Management Discussion and Analysis

The following operating and financial review is intended to convey the Management’s perspective on the financial and operating performance of the Company at the end of Financial Year 2016-17. This Report should be read in conjunction with the Company’s financial statements, the schedules and notes thereto and the other information included elsewhere in the Integrated Report. The Company’s financial statements have been prepared in accordance with Indian Accounting Standards (‘Ind AS’) complying with the requirements of the Companies Act, 2013 and guidelines issued by the Securities and Exchange Board of India (‘SEBI’).

This report is an integral part of the Directors’ Report. Aspects on industry structure and developments, opportunities and threats, outlook, risks, internal control systems and their adequacy, material developments in human resources and industrial relations have been covered in the Directors’ Report. Your attention is also drawn to sections on Strategy forming part of the Integrated Report. This section gives significant details on aspects mentioned above.

1. Tata Steel India

(i) Operations

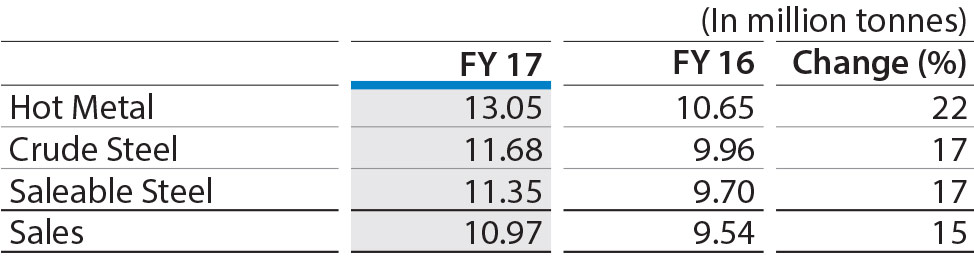

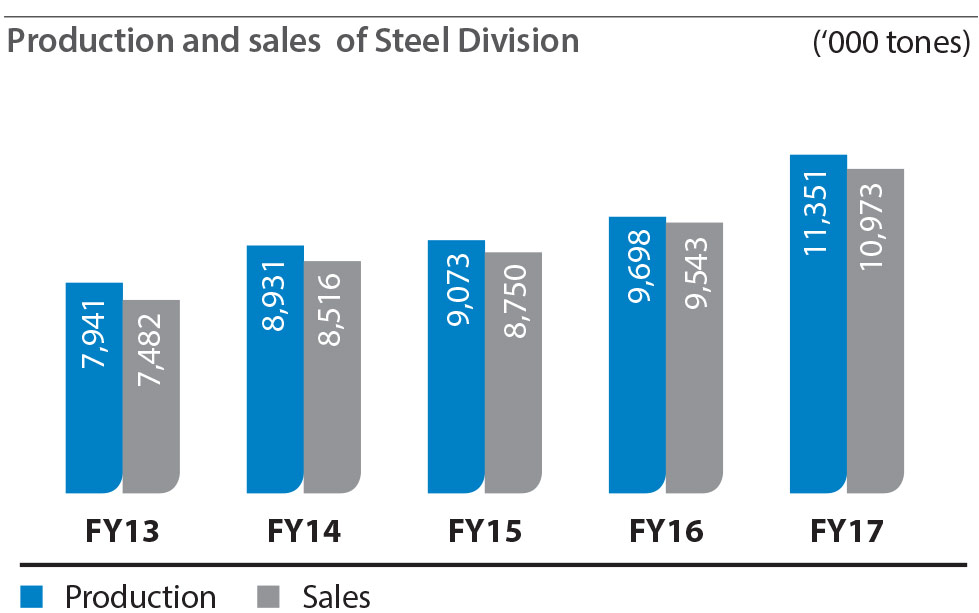

The saleable steel production and sales trend over the years is as follows:

Tata Steel Jamshedpur (TSJ)

During Financial Year 2016-17, the saleable steel production stood at 9.71 million tonnes which is same as that of previous year. The hot metal production for the financial year was at 10.83 million tonnes which is 1.60% higher over previous year. This stable performance was due to consistent supply of desired quality of raw materials from captive mines, use of low ash imported coking coal, consistent supply of energy, utilities and better plant yield. The Company has cross functional continuous improvement programs through Total Quality Management methodologies and Shikhar25 (accelerated improvement program). The key operational improvements during Financial Year 2016-17 over previous year are reduction in coke rate, lime consumption, refractory consumption, increase in pulverised coal and tar injection and other improvements.

Tata Steel Kalinganagar (TSK)

Tata Steel has set-up Phase 1 of the state-of-the-art 3MnTPA capacity steel plant at Kalinganagar. Trial run of the major facilities started in the last quarter of Financial Year 2015-16 and the commencement of commercial production started from May 2016.

The process route for the plant is Blast Furnace, Basic Oxygen Furnace, Continuous Caster, Hot Strip Mill and the product mix is Hot Rolled Coils and plates.

The Phase 1 of the plant consists of a 3.3 million tonnes Blast Furnace (4,330 cubic metre capacity), Two Coke Ovens- stamp charged gas recovery type batteries of 1.5 million tonnes of gross coke, Sinter plant with a gross production capacity of 5.75 million tonne, Steel Melting Shop with the largest converter in India (310 Tonne) and Hot Strip Mill having two roughing mills along with seven strands – all duly commissioned.

The facility is a testimony to technological excellence. Technologies that are unique in Kalinganagar Plant include Composition Adjustment System with Oxygen Blowing process for secondary refining in steel making, Twin Caster for steel casting, Twin Tippler for Raw Material handling and Granshot production from Hot Metal. Hot Strip Mill is designed to produce High Strength Steel in various segments with wide range of product features (up to 1200MPa tensile strength, 2050 mm width and 25 mm thickness of Hot Rolled Coils). The plant is provided with Waste Recycling Plant and Central Effluent Treatment Plant to conserve natural resources. Gas based Captive Power Plants maximize power generation using the by-product gases generated in the plant operations.

The Financial Year 2016-17 was defining for TSK. Ramp-up of all the major facilities was ahead of the plan and the plants reached very high levels of capacity utilization. The production volumes reached by the various plants are - Coke Plant - 1.3 million tonnes of Gross Coke, Blast Furnace - 2.2 million tonnes hot metal, Steel Melting Shop - 1.68 million tonnes crude steel, and Hot Strip Mill - 1.78 million tonnes of Hot Rolled Coils with rolling of additional slabs transferred from Jamshedpur Plant and procured from outside. Sales volume achieved during Financial Year 2016-17 was 1.6 million tonnes of Hot Rolled Coils. The quality ramp-up in steel making and rolling also remained ahead of the plan. The product mix comprised of low carbon grades, medium & high carbon grades, and peritectic grades, which served different market segments, such as LPG, Tube making, Tin plating, Construction & Projects, Lifting and Excavation, Automotives, Heavy Engineering, etc. The plant is poised to produce Advanced High Strength Steels (‘AHSS’) grades like CR Grades, high strength LPG grade, high strength grades for structural applications, special tube grades and automotive grades.

