Cashflow from operations

Tata Steel prioritises strategic capital allocation, drives operational efficiency, and manages debt effectively to ensure long-term sustainable returns for its stakeholders.

Financial Capital

Tata Steel’s financial strategy is focused on strategic capital allocation, cost leadership, cashflow maximisation and capital structure optimisation to maximise return on capital employed over the long-term. This strategy balances investment for growth in India with investment for sustaining and improving performance of existing assets including decarbonisation in Europe, while maintaining a resilient balance sheet which can weather the inherent cyclicality of the steel business.

Generation of capital

In FY2024-25, Tata Steel generated consolidated revenues of ₹2,18,543 crore, with EBITDA rising to ₹25,802 crore from ₹23,402 crore in the previous year. Our operating cash flows for the year increased by 16% y-o-y to ₹23,512 crore, driven by strong performance in India and a recovery of production performance to rated capacity levels coupled with working capital optimisation in the Netherlands. NINL was another key contributor as it achieved ₹1,000 crore EBITDA during FY2024-25, reflecting an EBITDA margin of 19%, and free cash flow in excess of ₹1,000 crore even in these challenging market conditions.

Across its global footprint, structured programmes like Shikhar25 and Project LEAP in India, along with transformation initiatives in the UK and the Netherlands, have continued to deliver significant value. In FY2024-25, these efforts resulted in performance improvements and cost takeouts of ~₹6,600 crore, of which ~₹2,800 crore was in India, ~₹2,600 crore in the UK, and ~₹1,150 crore in the Netherlands. The Company also completed the mergers of Angul Energy Limited, Bhubaneshwar Power Private Limited, and the Indian Steel & Wire Products Limited with the parent entity. This corporate simplification aims to unlock synergies, streamline operations, and enable better capital efficiency.

As part of long-term fund raising, the Company issued and allotted Unsecured, Rated, Listed, Redeemable and Non-Convertible Debentures (NCDs) aggregating to ₹3,000 crore, to identified investors on a private placement basis. Tata Steel also secured a $750 million External Commercial Borrowing (ECB) and raised term loans of ~₹10,000 crore.

Tata Steel continues to be rated as Investment Grade by global credit rating agencies, including Moody’s Baa3 (Stable), S&P BBB (Stable), and India Ratings IND AAA (Stable). It remains the only Indian steel company with investment-grade ratings from both international and domestic credit rating agencies, reflecting improved financial health, prudent leverage, and consistent cash flow generation. The upgrade strengthens the Company’s access to capital markets and enhances investor confidence, which would lead to reduced finance costs.

Baa3 (Stable) Rated by Moody’s

BBB (Stable) Rated by S&P

IND AAA (Stable) Rated by India Ratings

Cold Rolling Mill Complex, Tata Steel Kalinganagar

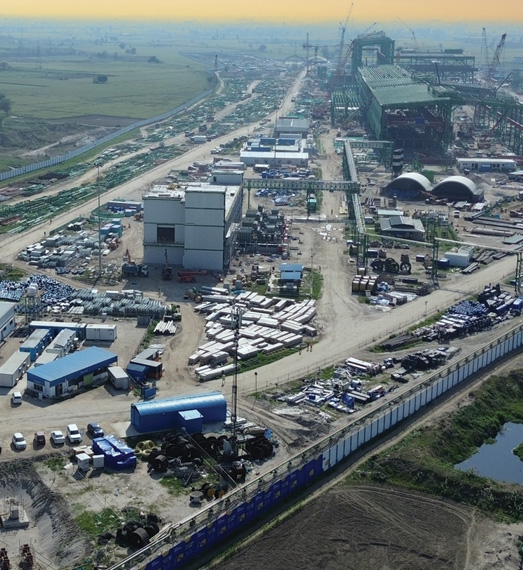

Ludhiana EAF Project

Deployment of capital

During FY2024-25, Tata Steel incurred a consolidated capital expenditure of ₹15,671 crore. In India, key investments included the Kalinganagar Phase II expansion, the Combi Mill project at Jamshedpur and the 0.75 MTPA EAF project in Ludhiana, Punjab. In Europe, Tata Steel UK progressed towards transitioning its Port Talbot facility to low-emission steelmaking, securing planning permissions for beginning construction of the EAF project from July 2025.

Tata Steel follows a progressive dividend policy, targeting an annual dividend payout of up to 50% of profit after tax, subject to internal and external considerations. This policy underscores the Company’s intent to share profits consistently with shareholders while investing in long-term growth. For FY2024-25, a dividend of ₹3.60 per share has been recommended, reinforcing Tata Steel Board's confidence in the Company’s performance and strategy.

Management of capital

Tata Steel remains committed to maintaining a healthy capital structure, ensuring balance sheet resilience and access to capital at competitive terms. Key levers include flexible terms of financing appropriate mix of longterm and short-term and diversified sources of capital. As of March 31, 2025, the Company’s Net Debt stood at ₹82,579 crore, with Net Debt to EBITDA at 3.2x, post deleveraging of ~₹6,200 crore in the last six months of the FY2024-25. Tata Steel is committed towards continuing to pursue further deleveraging based on cashflows.

Outlook

For FY2025-26, Tata Steel plans a capital expenditure of ~₹15,000 crore, with nearly 75% allocated in India. Key investments include the completion of TSK expansion, the Ludhiana EAF project, and initiatives to improve asset reliability and efficiency. In Europe, the Company will continue capital deployment to transition the Port Talbot facility to low-emission steelmaking, supported by £500 million in government funding, with design and regulatory approvals progressing. Efforts in the Netherlands focus on securing financial and policy support for decarbonisation and environmental initiatives.

The Company is targeting ₹11,500 crore in cost savings during FY2025-26, with ₹4,000 crore expected from India through improvements in operating KPIs, workforce productivity, and supply chain efficiency. The UK business aims to reduce fixed costs from £995 million in FY2023-24 to £540 million in FY2025-26, while Tata Steel Nederland targets €500 million in savings in FY2025-26 through volume growth and operational improvements.

Financial management will emphasise continued deleveraging, strategic capital allocation for business accretion, refinancing to reduce interest costs, working capital optimisation, and leveraging technology to improve asset health and process efficiency.