ approval at the ensuing AGM. Further, based on the recommendation of the NRC, the Board re-appointed Mr. Koushik Chatterjee as Whole Time Director, designated as Executive Director and Chief Financial Officer of the Company, liable to retire by rotation, with effect from November 9, 2017 to November 8, 2022 upon the terms and conditions as mentioned in the Notice convening the AGM.

The Board recommends above appointment/re-appointments for approval of the Shareholders.

The detailed profiles of the above Directors and particulars of their experience, skill or attributes that qualify them for Board Membership are provided in the Notice convening the AGM.

Communication to the Shareholders

We send quarterly financial results to our Shareholders electronically. Key financial data is published in The Indian Express, Financial Express, Nav Shakti, Free Press Journal and Loksatta. The financial results along with the earnings releases are also posted on the Company’s website www.tatasteel.com

Earnings calls are held with analysts and investors and their transcripts are published on the website. Presentations made to analysts and others are also made available on the Company’s website www.tatasteel.com

All price sensitive information and matters that are material to shareholders are disclosed to the respective Stock Exchanges where the securities of the Company are listed. All submissions to the Exchanges are made through their respective electronic filing systems.

The Company’s website is a comprehensive reference on it’s leadership, management, vision, mission, policies, corporate governance, sustainability, investor relations, products and processes and updates and news. The section on ‘Investors’ serves to inform the Shareholders, by giving complete financial details, shareholding patterns, corporate benefits, information relating to Stock Exchanges, Stock Exchange Compliances, details of Registrars & Transfer Agents and Frequently Asked Questions (‘FAQs’). Investors can also submit their queries and get feedback through online interactive forms. The section on ‘Media’ includes all major press reports and releases, awards and campaigns, amongst others.

Investor grievance and share transfer

We have a Board-level Stakeholders’ Relationship Committee to examine and redress investors’ complaints. The status on complaints and share transfers are reported to the entire Board.

For shares transferred in physical form, the Company provides adequate notice to the seller before registering the transfer of shares. For matters regarding share transfer in physical form, share certificates and dividends amongst others, shareholders should communicate with TSR Darashaw Limited, the Company’s Registrars and Transfer Agents (‘RTA’) quoting their folio number or Depository Participant ID (‘DP ID’) and Client ID number.

Share transactions in electronic form can be effected in a much simpler and faster manner. After a confirmation of a sale/purchase transaction from the broker, shareholders should approach the DP with a request to debit or credit the account for the transaction. The DP will immediately arrange to complete the transaction by updating the account. There is no need for a separate communication to the Company to register these share transfers.

Code of conduct

The Company has adopted the Tata Code of Conduct (‘TCoC’) for Executive Directors, Senior Management Personnel and other Executives, which is available on the website www.tatasteel.com The Company has received confirmations from the EDs as well as Senior Management Personnel regarding compliance of the Code during the year under review. The Company has also adopted the Code of Conduct for Non-Executive Directors of the Company which is available on the website www.tatasteel.com The Company has received confirmation from the NEDs regarding compliance of the Code for the year under review.

Details of non-compliance

The Company has complied with the requirements of the Stock Exchanges, SEBI and other statutory authorities on all matters relating to capital markets during the last three years. There has been no instance of non-compliance with any legal requirements during the year except as below:

Vide Adjudication Order No. EAD-2/DSR/RG/869/2017 dated December 7, 2017, the adjudication officer appointed by the SEBI has imposed a monetary penalty of `10,00,000/- (Rupees Ten Lakh Only) on the Company for delayed disclosures under Regulation 13(3) read with Regulation 13(5) of the SEBI (Prohibition of Insider Trading) Regulations, 1992 in relation to the increase in the Company’s shareholding in The Tinplate Company of India Limited pursuant to a rights issue of shares in 2009 and the automatic conversion of fully convertible debentures in 2011. This penalty has been paid by the Company. There have not been any other strictures imposed by any stock exchange or SEBI on the Company in last 3 years.

None of the Company’s listed securities are suspended from trading.

Auditors’ certificate on corporate governance

As required by Regulation 34(3) and Schedule V Part E of the Listing Regulations, the certificate given by Parikh and Associates, Practising Company Secretaries, is annexed to this report.

CEO and CFO certification

As required by Regulation 17(8) read with Schedule II Part B of the Listing Regulations, the CEO & MD and ED & CFO have given appropriate certifications to the Board of Directors.

Reconciliation of Share Capital Audit

In terms of Regulation 40(9) and 61(4) of the Listing Regulations, certificates on half-yearly basis have been issued by a Company Secretary in Practice with respect to due compliance of share and security transfer formalities by the Company.