(ii) Marketing and Sales Initiatives

During the year, our Steel Business achieved highest ever sales volume of 10.97 MT, registering a growth of ~15% over the previous year’s sales of 9.54 MT as against industry growth of ~3%. This growth is attributable to the ramp-up of our Kalinganagar plant.

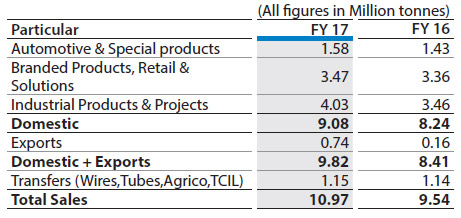

The break-up of sales in our various segments and the break-up of domestic sales to exports is as follows:

Automotive and Special Products: Achieved best ever sales in the Automotive segment. Currently, the Company occupies 44% of the market in this segment. Sales increased by ~9% over the previous year while the industry growth stood at ~6%. This was achieved through various initiatives such as Value Analysis & Value Engineering (‘VAVE’) workshops, organizing Milestone Celebration Activities, engagement with Auto OEMs, etc. The Company organized the 6th Edition of its biennial Auto Steel Knowledge Summit - “Driving Steel” in Kuala Lumpur, Malaysia which saw 155 participants from 9 countries. The Company has been recognized and awarded with ‘Outstanding Support in Sales Promotion’ by Honda Motors, ‘Excellence Award’ by Maruti Suzuki, ‘Overall Performance Award’ by Tata Motors and ‘Quality Certificate’ awarded by Toyota Kirloskar for achieving quality targets.

Branded Products, Retail and Solutions: Sales of branded products grew by ~3% in the Financial Year 2016-17 over the previous year. The Company achieved its highest ever B2C sales of 1.62 million tonnes, which include Tata Tiscon and Tata Shaktee brands. Tata Steel’s sales to Small and Medium Enterprises (‘SME’) segment (including brands of Astrum, Steelium & Galvano) also achieved the highest ever sales of 1.85 million tonnes in 2016-17. Tata Shaktee and Tata Tiscon have been adjudged as ‘Consumer Super brand’ for 2016-17 for third and fourth time in a row respectively by Super Brands India Pvt. Ltd. In addition to above, Tata Tiscon won ‘Asia’s Most Admired Brand’ in Infrastructure category by World Consulting & Research Corporation, India’s leading brand equity management and consulting firm.

Industrial Products, Projects and Exports: The Company continued the journey towards increasing the value added sales with a highest ever sales in LPG segment at 0.36 million tonnes. The Company achieved a market share of 47% coupled with almost a 5 fold jump in sales to new segments such as Pre-engineered Building, Construction & Projects, Lifting & Excavation and Oil & Gas segment. Industrial Products business (including exports) vertical has registered a growth of 32% and our focused efforts towards enhancing its presence in international geographies has resulted in best ever exports of 0.74 MnT (previous best 0.55 MnT in FY 2009).

As a recognition for its efforts towards achieving excellence, the Company was bestowed the ‘6th Engineering Procurement Construction’ awards in the ‘Outstanding Company in Steel’ category for its exceptional contribution towards infrastructure and construction sector. The Company was also awarded with the ‘Best in Quality Product’ by the 9th Annual Franchise India and Magppie Estate Awards.

(iii) Ferro Alloys and Minerals Division

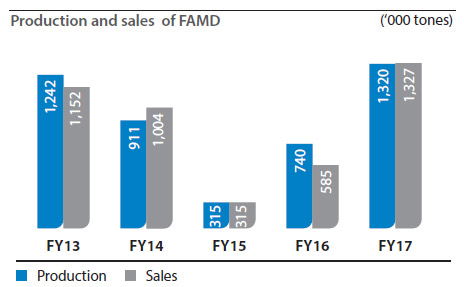

Our Ferro Alloys and Minerals Division (‘FAMD’) is amongst the top six chrome alloy producers globally with operations spanning across two continents. In India, it is the largest producer of ferro chrome and also one of the leading manganese alloy producer. During the year, there was a sudden increase in demand for stainless steel due to growth in global economy.

However, the supplies of ferro chrome and chrome ore was not geared up. This led to steep hike in international prices. The Company increased ferro chrome production through new ferro processing centres and sale at spot prices across different markets and different grades.

FAMD achieved a production of 1,320 KMT as against 740 KMT in the previous year.

In February 2017, our first greenfield Ferro Chrome Plant at Gopalpur commenced production. Our Chromite Mine at Sukinda became the first unit to obtain Integrated Management Systems (‘IMS’) certification. (ISO 9001:2015, ISO 14001:2015 and OHSAS 18001:2007).

(iv) Tubes Division

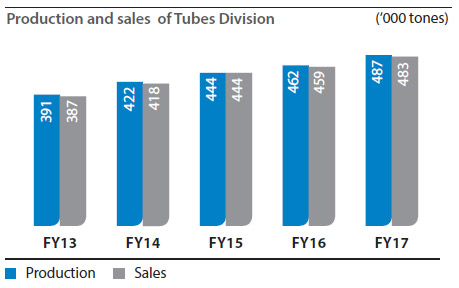

Our Tubes Strategic Business Unit (‘SBU’) is a leading manufacturer of pipes and tubes having its manufacturing facility at Jamshedpur. The division has an annual production capacity of ~5 lakh metric tonnes. The three main lines of businesses are conveyance tubes (Tata Pipes), structural tubes (Tata Structura) and precision tubes for auto and boiler segments.

During the year, the Tubes SBU achieved 5% growth in sales over the previous year. Tata Structura grew 10% and this was mainly due to improved demand in the construction segment. We also undertook measures to sustain the price in the market that resulted in higher sales revenue.

The division has undertaken digital initiatives and developed new products like differentiated blue coloured thin organic coated tubes for better corrosion protection, medium/heavy structural steel segment.

(v) Bearings Division

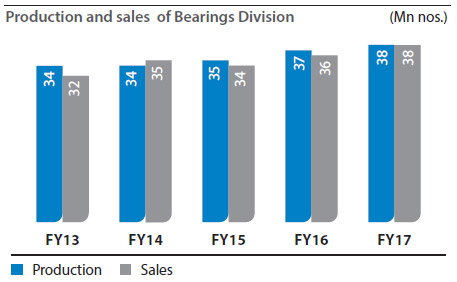

Our Bearings Division is one of the India’s largest quality bearing manufacturers, having manufacturing facility at Kharagpur. The division has an annual production capacity of 40 million bearing numbers. It is the only bearings manufacturer in India to win the TPM Award (2004) from Japan Institute of Plant Maintenance, Tokyo. The division is also certified with ISO/TS16949, OHSAS, ISO14001 and ISO9001:2008 certifications for all its systems and processes. We are foremost in the manufacturing of a wide variety of bearings and auto assemblies and product range includes Ball Bearings, Taper Roller Bearings, Hub Unit Bearings, Clutch Release Bearings, Double Row Angular Contact Bearings, Centre Bearings and Magneto Bearings.

The division attained 5% growth in sales over previous year mainly due to increased off-take by two wheeler and channel segments. The division has also improved plant availability by de-bottlenecking and leveraging its existing resources for sustainable operations.

