|

|

|

Directors' Report

Business Results

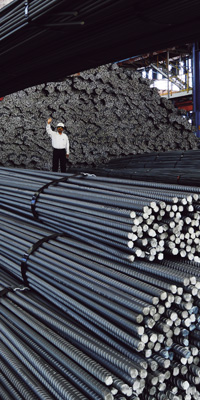

The year witnessed the best ever crude steel

production by the Company at 5.05 million tonnes.

Jamshedpur became the first plant in India to

produce more than 5 million tonnes of crude steel. |

The Company achieved the best ever sales turnover and

profitability during the year under review. A robust Indian

economy, firm steel prices, higher volumes and several

improvement initiatives contributed to the record performance.

Finished steel sales were higher by 11.33% at 4.51 million tonnes

over the previous year. Export turnover was lower by about

5% due to lower volumes. Average price realisation improved

mainly due to higher prices of hot rolled coils/sheets. Operating

profit was higher by over Rs. 1,000 crores at Rs. 6,973 crores

(2005-06: Rs. 5,938 crores), an increase of 17% over the previous year. Net interest charges were higher at Rs. 174 crores (2005-06: Rs. 125

crores), due to additional borrowings for the Company’s domestic

expansion programs and funding Company’s contribution for

financing the acquisition of Corus Group plc. After providing

for Rs. 819 crores for depreciation (2005-06: Rs. 775 crores) and

Rs. 152 crores towards employee separation scheme (2005-06: Rs. 53

crores), the profit before tax rose by 20% to Rs. 6,262 crores (2005-06:

Rs. 5,240 crores). Net Profit after taxes was higher at Rs. 4,222 crores

(2005-06: Rs. 3,506 crores), an increase of 20% compared to the

previous year.

The record financial results would not have been possible without

a matching performance by the operating departments including

the raw materials division. The year witnessed the best ever

crude steel production by the Company at 5.05 million tonnes,

an increase of 6.7% over the previous year. Jamshedpur Plant

became the first plant in India to produce more than 5 million

tonnes of crude steel in a year. The upgraded “G” Blast Furnace

produced over 2 million tonnes of hot metal, as against its rated

capacity of 1.8 million tonnes. Among the Finishing Mills, the

output at the Cold Rolling Mill and the Hot Strip Mill exceeded

their rated capacities. The all-round increase in production was

backed by improvements in operating practices and productivity resulting in a reduction in consumption of raw materials, energy,

refractories, etc.

The Company’s Collieries, for the first time, produced 1.9 million

tonnes of clean coal at a reduced level of ash content, which

has contributed significantly in substituting the more expensive

imported low ash coal. A modern beneficiation plant for iron ore

fines has been set up to reduce the alumina content in iron ore.

Pursuant to the Accounting Standard AS-21 issued by the

Institute of Chartered Accountants of India, consolidated financial

statements presented by the Company includes financial

information of its subsidiaries. The Company has made an

application to the Government of India seeking exemption under

Section 212(8) of the Companies Act, 1956 from attaching the

Balance Sheet, Profit and Loss Account and other documents of

the subsidiary companies to the Balance Sheet of the Company.

The Company will make available these documents / details upon

request by any member of the Company.

Dividend

The Board, for the year ended 31st March, 2007 has recommended

a dividend @ 130% (Rs. 13 per share) and a special dividend @ 25%

(Rs. 2.50 per share), subject to the approval of the shareholders

at the Annual General Meeting. The dividend will be paid on

608,972,856 Ordinary Shares at Rs. 15.50 per share (including

special dividend) (2005-06 : on 553,472,856 Ordinary Shares at

Rs. 13 per share). The dividend pay out works out to 26.15%

(2005-06 : 23.40%).

Acquisition of Corus Group plc, UK

Tata Steel’s investment in Corus Group plc is consistent with

the Company’s stated objective of growth and globalisation.

In keeping with its vision of becoming a truly global player and

creating a 50 million tonne steel capacity by 2015, through both

organic and inorganic growth, the Company had been examining

various opportunities. The process started with the acquisition

of NatSteel Asia Pte. Ltd. (Singapore) in 2005, and Tata Steel

(Thailand) Public Co. Ltd. (erstwhile Millennium Steel) in 2006, the

planned brownfield expansion in Jamshedpur and the long-term

greenfield projects in Orissa, Chhattisgarh and Jharkhand.

In October 2006, the Company submitted a bid to acquire the

UK based steel making company viz. Corus Group plc (Corus).

The acquisition was completed on 2nd April, 2007 at a price of 608 pence per ordinary share in cash for a net consideration of

USD 12.9 billion. Corus is a leading steel company with an annual

crude steel production of 18.3 million tonnes and revenues of USD

19.2 billion in 2006. Corus’ operations are organised into three

principal divisions; Strip Products, Long Products and Distribution

and Building Systems, with manufacturing facilities located in UK

and Netherlands. It holds a strong position in the automotive,

construction and packaging sectors in Europe.

With the acquisition, the Company has emerged as the sixth

largest steel manufacturer in the world. Tata Steel is the lowest

cost steel producer in the world, catering mainly to the domestic

market. The Company has a competitive advantage of captive

iron ore mines and collieries. On the other hand, Corus has

state-of-the-art plants located in the UK and Netherlands

producing mainly high end products, with a strong R & D

capabilities. The combination of these two entities will give

the Company access to highly developed and competitive

markets of Europe, a strong product portfolio and state-of-the-art technology in manufacturing. The Company also sees a

strong cultural fit with Corus, which is one of the key elements

for successful integration. The Company believes that there are

several areas where synergies are possible and is confident that

these benefits will start accruing from the current year itself.

Since the acquisition is effective from 2nd April 2007, the financial

results of Corus will get reflected in the consolidated financial

statements of the Company from the current year.

TOP |

|

|