The Company Secretary in Practice carried out a Reconciliation of Share Capital Audit to reconcile the total admitted capital with National Securities Depository Limited (‘NSDL’) and Central Depository Services (India) Limited (‘CDSL’) (collectively ‘Depositories’) and the total issued and listed capital. The audit confirms that the total paid-up capital is in agreement with the aggregate of the total number of shares in physical form and in dematerialised form (held with the Depositories) respectively.

Related Party Transactions

All transactions entered into with related parties as defined under the Companies Act, 2013 and Regulation 23 of the Listing Regulations during the year under review were on an arm’s length price basis and in the ordinary course of business. These have been approved by the Audit Committee. The Company has not entered into any materially significant related party transaction that may have potential conflict with the interests of the Company at large. The Board of Directors have approved and adopted a Policy on Related Party Transactions and the same has been uploaded on the website of the Company and can be accessed at www.tatasteel.com

During the Financial Year 2017-18, the Company did not have any material pecuniary relationship or transactions with Non-Executive Directors apart from paying Director’s remuneration. Further, the Directors have not entered into any contracts with the Company or its subsidiaries, which will be in material conflict with the interest of the Company.

In the preparation of financial statements, the Company has followed the applicable Accounting Standards. The significant accounting policies that are applied have been set out in the Notes to Financial Statements. The Board has received disclosures from KMPs relating to material, financial and commercial transactions where they and/ or their relatives have personal interest.

Policy for Determining Material Subsidiaries

The Company has formulated a Policy for Determining Material Subsidiaries and the same is available on the Company’s website www.tatasteel.com

Vigil Mechanism

The Vigil Mechanism approved by the Board provides a formal mechanism for all Directors, employees and vendors of the Company to approach the Ethics Counsellor/Chairman of the Audit Committee of the Company and make protective disclosures regarding the unethical behaviour, actual or suspected fraud or violation of the Company’s Code of Conduct. Under the Policy, every Director, employee or vendor of the Company has an assured access to the Ethics Counsellor/Chairman of the Audit Committee. Details of the Vigil Mechanism are given in the Directors’ Report. The whistle blower policy is available on the Company’s website www.tatasteel.com

General Body Meetings

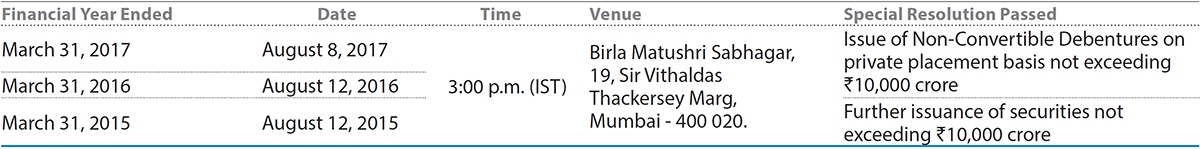

Table N: Location and time where last three AGMs were held:

No Special Resolution was passed by the Company last year through Postal Ballot. None of the businesses proposed to be transacted at the ensuing AGM require passing a Special Resolution through Postal Ballot.

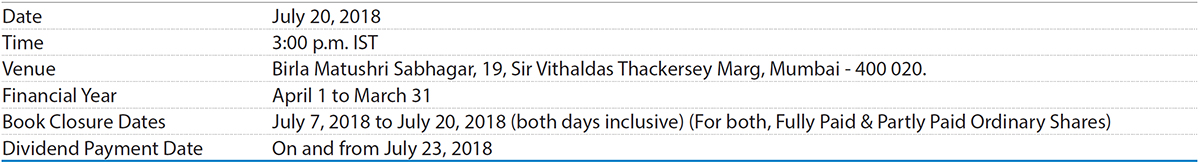

Table O: Annual General Meeting 2018:

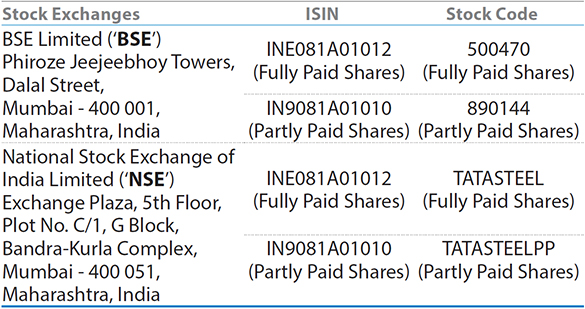

Dematerialisation of shares and liquidity

The Company’s Ordinary Shares are tradable compulsorily in electronic form. We have established connectivity with both the depositories, i.e., NSDL and CDSL. The International Securities Identification Number (‘ISIN’) allotted to the Fully paid and Partly paid Ordinary Shares under the Depository System are INE081A01012 and IN9081A01010 respectively.