The division has won number of awards and accolades - “Bosch Supplier Award-2016, India Region” for superior quality (<50 parts per billion for last 2 years) for excellent delivery performance, “Self Certified Supplier” recognition from Mitshubishi Heavy Industries – VST Diesel Engine Pvt Ltd.

2. Tata Steel Europe

Global GDP grew at 2.3% in 2016, the eurozone economy grew by 1.7%, which was slightly lower than in 2015 (2.0%). In order to avoid a deflationary environment the European Central Bank extended the quantitative easing programme causing a further depreciation of the euro. The UK economy grew by 1.8% in 2016 (2.2% in 2015). The impact of the UK referendum to leave the European Union (‘Brexit’) has to date been modest. The most significant development has been the depreciation of the pound against major currencies including the euro and the US dollar. Growth in China again decelerated in 2016 to 6.7% (2015 : 6.9%). The Government is seeking to transform the economy from being investment led to become more consumer driven, as its cost advantage is being eroded.

The steel industry is a highly cyclical industry. Financial performance is affected by general macroeconomic conditions that set the demand from the downstream steel using industries, as well as by available global production capacity and exchange rates relativities. As integrated steel players seek to maintain high capacity utilisation, changes in margins across regions lead to changes in the geographical sales pattern. In addition to market developments in the UK and mainland Europe, changes in the global market for steel influence the financial performance of Tata Steel Europe (‘TSE’). TSE is continuously undertaking strategic initiatives to maintain its ability to successfully compete in the long term.

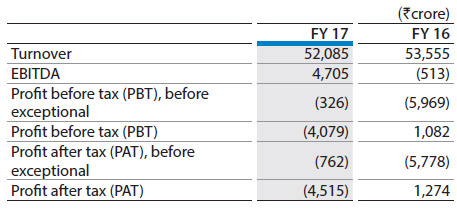

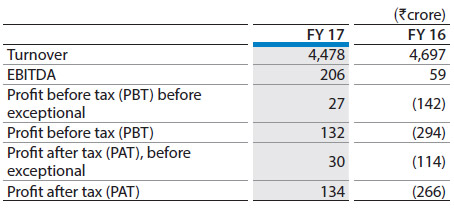

The turnover and profit/loss figures of TSE (continuing operations) are given below:

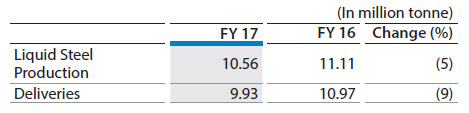

The production and sales performance of TSE (continuing operations) is given below:

TSE’s revenue of `52,085 crore for the Financial Year 2016-17 was 3% lower than the previous year in rupee terms.

However in GBP terms (TSE’s reporting currency) it was higher by 9% attributable to 20% increase in average revenue per tonnes on account of recovery to European Union (‘EU’) steel selling prices and benefit from depreciation of sterling following Brexit. These gains were partly offset by a 9% decrease in deliveries caused by lower production.

TSE reported lower loss (before exceptional items) from continuing operations mainly on account of stronger market conditions, currency tailwinds, restructuring of UK operations as well as the ongoing improvement programmes, including the supply chain transformation programme which went live during the year. Exceptional items including non cash pension curtailment charges aggregating to `3,753 crore resulted in a loss of `4,515 crore from continuing operations.

Liquid steel production during the year was 0.55MnT lower than the previous year mainly due to restructuring measures implemented in the UK to reduce production levels to rationalise costs and focus on higher margin business.

Post restructuring, TSE’s facilities at IJmuiden, Netherlands and Port Talbot, UK, produce carbon steel by the basic oxygen steelmaking method.

Strip Products Mainland Europe: During the year, the liquid steel production at IJmuiden Steel Works, Netherlands was at 6.9MnT which was 0.2MnT lower than the previous year. The decline was due to operational issues in the Blast Furnaces and Basic Oxygen Steelmaking. Record annual outputs of 1MnT were achieved at Cold Mill 22 and 0.6MnT at Hot Dipped Galvanised 3. The plant has undertaken improvement initiatives on cost reduction, business specific improvement plans and securing access to cost effective raw materials.

During the year the business progressed its ‘Sustainable Profit’ programme which is targeting improvements to delivery and yield performance, and reductions to operating costs and unplanned downtime. Further progress was also achieved in the ‘Strategic Asset Roadmap’ (‘STAR’) capital investment programme which will support the strategic growth of differentiated, high value products in the automotive, lifting & excavating and energy & power market sectors.

Strip Products UK: During the year, liquid steel production at the Port Talbot Steel Works at 3.6MnT, was 0.4MnT lower than the previous year. The decline was due to restructuring measures implemented in the UK in order to focus on higher value products. Record annual outputs were achieved in Port Talbot during the year on the following installations: 1.8MnT at Caster 3 (previous record in FY16 1.7MnT), 3.3MnT at the Hot Strip Mill (previous record in FY16 3.2MnT) and 1.2MnT in the Link (marginally higher than the previous record in FY16). In the Llanwern site the Zodiac line maintained production at the record level of 0.5MnT (unchanged from the previous year) but with a record level of 92% of automotive grades compared to 81% in Financial Year 2015-16. During the year the business progressed the ‘Delivering Our Future’ transformation programme, which is targeting increased customer value and a reduction to operating costs, and also initiated the first phase of the ‘Supply Chain Transformation’ programme.

3. NatSteel Holdings

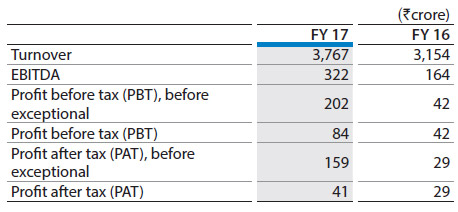

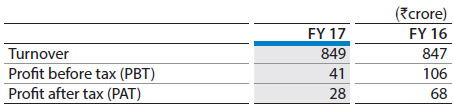

The turnover and profit/loss figures of NatSteel Holdings (‘NSH’) for Financial Year 2016-17 are as follows:

During the year, NSH recorded total deliveries of 1.35 million tonnes as against 1.55 million tonnes in the previous year. This led to lower revenues. In the current year, domestic demand in the steel bars remained weak due to sluggish construction market which led to lower volumes.

The improvement in profit is mainly due to increased profitability from NatSteel Singapore Upstream Business and reduced losses at China operations owing to closure of Xinhai operations in September 2015.

4. Tata Steel Thailand

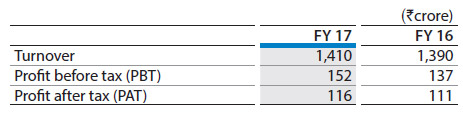

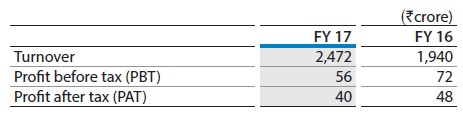

The turnover and profit/loss figures of Tata Steel Thailand (‘TSTH’) for Financial Year 2016-17 are as follows:

TSTH sales volume stood at 1,262 Kt, an increase of 10% over the previous year. This is primarily on account of increase in private consumption supported by stimulus measures from the Government. The turnover increased by 19% over the previous year, due to increase in commodity prices. The increase in TSTH profits is attributable to better operating performance, reduction in conversion cost, cost improvement initiatives, optimisation of spares and consumables inventory.

