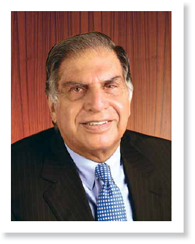

Chairman’s Statement

Steel has been and will be, the basic foundation material for national growth and the industry will continue to be an important ingredient in a global economic recovery.

Ratan N. Tata, Chairman

Dear Shareholder,

Following two years of the worst global economic downturn in most peoples’ living memory, the world seems to be regaining some economic stability but with some dramatic shifts in concentration of economic strength. The growth rates in the economies of the developed world are still extremely moderate, while countries in the developing world have registered high levels of economic growth and some have become new centres of global capacity, demand and control over natural resources.

In the developed world, there are definite signs of a recovery in the United States. Continental Europe is seeing a much more modest level of economic revival with some concerns about its sustainability. In the United Kingdom, a recovery is yet to take place.

By contrast, in the developing world, China, India, Brazil and certain Asian countries are registering very strong and sustainable economic growth with robust domestic markets. In 2025, it is forecast that the BRIC countries will have 42% of the global population, will consume 60% of the global production and will have 70% of the global GDP.

The steel industry has also been impacted by these global shifts. The requirement of steel is growing in Asia, where downstream user industries are experiencing high demand, whereas the markets for steel in the United Kingdom and Continental Europe have remained depressed. Major iron ore and coking coal resources have continued to be controlled by three companies which continue to opportunistically elevate prices that can never be passed on to the customer in these depressed times. One hopes that better sense prevails and a more responsible perspective is adopted by these mining companies, so as to enable an economic recovery to take place at this crucial time rather than drive the world into another collapse due to the spiraling cost of basic materials.

Through these difficult times, Tata Steel has struggled to adhere to its long-term strategies, both in India and overseas. There has nevertheless been need to re-schedule and re-prioritise investment strategies in consonance with market conditions during this period.

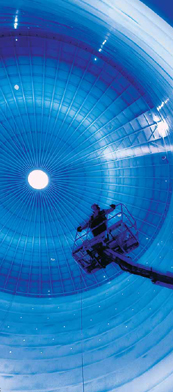

In India, the Company has given top priority to the 2.9 million tonne expansion programme at its Jamshedpur Works and its major greenfield 6 million tonne integrated steel plant in Orissa. Tata Steel Asia has steelmaking and finishing facilities in various Asian countries (including India) aggregating 10.5 million tonnes. Equal importance has been given to raw material security through the acquisition of iron ore and coal resources overseas to feed its UK and European plants, while rationalising capacities to make them viable in this period of slack demand.

Some of the decisions have been hard and some of the actions have been painful. Nevertheless, these were necessitated in order for the overall enterprise in the UK and Europe to survive. While Tata Steel’s Indian operations have remained profitable, albeit at a lower level than the previous year, Tata Steel’s European operations remained underutilised and hence unprofitable. However, with the rationalisation, the European operations have become EBITDA positive for the last two quarters. The benefits of the rationalisation will of course be more evident in the coming year.

As the economies of several nations return to normalcy, the demand for steel-based goods will undoubtedly grow. This is already starting to be evident in automotive products, building construction and large infrastructure projects. Steel has been and will be, the basic foundation material for national growth and the industry will continue to be an important ingredient in a global economic recovery. The concentration of economic growth rates, manufacturing capacities, market size and control over natural resources will shift markedly towards Asia, Latin America and the CIS countries. China, India and Brazil will become important centres of economic growth in the coming decade.

In the coming years, Tata Steel expects to emerge as a global steel producer with a total annual output of between 40-50 million tonnes, with major manufacturing plants in India, several countries in Asia, the UK and Continental Europe, supported by integrated mining operations in several geographies. Tata Steel has managed to weather the storm and the Company looks forward to the opportunity of fulfilling its objective of being a viable and innovative international steel producer in the years ahead.

Chairman

Mumbai, 31st May, 2010