The Company has 1,17,78,08,646 Ordinary Shares (including Fully and Partly paid shares) representing 97.81% of the Company’s share capital which is dematerialised as on March 31, 2018. To enable us to serve our Shareholders better, we request our Shareholders whose shares are in physical mode to dematerialise shares and to update their bank accounts and e-mail ids with their respective DPs.

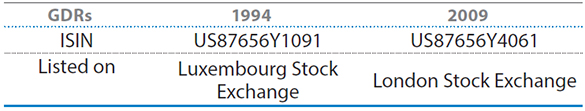

Further, 1,27,40,651 outstanding GDR Shares (31.03.2017: 1,55,10,420) of face value of `10 per share represent the shares underlying GDRs which were issued during 1994 and 2009. Each GDR represents one underlying Ordinary Share.

Designated e-mail address for investor services

To serve the investors better and as required under Regulation 46(2) (j) in the Listing Regulations, the designated e-mail address for investor complaints is cosec@tatasteel.com This email address for grievance redressal is continuously monitored by the Company’s Compliance Officer.

Investor Awareness

As part of good governance we have provided subscription facilities to our investors for IR alerts regarding press release, results, webcasts, analyst meets and presentations amongst others. We also provide our investors a facility to write queries regarding their rights and shareholdings and have provided details of persons to be contacted for this purpose. We encourage investors to visit our website for reading the documents and for availing the above facilities at www.tatasteel.com

Legal proceedings

There are certain pending cases related to disputes over title to shares in which we had been made a party. However, these cases are not material in nature.

Share Transfer System

Share Transfers in physical form can be lodged with TSR Darashaw Limited. The transfers are normally processed within 15 days from the date of receipt if the documents are complete in all respects.

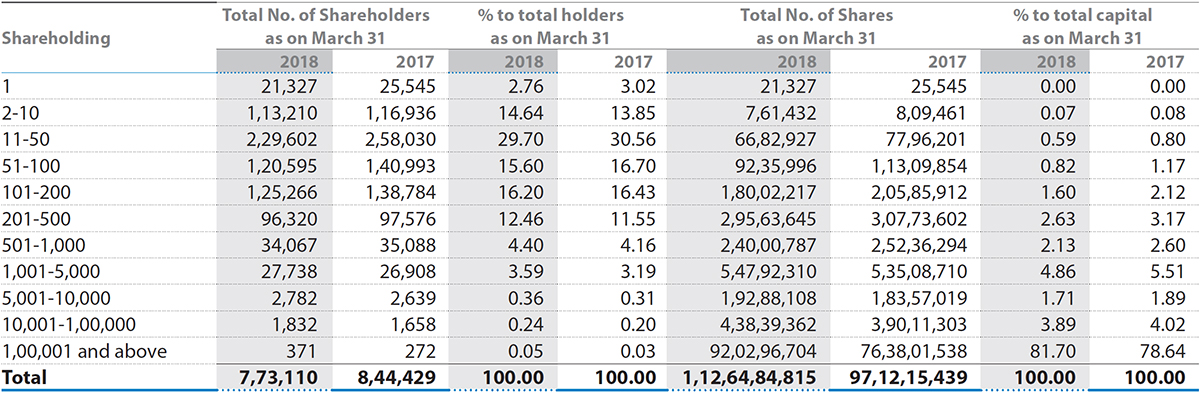

Table P: Distribution of Shareholding of Ordinary Shares:

Fully Paid Shares

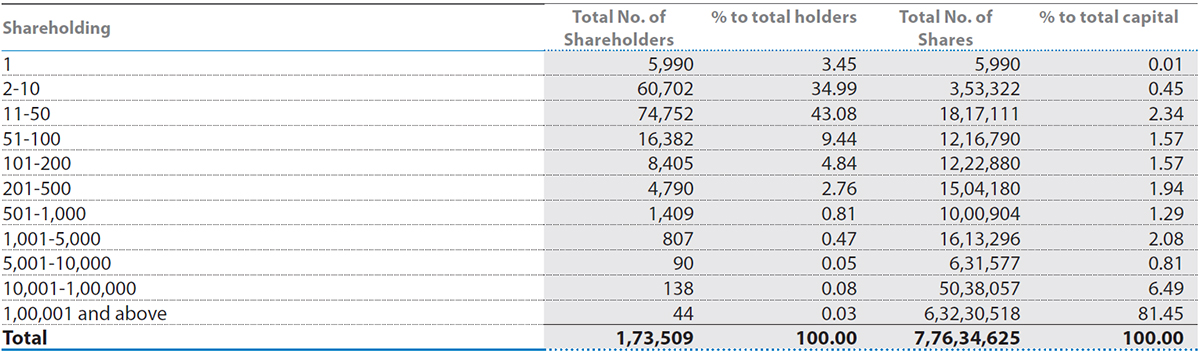

Partly Paid Shares (as on March 31, 2018)

Note : The Partly Paid Shares of the Company were alloted on March 14, 2018 and hence there are no comparable numbers for previous year.