During the year, the Siam Construction Steel Company Ltd. (‘SCSC’) plant of TSTH won the prestigious Prime Minister’s Industry Awards 2016 on Safety Management. TSTH won the “Thailand ICT Excellence Award 2017” on “Digital to Accelerate Performance Enhancement”.

5. Tata Metaliks Limited

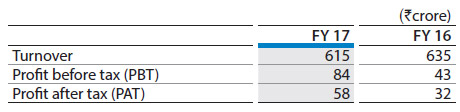

The turnover and profit/loss figures of Tata Metaliks Limited (‘TML’) for Financial Year 2016-17 are as follows:

TML has its manufacturing plant at Kharagpur, which produces annually 3 lakh tonnes of pig iron and 2 lakh tonnes of ductile iron pipes. Pig iron is marketed in the brand name ‘Tata eFee’ (world’s first brand) and ductile iron pipe is marketed in the brand name ‘Tata Ductura’.

During the year, the production and sale of ductile iron pipes increased by 41% and 40% respectively as compared to the previous year. The profits of current year are higher as compared to previous year primarily due to lower operating cost and higher volumes of ductile iron pipes off-set by higher operating cost and lower volumes of pig-iron.

During the year, TML took following strategic measures:

- Amalgamation of its subsidiary, Tata Metaliks DI Pipes Limited to realise greater synergies;

- Capacity expansion of DI pipe plant by installing a new casting machine and a finishing line;

- Coke Oven Project on BOOT (‘Build Own Operate Transfer’) basis having a capacity of 10,000 tonnes/month of blast furnace grade coke;

- 10 MW Power Plant utilizing the exhaust flue gases from Coke Ovens; and

- Modernization and expansion of mini-blast furnace.

6. The Tinplate Company Of India Limited

The turnover and profit/loss figures of The Tinplate Company of India Limited (‘TCIL’) for Financial Year 2016-17 are as follows:

TCIL is the largest indigenous producer of tin-coated and tin free steel used for metal packaging. TCIL has also been ‘value-adding’ its products by way of providing printing and lacquering facility to reach closer to food processors/ fillers. TCIL has two cold rolling mills and two electrolytic tinning lines. The installed annual production capacity of tinplate and tin-free steel is around 3.79 lakh tonnes.

During the year, the overall production from the two cold rolling mills was at 3.32 lakh tonnes, 3% higher than previous year (3.23 lakh tonnes). The annual production of tinning was at 3.21 lakh tonnes, 2% higher than previous year (3.14 lakh tonnes). The deliveries were lower by 2% due to cheaper imports and domestic competition which resulted in decline in turnover. The annual profits declined over previous year due to higher input cost and lower deliveries.

7. Tata Steel Processing And Distribution Limited

The turnover and profit/loss figures of Tata Steel Processing and Distribution Limited (‘TSPDL’) for Financial Year 2016-17 are as follows:

TSPDL is the largest steel service centre in India with a steel processing capacity of around 1.80 MTPA. It has ten steel processing units, several distribution locations and a host of partners like external processing agencies.

TSPDL has come a long way to be a leader in the steel service centre business in India. TSPDL has sustained its strong growth path with its commitment to quality processing, innovation and focus on value added services to its customers. TSPDL has an advanced state-ofthe- art Plate processing and Fabrication center at Tada in Andhra Pradesh aiming to cater to the specialized demand from various emerging engineering segments of the industry such as lifting and excavating, power equipment, wind energy, ship building, mining machinery, material handling equipment, boiler & steam generating plant, etc. TSPDL has undertaken several key initiatives such as setting up of new cold rolled hi-end coil slitting line at cold rolling plant at Jamshedpur, conduct of cold trials at wide cut to length line at Kalinganagar.

During the year, the profits of TSPDL declined on account of lower contribution from tolling business along with lower tolling compensation received from Tata Steel on account of lower volumes for Chennai Steel Servicing Centre (‘SSC’).

The flat processing and fabrication centre at Tada received OHSAS 18001:2007 certificate and the Pune unit achieved CII GreenCo Gold Certificate.

8. Tata Sponge Iron Limited

The turnover and profit/loss figures of Tata Sponge Iron Limited (‘TSIL’) for financial year 2016-17 are as follows:

TSIL is a manufacturer of sponge iron with an annual production capacity of 3.9 lakh tonnes and generates 26 MW of power through the waste heat recovery route. During the year, TSIL reported 3% decline in turnover due to 4% lower realisation from sponge iron.

TSIL has received Winners’ Award, Energy Management Award and SHE Commendation Certificate from Confederation of Indian Industries (Eastern Region).

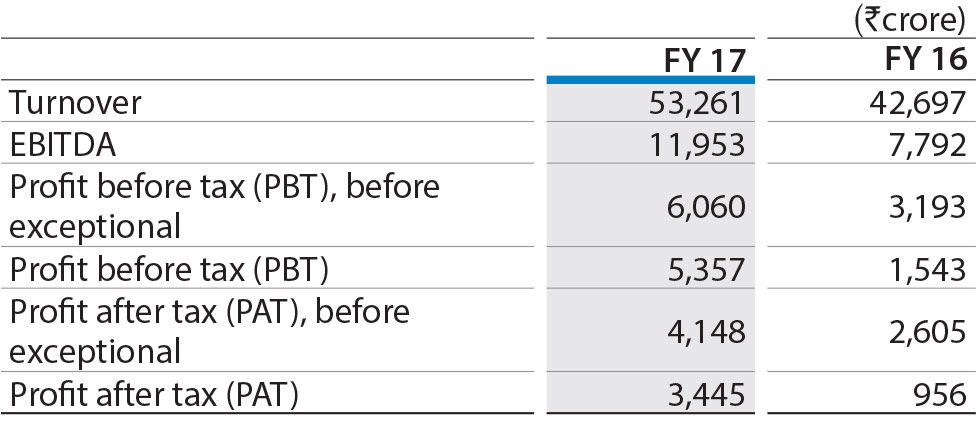

1. Tata Steel India

During the year, the Company recorded a profit after tax of `3,445 crore (previous year: `956 crore) on the back of supportive realisations, strong growth in deliveries, ramp-up of Kalinganagar plant and lower exceptional charges over previous year. The basic and diluted earnings per share were at `33.67 (previous year: `8.05).

The analysis of major items of the financial statements are given below:

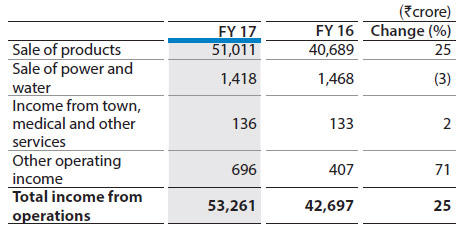

a) Net sales and other operating income

During the year, the overall turnover was higher as compared to the previous year. This was primarily due to commencement of operations at Tata Steel Kalinganagar (‘TSK’) in May 2016. The Ferro Alloys and Mineral Division (‘FAMD’) registered higher revenues owing to higher production of Chrome Concentrate and Ferro Chrome along with improved demand in the international market.

