Manufactured Capital

Aligned with our growth aspiration, we are continuously expanding crude steel capacity, both organically and inorganically.

SDGs impacted

0 MnTPA

Steel making capacity (consolidated)

0 MnT

FY2022-23 Production (consolidated)

Production numbers for consolidated financials are calculated using crude steel for India, liquid steel for Europe and saleable steel for South East Asia

Material issues addressed

- Circular Economy/Recycling of By-products

- Occupational Health and Safety

- Research and Development/ Technology, Product, and Process Innovation

- Risk Management

Strategic linkages

SO1

SO2

SO3

SO4

Tata Steel Minerals Canada

We are geographically one of the most diverse steel players with operations in India, the Netherlands, the United Kingdom, Thailand and Canada. The geographical spread of downstream units is further diversified with presence in countries such as USA, France and Germany.

Despite the widespread presence, we are continuously striving to optimise performance across locations. Safety of our people and reliability of our assets are at the core of the manufacturing capital and is delivered through multiple initiatives. Also, the culture of continuous improvement in the organisation is visible across the value chain from mining, ironmaking, steelmaking to the rolling mills, downstream units and supply chain facilities. While we are pursuing an aggressive growth target through both organic and inorganic routes, we are also focussing on benchmarking performance of the existing assets. Tata Steel has shown unwavering commitment to this in past few years.

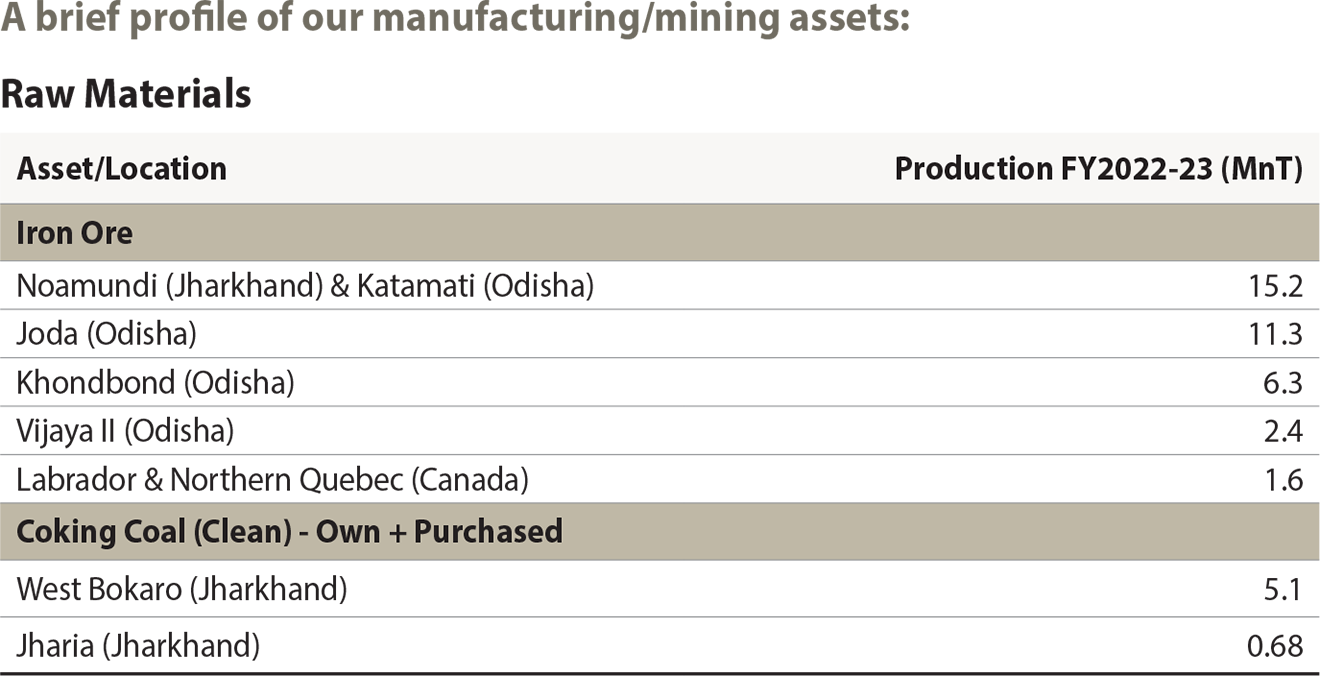

Raw materials

Our mining operations play a critical role in maintaining cost competitiveness and insulate Tata Steel from the volatility of market prices of iron ore and coking coal. Raw Materials Division provides necessary iron ore security for operating the steel units at Jamshedpur, Kalinganagar and Meramandali from six operating iron ore mining facilities viz. Noamundi, Katamati, Joda East, Khondbond, Vijaya II and Koida. In view of our aspiration to double Indian crude steel capacity in the next decade, capacity enhancement of captive iron ore mines also needs to be planned to remain self-reliant. Accordingly, Gandhalpada and Kalamang iron ore mines are planned to commence mining operations in coming years. Execution of the lease deed of Kalamang West (Northern Part) Iron Ore Mines in December 2022, is a step in this direction.