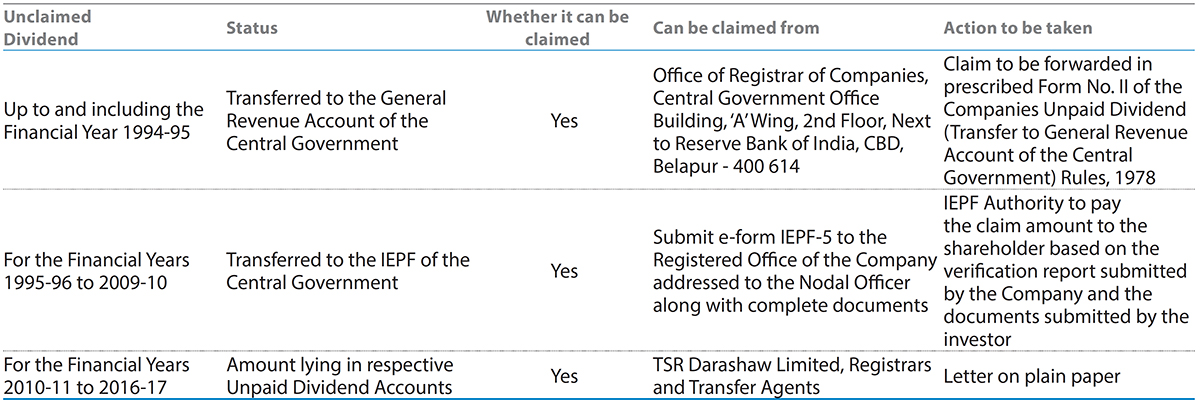

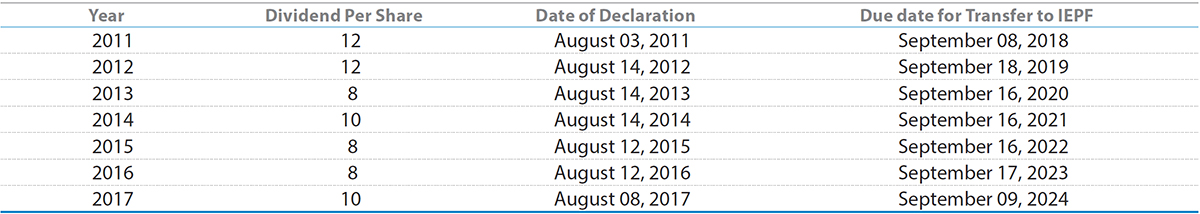

Transfer of Unclaimed Dividend and Shares to the Investor Education and Protection Fund (‘IEPF’)

Pursuant to the provisions of the Companies Act, 2013 read with The Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016, as amended, (‘Rules’), the dividends, unclaimed for a consecutive period of seven years from the date of transfer to the Unpaid Dividend Account of the Company are liable to be transferred to IEPF. Further, the shares (excluding the disputed cases having specific orders of the Court, Tribunal or any Statutory Authority restraining such transfer) pertaining to which dividend remains unclaimed for a period of continuous seven years from the date of transfer of the dividend to the unpaid dividend account are also mandatorily required to be transferred to the IEPF established by the Central Government. Accordingly, the Company has transferred eligible Shares to IEPF Demat Account maintained by the IEPF authority within statutory timelines.

The Company has sent individual communication to the concerned shareholders at their registered address, whose dividend remained unclaimed and whose shares were liable to be transferred to the IEPF by November 30, 2017. The communication was also published in national English and local Marathi newspapers.

Any person whose unclaimed dividend and shares pertaining thereto, matured deposits, matured debentures, application money due for refund, or interest thereon, sale proceeds of fractional shares, redemption proceeds of preference shares, amongst others has been transferred to the IEPF Fund can claim their due amount from the IEPF Authority by making an electronic application in e-form IEPF-5. Upon submitting a duly completed form, Shareholders are required to take a print of the same and send physical copy duly signed along with requisite documents as specified in the form to the attention of the Nodal Officer, at the Registered Office of the Company. The e-form can be downloaded from our website www.tatasteel.com under the ‘unclaimed dividend’ section and simultaneously from the website of Ministry of Corporate Affairs www.iepf.gov.in

Table Q: The status of dividend remaining unclaimed is given hereunder:

The Company has hosted on its website the details of the unclaimed dividend/interest/principal amounts for the Financial Year 2016-17 as per the Notification No. G S R 352 (E) dated May 10, 2012 of Ministry of Corporate Affairs. (As per Section 124 of the Companies Act, 2013).