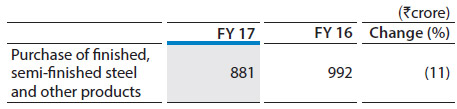

b) Purchase of finished, semi-finished steel and other products

During the year, the purchase of finished and semi-finished materials decreased as compared to the previous year. This was due to lower purchases of steel wire rods and imported rebars for resale.

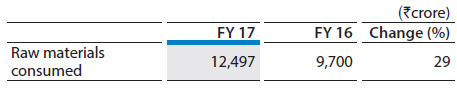

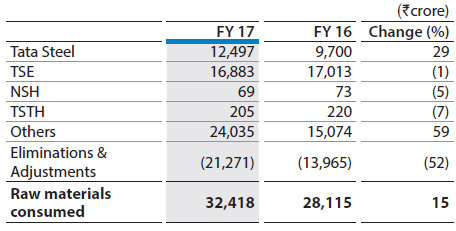

c) Raw materials consumed

During the year, the consumption of Raw Materials increased primarily due to commencement of production at TSK as well as higher cost of imported coal.

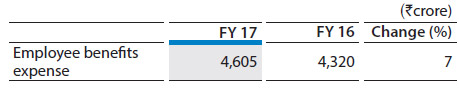

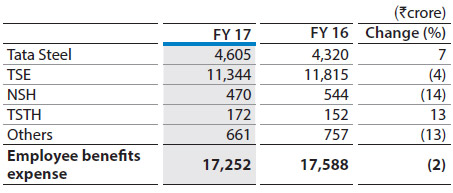

d) Employee benefits expense

During the year, the employee benefits expense increased as compared to the previous year. This was primarily on account of salary revisions and its consequential impact on the retirement provisions.

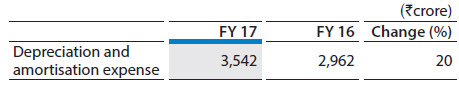

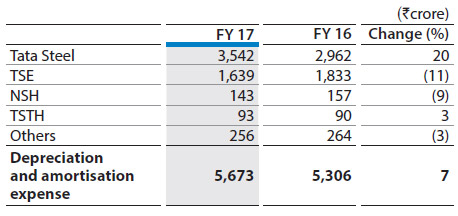

e) Depreciation and amortisation expense

The increase in depreciation is primarily due to commencement of operations at TSK, partly offset by impact of re-assessment of useful life of asset effective April 1, 2016.

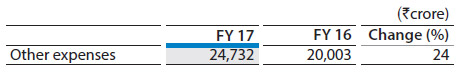

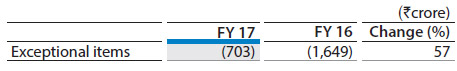

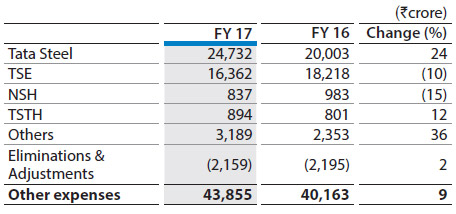

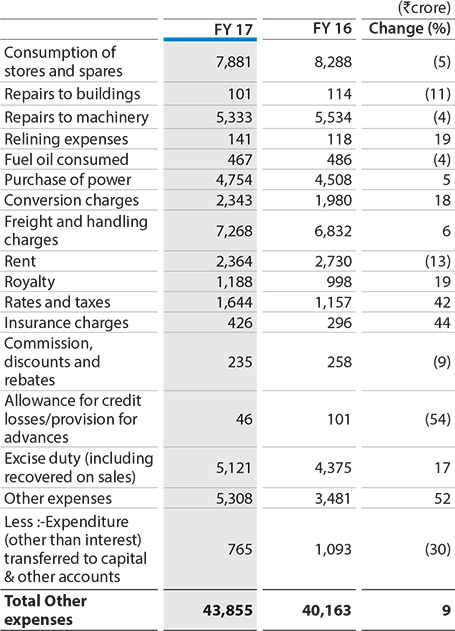

f) Other expenses

Other expenses were higher as compared to the previous year, primarily on account commencement of TSK. Further the increase in Rates and taxes is on account of higher charge in DMF (‘District Mineral Foundation’) as in previous year post notification in September 2015 stipulating the rate to 30% of the royalty, the Company has reversed the excess provision (January 2015 to August 2015) which was earlier provided at 100% of the royalty.

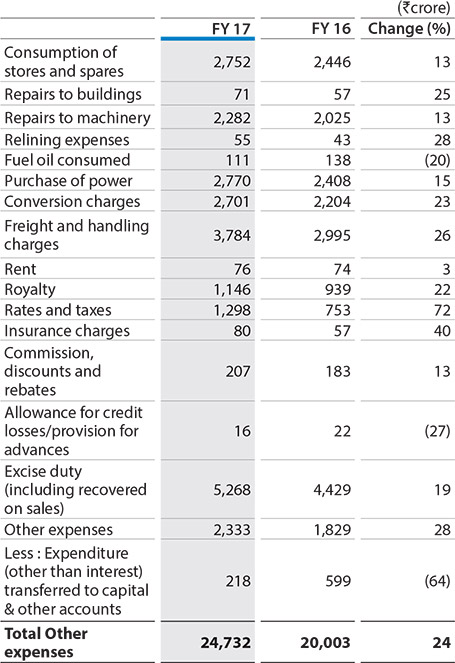

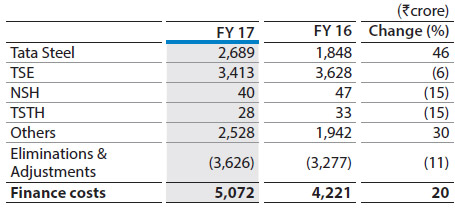

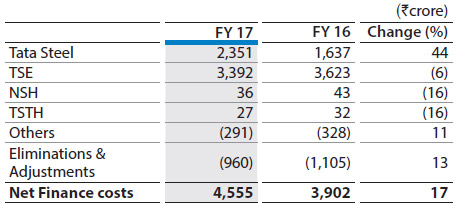

g) Finance costs and Net Finance costs

During the year, the finance costs were higher as previous year included higher interest capitalised of TSK. Net finance charges were higher in line with higher finance cost, partly offset by higher profits from sale of mutual funds.

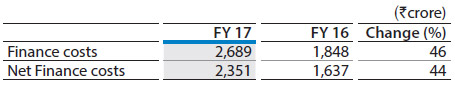

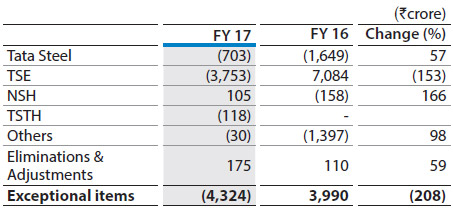

h) Exceptional items

The exceptional items during the year primarily represents statutory demand and claims, charge on account of Employee Separation Scheme (‘ESS’) under ‘Sunhere Bhavishya ki Yojana’ (‘SBKY’) scheme and provision for advances given for repurchase of equity shares in Tata Teleservices Limited from NTT Docomo Inc.