Additionally, Tata Steel owns iron ore assets in Labrador and Northern Quebec regions of Canada.

Apart from iron ore, coal is another important raw material which has an impact on steel value chain cost structure. Around 22% of coal required for the Indian operations is fulfilled by our mines of West Bokaro and Jharia divisions. State-of-the-art washing plants in Jharia and West Bokaro help us in leveraging technology to use our natural resource of coal efficiently by washing raw coal to produce clean coal suitable for blast furnace operations.

Leveraging the pillars of innovation, technology, and operational excellence, we have made good progress in the areas of sustainability, environment management, safety, digitalisation, and diversity & inclusion. We have undertaken various initiatives in the domain of automation and digitalisation of mines and beneficiation plants as well as logistics, including local area and wide area networks for digital communication and data transfer. Sensorisation and automation of plant and mining equipment has enabled automatic data capturing using Internet of Things. Investment in digital infrastructure has resulted in real-time data transmission, enabling remotely controlled operations of equipment like conveyors and pumps and centralised monitoring of plants and mine operations. Deployment of Suraksha Card, video analytics, online safety management plan, and digital mine mapping using drone survey and GIS-based technologies, etc. have resulted in significant improvements in our ability to manage assets with better efficiency.

0 %

Iron ore requirements is met through captive mines

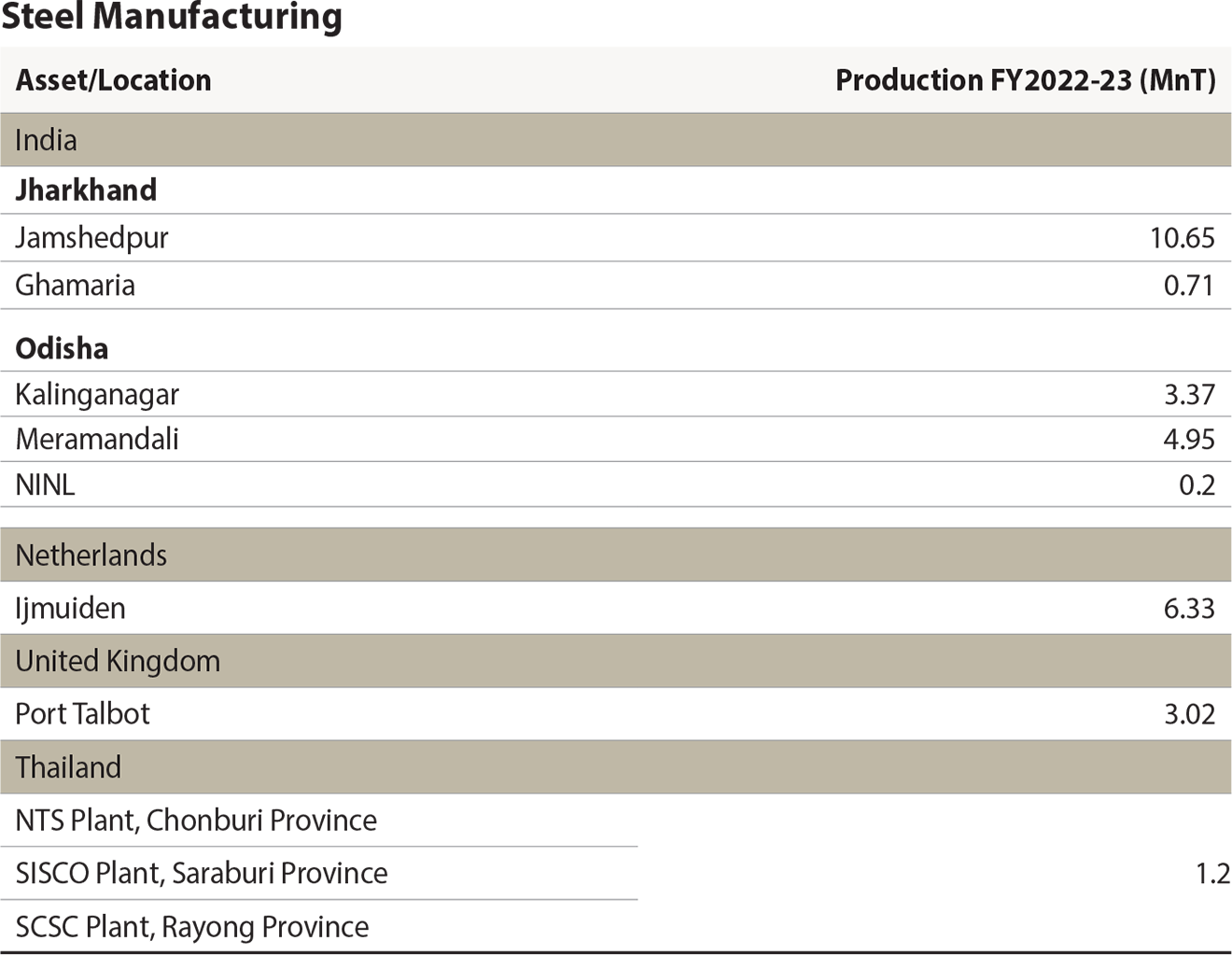

Steel manufacturing

Steel processing centre, Jamshedpur

We are one of the largest steel producers in the world with an annual crude steel capacity of approximately 35 MnT including both India and overseas operations. Tata Steel India Capacity stands at 21.6 MnTPA with operations at Jamshedpur and Gamharia in Jharkhand and Kalinganagar and Meramandali in Odisha. During the year, we completed the acquisition of Neelachal Ispat Nigam Limited (NINL) with a crude steel production capacity of 1 MnTPA. Tata Steel has restarted the unit within three months of its acquisition, which is testament to the agility and focus on turning around acquired assets. NINL will play a critical role in our long product growth aspirations as it gets transformed into a state-of-the-art long products complex within the current decade. In the flat products area, Tata Steel’s phase II expansion at Kalinganagar is progressing as per plan. In the year under review, the new state-of-the-art Pellet plant at Kalinganagar has started operations, enhancing our raw material mix.