Table R: Details of date of declaration & due date for transfer to IEPF

Shareholders are requested to get in touch with the RTA for encashing the unclaimed dividend/interest/principal amount, if any, standing to the credit of their account.

Nomination Facility

Shareholders whose shares are in physical form and wish to make/ change a nomination in respect of their shares in the Company, as permitted under Section 72 of the Companies Act, 2013, may submit to RTA the prescribed Forms SH-13/SH-14. The Nomination Form can be downloaded from the Company’s website www.tatasteel.com under the section ‘Investors’.

Shares held in Electronic Form

Shareholders holding shares in electronic form may please note that instructions regarding change of address, bank details, e-mail ids, nomination and Power of Attorney should be given directly to the DP.

Shares held in Physical Form

Shareholders holding shares in physical form may please note that instructions regarding change of address, bank details, e-mails ids, nomination and Power of Attorney should be given to the Company’s RTA i.e. TSR Darashaw Limited.

Updation of bank details for remittance of dividend/cash benefits in electronic form

The Securities and Exchange Board of India (‘SEBI’) vide its Circular No. CIR/MRD/DP/10/2013 dated March 21, 2013 (‘Circular’) to all listed companies requires them to update bank details of their shareholders holding shares in demat mode and/or physical form, to enable usage of the electronic mode of remittance i.e., National Automated Clearing House (‘NACH’) for distributing dividends and other cash benefits to the Shareholders.

The Circular further states that in cases where either the bank details such as Magnetic Ink Character Recognition (‘MICR’) and Indian Financial System Code (‘IFSC’), amongst others, that are required for making electronic payment are not available or the electronic payment instructions have failed or have been rejected by the bank, companies or their Registrars and Transfer Agents may use physical payment instruments for making cash payments to the investors. Companies shall mandatorily print the bank account details of the investors on such payment instruments.

Regulation 12 of the Listing Regulations, allows the Company to pay dividend by cheque or ‘payable at par’ warrants where payment by electronic mode is not possible. Shareholders to note that payment of dividend and other cash benefits through electronic mode has many advantages like prompt credit, elimination of fraudulent encashment/delay in transit and more. Shareholders are requested to opt for any of the above mentioned electronic modes of payment of dividend and other cash benefits and update their bank details:

- In case of holdings in dematerialised form, by contacting their DP and giving suitable instructions to update the bank details in their demat account.

- In case of holdings in physical form, by informing the Company’s RTA i.e., TSR Darashaw Limited, through a signed request letter with details such as their Folio No(s), Name and Branch of the Bank in which they wish to receive the dividend, the Bank Account type, Bank Account Number allotted by their banks after implementation of Core Banking Solutions (‘CBS’) the 9 digit MICR Code Number and the 11 digit IFSC Code. This letter should be supported by cancelled cheque bearing the name of the first shareholder.

Listing on Stock Exchanges

The Company has issued Fully and Partly paid Ordinary shares which are listed on BSE Limited and National Stock Exchange of India Limited in India. The annual listing fees has been paid to the respective stock exchanges.

Table S: ISIN details

Table T: International Listings of securities issued by the Company are as under:

Global Depository Receipts (‘GDRs’):

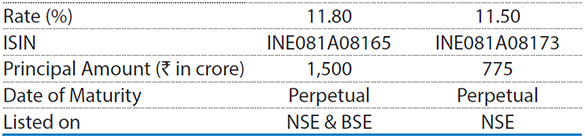

Table U(i): Perpetual Hybrid Securities in the form of Non-Convertible Debentures are listed on the Wholesale Debt Market segments of the Stock Exchanges as under:

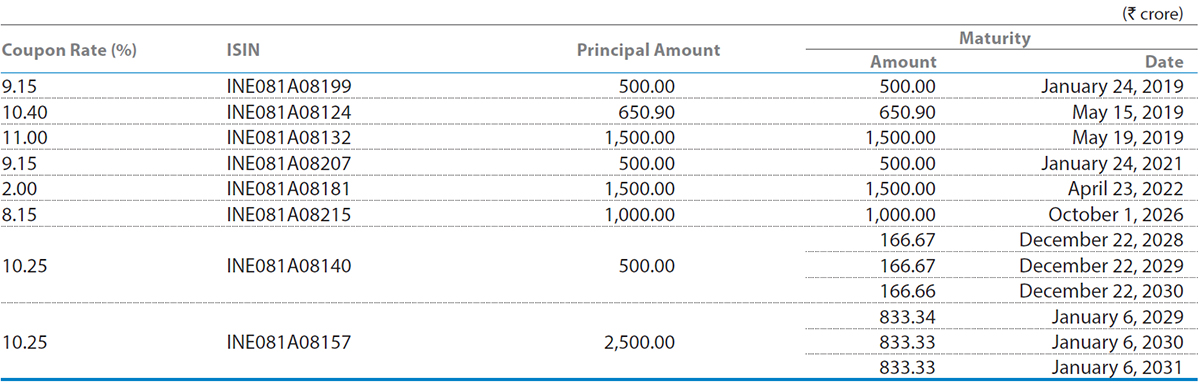

Table U(ii): Unsecured Redeemable Non-Convertible Debentures (‘NCDs’) are listed on the Wholesale Debt Market segment of the Stock Exchanges as under:

Market Information

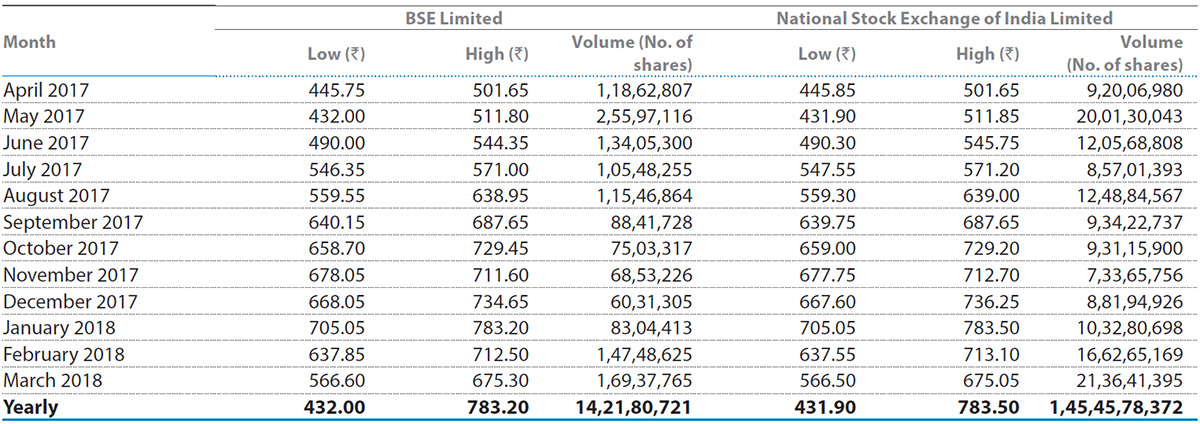

Table V: Market Price Data- High, Low (based on the closing prices) and volume during each month in last Financial Year of fully paid shares:

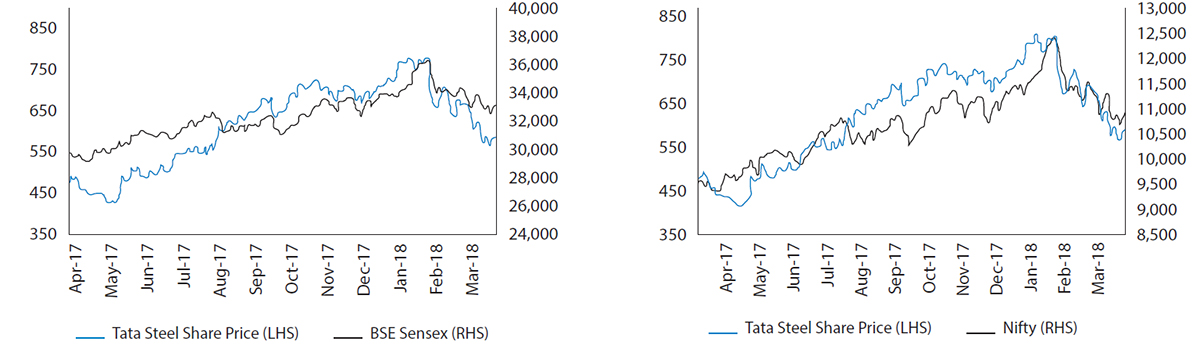

Tata Steel Fully Paid Share Price versus BSE Sensex/NIFTY

The Company’s shares are regularly traded on BSE Limited and National Stock Exchange of India Limited, as is seen from the volume of shares indicated in the Table containing Market Information.