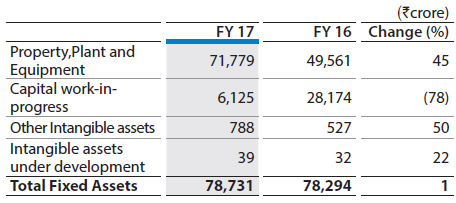

i) Fixed Assets

Capitalisation of Kalinganagar facilities from June 1, 2016.

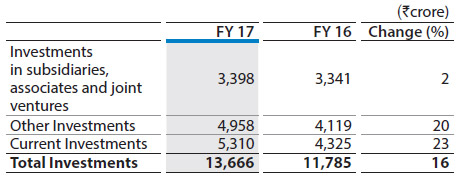

j) Investments

During the year, the increase in investments was predominantly on account of higher investments in Mutual Funds as compared to the previous year and fair value adjustments of non-current investments.

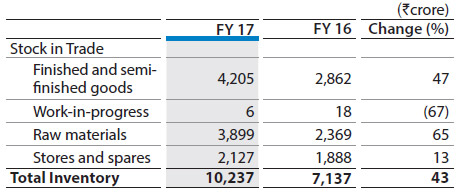

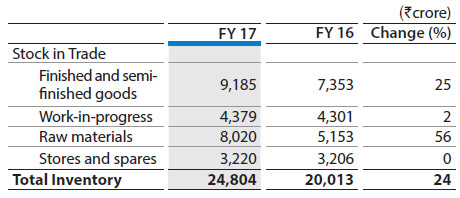

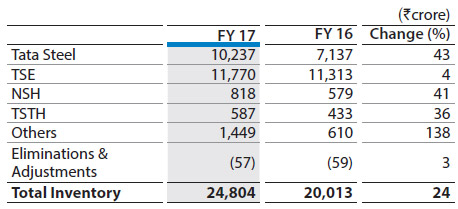

k) Inventories

Finished and semi-finished inventory increased as compared to the previous year. This increase is mainly due to commencement of operations at Kalinganagar. The increase in raw material inventories as compared to previous year is mainly due to increase in cost of imported coal.

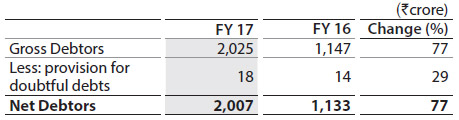

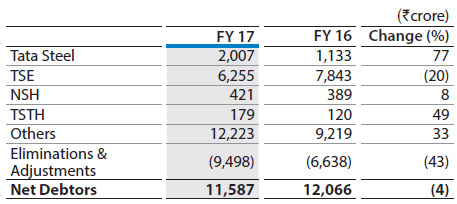

l) Sundry Debtors

The increase in sundry debtors as compared to previous year, primarily due to higher deliveries and increase in international prices.

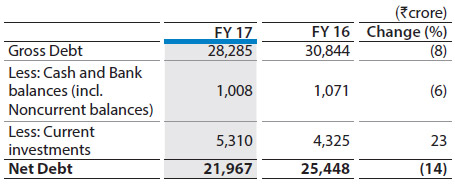

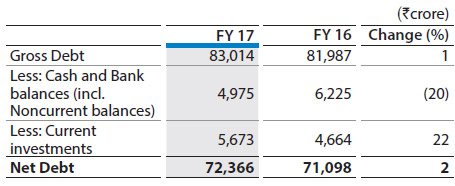

m) Gross Debt and Net Debt

During the current year gross debt decreased primarily due to following:

- Repayment of term loans (net of drawals) `3,347 crore and commercial paper (net of drawals) `960 crore partly offset by;

- Increase in non-convertible debentures (net of repayments) `736 crore and recognition of finance leases by `730 crore.

Further Current investments were higher by `985 crore as

compared to

March 31, 2016, thereby resulting in the decrease in

the net debts.

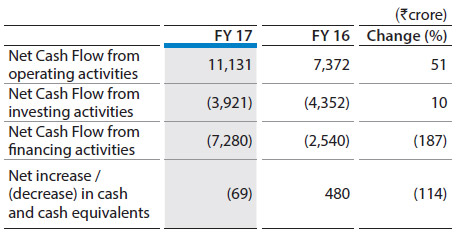

n) Cash Flow

Net cash flow from operating activities

During the year, the net cash from operating activities was `11,131 crore as compared to `7,372 crore during previous year. The cash operating profit before working capital changes and direct taxes was `11,561 crore as compared to `7,622 crore during previous year due to higher profitability. Working Capital decreased during the year by `1,111 crore. This was due to increase in financial and other financial liabilities/provisions by `5,276 crore partly offset by increase in inventories by `3,093 crore and financial and other financial assets by `1,072 crore.

The income taxes paid during the year was `1,541 crore as compared to `1,244 crore during the previous year.

Net cash from investing activities

During the year, the net cash outflow from investing activities amounted to `3,921 crore as compared to `4,352 crore during previous year. The outflow during the year broadly represents capex of `3,173 crore, advance of `144 crore given for repurchase of equity shares in Tata Teleservices Limited from NTT Docomo Inc and purchase (net of sale) of current investment amounting to `668 crore.

Net cash from financing activities

During the year, the net cash outflow from financing activities was `7,280 crore as against `2,540 crore during previous year.

The outflow during the year is primarily on account of repayment of borrowings (net of proceeds) amounting to `3,256 crore, interest payments of `2,625 crore, dividend payment of `925 crore and payment of `112 crore made towards finance lease liabilities.

2. Tata Steel Group

Tata Steel Group profit after tax from continuing operations before exceptional items for the current year was `4,020 crore as against loss of `1,948 crore during previous year. Exceptional items, including non cash pension curtailment charges, aggregating to `4,324 crore resulted in a loss of `304 crore from continuing operations during the current year.

The analysis of major items of the financial statements are given below:

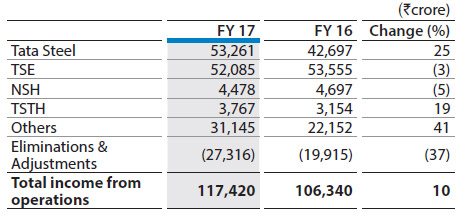

a) Net sales and other operating income

The turnover of the Group for the current year was higher as compared to the previous year. The increase at Tata Steel India was primarily on account of commencement of TSK and improved market conditions and at TSTH mainly on account of higher realisations.

In TSE, though revenue was 3% lower than the previous year in rupee terms, however in GBP terms it was higher by 9%. This reflects an increase in realisations.

In NSH turnover declined mainly on account of lower volumes.