The downstream operations growth is also commensurately planned with the upstream capacity expansion. Pickling Line Tandem Cold Mill at Tata Steel Kalinganagar successfully rolled out its first Full Hard Cold Rolled coil in FY2022-23. This will help cater to the production of high-strength cold-rolled products to meet the requirements of auto customers. With acquisition and integration of Tata Steel BSL Limited, we have emerged as the second-largest tubes manufacturer in the country with 1 MnTPA capacity. Tata Steel is also making significant investments in The Tinplate Company of India Limited to double its production capacity and The Indian Steel and Wire Products Limited to install rolling mill in a phased manner. Tata Steel Long Products Limited has Steel Processing Centres (SPCs) located in different parts of India, which convert billets into finished products closer to the markets. Our network of service centres cater to the requirements of our customers, such as construction companies and auto OEMs as we supply them with ready-to-use processed steel.

Under our European business, the total crude steel production capacity stands at 12 MnTPA including operations at the Netherlands and the United Kingdom. The downstream operations extend in about 12 countries across the globe such as France, Germany, the United States, Belgium, Sweden, Spain, and Turkey among others. We supply high value, high quality products through our European operations for various segments like automotive, construction, packaging and engineering. The European operations have also taken strides towards sustainability by using greener manufacturing technologies.

In South-East Asia, Tata Steel Thailand is primarily focussed on long-products - rebars and wire rods, with three manufacturing sites in central and eastern parts of the country. The annual crude steel capacity for Tata Steel Thailand is 1.7 MnT between the three plants. Tata Steel Thailand has significant plans to increase scrap usage in production. In FY2022-23, Tata Steel Thailand got its highest volume of better value in use scrap grades.

Enabling sustainable supply chain

Supply chain

Our supply chain management is responsible for planning, sourcing, delivery, and logistics of more than 100 MnT of materials including raw materials, finished goods, and by-products with a diverse global portfolio. Annually, more than 60 MnT of Raw Material comprising of 200 grades from 54 sources located across the globe is planned, scheduled and transported to 22 internal consumption centres. On the delivery side, 20 MnT of finished goods consisting of ~20,000 Stock-Keeping Units (SKUs) from ~65 production units (inclusive of SPCs) is delivered to a diverse group of customers. All material movements are enabled through combination of 7 ports, 24 stockyards and 37 Steel Processing Centres.

The size and complexity of this is further expected to increase with expansion. The integration of the supply chain functions has led to a greater focus on end-to-end margin management in raw materials and finished goods through synergies between hubs. We are also working on using integrated IT solutions to optimise logistics and planning. The goal is to ensure reliability in supplies and delivery at an optimal cost. Our focus is also on infrastructure building to address the future readiness. Slurry pipeline, captive port development, private rakes and best-in-class stockyards for raw materials and finished goods are some of the key infrastructure strengthening projects in progress.

NINL

plant restarted within

3 months of acquisition