Secretarial Audit

The Company’s Board of Directors appointed Parikh and Associates, Practising Company Secretaries Firm, to conduct the secretarial audit of its records and documents for the Financial Year 2017-18. The secretarial audit report confirms that the Company has complied with all applicable provisions of the Companies Act, 2013, Secretarial Standards, Depositories Act 1996, SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, SEBI (Prohibition of Insider Trading) Regulations, 2015 and all other regulations and guidelines of SEBI as applicable to the Company. The Secretarial Audit Report forms part of the Directors’ Report.

Green Initiative

As a responsible corporate citizen, the Company welcomes and supports the ‘Green Initiative’ undertaken by the Ministry of Corporate Affairs, Government of India, enabling electronic delivery of documents including the Annual Report, quarterly and half-yearly results, amongst others, to Shareholders at their e-mail address previously registered with the DPs and RTAs.

Shareholders who have not registered their e-mail addresses so far are requested to do the same. Those holding shares in demat form can register their e-mail address with their concerned DPs. Shareholders who hold shares in physical form are requested to register their e-mail addresses with the RTA, by sending a letter, duly signed by the first/sole holder quoting details of Folio Number.

Major Plant Locations:

Tata Steel Kalinganagar Plant

Tata Steel Limited

Kalinganagar Industrial Complex

Duburi, Dist. Jajpur

Odisha - 755026

Tata Steel Jamshedpur Plant

Tata Steel Limited

P.O. Bistupur

Jamshedpur - 831001

Cold Rolling Mill Complex, Bara

Tata Steel Limited

P.O. Agrico, P.S. Sidhgora

Block: Jamshedpur, Dist. Purbi Singhbhum

Pin - 831009

Tata Steel Growth Shop

Tata Steel Limited

Adityapur Industrial Estate,

P.O. Gamharia, Dist. Seraikela-Kharsawan

Pin - 832 108

Tata Steel Tubes Division

Tubes Division

Tata Steel Limited

P.O. Burma Mines

Jamshedpur - 831 007

Joda East Iron Mine

Joda Central Organisation

Tata Steel Limited, Joda

Dist. Keonjhar, Odisha - 758 034

Cold Rolling Complex (West)

Tata Steel Limited

Plot No S 76, Tarapur Industrial Area

P.O. 22, Tarapur Industrial Estate

District Palghar, Maharashtra - 401 506

Wire Division, Tarapur

Tata Steel Limited - Wire Division

Plot F8 & A6, Tarapur MIDC

P.O. Boisar, Dist. Palghar - 401 506

Wire Division, Indore

Tata Steel Limited - Wire Division

Plot 14/15/16 & 32 Industrial Estate

Laxmibai Nagar, Fort Indore

Madhya Pradesh - 452 006

Wire Division, Pithampur

Tata Steel Limited-Wire Division

Plot 158 & 158A, Sector III

Industrial Estate, Pithampur

Madhya Pradesh - 454 774

Bearings Division

Tata Steel Limited

P.O. Rakha Jungle

Nimpura Industrial Estate

Kharagpur, West Bengal - 721 301

Chromite Mine, Sukinda

Tata Steel Limited - Sukinda

Chromite Mine

P.O. Kalarangiatta, Dist. Jajpur

Odisha - 755 028

Noamundi Iron Mine

Tata Steel Limited

West Singhbhum, Noamundi

Jharkhand - 833 217

Ferro Alloys Plant

Tata Steel Limited

P.O. Bamnipal, Dist. Keonjhar

Odisha - 758 082

Joda West Manganese Mines

Tata Steel Limited

P.O. Bichakundi, Joda, Dist. Keonjhar

Odisha - 758 034

Bamebari Manganese Mines

Tata Steel Limited

P.O. Polaso ‘Ka’, Via: Joda, Dist. Keonjhar,

Odisha - 758 036

Gomardih Dolomite Quarry

Tata Steel Limited

P.O. Tunmura, Dist. Sundergarh

Odisha-770 070

Jharia Division

Tata Steel Limited

Jamadoba, Dhanbad

Jharkhand - 828 112

West Bokaro Division

Tata Steel Limited

Ghatotand, Dist. Ramgarh

Jharkhand - 825 314

Hooghly Met Coke Division

Tata Steel Limited

Patikhali, Haldia, Purba

Medinipur, West Bengal - 721 606

Ferro Alloy Plant, Joda

Tata Steel Limited - Joda

Dist. Keonjhar, Odisha - 758 034

Ferro Chrome Plant

Tata Steel Limited - Gopalpur Project

P.O. Chamakhandi, Chatrapur Tahsil

Dist. Ganjam, Odisha - 761 020

Investor Contact:

Registered Office:

Bombay House, 24, Homi Mody Street,

Fort, Mumbai-400 001.