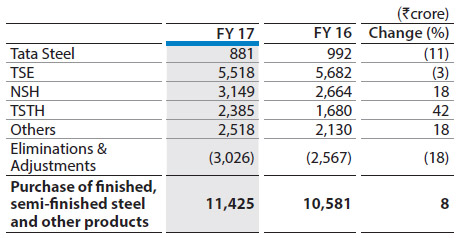

b) Purchases of finished, semi-finished steel & other products

Purchases at the TSTH and NSH increased owing to increase in production and input metallic price. Indian operations decreased primarily on account of lower purchases of imported rebars and wire rods. TSE recorded a decrease primarily due to exchange impact on translation, partly offset by external steel purchases required for operation.

c) Raw materials consumed

The increase at Tata Steel India is due to higher consumption at TSK and cost of imported coal. Decrease at TSE is primarily due to the exchange impact on translation, partly offset by increase in iron ore and coal costs.

The increase in ‘Others’ is primarily due to activities at TS Global Procurement (‘TSGP’) in relation to raw material procurement, eliminated on consolidation.

d) Employee benefits expense

Employee Benefit expenses increased in Tata Steel India mainly on account of increase in salary revisions and its consequential impact on the retirement provisions. At TSE wage cost was lower on account of exchange impact on translation, partly offset by increase in wages.

e) Depreciation and amortisation expense

The increase in depreciation at Tata Steel India is primarily due to commencement of TSK partly offset by impact of re-assessment of useful life of asset. Expense decreased at Tata Steel Europe mainly on account of exchange impact on translation.

f) Other expenses

Other expenditures increased at Tata Steel India mainly on account of commencement of TSK and increased charge under District Mineral Foundation. Decrease at Tata Steel Europe is primarily due to lower operational cost owing to reduced production. The increase in others is primarily due to adverse exchange rate movement at TSGH, Singapore.

g) Finance costs and Net Finance costs

Higher finance cost at Tata Steel India as previous year included higher interest capitalisation of TSK. Decrease at TSE is primarily due to exchange impact on translation and decrease in bank and other borrowings partly offset by addition of subordinate loan.

Net finance charges were higher as compared to previous year primarily due to the increase in finance cost partly offset by increase in finance income at Tata Steel India mainly due to higher profits from the sale of mutual funds.

h) Exceptional items

Exceptional items during the year primarily represent :

- Statutory demand and claims, provision for advances given for repurchase of equity shares in Tata Teleservices Limited from NTT Docomo Inc. and charge on account of Employee Separation Scheme (‘ESS’) under ‘Sunhere Bhavishya ki Yojana’ (‘SBKY’) at Tata Steel India.

- Impairment of property, plant and equipment mainly relating to the European and South East Asian operations.

- Curtailment charge relating to closure of Tata Steel Europe’s British Steel Pension Scheme (‘BSPS’) to future accrual.

Exceptional items during the previous year primarily represent:

- Net credit on account of pension schemes changes at Tata Steel Europe.

- Provision for statutory demands and claims, charge on account of ESS under SBKY scheme, advances related to a project which the Company has decided to discontinue.

- Impairment of property, plant and equipment and charge on account of Occupational Disease Claims taken at Tata Steel Europe.

- Provision for NatSteel Xiamen.

- Others represent non-cash write-down of PPE and goodwill at certain subsidiaries.

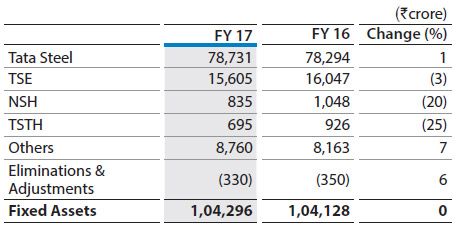

i) Fixed Assets

Almost at par with previous year.

j) Inventories

Increase in inventory at Tata Steel India was primarily on account of commencement of TSK and increase in coal cost. At Tata Steel Europe, the increase was primarily on account of increase in raw material prices partly offset by exchange impact and disposal of longs product business.

k) Sundry Debtors

Decrease in Sundry Debtors at Tata Steel Europe is due to disposal of Long products business as well as exchange impact on translation. This is partly offset by increase at Tata Steel India primarily on account of higher deliveries and realisations.

l) Gross Debt and Net Debt

Gross and Net Debt increased by over `1,000 crore as fresh drawals were partly offset by repayments primarily at Tata Steel India and exchange impact on translation.

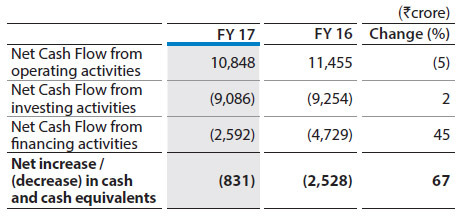

m) Cash Flow

Net cash flow from operating activities

During the year, net cash from operating activities was `10,848 crore as compared to `11,455 crore during previous year. The cash operating profit before working capital changes and direct taxes was `17,581 crore as compared to `6,824 crore during previous year due to higher profitability. Working Capital increased during the year by `4,891 crore due to increase in inventories by `8,243 crore along with financial and other financial assets by `524 crore, partly offset by increase in financial and other financial liabilities/provisions by `3,877 crore.

The income taxes paid during the year was `1,843 crore as compared to `1,534 crore during the previous year.

Net cash from investing activitiess

During the year, the net cash outflow from investing activities

amounted to `9,086 crore as compared to `9,254 crore during

previous year. The outflow during the year broadly represents capex

of `7,716 crore (mainly at Tata Steel India and Tata Steel Europe) and

purchase (net of sale) of current investment amounting to

`693 crore.

Net cash from financing activities

During the year, the net cash outflow from financing activities was `2,592 crore as against `4,729 crore during previous year.

The outflow during the year is primarily on account of interest payments of `4,732 crore, dividend payment of `950 crore and payment of `208 crore made towards finance lease liabilities. These payments were partly offset by proceeds from borrowings (net of repayment) amounting to `3,090 crore (mainly at TSGP).

The Company is exposed to risks arising out of the dynamic macro-economic environment as well as from internal business drivers. These could adversely impact its ability to create value over the short, medium and long-term.

The Company has an Enterprise Risk Management (‘ERM’) framework to continuously develop itself as a risk-intelligent organisation and strengthen corporate governance by supporting risk-informed business decision-making.

The ERM process is well-integrated with the key business processes; the strategy, planning, investment and capital allocation processes. It draws inputs from audit findings and is integrated with the internal audit process as well.

The key risks and Company’s mitigation plans are given below:

1. Macroeconomic risks

- Overcapacity and oversupply in the global steel industry and high levels of imports may negatively affect steel prices and demand thereby reducing the Company’s profitability.

- Developments in the competitive environment in the steel industry, such as consolidation among the Company’s competitors, could have a material adverse effect on the Company’s competitive position. This could potentially impact the Company’s business, financial condition, results of operations and future prospects.

- The Company has a global presence and its financial condition and results of operations may be affected by the local conditions prevalent in the countries where it operates.

- Any downgrading of India’s sovereign rating by independent agency(ies) may harm the Company’s ability to raise finance.

2. Financial risks

- Volatility in financial markets including fluctuation in foreign exchange rates impacts the Company’s debt financing programmes and creates uncertainties in accessing financial markets.

- Downgrade in credit rating of Company’s securities may have an adverse impact on the Company’s ability to raise finance at competitive rates.

- The Company has substantial amount of debt, which may adversely affect its cash flow and its ability to operate the business.

- Any changes in assumptions underlying the carrying value of certain assets, including as a result of adverse market conditions, could result in impairment of such assets.

- Restrictive covenants in financing agreements may limit the Company’s financial flexibility and adversely impact its financial condition, results of operations and prospects

3. Regulatory risks

- The Company faces regulatory risk from predatory pricing and surge in steel imports.

- Non-compliance to regulatory and environmental norms may result in liabilities and damage the Company’s reputation.

- The Company relies on leased mines and in case of non-renewable of the mining leases, it may be forced to purchase such minerals at higher prices from the open market, which may negatively impact its performance.

- The Company may benefit from certain protective trade restrictions, including anti-dumping laws, countervailing duties and tariffs, which if not available, may adversely affect its operations and financial condition.

- The Company’s business could be affected by potential regulatory and judicial actions.

4. Operational risks

- The industry is highly cyclical and a decrease in steel prices may adversely impact its financial condition.

- The Company’s operations and financial condition could be adversely affected if it is unable to successfully implement its growth strategies.

- The Company’s industry is inherently hazardous. Unsafe conditions/ acts leading to loss of life, injury may result in capital, financial and reputational damage.

- The Company’s business is prone to high proportion of fixed costs and volatility in the prices of raw materials and energy. Mismatches between trends in prices of raw materials and steel, as well as limitations on or disruptions in the supply of raw materials, could adversely affect its profitability.

- Estimates of the Company’s Indian mineral reserves and the mineral reserves of its other mining investments are subject to certain assumptions. If the actual amounts of such reserves are less than estimated, or if the Company is unable to gain access to sufficient mineral reserves, its results of operations and financial condition may be adversely affected.

- Hostilities, terrorist attacks or social unrest in regions where the Company operates may adversely affect its operations and financial condition.

- The Company’s operations impact the environment. Compliance with laws and regulations and remediation of contamination, could result in substantial increase of capital requirements and operating costs.

- Failure of Information Technology systems which control the Company’s manufacturing plants may adversely impact its business operations.

5. Market related risks

- Competition from other materials, or changes in the products or manufacturing processes of the Company’s customers who use steel products, could reduce market prices and demand for the Company’s products, thereby reducing its cash flow and profitability.

- Product liability claims may adversely affect the Company’s operations and finance.

6. Climate Change Risks

- In April 2016, 174 countries, including India signed the Paris agreement (COP21). The principle aim of the Agreement is to accelerate and intensify the actions required for a sustainable low carbon future. India’s commitments in COP21 have come into force and mandatory emission reduction targets are expected by 2020. Going forward, the industry will be challenged by increase in international and domestic regulations relating to GHG emissions.

- The ultimate effect of such international agreements and regulatory measures to limit GHG emissions on the Company’s performance and the timing of these effects will depend on a number of factors. Such factors include, among others, the sectors covered, the GHG emissions reductions required and the extent to which the Company will be able to recover the costs incurred through the pricing of its products in the competitive marketplace.

7. People risk

- The Company’s success depends on the continued services of its senior management team and business and prospects could suffer if it loses one or more key personnel or if it is unable to attract and retain its employees.

- Any labour unrest could adversely affect the Company’s operations and financial condition.

The Company’s mitigation strategies are enumerated as under:

The macroeconomic and market related risks are addressed through diversification of the Company’s product portfolio and development of value added products.

To counter exposure to foreign exchange volatility, the Company has formulated foreign exchange hedging policies to protect the trading and manufacturing margins. The Company actively monitor the currency and commodity markets and formulate strategies with inputs from market participants and industry experts. Liquidity management is integrated with business planning and cash flow projections. The Company opportunistically refinances its debt with favourable covenants and reduced interest rates to provide financial flexibility to its business.

The regulatory risks are managed through dialogue with regulatory authorities and proactive legal consultations to ensure timely sanctions, approvals, clearances, and renewal of mining leases for the Company’s operations. The Company works with policy makers to curb predatory pricing and surge in steel imports to create a level playing field. Efforts are made though Industry Associations towards simplification of rules, a predictive policy regime and transition time for regulatory changes. The Company continuously looks to invest in automated systems for monitoring the compliances to the regulatory and environmental norms.

The operational risks are mitigated through development of well-structured processes for effective project planning & management. The Company enhances in-house capability and leverage past project management expertise. It also looks to evaluate investment proposals for inorganic growth. The launch of “Committed to Zero” campaign has led to increased safety awareness and improved safety practices at the Company’s facilities. The Company continues to focus on various initiatives to address Health, Education and Livelihood of the community in its operating areas. The continued supply of raw material is ensured through centralized procurement, continued monitoring of market conditions and robust contractual arrangements. Risk assessments of extended supply chain has been undertaken to identify weak links.

The Company is conscious of the impact of its operations on environment and it continues to invest in projects & schemes including pollution control equipment, effluent treatment plants, air quality monitoring systems, waste recycling & disposal schemes, etc. aimed at minimizing environmental footprint.

To mitigate the risk of climate change and to be sustainable, the Company is focussing on innovative technologies that can significantly lower emissions over the long-term. The GHG issues and the Company’s responses are integrated into the Company’s strategy and planning, capital investment reviews, and risk management tools and processes, where applicable. Further, the Company draws on the Tata Group’s initiatives and collaborations with academic & research institutions for projects on Climate Change issues.

The Company periodically reviews the succession plan for its senior management team to ensure continuity in leadership. The Company’s people related policies are reviewed and monitored to attract and retain its employees.

The Company continues to adapt to the ever changing business environment to take advantage of the opportunities to deliver sustainable value for all its stakeholders.

With increasing migration, newer centres of development and government programmes such as the Smart City Mission, the rate of urbanisation in India is expected to rise significantly in the near future. A young demography tends to propel demand for housing, transportation and public infrastructure. Despite a significantly growing urban population, India’s per capita steel consumption is considerably low (61kg) compared to China (540kg). This clearly shows that there is significant headroom for consumption growth. The Company expects to take advantage of the growth opportunity provided by the Indian economy, by enhancing its steel producing capacity in India by both, organic and inorganic means.

Further, India’s iron ore reserves and competitive labour costs give steel manufacturers based in the country a distinctive cost advantage. The Company seeks to leverage this advantageous position and strengthen its status as a low-cost and high-quality producer of steel.

The Company also endeavours to access high quality, low-cost iron ore that is available in its proximity by continuously investing in mining assets to secure the long term availability of iron ore.

The demand for new product segments and creating differentiation through services and solutions will be leveraged through acceleration of new product development and creation of differentiated products, services and solutions.

The Company expects the demand for steel products to be strong in the developing economies and the Company proposes to utilise it as well as its Group’s existing network to meet this increased demand.

The Company intends to adopt digital technology to improve productivity and become more agile. To strengthen this opportunity, the Company is currently undertaking pilot projects and developing capabilities on an organization-wide basis.

To enable the Company’s customers to realize value from its by-products, the Company assists them in exploring new application areas.

The Managing Director (India & South East Asia) and Group Executive Director (Finance, Corporate & Europe) make a declaration at each Board Meeting regarding compliance with provisions of various statutes after obtaining confirmation from respective units of the Company. The Company Secretary ensures compliance with all corporate laws and listing rules applicable to the Company.