Tel.: +91 22 6665 8282; Fax: +91 22 6665 7724

E-mail: cosec@tatasteel.com

Website: www.tatasteel.com

Corporate Identity Number -

L27100MH1907PLC000260

Name, designation & address of Compliance Officer:

Mr. Parvatheesam K, Company

Secretary

Bombay House, 24, Homi Mody Street,

Fort, Mumbai-400 001.

Tel.: +91 22 6665 7279; Fax: +91 22 6665 7724

E-mail: cosec@tatasteel.com

Name, Designation & Address of Investor Relations Officer:

Mr. Sandep Agrawal,

Head - Group Investor Relation

One Forbes, 6th Floor, 1, Dr. V. B. Gandhi

Marg, Fort, Mumbai-400 001.

Tel.: +91 22 6665 0530; Fax: +91 22 6665 0598

E-mail: ir@tatasteel.com

Registrars and Transfer Agents:

TSR Darashaw Limited

Unit: Tata Steel Limited,

6-10, Haji Moosa Patrawala Industrial Estate,

Nr. Famous Studio, 20, Dr. E Moses Road,

Mahalaxmi, Mumbai-400 011.

Contact Person: Ms. Mary George

Tel.: +91 22 6656 8484/8411/8412/8413

Fax: +91 22 6656 8494

Timings: Monday to Friday,

10 a.m. to 3.30 p.m.

E-mail: csg-unit@tsrdarashaw.com

Website: www.tsrdarashaw.com

Luxembourg Stock Exchange

35A Boulevard Joseph II

L-1840 Luxembourg,

Tel: (+352) 4779361

Fax: (+352) 473298

Website: www.bourse.lu

London Stock Exchange

10 Paternoster Square,

London - EC4M 7LS

Tel: (+44) 20 7797 1000

Website: www.londonstockexchange.com

Central Depository Services (India)

Limited

Marathon Futurex, A-Wing, 25th Floor,

NM Joshi Marg,

Lower Parel (East), Mumbai-400013.

Tel.: +91 22 2305 8640/8642/8639/8663

E-mail: helpdesk@cdslindia.com

Investor Grievance:

complaints@cdslindia.com

Website: www.cdslindia.com

Stock Exchanges:

BSE Limited

Phiroze Jeejeebhoy Towers,

Dalal Street, Mumbai-400 001.

Tel.: +91 22 2272 1233; Fax: +91 22 2272 1919

Website: www.bseindia.com

National Stock Exchange of India Limited

Exchange Plaza, Plot No. C/1,

G Block Bandra-Kurla Complex,

Bandra (E), Mumbai-400 051.

Tel.: +91 22 2659 8100; Fax: +91 22 2659 8120

Website: www.nseindia.com

Depository Services:

National Securities Depository Limited

Trade World, A Wing, 4th & 5th Floors,

Kamala Mills Compound,

Lower Parel, Mumbai-400 013.

Tel.: +91 22 2499 4200; Fax:+91 22 2497 6351

E-mail: info@nsdl.co.in

Investor Grievance: relations@nsdl.co.in

Website: www.nsdl.co.in

Debenture Trustee:

IDBI Trusteeship Services Limited

Asian Building, Ground Floor,

17, R. Kamani Marg, Ballard Estate,

Mumbai-400 001.

Tel.: +91 22 4080 7000; Fax:+91 22 6631 1776

E-mail: itsl@idbitrustee.com

Website: www.idbitrustee.com

Details of Corporate Policies

PRACTISING COMPANY SECRETARIES’ CERTIFICATE ON CORPORATE GOVERNANCE

To The Members of

Tata Steel Limited

We have examined the compliance of the conditions of Corporate Governance by Tata Steel Limited (‘the Company’) for the year ended on March 31, 2018, as stipulated under Regulations 17 to 27, clauses (b) to (i) of sub-regulation (2) of Regulation 46 and para C, D & E of Schedule V of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘SEBI Listing Regulations’).

The compliance of the conditions of Corporate Governance is the responsibility of the management. Our examination was limited to the review of procedures and implementation thereof, as adopted by the Company for ensuring compliance with conditions of Corporate Governance. It is neither an audit nor an expression of opinion on the financial statements of the Company.

In our opinion and to the best of our information and according to the explanations given to us, and the representations made by the Directors and the management, we certify that the Company has complied with the conditions of Corporate Governance as stipulated in the SEBI Listing Regulations for the year ended on March 31, 2018.

We further state that such compliance is neither an assurance as to the future viability of the Company nor of the efficiency or effectiveness with which the management has conducted the affairs of the Company.

|

For Parikh & Associates Practising Company Secretaries sd/- P. N. PARIKH FCS No.: 327 CP No.: 1228 |

Mumbai, May 16, 2018